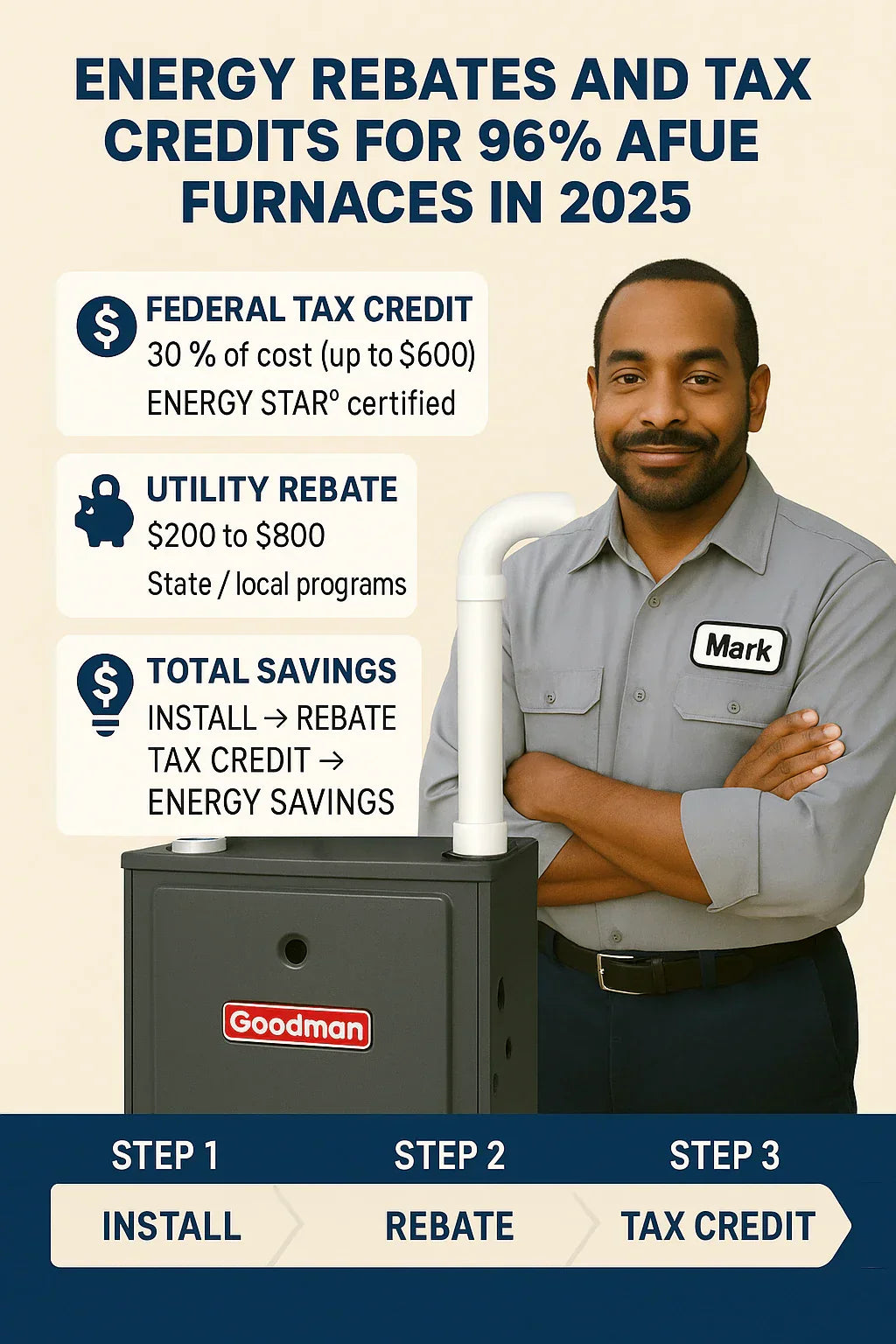

If you’ve been considering upgrading your old furnace, 2025 might be the best year yet to make the move.

