If you're considering a new air conditioner under 2 tons, you're likely evaluating both performance and cost. R-32 refrigerant systems, particularly those under 2 tons, are gaining popularity due to their improved efficiency and lower environmental impact. But beyond the performance benefits, you may be eligible for energy rebates and tax credits that can significantly offset your upfront investment.

In this guide, we'll explore how U.S. homeowners can leverage these financial incentives in 2025 and beyond. From federal tax credits to local utility rebates, we’ll break down:

-

Why R-32 refrigerant matters

-

Which systems qualify

-

Federal and state-level programs

-

ENERGY STAR and SEER2 requirements

-

How to apply for rebates and tax credits

-

Real-world savings examples

Why R-32 Systems Are Eligible for More Incentives

The HVAC industry is undergoing a major refrigerant shift. R-410A, once the industry standard, is being phased out due to its high global warming potential (GWP). R-32 systems offer:

-

Lower GWP: Approximately 675 vs. 2,088 for R-410A

-

Improved efficiency: Up to 10% higher performance

-

Better compatibility with future energy standards

Because of these improvements, many R-32 systems are eligible for tax credits and utility rebates designed to encourage lower-emission technologies.

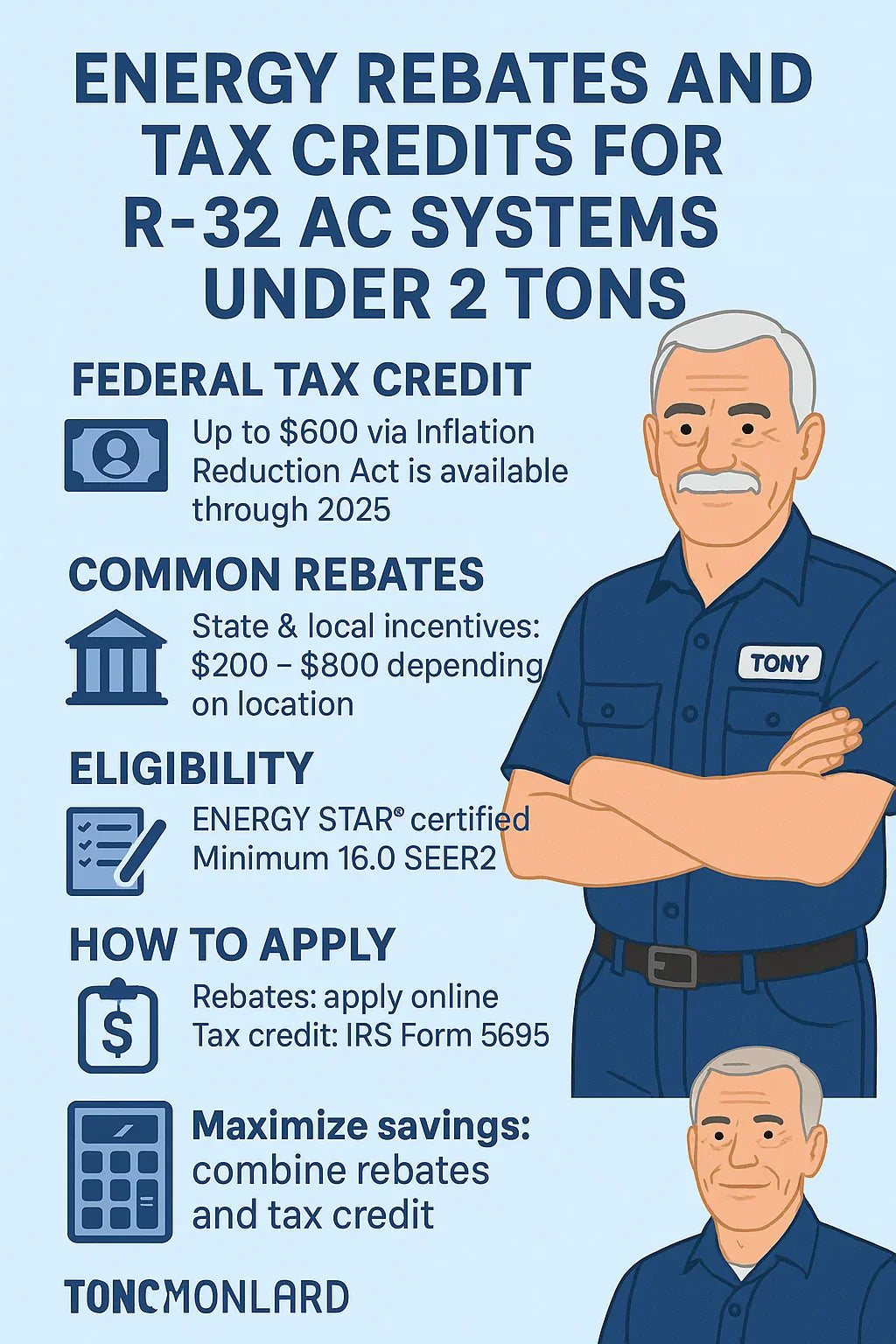

Federal Tax Credits in 2025 for R-32 Systems < 2 Tons

The Inflation Reduction Act (IRA) extended and enhanced many tax credit programs for homeowners. One key provision is the 25C Residential Energy Efficiency Tax Credit, which allows homeowners to claim up to 30% of the total installed cost, capped at $600 for qualified air conditioners.

