Can a through-the-wall air conditioner be energy-efficient? Can it save you money beyond your electric bill—like qualifying for federal tax credits or utility rebates? This guide dives deep into how wall-mounted AC units stack up when it comes to efficiency, regulations, and savings.

🧠 Why Energy Efficiency Matters for Wall AC Units

Cooling accounts for nearly 12% of residential energy use in the U.S. Choosing a high-efficiency through-the-wall (TTW) unit can:

-

🌬️ Lower electricity bills

-

🧊 Cool more effectively without short cycling

-

🌎 Reduce carbon footprint

-

💸 Qualify for rebates and federal tax credits

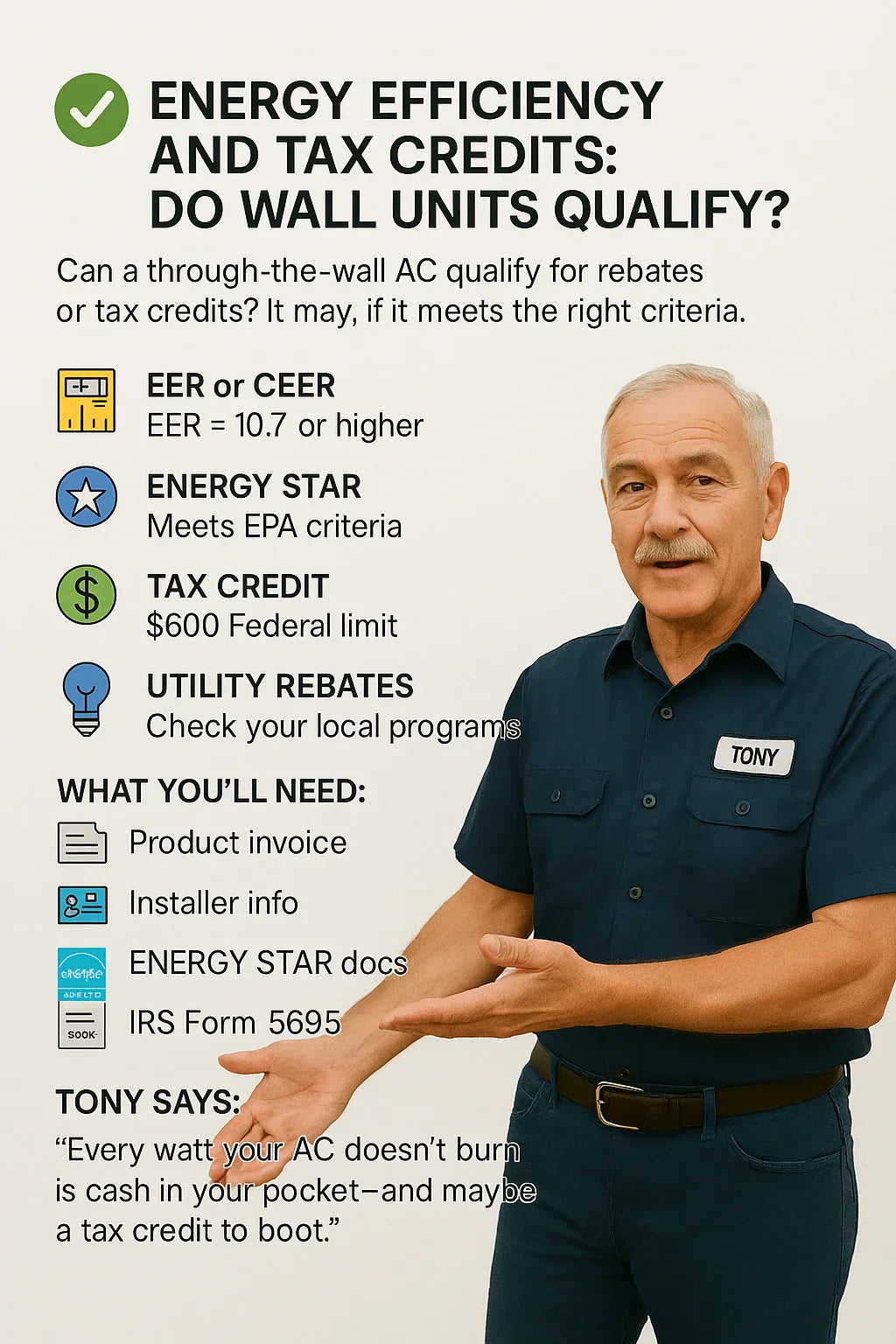

🧰 Tony says: “Every watt your AC doesn’t burn is cash in your pocket—and maybe a tax credit to boot.”

🔎 Key Efficiency Ratings to Understand

🟢 1. EER (Energy Efficiency Ratio)

Formula: BTUs ÷ Watts

-

Measures cooling efficiency at a set temperature (95°F outdoor)

-

Higher = better

-

Standard range: 8.5 to 12.5+

📌 EER is especially relevant for through-the-wall and window ACs

🔗 Energy.gov EER vs. SEER Guide

🟡 2. CEER (Combined Energy Efficiency Ratio)

-

Adds standby/off-mode power use to the EER

-

Required by DOE as of 2014

-

Represents the true all-day efficiency

🧰 Tony says: “It’s the ‘real-world MPG’ of your AC.”

