HEEHRA, the high-efficiency electric home rebate program established by the 2022 Inflation Reduction Act (IRA), will soon be up and running. It will enable consumers to capitalize on energy-efficient home improvements and reduced energy costs. Homeowners who make energy-efficient upgrades are essential in the nationwide move to reduce carbon emissions. According to Resources for the Future, the use of fossil fuels in residential and commercial buildings accounts for about 12.5% of greenhouse gas emissions in the United States. Households can reduce emissions by switching to cleaner forms of energy for heating, cooling, and cooking.

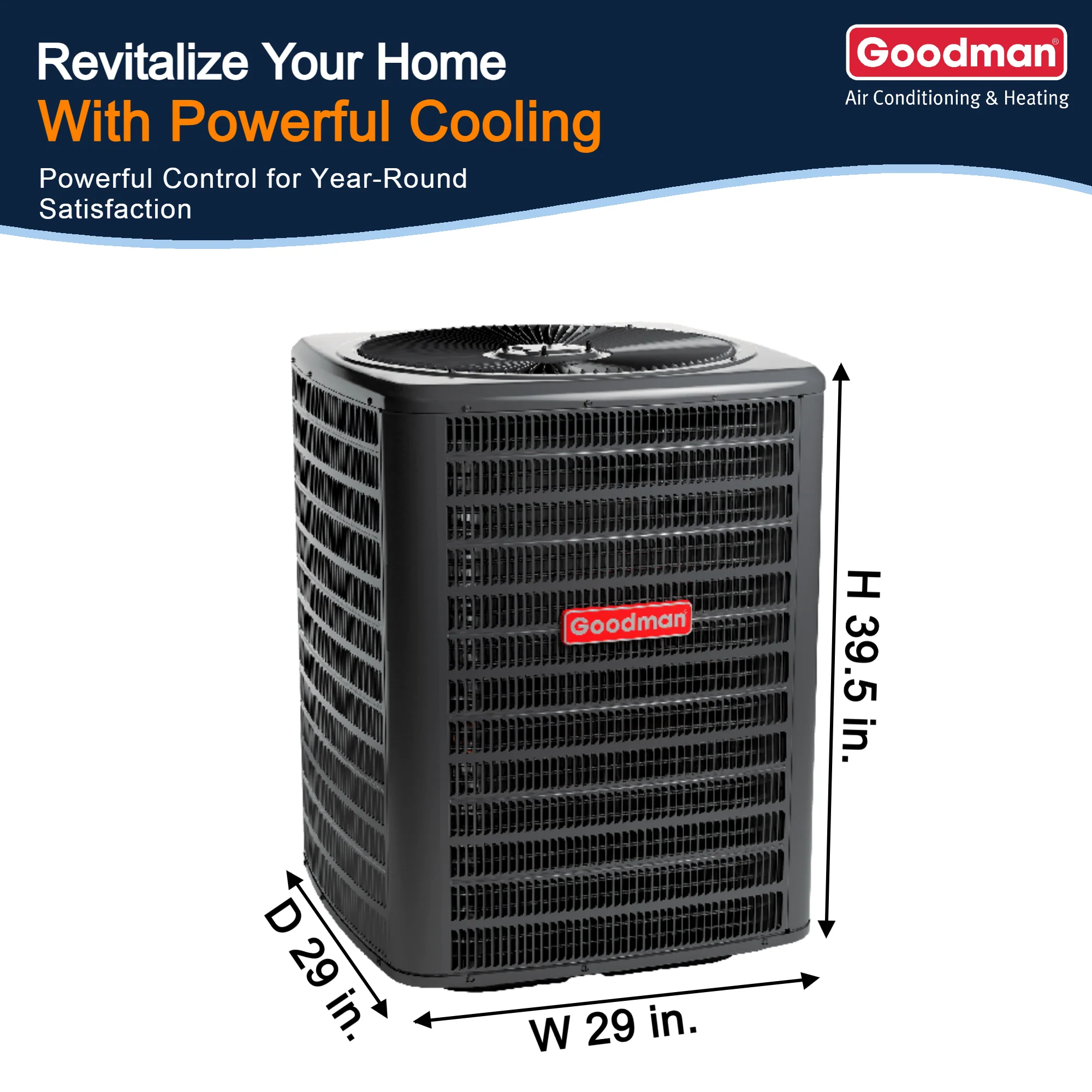

One home improvement covered by the HEEHRA program is heat pump installation. Heat pumps are highly efficient electric heating and cooling units. A single heat pump system can replace a home’s air conditioner and furnace. Heat pumps are gaining popularity in the U.S., demonstrating 15% growth in 2021. While this number is promising after five years of consistent 5% growth, government policies aim to bolster heat pump installations and other energy-saving solutions to reach net-zero emissions by 2050.

What is HEEHRA?

HEEHRA (High-Efficiency Electric Home Rebate Act) is a new IRA program offering point-of-sale rebates on household electrification and weatherization projects to assist low- to moderate-income families in reducing energy bills and carbon emissions to improve indoor and outdoor air quality.

The act allocates 4.5 billion dollars to state energy offices to administer the program. According to the wording in the Inflation Reduction Act, heat pumps and other high-efficiency appliances, as well as efficiency-improving upgrades, such as breaker boxes and home insulation, are eligible for discounts.

How does the high-efficiency electric home rebate program work?

As of publication, the HEEHRA program has not been enacted in any states. The federal government must distribute the funds and set up the guidelines with the state energy offices before the program can be implemented. Program rollouts are expected to begin in late 2023 to early 2024.

Once the program is running, consumers can receive cash rebates of up to $14,000 on qualified upgrades at purchase. Discounts will cover equipment and installation costs. The program is set to run until September 30, 2031, or when funds are depleted.

