Mark’s Complete Homeowner’s Guide to Saving Money

1. 📢 Why Incentives Matter

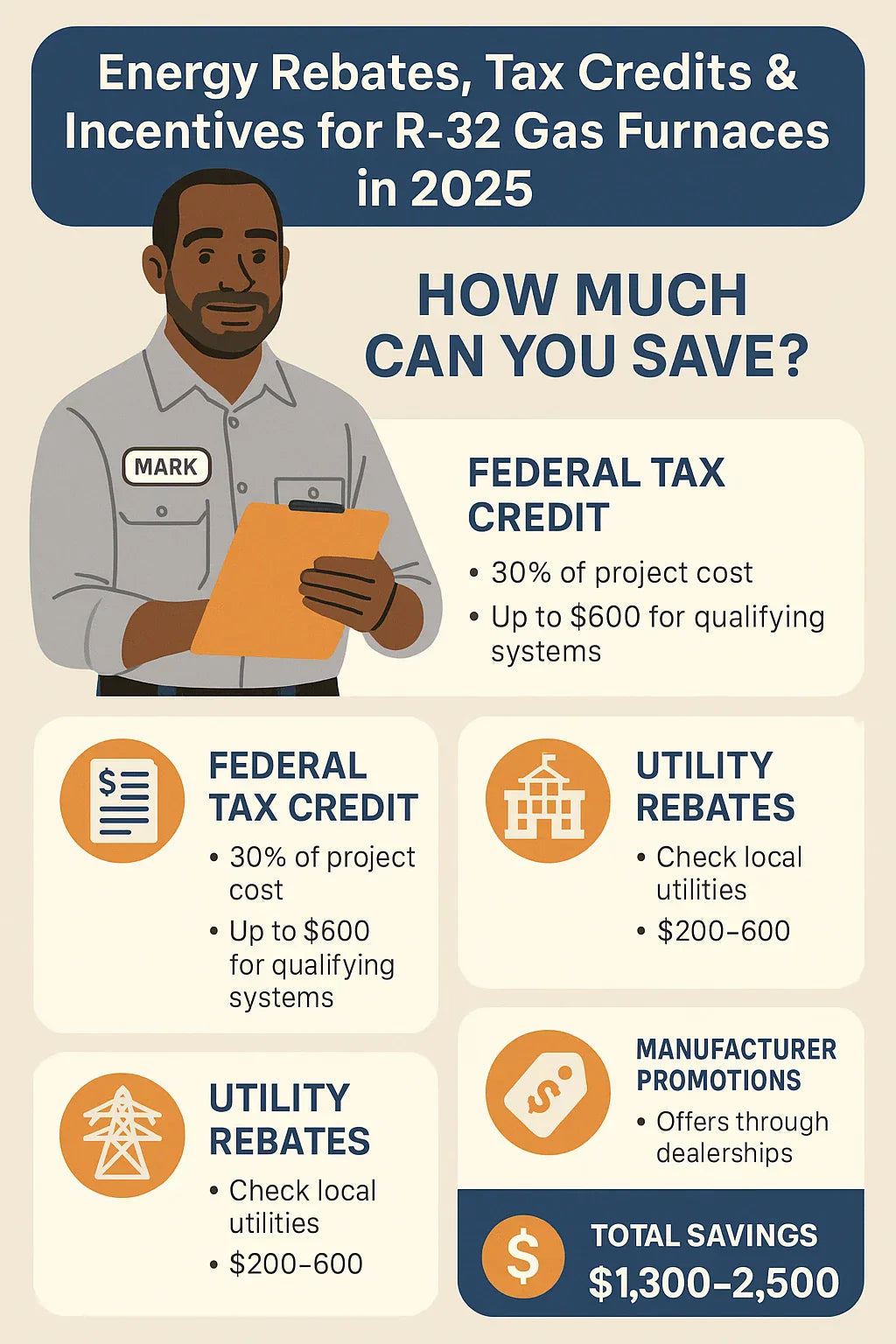

When I upgraded to a 100,000 BTU high-efficiency R-32-compatible gas furnace in early 2025, the sticker price nearly made me spill my coffee. But after applying federal, state, and utility incentives, my total cost dropped by 27%.

Energy incentives aren’t just about saving money—they’re designed to push homeowners toward high-efficiency, low-emission equipment.

If you’re buying a furnace that’s R-32-compatible, you’re already thinking ahead about refrigerant phase-outs and future compliance. Why not think ahead about your budget too?

