🏠 Do Vertical PTAC Units Qualify for Rebates or Tax Credits in 2025?

Buying a vertical PTAC (Packaged Terminal Air Conditioner) is a big investment. Units like the GE Zoneline Vertical PTAC often cost $2,500–$4,300 installed. For property managers, developers, or condo owners, rebates and tax credits can make a major difference in affordability.

So the big question for 2025 is:

👉 Do vertical PTACs qualify for rebates or tax credits—and how much can you really save?

The short answer: sometimes yes, sometimes no. It depends on:

-

Whether the unit is ENERGY STAR-certified

-

If it’s a heat pump model vs. electric resistance only

-

Your state, local utility programs, and federal tax credit rules

This Savvy guide breaks it down so you know exactly what to expect before buying.

⚡ Understanding PTAC Efficiency Standards

Before diving into incentives, it’s important to understand how PTACs are rated.

-

EER (Energy Efficiency Ratio): Measures cooling efficiency (BTUs ÷ watts).

-

CEER (Combined EER): More accurate, includes standby power.

-

Heating Efficiency: Electric resistance heat (COP ~1.0) or heat pump (COP 2.5–4.0).

📌 Vertical PTACs typically range 9.5–11.0 EER, putting them on par with or slightly better than standard PTACs.

💡 ENERGY STAR requires PTACs to meet or exceed set EER/CEER thresholds to qualify for rebates. In most cases:

-

9,000–15,000 BTU models need EER ≥ 10.0.

-

Larger 17,000–24,000 BTU models need EER ≥ 9.3–9.7 (varies by size).

👉 Savvy takeaway: Only ENERGY STAR-certified PTACs typically qualify for rebates.

💵 Federal Tax Credits in 2025

The Inflation Reduction Act (IRA) continues to drive energy efficiency incentives through 2032.

🔹 Federal Energy Efficiency Home Improvement Credit

-

Covers 30% of project cost, up to $600–$2,000 depending on the system.

-

Applies to heat pumps, central AC, furnaces, boilers, and insulation.

-

Most standard electric resistance PTACs DO NOT qualify.

-

Heat pump PTACs MAY qualify, if they meet ENERGY STAR requirements.

📌 IRS guidance (2025 update): Only heat pump systems and advanced AC equipment are eligible, not standard electric resistance PTACs.

👉 Savvy takeaway: If you’re installing a heat pump vertical PTAC, you might get a federal tax credit. If it’s electric resistance only (like many GE Zoneline models), don’t count on it.

🏢 State & Utility Rebates for Vertical PTACs

This is where many buyers save money.

🔹 Local Utility Rebates

-

Many utilities offer $100–$300 per ENERGY STAR PTAC unit.

-

Some programs cover bulk installs (multi-family, hotels, senior housing).

-

Example:

-

Con Edison (NY): Rebates up to $200 per PTAC.

-

Southern California Edison: Rebates vary, often $100–$250 for ENERGY STAR-certified PTACs.

-

🔹 State Rebates

-

California, New York, and Massachusetts are leaders in PTAC rebate programs.

-

Rebates often tied to multi-family housing projects or building upgrades.

-

Energy efficiency agencies sometimes bundle PTAC incentives with insulation or duct sealing upgrades.

👉 Savvy Tip: Always check your local utility rebate database (like DSIRE) before buying.

🌍 Commercial vs. Residential Incentives

Vertical PTACs are used in both residential condos and commercial properties (hotels, multi-family).

-

Residential: Rebates usually limited to ENERGY STAR-certified units. Federal credits more restrictive.

-

Commercial: Utilities often run custom incentive programs where bulk installs or retrofits qualify for larger payouts.

📌 Example: A 50-unit senior housing project replacing old PTACs with ENERGY STAR-certified vertical PTACs may receive rebates in the tens of thousands of dollars through utility incentive programs.

👉 Savvy takeaway: Commercial projects see the biggest incentive benefits.

🧾 Documentation You’ll Need

To claim rebates or credits, be prepared to provide:

-

Proof of ENERGY STAR certification (label or product sheet).

-

Manufacturer efficiency ratings (EER/CEER, COP).

-

Proof of purchase (invoice).

-

Installation date and contractor details.

👉 Savvy Tip: Always ask your HVAC dealer for a spec sheet and ENERGY STAR certificate before installation—it’s required for most rebates.

