🏠 Introduction — Efficiency That Pays You Back

Savvy has always believed in smart home investments.

Not just new gadgets — but upgrades that earn their keep.

“I love comfort,” she laughs, “but I love seeing my utility bill drop even more.”

That’s why, when she learned about the 2025 federal energy efficiency tax credits, she dove in headfirst. Homeowners across the U.S. can now save thousands on new HVAC systems that meet the latest Energy Star® and AFUE efficiency standards — including Goodman furnaces and heat pumps.

If you’ve been thinking about upgrading your system, this is the year to act.

Let’s break down how these programs work, what qualifies, and how you can claim your share of the 2025 energy incentives.

⚙️ 1. What the 2025 Energy Efficiency Credits Include

In 2025, federal tax incentives are more generous — and easier to qualify for — than ever.

The main two programs you’ll want to know about are:

🔹 1. The Energy Efficient Home Improvement Credit (Section 25C)

Part of the Inflation Reduction Act, this credit covers 30% of the total cost of qualified energy-efficient improvements.

That includes:

-

High-efficiency furnaces

-

Central air conditioners

-

Heat pumps

-

Smart thermostats

-

Insulation and duct sealing

You can claim up to $1,200 per year, and for heat pumps, an additional $2,000 credit is available.

🔹 2. The High-Efficiency Electric Home Rebate Program (HEEHRP)

This program provides point-of-sale rebates (not just tax credits) for lower- and middle-income households upgrading to efficient electric systems like heat pumps and induction appliances.

Rebates can total up to $14,000, depending on income and location.

External link: EnergyStar Federal Tax Credit Info.

“These aren’t complicated programs,” Savvy explains. “They’re real incentives for people who just want to stop wasting energy — and money.”

