A Mark Callahan Practical Guide to Saving Money While Upgrading Your HVAC

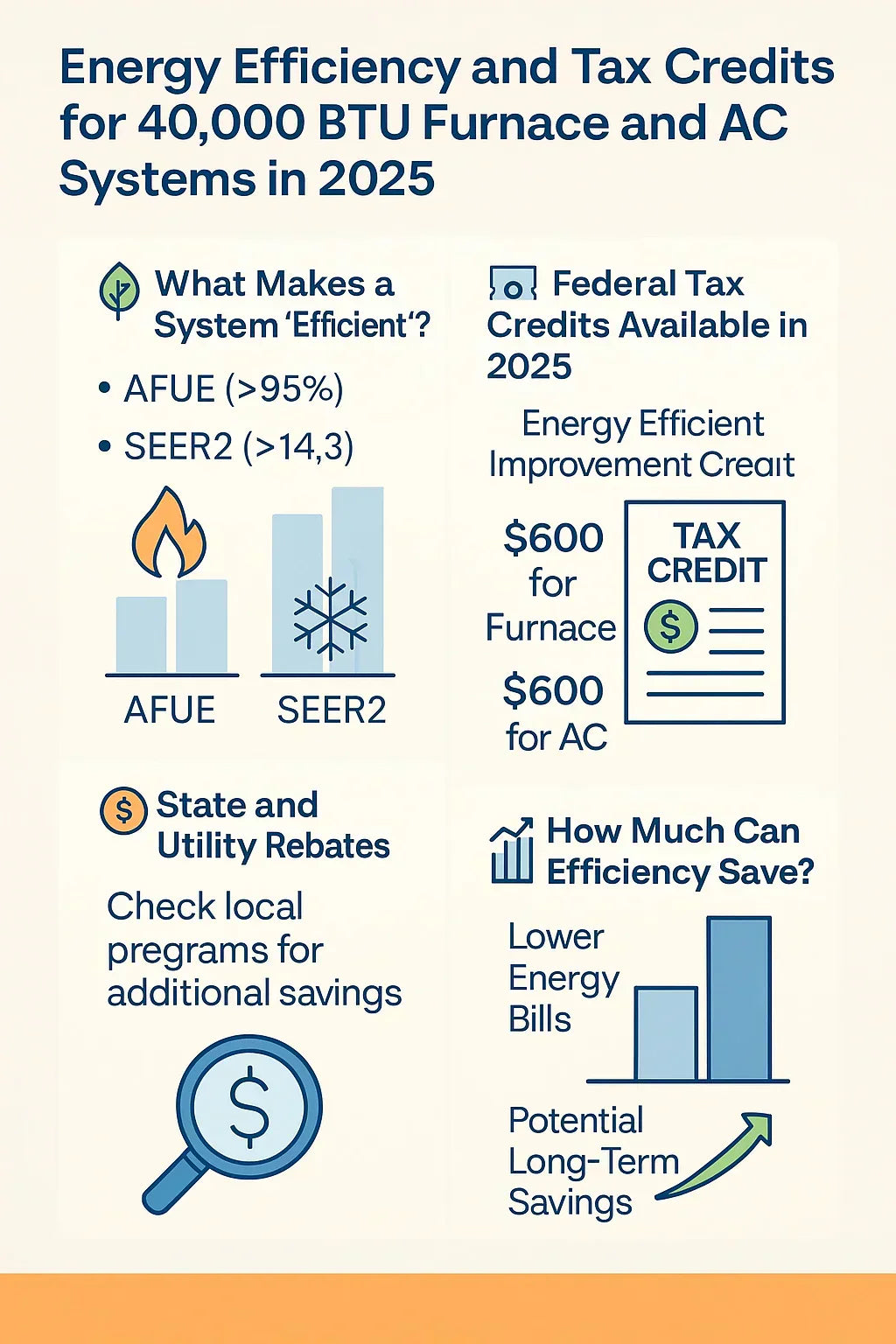

🌿 What Makes a Furnace and AC System “Efficient”?

Efficiency Ratings:

-

AFUE (Annual Fuel Utilization Efficiency): Measures furnace fuel efficiency. 95%+ typically qualifies for rebates and tax credits.

-

SEER2 (Seasonal Energy Efficiency Ratio 2): Measures AC cooling efficiency under new 2023 test standards. 14.3+ SEER2 often required for credits.