Between expanded federal tax credits, new rebate programs, and ongoing state and utility incentives, homeowners can now save thousands when they install a high-efficiency model like the Goodman 96% AFUE Two-Stage Gas Furnace (Model GRVT961005DN).

For Mark — a homeowner in the Midwest who recently replaced his 20-year-old furnace — the timing couldn’t have been better:

“I was shocked. I got a $400 rebate from my gas company and another $600 in federal tax credits. That’s a thousand dollars back — before I even turned the furnace on.”

This guide breaks down everything you need to know about energy rebates and tax credits for 96% AFUE furnaces in 2025 — who qualifies, how much you can save, and exactly how to claim your benefits.

💡 1. Why High-Efficiency Furnaces Qualify for Energy Incentives

The U.S. government and state energy agencies encourage homeowners to upgrade to high-efficiency HVAC systems because it reduces carbon emissions and lowers energy demand during peak winter months.

That’s where AFUE comes in — it stands for Annual Fuel Utilization Efficiency, and it measures how efficiently a furnace converts fuel into heat.

| AFUE Rating | Efficiency Level | Description |

|---|---|---|

| 80% | Standard | Older, less efficient models (20% of heat lost through exhaust) |

| 90–94% | High Efficiency | Condensing furnaces that reuse exhaust heat |

| 95–98% | Premium Efficiency | ENERGY STAR-qualified models like the Goodman GRVT961005DN |

At 96% AFUE, Goodman’s furnace converts 96 cents of every gas dollar into usable home heat — wasting just 4%.

That’s why it qualifies for federal tax credits, state rebates, and utility incentives — all designed to reward energy-smart homeowners.

🏛️ 2. Federal Energy Tax Credit for High-Efficiency Furnaces (2025 Update)

The biggest nationwide benefit for 2025 is the Energy Efficient Home Improvement Credit, also known as the Section 25C tax credit, updated by the Inflation Reduction Act (IRA).

This program rewards homeowners who install qualifying energy-efficient heating and cooling systems.

🧾 Key Details:

-

Credit amount: 30% of total installation cost, up to $600 for furnaces.

-

Eligibility period: Through December 31, 2032.

-

Applies to: Primary residences (not rentals).

-

Efficiency requirement: At least ENERGY STAR certified (typically ≥95% AFUE).

Goodman’s GRVT961005DN 96% AFUE furnace meets this criterion, making it eligible for the full federal credit.

To confirm your model, check its AHRI (Air-Conditioning, Heating, and Refrigeration Institute) certificate, which lists its efficiency and certification.

👉 Source: ENERGY STAR – Federal Tax Credits for HVAC

📊 3. How the Inflation Reduction Act Expands Your Options

The Inflation Reduction Act (IRA), signed into law in 2022, allocates $8.8 billion for home energy upgrades through 2032 — including rebates and credits for heating and cooling systems.

It introduced two major programs relevant to HVAC:

🏠 1. Energy Efficient Home Improvement Credit (25C)

This is the tax credit mentioned above — available when filing your annual tax return.

⚡ 2. Home Energy Rebate Programs (HEEHRP & HOMES)

These are point-of-sale rebates, meaning you receive the discount directly when purchasing or installing qualifying systems.

While some IRA rebates focus on electric heat pumps, homeowners upgrading to gas furnaces can still qualify for funding if they bundle improvements like:

-

Smart thermostats

-

Home weatherization (insulation, air sealing)

-

Duct sealing and system optimization

🏡 4. State and Local Utility Rebates (2025 Edition)

In addition to federal incentives, most U.S. states — and hundreds of local utility companies — offer rebates for homeowners who install ENERGY STAR-qualified furnaces.