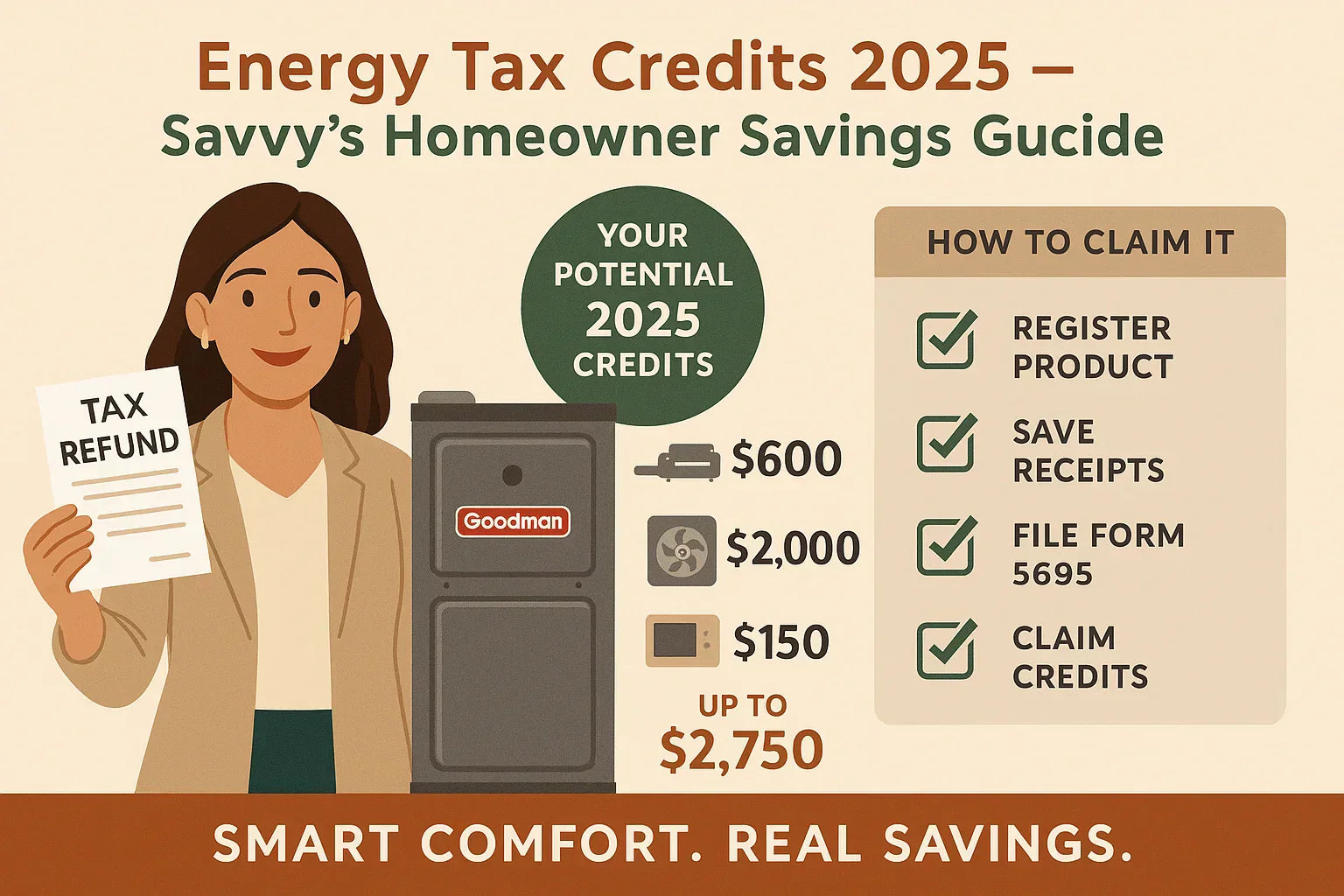

🔥 2. Which Goodman Products Qualify in 2025

Goodman systems are designed with efficiency in mind — and many of their furnaces, heat pumps, and air conditioners meet or exceed the criteria for federal credits.

Here’s a snapshot of what qualifies:

| Equipment Type | Efficiency Rating | Tax Credit Eligibility |

|---|---|---|

| 96% AFUE Gas Furnace | Meets Energy Star® | ✅ Up to $600 credit |

| 15.2 SEER2 Air Conditioner | Energy Star® Certified | ✅ Up to $600 credit |

| 16+ SEER2 Heat Pump | Energy Star® Most Efficient | ✅ Up to $2,000 credit |

| Smart Thermostat | Energy Star® | ✅ Up to $150 credit |

“My Goodman furnace easily hit the 96% mark,” Savvy says. “That meant $600 back on my taxes — just for choosing a high-efficiency model.”

💸 3. Federal Tax Credit Breakdown — What You Can Claim

The federal Energy Efficient Home Improvement Credit (25C) breaks down like this:

| Upgrade | Minimum Rating | 2025 Credit | Annual Limit |

|---|---|---|---|

| Gas Furnace | ≥95% AFUE | 30% of cost, up to $600 | $1,200 total for most HVAC upgrades |

| Central AC | ≥16 SEER2 | 30% of cost, up to $600 | |

| Heat Pump | ≥15.2 SEER2 / ≥7.8 HSPF2 | 30% of cost, up to $2,000 | Separate limit |

| Smart Thermostat | Energy Star® Certified | 30% of cost, up to $150 |

Total potential savings: up to $3,200 per year in combined credits.

External link: IRS Form 5695 — Residential Energy Credits.

“Between the furnace and my new thermostat,” Savvy smiles, “I saved $750 in one tax season. It felt like a thank-you note from the government.”

🧮 4. Example: Savvy’s 2025 Energy Upgrade

Here’s what Savvy’s actual 2025 HVAC project looked like:

| Upgrade | Installed Cost | Tax Credit | Out-of-Pocket |

|---|---|---|---|

| Goodman 96% AFUE Two-Stage Furnace | $4,500 | $600 | $3,900 |

| Smart Thermostat | $200 | $150 | $50 |

| Total Savings: | $750 |

And that’s before she added her local energy rebate — which covered another $250 through her gas utility program.

“All in, I paid less than $4,000 for a furnace that’ll save me hundreds every year,” Savvy says.

💼 5. What Qualifies a Furnace for a 2025 Credit

To earn the federal credit, your system needs to meet specific efficiency and installation standards:

✅ Energy Star® certification

✅ Installed in your primary residence (no rentals or vacation homes)

✅ New equipment only — no refurbished systems

✅ Meets or exceeds 95% AFUE (furnaces)

✅ Installed by a licensed professional

External link: EnergyStar Qualified Furnace Criteria.

“Not every furnace on the shelf qualifies,” Savvy cautions. “Double-check the Energy Star® label before you buy.”

🧾 6. How to Claim Your Credit Step-by-Step

Savvy loves checklists, and her tax prep list is no different.

Here’s how she handled her 2025 energy credit filing:

-

Get your Manufacturer’s Certification Statement — download it from the Goodman website.

-

Keep all receipts — including installation invoices.

-

Fill out IRS Form 5695 — enter your system type, cost, and efficiency rating.

-

Attach Form 5695 to your Form 1040 (Schedule 3).

-

Save your documents — the IRS may request proof.

External link: IRS Energy Credit Instructions.

“It took me about 20 minutes,” Savvy says. “And the $600 credit showed up as a direct reduction on my tax bill — not a refund I had to wait for.”

🌞 7. Stack Your Savings with State & Local Rebates

In addition to the federal credits, many states and utilities offer their own rebate programs for efficient HVAC upgrades.

| State | Program | Rebate Range |

|---|---|---|

| California | TECH Clean California | $1,000–$3,000 |

| New York | NYSERDA Clean Heat | Up to $2,500 |

| Michigan | Consumers Energy | $500–$1,000 |

| Minnesota | CenterPoint Energy | Up to $400 |

| Texas | Oncor Energy | $200–$800 |

External link: DSIRE Energy Rebate Database.

