🏠 Introduction: Tony’s Budget Decision

Tony’s old 10 SEER central air conditioner was finally giving out. He decided to replace it with a Goodman 3 Ton 13.4 SEER2 system—a reliable, affordable, DOE-compliant choice for his 1,900 sq. ft. Northeast home.

The problem? The quotes he received for equipment + installation ranged between $7,500 and $9,000.

That’s not pocket change. Like many homeowners, Tony didn’t want to empty his savings or rack up high-interest debt. Instead, he researched financing options available in 2025 that could spread payments out while keeping costs manageable.

This guide walks through every financing path Tony considered—and shows which one made the most sense for him.

💰 Why Finance an HVAC System?

Before we dive into the options, let’s look at why most homeowners finance:

-

High upfront costs: Central AC systems cost $7,000–$12,000 installed in the Northeast.

-

Unexpected replacement: Systems often fail suddenly in summer. Financing prevents emergencies from draining savings.

-

Energy savings offset payments: A 13.4 SEER2 system can reduce energy bills by 20–25%, freeing money for monthly payments.

-

Improved comfort now: Financing lets you enjoy efficient cooling immediately instead of waiting years to save.

Tony’s mindset: “If I can keep my monthly payment reasonable and lower my bills, that’s a win-win.”

📖 Reference: Energy.gov – Central Air Conditioning

💳 Option 1: Dealer/Installer Financing

📖 How It Works

-

Offered directly by HVAC contractors or distributors at point of sale.

-

Often backed by financing partners (e.g., Synchrony, Wells Fargo).

-

Promotional offers include 0% APR for 24–36 months.

-

Long-term financing (up to 60 months or more) available with interest.

✅ Pros

-

Convenient—apply and sign paperwork during installation.

-

0% promotions save money if paid off on time.

-

Quick approval process.

❌ Cons

-

Best terms require strong credit.

-

Missed payments can trigger retroactive interest.

-

May include fees if loan is not repaid in the promotional period.

💵 Example (Dealer Financing)

-

System cost: $8,000

-

0% APR for 36 months → $222/month

-

Paid in full within 3 years, no interest.

Tony’s installer offered him a 60-month fixed APR plan—a balance between affordability and predictability.

📖 Reference: HVAC Financing Options

🏦 Option 2: Personal Loans from Banks or Credit Unions

📖 How It Works

-

Borrow a lump sum and repay with fixed monthly installments.

-

Loan terms: 3–7 years.

-

Interest rates: typically 6–12% (depends on credit score).

✅ Pros

-

Predictable payments.

-

No dealer restrictions—money can cover equipment, labor, extras.

-

Good choice for those without access to promotional dealer offers.

❌ Cons

-

Higher interest than 0% dealer financing.

-

Requires good-to-excellent credit for the best rates.

-

May include origination fees.

💵 Example (Bank Loan at 7%)

-

Loan amount: $8,000

-

Term: 60 months

-

Interest: 7%

-

Payment: $158/month

-

Total paid: $9,480 (includes ~$1,480 in interest).

Tony checked with his local credit union. While the monthly payment looked good, he didn’t like paying almost $1,500 extra in interest compared to a 0% option.

📖 Reference: Consumer Reports – Best Ways to Finance Home Upgrades

💳 Option 3: Credit Cards

📖 How It Works

-

Use a credit card to cover part or all of the system cost.

-

Best used with 0% APR introductory offers (12–18 months).

✅ Pros

-

Fast and flexible.

-

Earn rewards, points, or cashback.

-

Great for bridging small gaps if you can pay off quickly.

❌ Cons

-

Standard APR: 20%+.

-

Carrying a balance beyond promo period is very expensive.

-

Large charges may affect credit utilization and score.

💵 Example (0% APR for 15 Months)

-

Charge: $8,000

-

Payment: $533/month for 15 months → no interest.

-

If unpaid after promo: 22% APR could add thousands in interest.

Tony decided credit cards were too risky unless he could pay off fast.

⚡ Option 4: Utility & State Financing Programs

Some of the best financing deals in the Northeast come from state-backed or utility-sponsored programs.

🌎 Massachusetts: Mass Save HEAT Loan

-

0% interest financing for up to 7 years.

-

Covers central AC, heat pumps, and insulation upgrades.

-

Payment example: $8,000 ÷ 84 months = $95/month.

🌎 New York: NYSERDA Financing

-

Offers low-interest loans for efficient HVAC upgrades.

-

Flexible repayment terms.

-

Can be paired with rebates.

🌎 Other Northeast Utilities

-

Some utilities provide rebates + financing bundles.

-

Often limited to approved equipment and contractors.

✅ Pros

-

0% interest saves thousands over time.

-

Encourages energy-efficient upgrades.

-

Lower monthly payments spread over longer terms.

❌ Cons

-

More paperwork and approval steps.

-

Limited to certain contractors and equipment models.

-

May require energy audit before approval.

Tony’s friend in Massachusetts used a Mass Save HEAT Loan and paid just $95/month for his central AC—interest-free.

