🏠 Why This Matters for Mark

Homeowners like Mark Callahan can lower the cost of upgrading to a 2-ton R-32 AC and furnace system by using available federal tax credits, state incentives, and utility rebates in 2025.

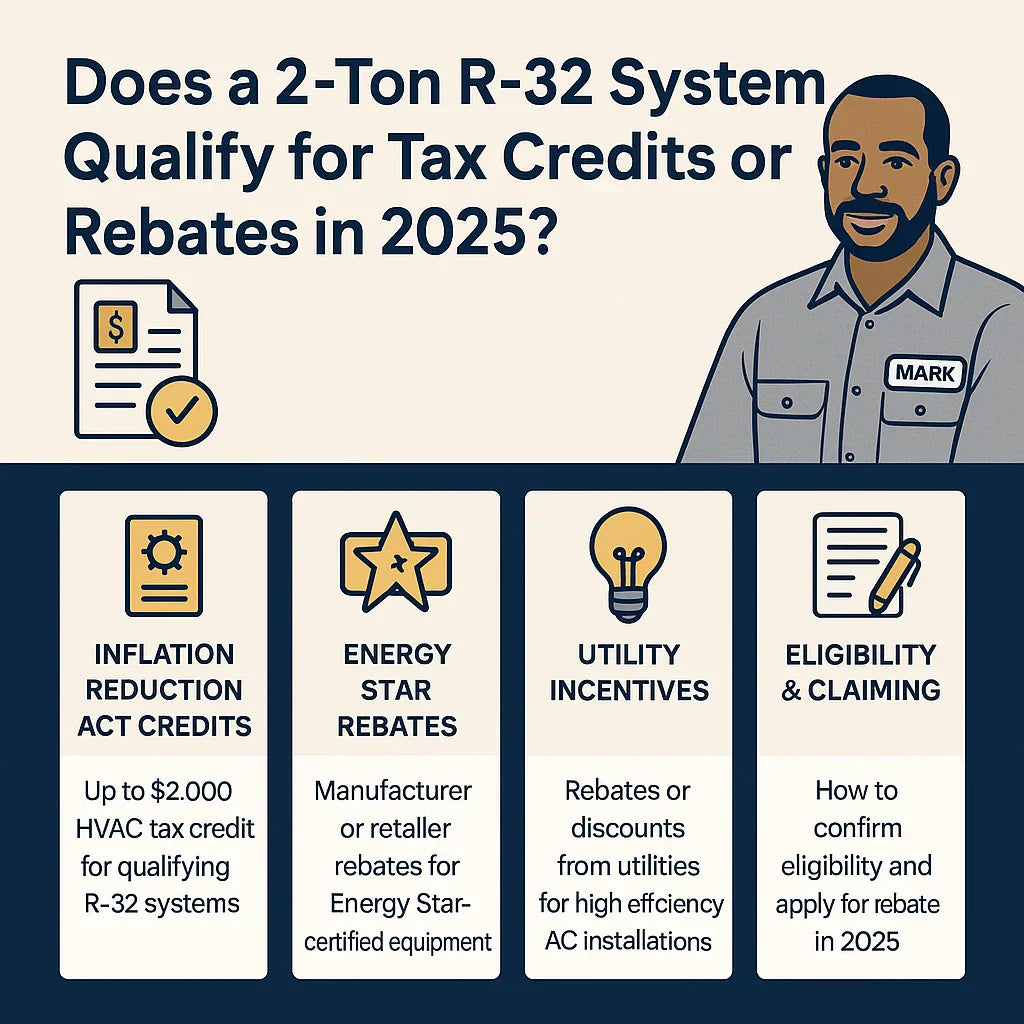

🌱 Federal Tax Credits Under the Inflation Reduction Act

Under the Inflation Reduction Act (IRA): ✅ Up to 30% of the installed cost, capped at $600 for ACs and $600 for furnaces. ✅ Must meet CEE Tier 1 efficiency requirements (typically 15+ SEER2, 12+ EER2). ✅ Must be Energy Star certified. ✅ Home must be the primary residence.

Mark can claim this credit when filing his 2025 taxes using IRS Form 5695.

⚡ State and Utility Rebates

Many states and local utilities offer additional rebates for high-efficiency HVAC installations: ✅ Typical rebates range from $150 to $1,000+ depending on local programs. ✅ Requirements often include high SEER2 ratings and Energy Star certification. ✅ Some utilities provide instant rebates deducted from contractor invoices.

Check incentives here:

✅ Do R-32 Systems Qualify?

Yes, if the 2-ton R-32 AC system meets:

✅ Energy Star certification.

✅ SEER2/EER2 requirements under the IRA.

✅ Proper professional installation with documentation.

Mark should confirm that the specific unit he selects qualifies before purchase.

🏷️ Documentation Required to Claim Credits

✅ Proof of purchase and installation invoice. ✅ AHRI certificate showing SEER2 and EER2 ratings. ✅ Manufacturer’s certification statement. ✅ Completed IRS Form 5695.

Keep these records for your tax preparer.

🔍 Additional Potential Incentives

✅ Heat Pump Add-On Credits: If Mark chooses a heat pump paired with a gas furnace, additional credits may apply. ✅ Home Energy Audits: Up to $150 in credits for audits conducted before upgrades. ✅ Utility Demand Response Programs: Some utilities offer bill credits for participating in energy-saving programs.

💡 Tips to Maximize Savings

✅ Choose a unit that exceeds minimum SEER2 requirements for higher rebates. ✅ Get quotes from installers familiar with Energy Star and rebate paperwork. ✅ Time your installation before rebate deadlines. ✅ Consider bundling attic insulation or air sealing upgrades for additional IRA credits.

🚩 Potential Limitations to Note

❌ Annual tax credit caps may limit total savings in a single year. ❌ Rebates vary significantly by location and utility. ❌ Eligibility may depend on using approved contractors.

✅ Key Takeaways

-

A 2-ton R-32 system can qualify for up to $600 federal tax credits in 2025.

-

Additional state and utility rebates can further lower costs.

-

Ensure the system is Energy Star certified and meets SEER2/EER2 thresholds.

-

Keep thorough documentation to claim credits.

👉 Ready to Explore R-32 Systems?

View R-32 AC and Gas Furnaces – 2 Ton Collection

In the next topic we will know more about: Cold Climate Ready? How a 2-Ton R-32 System Performs in Winter