“Stacking rebates feels like couponing — but for grown-ups,” Savvy jokes. “My total rebates topped $1,000 after combining local and federal programs.”

🔋 8. Why Efficiency Pays Off Long After Tax Season

Federal incentives are just the beginning.

The real payoff comes from lower monthly utility bills and less maintenance over the system’s lifetime.

Average annual savings:

-

96% AFUE furnace vs. 80% = $300–$600 per year.

-

16 SEER2 AC vs. 14 SEER2 = 15–20% lower energy costs.

-

Energy Star® heat pump = up to 50% savings vs. electric resistance heat.

External link: Energy.gov Energy Savings Calculator.

“Every month, I see the difference,” Savvy says. “My gas bill dropped, my air is cleaner, and my home feels more balanced.”

🧠 9. Savvy’s Smart Tips for Maximizing Your 2025 Credits

-

Bundle upgrades. If you install both a furnace and a thermostat, you can claim both credits.

-

Don’t wait for next year. Credits are annual, not retroactive — use them while available.

-

File the right forms. Keep Form 5695 in your tax documents for future audits.

-

Choose Energy Star®-certified installers. Some rebates require it.

-

Save your utility bill history. It helps prove efficiency improvements if needed.

“Think of it like optimizing your taxes — but for your comfort,” Savvy smiles.

🧩 10. Goodman vs. Other Brands for Energy Qualification

Here’s how Goodman stacks up against other major brands when it comes to credit eligibility and efficiency compliance:

| Brand | Efficiency Range | Energy Star® Qualified | 25C Credit Eligible |

|---|---|---|---|

| Goodman | 96–98% AFUE | ✅ Yes | ✅ Yes |

| Lennox | 95–99% AFUE | ✅ Yes | ✅ Yes |

| Trane | 96–98% AFUE | ✅ Yes | ✅ Yes |

| Rheem | 95–97% AFUE | ✅ Yes | ✅ Yes |

“Goodman hits that sweet spot — high efficiency and affordability without luxury pricing,” Savvy says. “That’s real-world smart.”

🧾 11. The ROI Math — When Efficiency Pays for Itself

Let’s crunch the numbers on a real 10-year projection:

| Category | Cost | Savings / Credits | Net Cost |

|---|---|---|---|

| Furnace Installation | $4,500 | -$600 tax credit | $3,900 |

| Energy Savings (10 yrs) | -$3,000 | $900 | |

| Total Out-of-Pocket (after 10 years) | $900 |

“Basically,” Savvy laughs, “I bought a new furnace for the price of a winter coat.”

🏦 12. Financing + Credits = Win-Win

Many Goodman dealers (including The Furnace Outlet) offer financing options that combine low monthly payments with instant rebates or deferred interest.

External link: Goodman Financing Options.

Savvy tip:

“If your loan payment matches your monthly energy savings, your upgrade pays for itself from day one.”

🔍 13. Common Questions About Energy Tax Credits

Q: Can I claim credits for equipment installed in 2024 but paid for in 2025?

A: Yes — claim the credit the year the installation is completed.

Q: Can landlords claim credits for rental properties?

A: No — only for the homeowner’s primary residence.

Q: Do labor costs qualify?

A: Yes, as long as they’re part of a qualified installation.

Q: Do rebates reduce the credit amount?

A: No — you claim the full system cost before rebates are applied.

“I almost missed that last one,” Savvy admits. “It made my credit $200 higher than I expected.”

🌿 14. The Bigger Picture — Energy Efficiency and the Planet

Beyond the tax savings, high-efficiency HVAC systems cut household emissions by up to 20%. Goodman’s Energy Star® partnership supports cleaner manufacturing and recyclable materials.

External link: EPA Energy Star Climate Impact Report.

“I didn’t just upgrade for comfort,” Savvy says. “I wanted to know my home was part of the solution, not the problem.”

🧩 15. Savvy’s 2025 Energy Credit Checklist

✅ Choose Energy Star®-certified equipment.

✅ Register product with manufacturer.

✅ Save receipts and certificates.

✅ File IRS Form 5695 with your 2025 taxes.

✅ Check local utility rebates before installing.

✅ Schedule installation by December 31.

“It’s basically free money — but only if you’re organized enough to claim it,” Savvy smiles.

🏁 16. Conclusion — Comfort, Savings, and a Smarter 2025

Energy efficiency isn’t just about lower bills — it’s about smarter living.

With Goodman’s lineup of high-efficiency furnaces and heat pumps, you’re not just warming your home; you’re earning rewards for doing it responsibly.

“I tell my friends this all the time,” Savvy says. “The coziest feeling in winter isn’t just the heat — it’s knowing my investment is paying me back.”

So whether you’re upgrading your furnace, switching to a heat pump, or just adding a smart thermostat, 2025 is your chance to save big and live better.

In the next topic we will know more about: An explanation of the two-stage operation—quieter, more intelligent heating for all seasons