If you’ve been shopping for a through-the-wall air conditioner (TTW AC) lately, you’ve probably noticed the efficiency labels — EER, CEER, ENERGY STAR®, and even SEER2 on some newer models.

But there’s one question I hear all the time:

“Can I get a tax credit or rebate for installing an energy-efficient wall unit?”

The short answer: Yes, sometimes.

The longer answer — and the one that could save you a few hundred bucks — depends on what kind of system you buy, how efficient it is, and whether it meets ENERGY STAR® and IRS 25C credit requirements.

In this guide, I’ll walk you through everything you need to know about energy-efficient wall units, what tax credits and rebates apply in 2025, and how to make sure you don’t leave money on the table.

⚡ 1. Why Efficiency Matters More Than Ever

Electricity costs are rising almost everywhere in the U.S. The average homeowner now spends between $150 and $250 per month on electricity during peak cooling season.

The good news is, through-the-wall air conditioners have come a long way in terms of energy use. A decade ago, the typical model had an EER rating of around 8.5. Today, modern ENERGY STAR wall units often score 10.5 or higher — using 20% less energy to deliver the same cooling.

That means lower bills, a quieter home, and in many cases, eligibility for rebates or federal credits.

As Energy.gov points out, even small gains in efficiency make a big difference over a product’s lifespan. A well-chosen system can pay for itself through savings in as little as three years.

🧊 2. What Makes a Wall Unit “Energy Efficient”?

Before diving into tax credits, it helps to understand how energy efficiency is actually measured.

📏 EER (Energy Efficiency Ratio)

The EER rating tells you how many BTUs of cooling your unit delivers per watt of electricity under fixed conditions.

-

Higher EER = lower operating cost.

-

Example: An AC with EER 10.7 uses about 10% less energy than one rated EER 9.5.

⚙️ CEER (Combined Energy Efficiency Ratio)

CEER is the updated version of EER that also accounts for standby power — energy used when the unit is turned off but still plugged in. This rating is now required by the U.S. Department of Energy for all room and wall ACs.

🌡️ SEER2 (Seasonal Energy Efficiency Ratio)

Some wall units that include heat pump functionality use SEER2 instead. This measures performance over an entire cooling season under varying loads, similar to central systems.

Jake’s Tip:

“If your wall unit has both cooling and heating, you’ll want to look for SEER2 and HSPF2 ratings — that’s what the IRS looks at for heat pump credits.”

🌟 3. ENERGY STAR® Certification Explained

Not all efficient ACs qualify for rebates — only ENERGY STAR-certified models do.

ENERGY STAR units meet strict federal efficiency benchmarks based on CEER ratings and power usage.

✅ To Qualify for ENERGY STAR (2025 Standards):

| BTU Range | Minimum CEER | Notes |

|---|---|---|

| ≤ 8,000 BTU | 10.0 | Small rooms / bedrooms |

| 8,001–14,000 BTU | 9.8–10.3 | Mid-size living spaces |

| ≥ 14,001 BTU | 9.4 | Large rooms or apartments |

That means a model like the GE AJEQ10DCF (10,200 BTU) or LG LT1036CER (10,000 BTU) meets ENERGY STAR criteria — both delivering a CEER of about 10.7.

ENERGY STAR certification isn’t just marketing fluff. It’s the gateway to rebates and tax credits — because it proves your unit meets the government’s efficiency threshold.

(Reference: ENERGY STAR Certified Room ACs)

💰 4. Do Through-the-Wall Air Conditioners Qualify for Federal Tax Credits?

Here’s where most homeowners perk up.

The short answer is: Yes — but not all models qualify.