🔵 3. SEER2 (Seasonal Energy Efficiency Ratio 2)

-

New U.S. standard launched in 2023

-

Measures seasonal performance over time

-

Includes part-load performance, not just full blast

Most through-the-wall ACs now list SEER2, especially if they also function as heat pumps.

🔗 SEER2 compliance details from U.S. DOE

✅ ENERGY STAR Certification for Wall Units

ENERGY STAR is a program run by the U.S. Environmental Protection Agency (EPA) to label products that meet strict efficiency standards.

ENERGY STAR Criteria for Wall ACs:

-

EER ≥ 10.7 for 8,000–13,999 BTU units

-

EER ≥ 9.4 for 14,000+ BTUs

-

Must meet CEER benchmarks

-

Must be 10% more efficient than standard models

🔗 ENERGY STAR Room AC Criteria

Certified TTW Brands:

| Brand | ENERGY STAR Models |

|---|---|

| Friedrich | Yes (WallMaster & Kuhl) |

| GE | Yes (Smart TTW series) |

| LG | Some models (LT line) |

🧰 Tony says: “Don’t buy a wall unit in 2025 unless it’s got that blue ENERGY STAR badge. Period.”

💰 Federal Tax Credits for High-Efficiency Units

The Inflation Reduction Act (IRA) and Energy Efficient Home Improvement Credit now provide up to $3,200 in tax credits for qualifying upgrades.

🧾 25C Tax Credit Overview

-

📆 Available: Through 2032

-

🏠 Homeowners only (no rentals)

-

💵 Covers 30% of the cost of qualifying equipment + labor

-

🧊 Can apply to room air conditioners if they meet performance criteria

Credit Limit:

-

$600 for qualified air conditioners (including wall units if Energy Star + ≥12.5 EER)

🔗 Official White House Tax Credit Portal

🔌 State + Local Utility Rebates

Most states and utility companies offer incentives for upgrading to efficient cooling appliances.

🗺️ How to Find Rebates:

-

Enter your ZIP code

-

Filter for:

-

EER/SEER ≥ required level

-

Total system installation

Example:

-

🏡 New York: Up to $150 back on ENERGY STAR TTW ACs

-

🌞 California: $300 rebate from select utility districts

-

🔌 Texas: $50–$200 rebates via municipal electric co-ops

🧰 Tony says: “You’d be shocked how many utilities hand you money just for choosing the efficient option.”

🏆 Top Energy-Efficient Through-the-Wall AC Units (2025)

| Model | BTUs | EER / CEER | ENERGY STAR | Tax Credit Eligible |

|---|---|---|---|---|

| Friedrich WallMaster | 12,000 | 11.3 / 10.9 | ✅ | ✅ |

| GE AHTT12BC | 12,000 | 11.0 / 10.8 | ✅ | ✅ |

| LG LT1036CER | 10,000 | 10.7 / 10.5 | ✅ | ✅ |

| Frigidaire FFTA123WA1 | 12,000 | 10.5 / 10.2 | ❌ | ❌ |

📋 What Makes a Unit Qualify?

To be eligible for federal or state energy incentives, the unit typically must:

-

Be ENERGY STAR certified

-

Meet minimum EER or CEER (10.7+)

-

Be installed in your primary residence

-

Be new equipment (not refurbished or used)

-

Be installed by a licensed professional (for some rebates)

📄 Documentation You’ll Need

To claim rebates or credits:

| Requirement | Details |

|---|---|

| Product invoice | Must show make, model, BTU rating |

| Installer information | Especially for labor credits |

| ENERGY STAR documentation | Found on brand websites or ENERGY STAR portal |

| IRS Form 5695 | For federal tax credit claim |

🔗 IRS Instructions for 5695 Form

💬 Common Myths Busted

| Myth | Reality |

|---|---|

| “Wall ACs don’t qualify for rebates.” | If ENERGY STAR-certified, many do. |

| “Only central air qualifies for credits.” | Not true. Room ACs can qualify. |

| “Window and wall units are the same.” | Wall units often qualify due to higher efficiency and sealed install. |

🔄 How to Upgrade an Old Unit

Already have an older wall AC and want to switch to a qualifying model?

Steps:

-

Measure your current sleeve

-

Match dimensions and vent type

-

Choose ENERGY STAR rated unit

-

Check your local rebate portal

-

Save receipts and installer info

-

File tax documents if eligible

🛠️ DIY vs. Professional Install for Tax Credits

Federal credits do not require a pro install for most wall units. But some state/local utility programs do.

🧰 Tony says: “When in doubt—call it out. If your utility says pro install only, don’t DIY it and lose the rebate.”

🧾 Final Checklist for Energy and Tax Credit Qualification

✔️ ENERGY STAR certified

✔️ ≥10.7 EER or SEER2-compliant

✔️ New purchase (not secondhand)

✔️ Installed in primary home

✔️ Tax credit paperwork ready (Form 5695)

✔️ Check local utility for extra rebates

🧠 Final Thoughts from Tony

“You know what’s cooler than air conditioning? Getting money back for being smart about it. If you’re buying a wall unit in 2025 and it’s not Energy Star, you’re leaving money on the table.”.

In the next topic we will read about: Will a Through-the-Wall AC Work in a Mobile Home, Apartment, or Condo?