-

ENERGY STAR Certification: Systems that meet high-efficiency thresholds recognized by the EPA.

High-efficiency systems reduce utility bills by using less energy to heat or cool your home.

See Energy Star’s HVAC Efficiency Guide for efficiency thresholds.

🏷️ Federal Tax Credits Available in 2025

In 2025, the Energy Efficient Home Improvement Credit allows homeowners to claim:

-

Up to $600 for qualifying air conditioners.

-

Up to $600 for qualifying furnaces.

-

30% of the cost up to the annual limit for qualifying systems.

Qualifying Requirements:

-

Furnace: 95%+ AFUE and ENERGY STAR certified.

-

AC: Meets SEER2/EER2 requirements for your region.

How to claim:

-

File IRS Form 5695 when submitting your federal tax return.

-

Save invoices and manufacturer certification statements.

Review IRS Energy Credits for instructions.

🪙 State and Utility Rebates

Many states and local utilities offer additional rebates for high-efficiency HVAC installations:

-

State Rebates: Range from $100–$1,000 depending on state programs.

-

Utility Rebates: Often $100–$500 for upgrading to ENERGY STAR high-efficiency systems.

-

Eligibility: Based on system efficiency, local utility guidelines, and installer certification.

Use DSIRE to find rebates available in your ZIP code.

📈 How Much Can Efficiency Actually Save You?

✅ Heating Savings: A 95% AFUE furnace can save 10–15% on heating costs compared to an 80% AFUE system. ✅ Cooling Savings: Upgrading from a 13 SEER system to 15 SEER2 can reduce cooling costs by 10–15%. ✅ Lifetime Savings: For an average small home, expect $500–$1,500 in annual energy savings depending on climate and usage.

⚖️ Cost vs. Long-Term Savings: Is It Worth Upgrading?

Consider:

-

Local utility rates.

-

Climate zone (colder climates benefit most from high-efficiency furnaces).

-

Your home’s insulation and air sealing.

-

How long you plan to stay in your home (payback periods are typically 5–7 years).

Upgrading to high-efficiency systems can offset higher upfront costs with lower utility bills and rebate opportunities.

🧾 How to Claim Tax Credits and Rebates

✅ For Federal Tax Credits:

-

Save your detailed invoice showing system model numbers and installation costs.

-

Download and complete IRS Form 5695.

-

Attach with your annual tax return.

✅ For State and Utility Rebates:

-

Contact your local utility before installation to confirm rebate eligibility.

-

Complete rebate forms with system documentation.

-

Submit within required timeframes (typically within 90 days of install).

✅ Choosing Qualifying 40,000 BTU Systems

To ensure eligibility for rebates and credits:

-

Look for ENERGY STAR or AHRI certified systems.

-

Verify AFUE and SEER2 ratings on the unit and spec sheets.

-

Request a copy of the manufacturer’s certification for your records.

-

Work with licensed installers familiar with rebate programs.

🚪 Efficiency in Tight Spaces

If installing in a closet:

-

High-efficiency units require condensate drainage.

-

Verify space and clearance needs.

-

Use proper venting and combustion air supply as required by the model.

See Energy Star’s Furnace Installation Best Practices for safe, efficient installs in tight spaces.

🔧 Maintenance and Efficiency

Regular maintenance helps keep your system operating at high efficiency:

-

Replace filters every 1–3 months.

-

Schedule annual professional service.

-

Clean outdoor coils and check refrigerant levels.

-

Keep registers and vents unobstructed.

Maintenance may be required to maintain eligibility for rebates and warranties.

For maintenance guidance, see Carrier’s Maintenance Tips.

📝 Conclusion

Investing in a high-efficiency 40,000 BTU furnace and AC system can:

-

Lower your heating and cooling bills.

-

Make your home more comfortable.

-

Qualify you for valuable federal tax credits and local rebates.

For Mark Callahan and homeowners planning a practical, budget-conscious upgrade, taking advantage of 2025 incentives can reduce upfront costs while maximizing long-term savings.

If you are ready to upgrade, explore The Furnace Outlet’s 40,000 BTU Furnace and AC Systems for qualifying models and start your energy-efficient journey.

In the next topic we will know more about: What Size Home Can a 40,000 BTU Furnace and AC System Comfortably Heat and Cool?