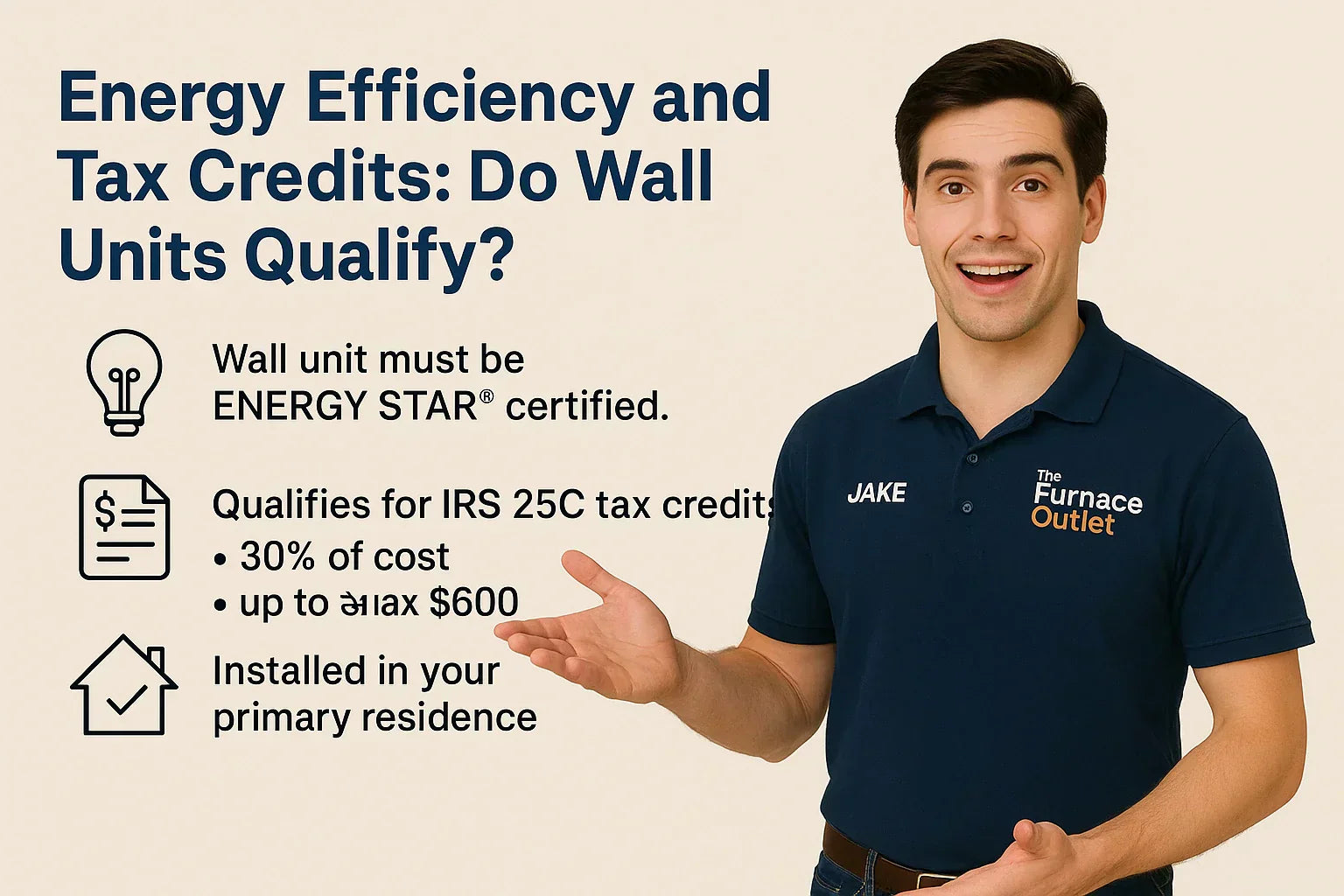

Through-the-wall air conditioners can qualify under the Energy Efficient Home Improvement Credit (IRS Section 25C), introduced as part of the Inflation Reduction Act (IRA).

🧾 The 25C Credit, in a Nutshell

-

Credit covers 30% of the cost (equipment + installation)

-

Capped at $600 per qualifying air conditioner

-

Applies to ENERGY STAR-certified models

-

Must be installed in your primary residence

-

Valid for units purchased and installed through 2025 and beyond

If your unit includes a heat pump or dual-function heating capability, the cap can be even higher (up to $2,000).