📍 Example Utility Rebates for 96% AFUE Furnaces (2025):

| State / Utility | Rebate Amount | Efficiency Requirement |

|---|---|---|

| Consumers Energy (MI) | $350 | ≥95% AFUE |

| Xcel Energy (MN/CO) | $400 | ≥96% AFUE |

| National Grid (NY/MA) | $550 | ENERGY STAR Certified |

| PECO Energy (PA) | $300 | ≥95% AFUE |

| SoCalGas (CA) | $600 | ≥95% AFUE |

| Dominion Energy (UT/VA) | $250 | ≥95% AFUE |

Most rebates can be combined with the federal tax credit, multiplying your total savings.

👉 Source: DSIRE – Database of State Incentives for Renewables & Efficiency

🧮 5. Real-World Savings Breakdown

Let’s use Mark’s example to show how these programs work together.

| Item | Amount |

|---|---|

| Goodman 96% Furnace + Installation | $4,500 |

| Federal 25C Tax Credit (30%, max $600) | -$600 |

| State Utility Rebate | -$400 |

| Smart Thermostat Rebate | -$75 |

| Final Cost After Incentives | $3,425 |

On top of that, Mark’s new furnace is saving him about $250 per year in gas bills. Over 10 years, that’s another $2,500 in energy savings.

“I spent less than $3,500 total and started saving right away. I wish I’d upgraded sooner.”

⚙️ 6. How to Confirm Your Goodman Furnace Qualifies

To qualify for energy credits, your furnace must meet ENERGY STAR certification standards.

✅ Goodman GRVT961005DN Qualification Checklist:

-

AFUE: 96%

-

System Type: Two-Stage, Variable Speed

-

Fuel Type: Natural Gas

-

ENERGY STAR Certified: Yes

-

Meets Federal 25C Credit: ✔️

-

Eligible for State Rebates: ✔️

When you buy your Goodman furnace, ask for:

-

The AHRI Certificate of Product Ratings (proof of efficiency)

-

The ENERGY STAR label (usually on the unit or manual)

-

Your installation invoice (required for IRS Form 5695)

👉 Source: GoodmanMfg.com – Product Specifications

🧾 7. Step-by-Step: How to Claim Your Federal Tax Credit

Claiming your furnace tax credit is simpler than most homeowners think.

Here’s exactly how Mark did it when filing his taxes:

-

Save your paperwork

-

Installation invoice

-

AHRI certificate

-

Proof of ENERGY STAR certification

-

-

Download IRS Form 5695

-

Section II covers “Energy Efficient Building Property.”

-

List your furnace and installation cost.

-

-

Calculate 30% of total cost (up to $600)

-

Example: $4,000 install × 30% = $1,200 → Credit capped at $600.

-

-

Attach to your tax return (Form 1040)

-

Report on Schedule 3, “Nonrefundable Credits.”

-

-

File for the year installed

-

If installed in 2025, claim when filing 2026 taxes.

-

👉 Source: IRS – About Form 5695

💬 8. Combining Rebates, Credits, and Financing

Here’s the good news: you can combine multiple savings opportunities.

| Type | Example | When You Get It |

|---|---|---|

| Federal Tax Credit (25C) | Up to $600 | At tax time |

| Utility Rebate | $200–$800 | 4–12 weeks post-install |

| Smart Thermostat Rebate | $50–$100 | Instant or online submission |

| Financing Incentives | 0% APR | During purchase |

Mark stacked all three:

“My dealer offered a financing plan with no interest, and my rebate came in by mail in six weeks. The credit hit when I filed my taxes.”

📆 9. Important Deadlines & Eligibility Windows

-

Federal Credit (25C): Valid through 2032.

-

State Rebates: Renew annually — most require submission within 90 days of installation.

-

Utility Rebates: Apply online or through your installer (some offer instant rebates).

-

Documentation: Keep receipts and AHRI certificate for at least 3 years in case of audit.

Tip: Some states (like California and Massachusetts) may require a permit or inspection before approving rebates.

🧠 10. Common Questions About Furnace Rebates

❓ Does every 96% furnace qualify?

Not automatically — it must be ENERGY STAR certified and professionally installed.

❓ Can landlords claim these credits?

No, only owner-occupied primary residences are eligible under the 25C credit.