2. 🏛 Federal Tax Credits in 2025

Thanks to the Inflation Reduction Act (IRA), 2025 continues strong incentive programs for energy-efficient HVAC equipment.

2.1 Section 25C – Energy Efficient Home Improvement Credit

-

Credit Amount: 30% of total project cost, up to $600 for qualifying furnaces.

-

Eligibility: Furnace must meet or exceed 97% AFUE and be ENERGY STAR® certified (ENERGY STAR Furnace Criteria).

-

Installation: Must be in an existing primary residence (not new construction).

-

Claiming: File IRS Form 5695 with your federal tax return (IRS Energy Efficient Home Improvement Credit).

2.2 Section 25D – Residential Clean Energy Credit

-

While mainly for solar/renewables, pairing a furnace with renewable-powered systems may allow indirect benefits.

Example:

If your R-32 furnace cost $3,000 installed, and qualifies for the $600 max credit, you save $600 at tax time.

3. 🌎 State & Local Incentives

Every state is different. Some offer cash rebates, others provide tax deductions, and some have zero-interest financing.

How to Find Yours: Use the DSIRE Database (Database of State Incentives for Renewables & Efficiency) to search by ZIP code.

Example State Rebates (2025 data):

| State | Program Name | Furnace Incentive |

|---|---|---|

| California | TECH Clean California | $500–$1,000 for 95%+ AFUE gas furnaces |

| New York | NYSERDA Heating Efficiency Program | $350–$500 rebate |

| Minnesota | Minnesota Energy Efficiency Rebate | $400–$800 based on AFUE |

| Massachusetts | Mass Save® | $400 for ENERGY STAR furnaces |

4. ⚡ Utility Company Rebates

Many utility companies encourage customers to install high-efficiency equipment to reduce peak demand.

Common Requirements:

-

AFUE 95% or higher.

-

Installed by a licensed contractor.

-

Proof of ENERGY STAR certification.

2025 Utility Rebate Examples:

| Utility | Region | Rebate |

|---|---|---|

| Xcel Energy | Midwest | $300–$500 |

| PSEG | Northeast | $350 |

| SoCalGas | California | $500 |

| Consumers Energy | Michigan | $400 |

Pro tip: Many utilities allow stacking with state and federal incentives—meaning you could combine them all for maximum savings.

5. 🏷 Manufacturer & Dealer Promotions

Furnace manufacturers often run seasonal rebates—especially in spring and fall shoulder seasons.

2025 Examples:

-

Goodman®: Up to $350 rebate when paired with a matching R-32-compatible AC or heat pump.

-

Amana®: 10-year extended warranty upgrade for high-efficiency installs.

-

Daikin®: Instant rebates of $300–$500 during promotional periods

Local dealers sometimes discount labor if you install multiple pieces of equipment at once.

6. 📋 How to Qualify & Apply

What You’ll Need:

-

Proof of purchase (invoice showing model, AFUE rating).

-

AHRI certificate (lists matching furnace/coil efficiency ratings).

-

Installer’s license number (often required for rebates).

-

Completed rebate forms from the program provider.

Application Tips:

-

Submit within the stated time window (often 30–90 days after install).

-

Keep copies of all paperwork for tax season.

-

For federal credits, retain records for at least 3 years.

7. 💡 Mark’s Savings Playbook

Here’s how I stacked my incentives in 2025:

| Incentive Type | Savings |

|---|---|

| Federal 25C Tax Credit | $600 |

| State Rebate (Minnesota) | $500 |

| Utility Rebate (Xcel Energy) | $400 |

| Manufacturer Promotion (Daikin) | $300 |

| Total Savings | $1,800 |

My installed cost went from $5,500 down to $3,700 after incentives.

8. 📚 Case Studies

Case 1 – Midwest Homeowner

-

Installed 97% AFUE R-32-compatible furnace.

-

Claimed $1,600 total savings through state + utility + federal.

-

Payback period shortened by 2 years.

Case 2 – Northeastern Family

-

Paired furnace with R-32 AC for dual rebates.

-

Saved $2,200 total.

-

Chose variable-speed for added comfort.

Mark’s Final Word:

“If you skip checking incentives before buying your furnace, you’re leaving hundreds—maybe thousands—of dollars on the table. Stack your savings like I did, and you’ll feel a lot warmer about the price tag.”

In the next topic we will read more about: Is a 100,000 BTU Gas Furnace Right for Your Home? R-32 Sizing Tips & Layout Guidance