Key Requirements:

-

System must be installed in your primary residence

-

The AC must be ENERGY STAR certified

-

Must meet or exceed SEER2 efficiency requirements

-

Professional installation required

What this means for R-32 units: Most modern R-32 air conditioners under 2 tons meet these standards. If you install a qualifying system and have proper documentation, you can reduce your federal tax bill by up to $600.

Tip: Keep your invoice, AHRI certificate, and product manual with the ENERGY STAR label for your records.

SEER2 and ENERGY STAR Certification Explained

To qualify for federal tax credits, your R-32 AC system must meet specific SEER2 (Seasonal Energy Efficiency Ratio 2) standards:

| Region | Minimum SEER2 for Split ACs (under 2 tons) |

|---|---|

| Northern U.S. | 13.4 |

| Southern U.S. | 14.3 |

| Southwest U.S. | 14.3 |

ENERGY STAR certification typically exceeds these SEER2 minimums. When shopping, check for SEER2 ratings above 14.3 to qualify in all regions.

State and Local Rebates for R-32 Systems

In addition to federal credits, your state energy office or local utility may offer rebates ranging from $100 to $1,200+, depending on your location.

Example Rebates:

-

California: PG&E and SoCal Edison offer rebates of $300 to $800 for ENERGY STAR-certified systems

-

New York (NYSERDA): Incentives of up to $1,000 for high-efficiency systems

-

Texas: Oncor offers rebates of $350+ for systems meeting SEER2 benchmarks

To find programs in your state, visit:

-

Your local utility company’s rebate portal

-

State energy efficiency websites

How to Apply for Rebates and Credits

Federal Tax Credit:

-

Have your system installed by a licensed HVAC technician

-

Obtain proof of ENERGY STAR status (AHRI certificate or product sheet)

-

File IRS Form 5695 with your tax return

-

Enter your system info and costs in Part II, Line 18a

Local Rebates:

-

Visit your utility’s website and locate the AC rebate program

-

Download and complete the rebate form

-

Submit within 60–90 days of installation

-

Include copies of invoice, proof of SEER2 rating, and contractor certification

Some rebates are applied as instant discounts at the point of sale through participating contractors.

Can You Combine Multiple Incentives?

Yes! Many homeowners stack:

-

Federal 25C tax credit ($600)

-

Local utility rebate ($200 to $1,000)

-

Manufacturer promotion ($100 to $300)

This can reduce a $4,000 AC installation to $2,000–$2,500 after all incentives are applied.

Real-World Example: Tony in Georgia

Tony, a homeowner in Atlanta, replaced his old R-410A unit with a 1.5-ton R-32 Goodman system:

-

Equipment & install cost: $3,800

-

Federal tax credit (25C): $600

-

Georgia Power rebate: $400

-

Goodman promotional discount: $200

Final net cost: $2,600

Over the next 12 months, Tony reported saving $180 on electricity thanks to the more efficient SEER2 rating.

Manufacturer Rebates on R-32 Systems

Some leading brands offer seasonal rebates for R-32 AC systems:

-

Goodman: Rebates up to $250 on select ENERGY STAR models

-

Daikin: Instant rebates when installed by a certified Comfort Pro

-

Carrier: Bundled rebates when paired with smart thermostats

Check manufacturer websites and ask your installer about current offers.

Common Mistakes to Avoid

-

Missing the rebate deadline (usually 30–90 days post-install)

-

Installing non-ENERGY STAR units

-

Not saving required documentation

-

Filing the wrong tax form

Keep a dedicated rebate folder with:

-

Invoice

-

Installation date

-

Contractor license

-

Product spec sheets

-

AHRI certification

Final Thoughts: Is the Upgrade Worth It?

Yes—especially when you consider:

-

Lower energy bills

-

Up to $1,500 in incentives

-

Increased home value

-

Support for climate-friendly technologies

With new mandates favoring low-GWP refrigerants, R-32 systems offer future-proof performance and a financial edge. If your system is under 2 tons, you're in a sweet spot for maximizing rebate value without overspending on oversized equipment.

In the next topic we will know more about: Is a 1.5 Ton R-32 AC Enough for Your Home? Sizing Tips & Climate Factors