The act specifies different rebate levels and requirements for various upgrades. The program allows up to $8,000 for HVAC heat pumps, $1,750 for heat pump water heaters, and $840 for heat pump clothes dryers.

HEEHRA Program Requirements

The HEEHRA program is only applicable to low- to moderate-income households. Low-income families have annual incomes less than 80% of the local median income and are eligible for 100% discounts up to $14,000. Moderate-income families have annual incomes of 80 to 150% of the local median income and are eligible for 50% discounts up to $14,000. Households with incomes above 150% do not qualify for the HEEHRA program. Visit the HUD website for income limits in your county.

The act specifies requirements for each home improvement project, stipulating that heat pumps and other appliances must be Energy Star-qualified.

Energy Star Heat Pump Criteria

| Product Type | Specification |

|

Central AC split system heat pump |

≥ 7.8 HSPF2 / ≥15.2 SEER2 / ≥11.7 EER2 |

|

Central AC single package heat pump |

≥ 7.2 HSPF2 / ≥15.2 SEER2 / ≥10.6 EER2 |

|

Split system ductless heat pump |

≥ 8.5 HSPF2 / ≥15.2 SEER2 |

|

Split system ducted heat pump |

≥ 8.1 HSPF2 / ≥15.2 SEER2 |

|

Single package heat pump |

≥ 8.1 HSPF2 / ≥15.2 SEER2 |

Benefits of the High-Efficiency Electric Home Rebate Program

The HEEHRA program makes energy-efficient home upgrades more attainable to low- to moderate-income families. These upgrades will lower families’ energy costs and increase their household savings. The program also aims to create healthier home environments by eliminating emissions from gas appliances.

But the HEEHRA program benefits not only the households enrolled in it but also the country as a whole. Demand for energy-efficient home improvements is expected to spur economic growth and job creation. Moreover, increased reliance on energy-efficient electric appliances for heating and cooking will reduce harmful emissions and create cleaner air for all to enjoy.

Lower Energy Bills

High-efficiency appliances perform better and use less energy than old, inefficient appliances. Consequently, energy-efficient upgrades reduce household energy bills. 85% of American households would save a combined total of $37.3 billion by switching to efficient electric space and water heating, according to Rewiring America.

