If you're planning to install or upgrade to a high-efficiency HVAC system, now is one of the best times to act — especially if you're choosing a system that uses R-32 refrigerant. Thanks to federal tax credits, state-level energy incentives, and utility company rebates, homeowners can potentially save thousands by choosing R-32-equipped, ENERGY STAR®-qualified systems.

This guide walks you through how R-32 improves your eligibility, what rebates to look for, and how to maximize your savings in 2025 and beyond.

✅ Why R-32 Helps You Qualify for Incentives

R-32 is a newer refrigerant with a Global Warming Potential (GWP) of just 675, compared to R-410A’s 2,088. It's widely used in systems that meet or exceed the latest SEER2 and HSPF2 standards required for rebate eligibility.

These systems are:

-

More energy-efficient

-

Environmentally friendly

-

Often ENERGY STAR certified

This certification is the key that unlocks many available rebates.

🧾 Federal Tax Credits: 25C Energy Efficient Home Improvement Credit

Under the Inflation Reduction Act (IRA), you can claim up to $2,000 per year for eligible HVAC upgrades.

To qualify:

-

Your R-32 system must meet ENERGY STAR requirements

-

It must have a SEER2 of ≥15.2 (AC) or ≥16 (heat pump)

-

Installation must be in your primary residence

What you’ll need:

-

Manufacturer Certification Statement

-

IRS Form 5695

-

Your installer’s invoice with model numbers

👉 IRS Form 5695 and Instructions

🏛️ State & Local Rebates

Many states offer additional incentives through energy agencies and public utility programs. Examples include:

-

California TECH Initiative: Up to $3,000 for heat pumps

-

Mass Save: $500–$10,000 rebates based on income

-

Efficiency Vermont: $400–$1,000 on ENERGY STAR AC or heat pumps

Check your zip code in national rebate databases to find what’s available to you.

👉 DSIRE – Database of State Incentives for Renewables & Efficiency

🔌 Utility Company Rebates

Local utility companies often provide cash-back offers for installing energy-efficient equipment.

Typical offers:

-

$100–$500 for high-SEER2 heat pumps or central ACs

-

$50–$100 for smart thermostat pairing

-

Free energy audits before or after installation

Eligibility often requires:

-

Using a certified contractor

-

Submitting proof of ENERGY STAR or AHRI certification

-

Having the system verified via post-install inspection

📋 How to Claim Your Rebates and Credits

-

Check eligibility requirements BEFORE installation

-

Ask your HVAC contractor to supply model numbers and certification forms

-

File IRS Form 5695 for federal tax credits

-

Submit rebate applications to your utility or state program, usually within 30–90 days

-

Keep all paperwork, including contractor invoices and product labels

👉 AHRI Certificate Lookup Tool

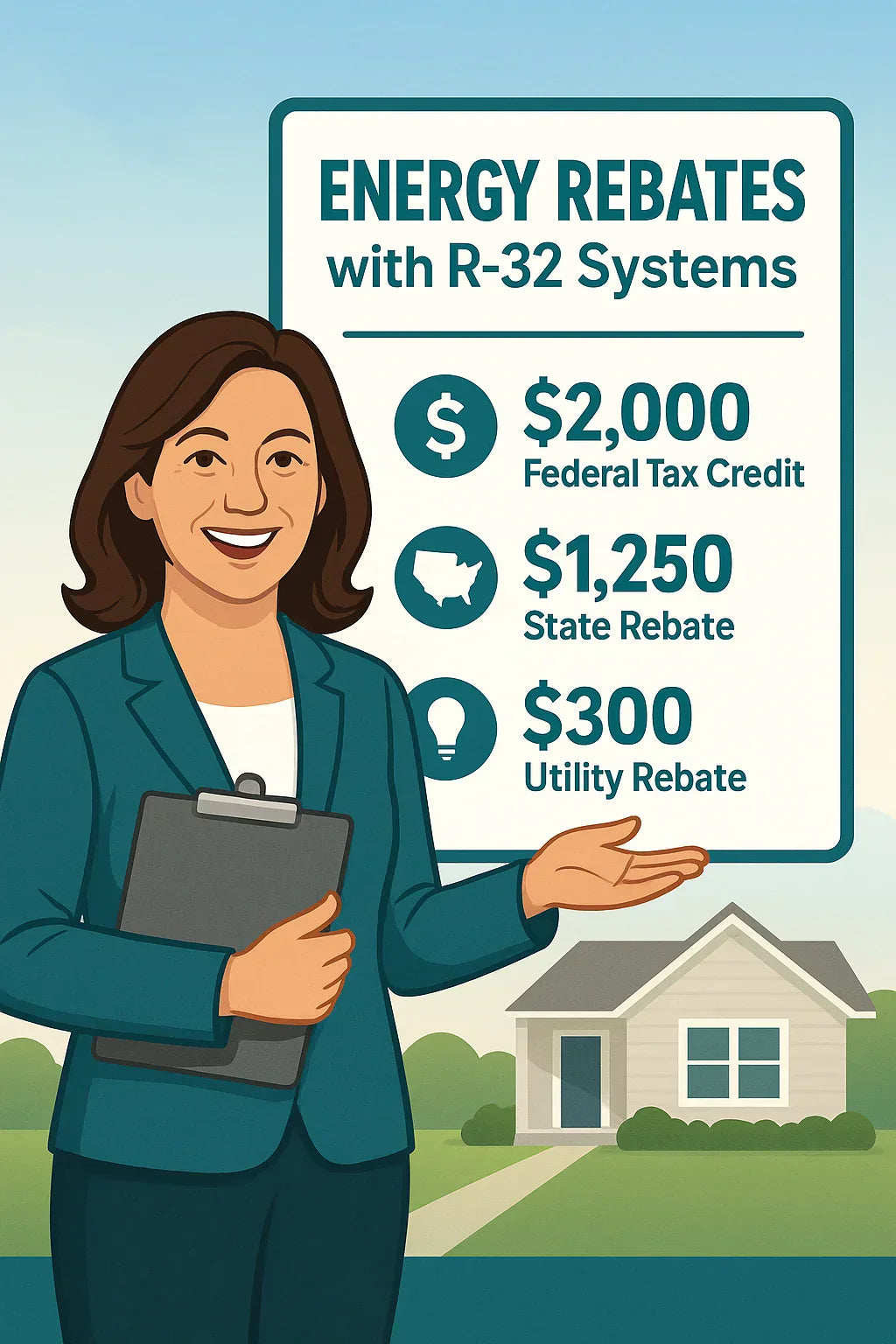

🏠 Example Savings Scenario

Let’s say you install a 2.5-ton R-32 heat pump system with a SEER2 rating of 16.0:

-

Federal Tax Credit: $2,000

-

State Rebate (e.g., Mass Save): $1,250

-

Utility Rebate: $300

Total Possible Savings: $3,550

That’s a significant offset to a system installation that might cost $7,500–$9,000.

🧠 Samantha’s Tips for Maximizing Rebates

"Don’t wait until after the install to gather paperwork. Ask your installer for model certification forms up front. And look for rebates that stack — federal, state, and utility programs can all work together to save you more."

🔍 Final Takeaway: R-32 Is Good for the Planet and Your Wallet

R-32-based HVAC systems offer powerful cooling, lower environmental impact, and outstanding efficiency — all of which can qualify you for major incentives.

By choosing ENERGY STAR and SEER2-compliant models and working with a certified contractor, you can take advantage of every rebate and credit available.

👉 Start browsing rebate-eligible R-32 systems today at The Furnace Outlet

In the next topic we will kow more about: How R-32 Systems Support a Greener Future