By Tony Marino — A homeowner who believes in staying cool without draining the wallet.

📘 Introduction

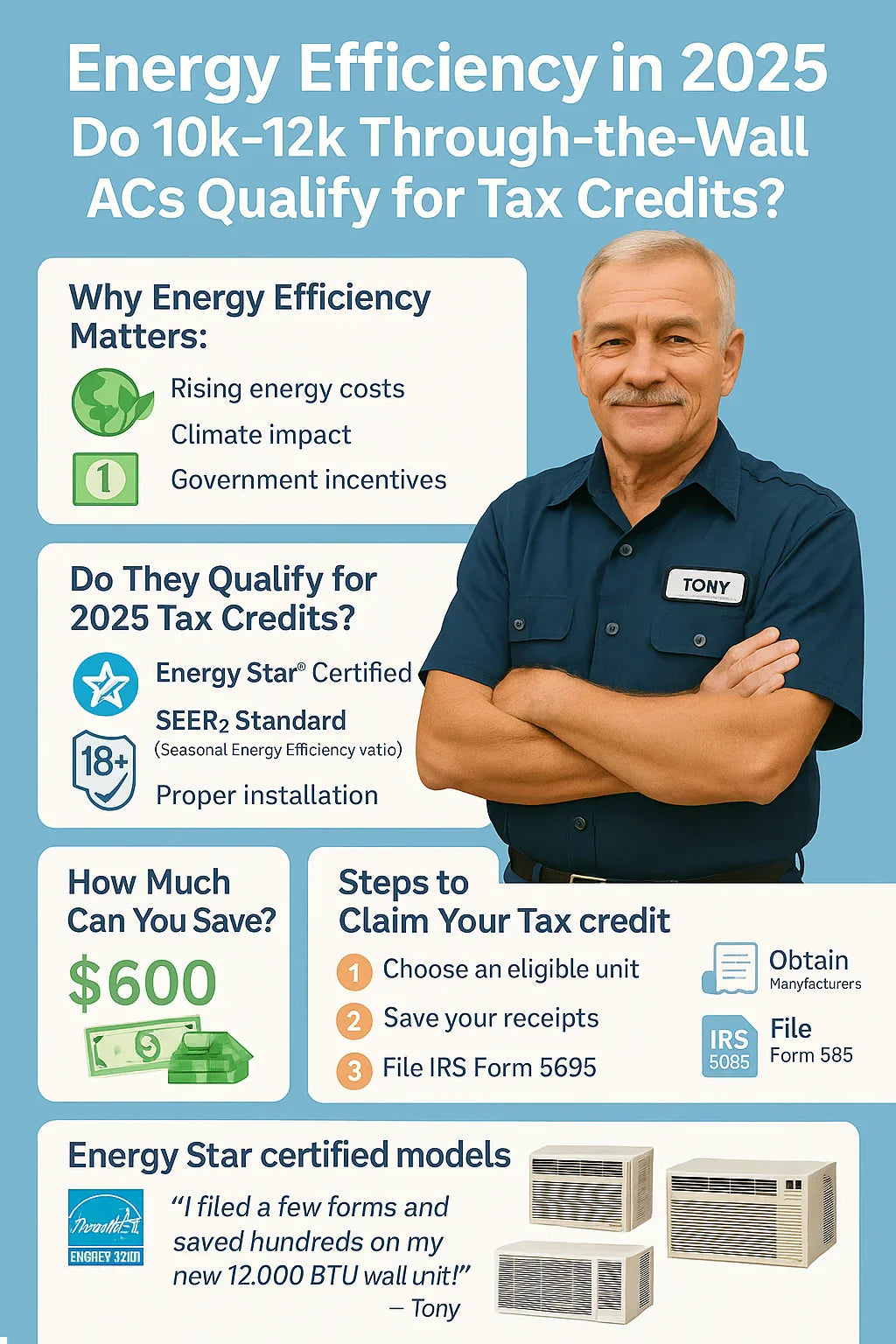

When I upgraded my old window AC to a 12,000 BTU through‑the‑wall system, my first question wasn’t just “Will it cool my family room?” — it was “Can I get a tax credit for this?”

The good news: in 2025, many 10,000–12,000 BTU through‑the‑wall ACs do qualify for federal tax credits and state utility rebates, as long as they meet certain energy efficiency standards.

According to the U.S. Department of Energy, cooling and heating make up nearly half of a home’s energy use, so incentives can save families hundreds of dollars a year.

Let’s break down how you can benefit.

🌍 1. Why Energy Efficiency Matters in 2025

Energy costs are rising, and so are government efforts to encourage homeowners to go green.

✅ Benefits of Energy‑Efficient ACs

-

Lower Utility Bills: High‑efficiency models use up to 30% less electricity.

