Replacing your old furnace or AC with a high-efficiency system isn’t just good for your utility bills—it might also qualify for thousands of dollars in rebates and tax incentives in 2025.

Here’s what Tony wants you to know about saving real money on your Goodman system this year.

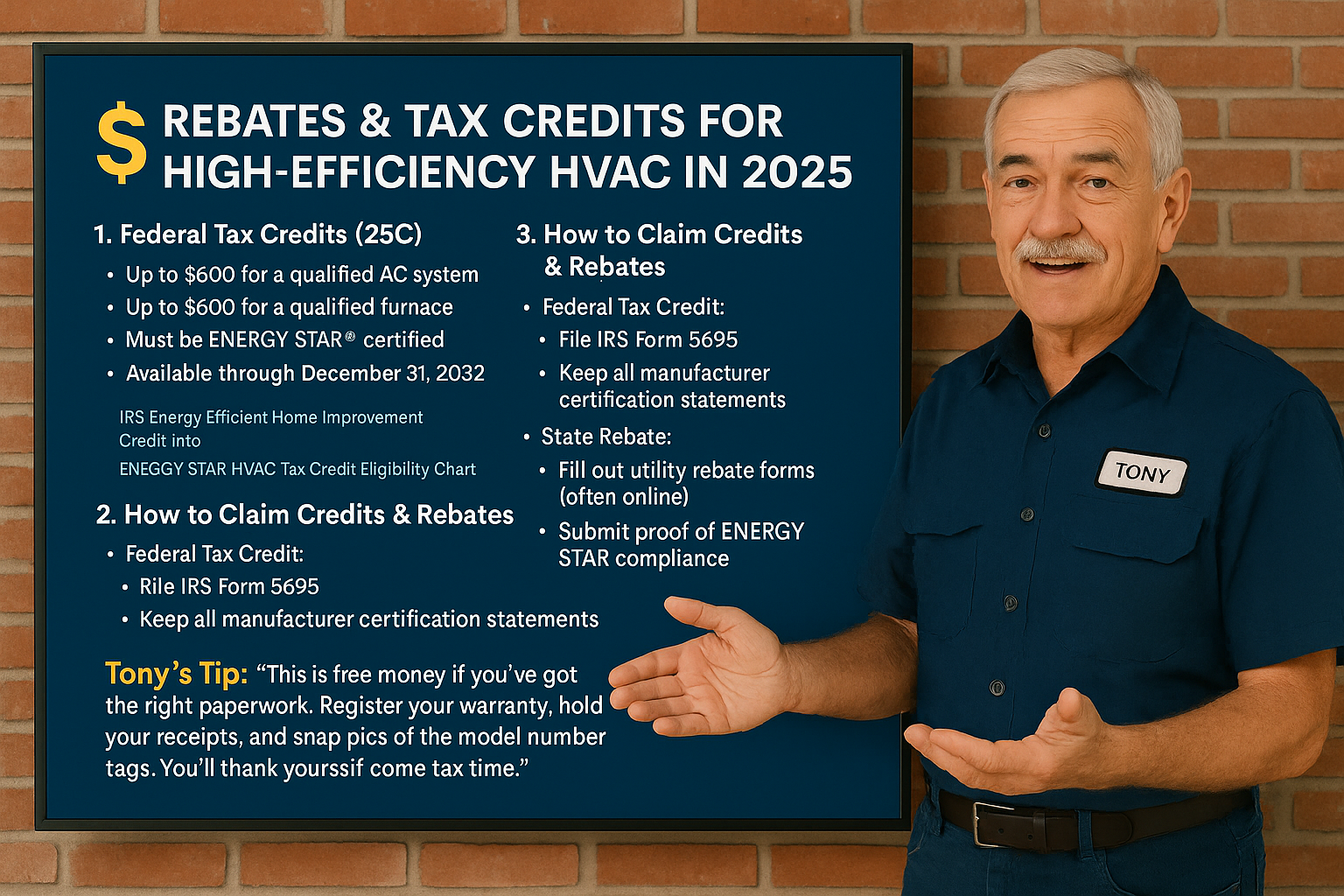

🏛️ 1. Federal Tax Credits (25C)

Thanks to the Inflation Reduction Act, the 25C Residential Energy Efficiency Tax Credit lets homeowners claim:

-

Up to $600 for a qualified AC system

-

Up to $600 for a qualified furnace

-

Must be ENERGY STAR® certified

-

Available through December 31, 2032

To qualify, your equipment must meet SEER2 and AFUE minimums as defined by ENERGY STAR for your region.

👉 IRS Energy Efficient Home Improvement Credit Info

👉 ENERGY STAR HVAC Tax Credit Eligibility Chart

🧾 2. State & Local Rebates (ZIP Code-Based)

Utility providers and state energy agencies often offer additional rebates on top of federal incentives. These can range from $200 to over $2,000, depending on your location.

To find offers near you, use:

👉 DSIRE (Database of State Incentives for Renewables & Efficiency)

👉 ENERGY STAR Rebate Finder Tool

These tools let you search by ZIP code and equipment type—perfect for Northeast homeowners upgrading to SEER2- and AFUE-compliant systems.

🧠 3. How to Claim Credits & Rebates

Federal Tax Credit:

-

File IRS Form 5695 with your tax return

-

Keep all manufacturer certification statements

-

Hold onto proof of purchase and installation

👉 Form 5695 Instructions (IRS)

State Rebate:

-

Fill out utility rebate forms (often online)

-

Submit proof of ENERGY STAR compliance

-

Submit within 30–90 days of install (varies)

🛠️ Tony’s Tip

“This is free money if you’ve got the right paperwork. Register your warranty, hold your receipts, and snap pics of the model number tags. You’ll thank yourself come tax time.”

In the next topic you will know about: What Makes the GLXS3BN2410 Condenser Efficient?