🏡 Introduction: A Rare Window of Savings for Homeowners

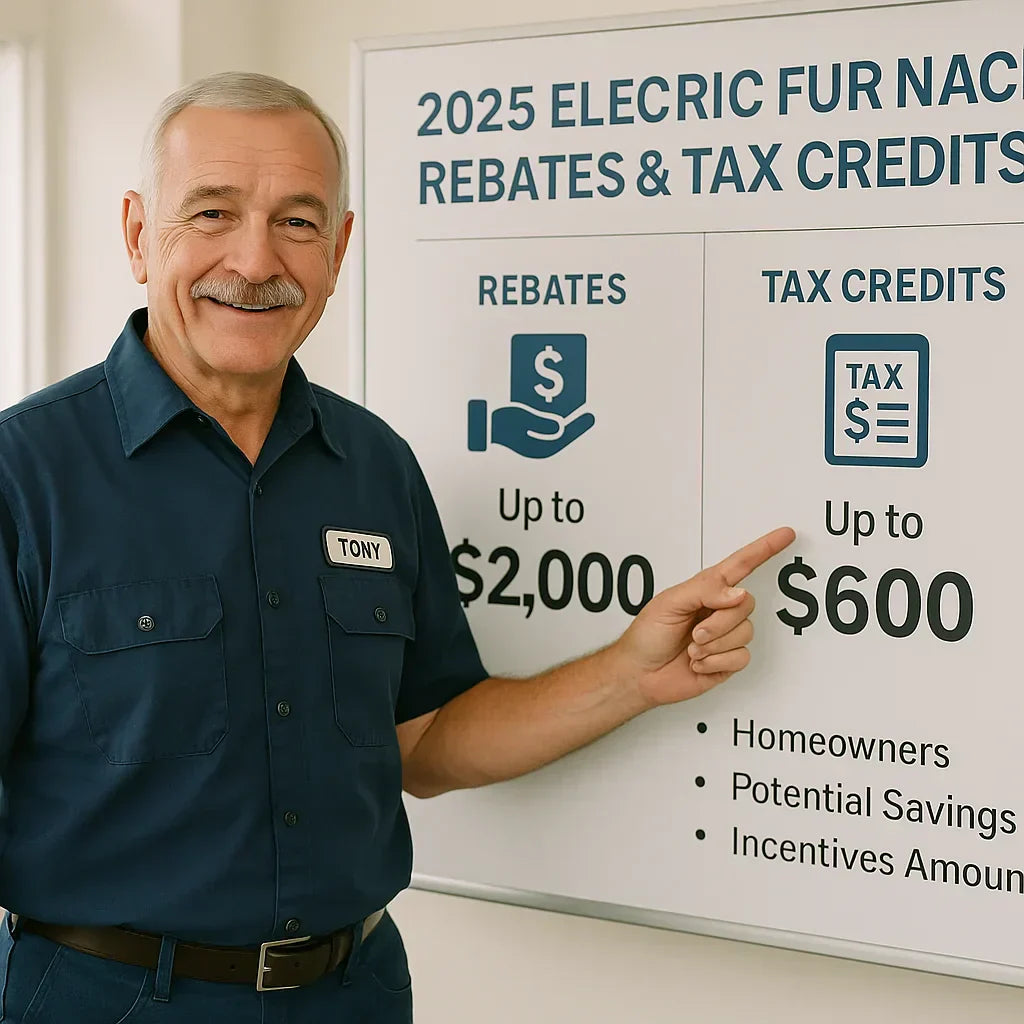

If you've been thinking about upgrading to a new electric furnace, 2025 may be the best time in decades. With federal tax credits, state rebates, utility incentives, and manufacturer promotions, homeowners can potentially save thousands on their heating system replacement. In this in-depth guide, Tony Marino breaks down every available incentive and how to claim them.

🏛️ The Inflation Reduction Act (IRA) 2025: The Biggest Federal Program

-

Signed into law in 2022; expanded in 2025

-

Offers substantial tax credits for high-efficiency electric heating

-

Designed to promote electrification, reduce emissions, and lower household energy costs

Key IRA Benefits for Electric Furnace Buyers:

-

30% federal tax credit, up to $2,000

-

Covers equipment and labor costs

-

Stacks with other incentives

IRS - 2025 Energy Efficient Home Improvement Tax Credit

🌟 Basic Eligibility for Federal Tax Credits

-

Must be installed in your primary residence (not rental or vacation home)

-

Installed between Jan 1, 2025 – Dec 31, 2032

-

Equipment must meet efficiency standards (typically ENERGY STAR qualified)