-

Comfort: Advanced compressors and airflow designs cool more evenly.

-

Environmental Impact: Reduced greenhouse gas emissions.

-

Financial Incentives: Federal tax credits + local rebates.

👉 Explore Energy Saver by DOE for updated home energy efficiency guidance.

📏 2. Efficiency Ratings You Need to Know

When shopping for a through‑the‑wall AC in 2025, you’ll see three key efficiency ratings:

📊 SEER2 (Seasonal Energy Efficiency Ratio)

-

Updated in 2023 for stricter accuracy.

-

Measures cooling output vs. energy used over a season.

-

Higher SEER2 = better efficiency.

⚡ EER (Energy Efficiency Ratio)

-

Snapshot of efficiency at peak load.

-

Good for comparing units in hot climates.

🔋 CEER (Combined Energy Efficiency Ratio)

-

Accounts for standby energy use (important for units that remain plugged in).

👉 Learn more at Energy Star – Room AC Ratings.

🏠 3. Do 10k–12k Through‑the‑Wall ACs Qualify for 2025 Federal Tax Credits?

Yes — but only if they are Energy Star certified and meet updated SEER2 standards.

📌 Key Requirements

-

Energy Star Certification: Non‑certified units don’t qualify.

-

BTU Range: 10,000–12,000 BTUs are included in eligible categories.

-

SEER2 Minimums: Must meet your regional efficiency standard.

-

Proper Installation: Must be installed according to Energy Star guidelines.

👉 Full details: IRS Residential Energy Credits.

💵 4. How Much Can You Save?

📈 Federal Savings

-

Tax credit = 30% of the cost, capped at $600 per unit.

-

Includes installation costs if part of the HVAC upgrade.

🌎 State & Utility Rebates

-

Many states and power companies add $100–$300 rebates.

-

Rebates can often be combined with federal credits.

Tony’s Example:

When I installed my 12,000 BTU LG unit, I got:

-

$300 back on federal taxes

-

$150 rebate from my local utility company

-

Annual electricity savings of ~$120

👉 Check the DSIRE Database for state‑specific rebates.

📋 5. Steps to Claim Your 2025 Tax Credit

Here’s how I handled my claim:

-

Choose an Energy Star Certified Unit

Look for the blue Energy Star label before you buy. -

Get the Manufacturer’s Certification Statement

Most brands provide this online or with the unit paperwork. -

Save All Receipts

Include purchase and installation documentation. -

File IRS Form 5695

Fill out the section for Residential Energy Efficient Property Credit. -

Attach Proof

Submit your receipts and certification with your tax return.

👉 Download: IRS Form 5695 Instructions.

🧰 6. Top Energy Star Certified Models in the 10k–12k Range

Based on my research and testing, these models stand out:

🌟 LG LT1216CER

-

12,000 BTUs

-

Wi‑Fi enabled for app control

-

Energy Star certified

🌟 GE AJEQ12DCF

-

12,000 BTUs

-

Affordable and widely available

-

Energy Star certified

🌟 Friedrich Uni-Fit UCT12A10A

-

12,000 BTUs

-

Whisper‑quiet with premium build

-

Energy Star certified

👉 Search Energy Star Certified Products for the latest models.

⚡ 7. Regional Standards to Keep in Mind

The DOE SEER2 update introduced regional efficiency standards.

🧭 North Region

-

Lower SEER2 minimums (benefits cooler climates).

☀️ South & Southwest Regions

-

Stricter SEER2 requirements due to hotter weather.

-

May narrow which 10–12k BTU units qualify.

👉 Check DOE SEER2 Standards Update for your region.

🧠 8. Common Mistakes Homeowners Make

I’ve seen too many neighbors miss out on credits because of small oversights:

-

❌ Buying a non‑Energy Star unit.

-

❌ Forgetting to file IRS Form 5695.

-

❌ Assuming all 12k BTU models qualify.

-

❌ Ignoring utility rebates.

-

❌ Not keeping receipts or certification documents.

⭐ 9. Tony’s Final Advice

“I saved hundreds on my 12,000 BTU through‑the‑wall AC just by choosing the right model and filing a simple tax form. Don’t leave that money on the table.”

Tony’s Quick Checklist:

-

✅ Buy an Energy Star certified model

-

✅ Confirm SEER2 meets your region’s standard

-

✅ Save all receipts & certification paperwork

-

✅ File IRS Form 5695 with your taxes

-

✅ Check local utility rebates

👉 Browse the Through‑the‑Wall AC Collection (10k–12k BTUs) for qualifying units.

In the next topic we will know more about: Maintenance Tips: Keeping Your 10k–12k BTU Wall AC Running Like New