💡 Introduction: My Search for Savings

When I installed my GE 12,000 BTU Through-the-Wall Air Conditioner with Electric Heat (AJEM12DWJ), the price tag wasn’t my only concern. I also wondered: could I get any rebates or tax credits to ease the cost?

With so much buzz around energy efficiency and government incentives, many homeowners (myself included) assume every energy-efficient product qualifies for rebates. But when I dug deeper into through-the-wall (TTW) units, I realized the answer in 2025 is… complicated.

This guide lays out everything I learned about rebates, tax credits, and incentives for through-the-wall ACs in 2025—so you don’t waste time chasing programs that don’t apply.

🧾 Understanding Rebates vs. Tax Credits

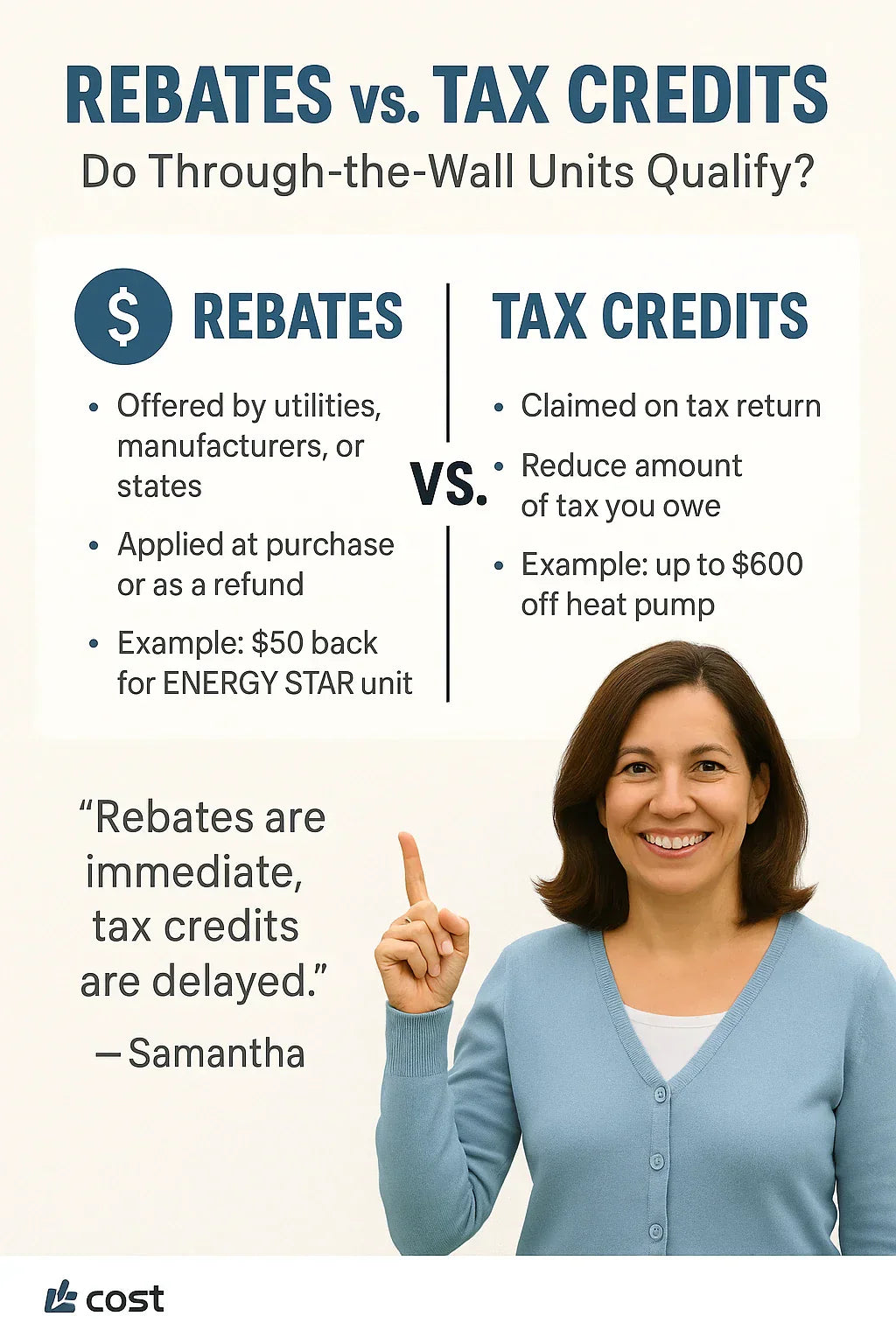

Before diving into qualifications, let’s define the two main incentives:

💵 Rebates

-

Offered by utilities, manufacturers, or state programs.

-

Usually applied at purchase or as a refund check.

-

Example: Your local power company gives you $50 back for upgrading to an Energy Star unit.

🏛️ Federal Tax Credits

-

Applied when filing your taxes.

-

Reduce the amount of tax you owe, dollar-for-dollar.