-

Includes both equipment and installation labor

-

Credit applies only for new installations or qualified upgrades

Energy Star - Federal Tax Credits 2025

🤝 Qualifying Equipment Standards for Electric Furnaces

-

100% AFUE (Annual Fuel Utilization Efficiency)

-

ENERGY STAR certification often required

-

Smart thermostat integration may be recommended or required for full credit

-

Compatible with future electrification goals

ENERGY STAR Qualified Heating Products List

🔄 State-Specific Rebates: How to Double Your Savings

Many states offer additional incentives that stack with federal credits:

-

California: Up to $3,000 rebate through TECH Clean California

-

New York: NYSERDA rebates $500-$1,000

-

Massachusetts: Mass Save up to $1,250

-

Oregon: Energy Trust of Oregon up to $1,500

-

Colorado: Xcel Energy rebates $400-$1,200

Always check your local state energy office or utility provider.

Database of State Incentives for Renewables & Efficiency (DSIRE)

🏦 Utility Company Rebates & Incentives

-

Offered by hundreds of utilities nationwide

-

May include instant rebates, bill credits, or post-installation rebates

-

Often requires installation by approved contractors

-

Commonly paired with home energy audits

| Utility | Average Rebate |

|---|---|

| Duke Energy (NC) | $500-$1,000 |

| Pacific Gas & Electric (CA) | $400-$1,200 |

| Consumers Energy (MI) | $500 |

| PSE&G (NJ) | $800 |

| NV Energy (NV) | $1,000 |

Energy.gov - Utility Incentive Programs

🥇 Manufacturer Promotions: Seasonal Bonus Savings

-

Goodman: Often offers $250 - $500 manufacturer rebates

-

King Electric: Bundle rebates with controls

-

Stelpro: Partnered discounts with local utilities

-

Promotions often run spring and fall

Always check current seasonal offers through authorized dealers.

📢 What Expenses Can Be Included?

-

New electric furnace equipment

-

Professional installation labor

-

Electrical panel upgrades (if directly tied to furnace installation)

-

New compatible thermostats

-

Duct sealing or minor adjustments required for proper furnace operation

IRS Publication 5695 - Qualified Energy Improvements

🔒 Tax Credit Limitations and Rules

-

Federal credit capped at $2,000 per year (for heat pumps, furnaces, boilers)

-

Cumulative lifetime limit resets annually through 2032

-

Cannot exceed actual tax liability (non-refundable)

-

Must file IRS Form 5695 with your federal return

-

Cannot claim on rental or vacation properties

💼 Required Paperwork & Documentation

-

Manufacturer certification statements

-

Contractor invoice showing model, serial number, installation address

-

Proof of payment for total system cost

-

State rebate forms and utility paperwork (when applicable)

🔄 Smart Thermostats: Often Required for Maximum Incentives

-

Qualifying models include:

-

Google Nest

-

ecobee SmartThermostat

-

Honeywell Home T9

-

-

May add $150-$300 to installation cost, but often required for top rebates

ENERGY STAR Smart Thermostat Criteria

👨💼 Should You Hire a Professional Contractor? (The Answer Is Almost Always Yes)

-

Required for utility rebates

-

Ensures electrical code compliance

-

Prevents voiding manufacturer warranties

-

Verifies accurate paperwork for tax credits

National Electrical Contractors Association (NECA)

🔧 Stacking Rebates: Maximize Your Total Savings

Example Homeowner Savings (Midwest, 2025):

-

Goodman 15 kW electric furnace: $3,500

-

Installation labor: $1,800

-

Electrical panel upgrade: $2,000

-

Smart thermostat: $300

-

Total Project Cost: $7,600

Rebates and Credits:

-

Federal IRA Tax Credit: -$2,000

-

State Energy Office Rebate: -$750

-

Utility Company Rebate: -$500

-

Manufacturer Spring Promotion: -$300

-

Total Net Cost: $4,050 (47% total savings)

🤓 Tony Marino’s Pro Tips for Claiming Maximum Rebates

-

"Always get pre-approval on utility rebates before scheduling install."

-

"Use authorized installers to avoid paperwork headaches."

-

"Keep every invoice and form—the IRS and state agencies will want details."

-

"Don’t miss smart thermostat add-ons—they’re often required."

-

"Be aware that some rebates run out of funds late in the year. Act early."

📍 Get Full Rebate Assistance from The Furnace Outlet

The Furnace Outlet makes maximizing your savings easy. Their expert team tracks current rebates, ensures compliance, and handles paperwork so you get every available dollar. Visit The Furnace Outlet Electric Furnaces Collection to explore qualified models and request a full rebate consultation.

In the next topic we will read about: Electric Furnace Maintenance: How to Maximize Lifespan & Efficiency