Household Savings

Households can increase their savings through reduced energy bills from home efficiency improvements. Rewiring America estimates that families that switch from electric resistance, propane, and oil methods of space and water heating would save about $496 per year.

LMI Savings

Less than 50% of households with savings are low- to moderate-income (LMI) households, according to Rewiring America. The energy cost savings from efficient upgrades and the elimination of repair costs on outdated units would help LMI households save up to $493 a year.

Reduced Emissions

Replacing gas appliances with energy-efficient electric units will reduce harmful carbon emissions and create a cleaner environment. According to Rewiring America, 95% of residential building emissions derive from furnaces, water heaters, dryers, and stoves. Research suggests that switching from natural gas to electric space heating would reduce emissions by 50 to 70% and from natural gas to electric water heating by 46 to 54%.

Economic Growth

The country is expected to experience economic growth through job creation as people make their homes more energy efficient. The BlueGreen Alliance projects that millions of jobs will be created over the next ten years with an increased reliance on electricity. Rewiring America predicts the growth of installation, manufacturing, indirect, and induced jobs.

-

Installation: 463,430 jobs, including electricians, plumbers, and contractors

-

Manufacturing: 80,000 jobs, including factory, assembly line, and supply chain workers

-

Indirect and Induced: 800,000 jobs, including truck drivers, welders, mine engineers, accountants, service, retail, food and beverage workers, teachers, etc.

Improved Health

Electrification will lead to cleaner indoor and outdoor air and improved health for everyone by reducing emissions such as nitrogen dioxide, carbon monoxide, and formaldehyde. Rewiring America asserts that gas stove usage alone has been linked to a 42% increased risk of asthma symptoms in children.

Prepare and Prioritize Home Improvements

Although the IRA was signed into law in August of 2022, the HEEHRA program has yet to be enacted as of publication. Consumers can’t receive discounts or reap the HEEHRA program’s benefits until the program is put into motion by the state energy offices. The states are awaiting funding and guidelines from the federal government.

The program is expected to roll out in late 2023 to early 2024. In the meantime, homeowners should prepare for the program’s commencement to take full advantage of it before contractors book up, inventories decline, and funding runs out. Homeowners can prepare by scheduling energy audits, vetting local contractors, and prioritizing energy-efficiency home improvements.

-

Have an energy audit performed on your home. Auditors recommend efficiency improvements to save money and suggest local companies perform the work. Some electric companies perform free energy audits, although there might be a long wait for this service. Many home service companies do energy audits for a few hundred dollars and apply it to any projects you hire them to perform. Families can claim a Clean Energy tax credit of 30% of the cost of an energy audit conducted by an inspector, up to $150.

-

Consider contractors in your area. Home service companies might quickly book up when the program is implemented. Do research to find top-rated contractors and get on their schedules now.

-

Determine the best home improvement options. Inventories might rapidly decline when rebates become available. Know which upgrades you want to make and prioritize them, whether it’s a heat pump, new windows, better insulation, or all of the above.

Frequently Asked Questions

Will HEEHRA be retroactive?

It’s unclear if HEEHRA rebates will be issued retroactively. The rebates are intended to be issued at the point of sale. Still, the IRA authorizes states to give Home Efficiency rebates for projects beginning on or after the law was enacted on August 16, 2022.

When will HEEHRA rebates be available?

HEEHRA rebates are expected to be available in late 2023 to early 2024 after the states receive direction and funding from the federal government.

Can HEEHRA be combined with federal tax credits?

Yes, HEEHRA can be combined with federal energy efficiency and electrification tax credits, such as 25C and 25D.

2 comments

https://Odessaforum.Biz.ua/

Thanks for sharing your thoughts. I really appreciate

your effforts and I am waifing for your furthuer post thanks once again. https://Odessaforum.Biz.ua/

https://Odessaforum.Biz.ua/

Thanks for sharing your thoughts. Ireally appreciate your efforts and I am waiting for your further post thanks once

again. https://Odessaforum.Biz.ua/