📊 ROI With and Without Incentives

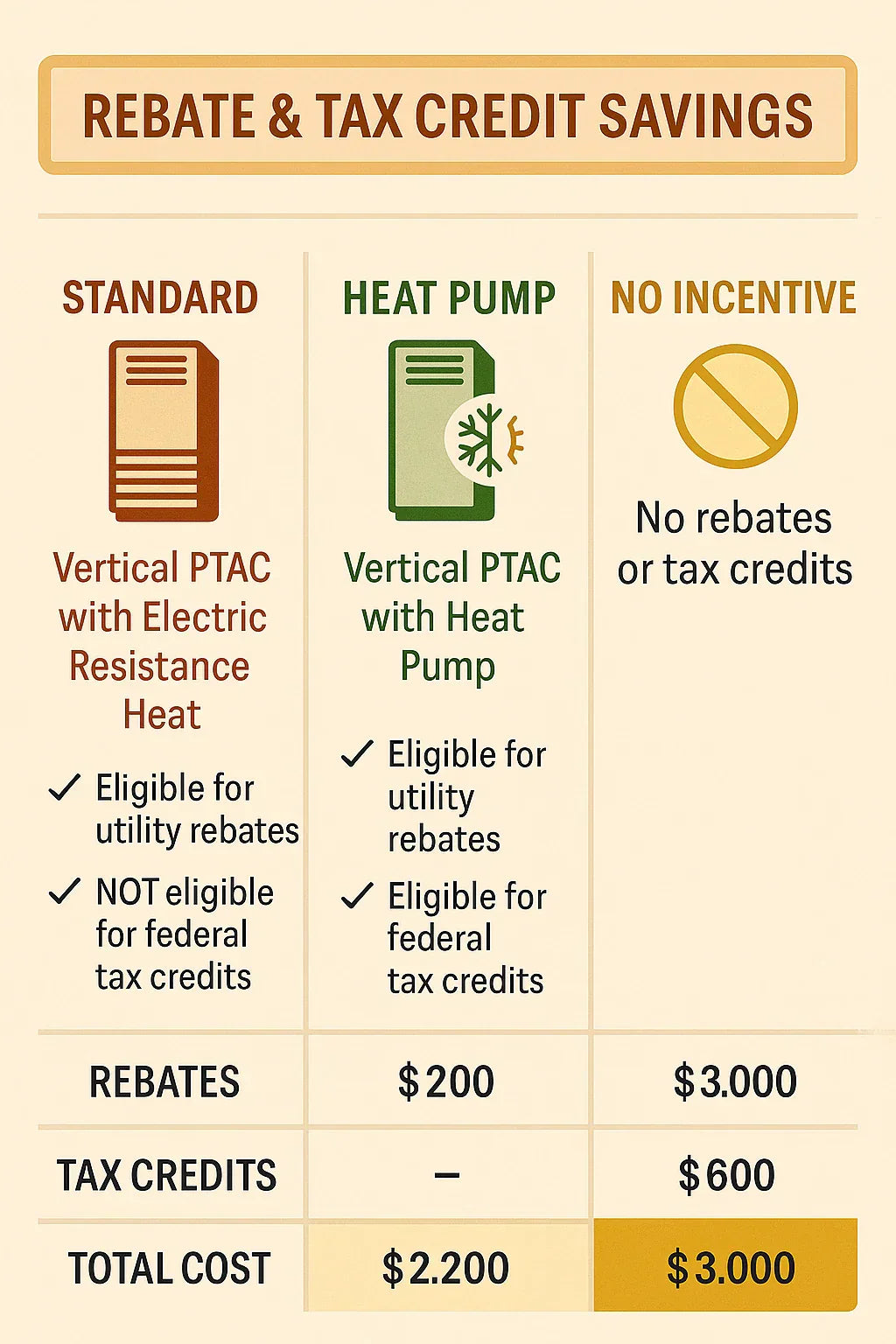

Let’s run the numbers on a GE Zoneline Vertical PTAC (~$3,000 installed).

Without Incentives

-

Installed cost: $3,000.

-

Monthly operating cost (average climate): ~$63.

-

Lifespan: 12 years.

Total 12-year cost = ~$12,000 (equipment + electricity).

With Rebates & Incentives

-

Utility rebate: -$200.

-

State incentive (if available): -$150.

-

Federal credit (heat pump model only): up to -$600.

Total savings: $350–$950 per unit.

Net cost: ~$2,050–$2,650 per unit installed.

👉 ROI improved: Payback period shortens by 1–2 years, especially in multi-family installs.

✅ Savvy’s Take: Do They Qualify?

-

Standard Electric Resistance Vertical PTACs → ❌ Do NOT qualify for federal tax credits. May qualify for local utility rebates if ENERGY STAR-certified.

-

Heat Pump Vertical PTACs → ✅ Eligible for federal tax credits and utility/state rebates if ENERGY STAR-certified.

-

Commercial/Multi-Family Projects → ✅ Bulk rebate programs often apply.

📦 Conclusion: Check Before You Buy

Vertical PTACs are a smart investment for multi-room condos and apartments. But when it comes to incentives in 2025:

-

Don’t expect federal tax credits unless it’s a heat pump PTAC.

-

Do check local utilities—they’re the most reliable source of PTAC rebates.

-

Even without rebates, vertical PTACs deliver ROI through long lifespan, quiet comfort, and higher property value.

👉 Final Savvy Tip: Before buying, call your utility rebate office and check DSIRE’s database. You might save hundreds—or thousands—on your project.

In the next topic we will Know more about: Noise Levels & Comfort: How Quiet Is a GE Zoneline Vertical PTAC?