❓ What if my furnace was installed in late 2024?

You claim the credit for the year installation was completed (file with 2024 taxes).

❓ Do electric and gas furnaces qualify for the same amount?

Both can qualify, but gas furnaces are capped at $600, while heat pumps can earn up to $2,000.

❓ Can I stack with a thermostat or insulation credit?

Yes! You can combine multiple efficiency upgrades — the total annual 25C credit cap is $3,200.

🔍 11. The Goodman Advantage: Built for Rebates and Credits

Goodman furnaces are engineered to meet modern energy standards. The GRVT961005DN model’s two-stage gas valve and variable-speed ECM blower allow it to fine-tune operation for maximum efficiency.

That makes it a perfect candidate for:

-

ENERGY STAR certification

-

25C federal tax credits

-

Most state rebate programs

Plus, Goodman’s limited lifetime heat exchanger warranty ensures long-term value — meaning the rebates are just the start of your savings.

📋 12. Checklist: What You’ll Need to Claim Your Incentives

✅ Furnace model number (e.g., Goodman GRVT961005DN)

✅ AHRI certificate number

✅ ENERGY STAR certification proof

✅ Installation invoice with date and total cost

✅ IRS Form 5695 for federal credit

✅ Utility rebate form or online portal login

✅ Photos of installed unit (some programs require verification)

Mark’s installer handed him a folder with everything pre-filled — a common service offered by professional HVAC contractors.

💬 13. Mark’s Real-World Example

Here’s how it worked for Mark in Michigan:

-

Goodman 96% AFUE furnace installed: $4,200

-

Consumers Energy rebate: $350

-

Federal 25C tax credit: $600

-

Smart thermostat rebate: $75

-

Total savings: $1,025

Mark’s gas usage dropped by 23% that winter, saving another $250 on bills.

“Between the rebates, credits, and fuel savings, I paid myself back in the first year. My Goodman furnace basically started earning money.”

📉 14. Long-Term Payback: Why Efficiency Always Wins

A 96% AFUE furnace doesn’t just qualify for rebates — it also keeps paying dividends year after year.

| Factor | Old 80% Furnace | Goodman 96% Furnace |

|---|---|---|

| Fuel Efficiency | 80% | 96% |

| Annual Gas Cost (Typical Home) | $1,000 | $750 |

| Yearly Savings | — | $250 |

| 10-Year Savings | — | $2,500 |

| Lifetime Warranty Value | — | Included |

Combine that with upfront incentives, and your total 10-year benefit can exceed $4,000.

🧾 15. Where to Find Rebates Near You

Finding local rebates is easy. Here are trusted resources:

-

DSIREUSA.org: Comprehensive database of all U.S. energy incentives.

-

EnergyStar.gov/Rebate-Finder: Search by ZIP code and product type.

-

Your local utility website: Many offer “Instant Savings” links for approved contractors.

-

The Furnace Outlet Customer Support: Can help confirm which Goodman models qualify in your state.

🧩 16. Key Takeaways

✅ Federal tax credit = 30% of cost, up to $600 for furnaces.

✅ Local utility rebates = $200–$800.

✅ Combined savings = $900–$1,500+ average.

✅ Goodman 96% AFUE models (like GRVT961005DN) qualify for most programs.

✅ Claim using IRS Form 5695 + local rebate applications.

The bottom line: high-efficiency heating pays off twice — once through rebates, and again through lower energy bills.

📣 17. Final Thoughts: Turn Efficiency Into Instant Savings

Between record-breaking energy costs and expanded incentives, 2025 is the year to upgrade to a Goodman 96% AFUE furnace.

You’ll heat your home more efficiently, cut your gas bills, and earn hundreds (even thousands) back through credits and rebates.

As Mark puts it:

“I thought I was just getting a new furnace — I didn’t realize I was also getting a refund from the government.”

In the next topic we will know more about: Understanding Two-Stage Heating: Why It Feels More Comfortable and Costs Less