📖 Reference: Mass Save – HEAT Loan Program

📖 Reference: NYSERDA – Residential Financing

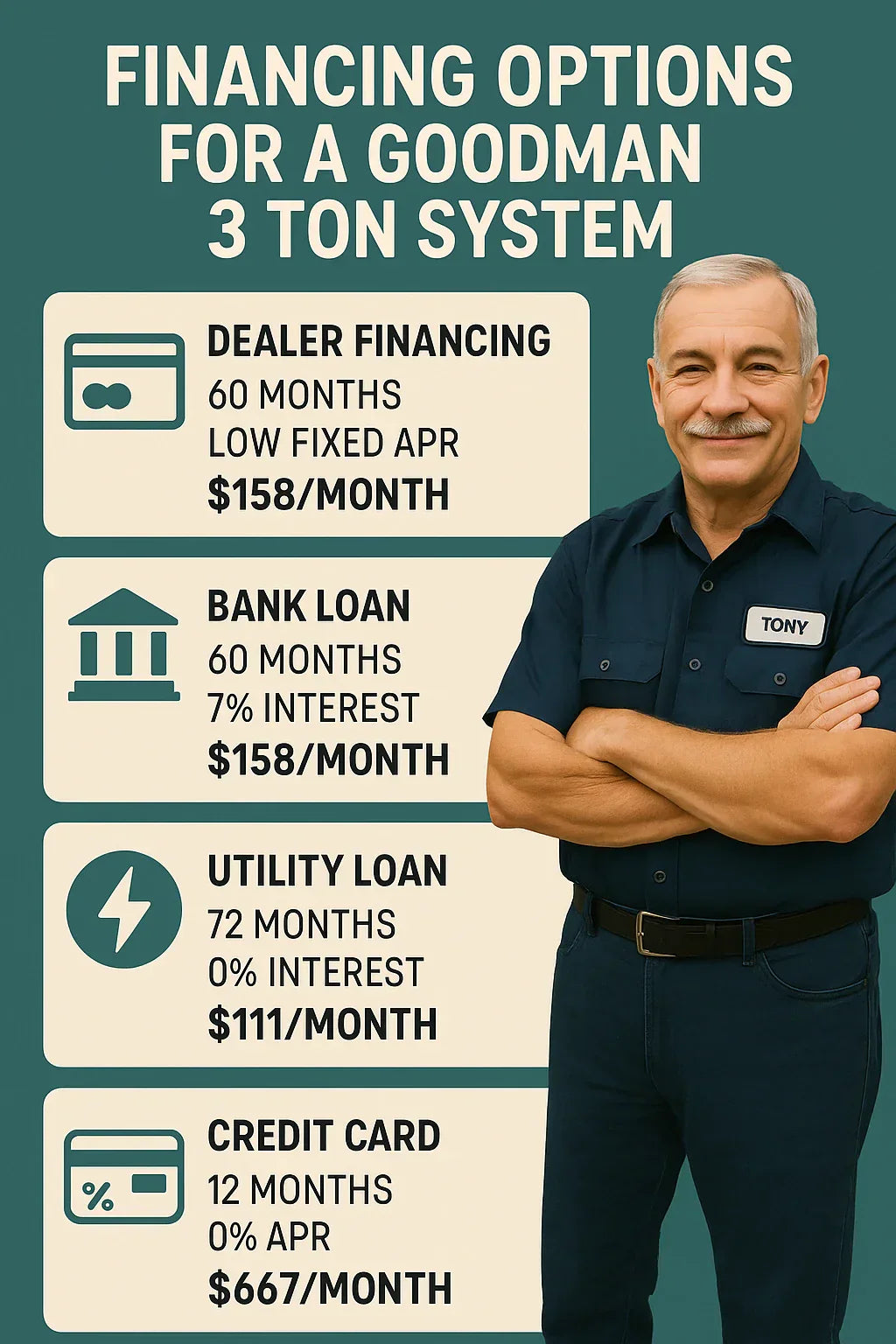

📊 Comparing Monthly Payments (Example: $8,000 System)

| Financing Option | Term | Interest Rate | Monthly Payment | Total Paid |

|---|---|---|---|---|

| Dealer Financing (0%) | 36 months | 0% | $222 | $8,000 |

| Bank Loan | 60 months | 7% | $158 | $9,480 |

| Credit Card (0% intro) | 15 months | 0% | $533 | $8,000 |

| Utility HEAT Loan (0%) | 84 months | 0% | $95 | $8,000 |

👉 Tony chose the 60-month dealer financing plan because it offered a manageable monthly payment without high interest—though he admits the Mass Save HEAT Loan would have been the best deal if he lived in Massachusetts.

🔧 Rebates & Incentives to Pair With Financing

Financing gets your system in the door, but rebates lower the final cost.

-

Federal Incentives (2025): Up to $2,000 credit for heat pumps (AC-only units usually don’t qualify).

-

State Programs: Vary by location; some offer $300–$500 rebates for efficient ACs.

-

Utility Rebates: Many utilities offer $100–$400 for Energy Star-certified units.

Tony received a $300 utility rebate, which he applied directly toward his first payment.

📖 Reference: DSIRE – State Incentives Database

🧾 Tony’s Real-World Takeaway

Here’s how Tony broke it down:

-

Total system + installation cost: $8,200

-

Rebate: -$300

-

Final financed amount: $7,900

-

Financing plan: 60-month dealer loan at low fixed APR

-

Monthly payment: ~$155

-

Energy savings: ~$55/month compared to old system

👉 Net impact: His energy savings covered about 1/3 of the payment, making the upgrade affordable.

✅ Final Takeaway: Choosing the Right Financing Path

For most Northeast homeowners, financing a Goodman 3 Ton 13.4 SEER2 system in 2025 comes down to:

-

Dealer Financing: Best if you qualify for 0% promotions.

-

Utility Programs (like Mass Save): Best long-term option if available in your state.

-

Bank/Credit Union Loan: Solid fallback with predictable payments.

-

Credit Cards: Only smart if you can pay off quickly under a 0% promo.

Tony’s advice:

“Don’t just look at the sticker price—look at the monthly payment and long-term cost. With the right financing, your Goodman system pays for itself in comfort and energy savings.”

In the next topic we will Know more about: Is a 3 Ton 13.4 SEER2 AC Enough for Your Northeast Home?