-

Governed by the Inflation Reduction Act (IRA) and other federal efficiency programs.

👉 Key takeaway: Rebates are immediate savings. Tax credits are delayed but often larger.

❄️ Do Through-the-Wall Units Qualify for Rebates in 2025?

Here’s the reality: most rebates are focused on heat pumps, central ACs, and ENERGY STAR-certified window units.

Utility Rebates

Many utility companies offer rebates for high-efficiency appliances.

-

For example, Con Edison in New York provides rebates for room ACs—but typically only Energy Star-rated window units, not wall units.

-

Similar restrictions apply in California’s PG&E marketplace.

Manufacturer Rebates

Occasionally, companies like GE or Amana run seasonal promotions. These are usually discounts or mail-in rebates rather than government-backed incentives.

👉 Samantha’s verdict: Check your local utility’s rebate list. In 2025, very few list TTW units specifically.

🏆 Do Through-the-Wall Units Qualify for Federal Tax Credits in 2025?

This is where things get tricky.

The Inflation Reduction Act (IRA)

The IRA expanded federal tax credits for home energy upgrades, including:

-

Heat pumps

-

Central air conditioners

-

Furnaces

-

Insulation & windows

According to Energy Star’s official rebate and tax credit guide, through-the-wall air conditioners are not explicitly covered under the 2025 IRA tax credit categories.

Why Not?

The federal government prioritizes whole-home systems and heat pumps, which deliver larger energy savings than localized wall ACs.

Exceptions

Some through-the-wall heat pumps may qualify if they meet Energy Star criteria. But most standard TTW AC/heat combos (like the GE AJEM12DWJ) do not.

📉 What This Means for GE, Amana, and Friedrich Wall Units

Let’s break it down by brand:

-

GE AJEM12DWJ: Efficient, but does not qualify for IRA federal tax credits.

-

Amana 12,000 BTU Wall Unit with Heat: Same story—no federal credit, but possible local rebates if Energy Star-certified.

-

Friedrich WallMaster Series: Some models are Energy Star-rated, which makes them more likely to qualify for utility rebates (still not for federal credits).

👉 Bottom line: ENERGY STAR certification is your best chance at rebates.

🌍 State & Local Incentives for TTW Units

Even if federal tax credits don’t apply, state or city programs sometimes do.

-

California (CEC Rebates): Focus on central systems, but occasionally offer room AC incentives.

-

New York State Energy Research & Development Authority (NYSERDA): Rebates for efficient appliances, sometimes including Energy Star room ACs. (NYSERDA)

-

Massachusetts Mass Save Program: Offers rebates on heat pumps, but not TTW ACs.

👉 Samantha’s tip: Use the Database of State Incentives for Renewables & Efficiency (DSIRE) to search for programs in your ZIP code.

⚡ Hidden Ways TTW Units Save You Money

Even if you don’t qualify for rebates or tax credits, through-the-wall units can save in other ways:

1. Lower Energy Bills

A modern Energy Star wall unit like GE’s AJEM12DWJ uses up to 15% less energy than older models (Energy Star).

2. Avoiding Window AC Leaks

Sealed sleeves prevent drafts, keeping heating and cooling bills lower year-round.

3. Longer Lifespan

Wall units typically last 10–15 years, compared to 5–7 for window ACs. That’s fewer replacements to buy.

🛠️ My Personal Journey: Why I Still Chose GE

Even though my GE AJEM12DWJ didn’t qualify for rebates, I chose it for three reasons:

-

It fit my 500 sq ft condo perfectly.

-

My monthly bill dropped ~$20 compared to my old window AC.

-

The sealed installation keeps my living room more comfortable in both summer and winter.

Would a rebate have sweetened the deal? Absolutely. But even without one, the long-term value justified the purchase.

📋 Checklist: How to Check if Your TTW Unit Qualifies

-

Look for ENERGY STAR Label – Only certified models are considered for most rebates.

-

Check Local Utility Rebate Programs – Use Energy Star’s rebate finder.

-

Review Federal Tax Credit List – See what’s covered under the IRA Energy Efficient Home Improvement Credit.

-

Search DSIRE Database – Find state/city programs near you.

-

Ask Your Installer – Contractors often know about regional incentives.

✅ Conclusion: Rebates Rare, Efficiency Real

So, do through-the-wall air conditioners qualify for rebates or tax credits in 2025?

-

Federal tax credits: ❌ No, unless it’s a heat pump model.

-

Utility rebates: ✅ Possible, but usually only for ENERGY STAR-certified models.

-

Manufacturer promos: ✅ Sometimes available seasonally.

While you may not score a big rebate, TTW units like the GE AJEM12DWJ still deliver savings through efficiency, comfort, and durability.

👉 My takeaway: Don’t count on federal incentives for wall units, but do check local utility programs—and remember that long-term energy savings matter just as much.

In the next topic we will know more about: Best Accessories for Your GE Wall Unit: Wall Sleeves, Thermostats & Smart Controls