(Reference: IRS – Energy Efficient Home Improvement Credit (25C))

💡 Example: How Jake Claimed His Credit

Let’s say I buy a Friedrich Uni-Fit UCT10A10A for $950 and have it professionally installed for $300.

That’s a total project cost of $1,250.

The 25C credit covers 30%, up to $600 — meaning I could claim $375 back at tax time.

I fill out IRS Form 5695, attach my receipt, and boom — real cash savings.

(Reference: IRS Form 5695)

❌ What Doesn’t Qualify

-

Portable AC units (even if efficient)

-

Window air conditioners

-

Non-ENERGY STAR through-the-wall models

-

Systems installed in rentals or vacation homes

The IRS makes it clear: the credit only applies to permanent, high-efficiency installations in your main residence.

🏠 5. State & Utility Rebates: The Hidden Savings

Even if your wall unit doesn’t qualify for the federal tax credit, you might still be eligible for state or local energy rebates.

Utility companies and energy offices often reward customers for choosing ENERGY STAR-rated units because it helps reduce strain on the grid.

Here are some real examples for 2025:

| Provider | Region | Rebate | Eligibility |

|---|---|---|---|

| Con Edison | New York | $50 | ENERGY STAR wall or window AC |

| PG&E | California | $75 | ENERGY STAR heat pump or TTW AC |

| Mass Save | Massachusetts | $100 | ENERGY STAR room or wall AC |

| Austin Energy | Texas | $50 | ENERGY STAR air conditioner |

(Reference: ENERGY STAR Rebate Finder)

Jake’s Tip:

“Before buying, search your ZIP code on the ENERGY STAR Rebate Finder. You’d be surprised how often local rebates stack with the federal credit.”

⚙️ 6. Comparing Systems: Wall Unit vs. Mini Split vs. Window AC

Let’s look at how through-the-wall units compare with other cooling types in terms of efficiency and incentives.

| System Type | Efficiency (CEER / SEER2) | Qualifies for 25C? | Typical Rebate Potential | Energy Use (kWh/year) |

|---|---|---|---|---|

| Through-the-Wall AC | 9.5–10.7 CEER | ✅ Sometimes | $50–$600 | 800–1,000 |

| Mini Split Heat Pump | 16–25 SEER2 | ✅ Always | $300–$2,000 | 400–600 |

| Window AC | 8.5–9.5 CEER | ❌ Rarely | $0–$50 | 950–1,100 |

Takeaway:

While mini splits are the gold standard for efficiency, through-the-wall units hit the sweet spot between affordability, durability, and rebate eligibility — especially in single-room setups or older homes without ductwork.

📄 7. What You’ll Need to Claim the Tax Credit

If your wall AC qualifies under Section 25C, make sure you keep all documentation.

📋 Checklist:

-

📑 Purchase receipt showing model, date, and cost

-

🧾 Installer invoice (if applicable)

-

💡 ENERGY STAR certification label or screenshot

-

🏠 Proof of installation at primary residence

-

🖋️ IRS Form 5695

When filing taxes, you’ll enter the system cost and credit amount on Form 5695, line 22a (“Qualified Energy Efficiency Improvements”).

Keep these records for at least 3 years in case the IRS requests verification.

🔋 8. Practical Energy Tips to Maximize Efficiency

Even if your AC qualifies for tax credits, you’ll only see the full benefit if it’s installed and maintained correctly.

Here are some real-world tips I give customers all the time:

🧱 1. Seal Around the Wall Sleeve

Use foam insulation and silicone caulk to prevent air leaks between the sleeve and wall framing. Even tiny gaps can cut efficiency by 10%.

💨 2. Clean Filters Monthly

Dust and debris restrict airflow, forcing the compressor to work harder. Clean your filters at least once a month during cooling season.

🌡️ 3. Use a Smart Thermostat or Timer Plug

Many modern wall units can pair with smart outlets or built-in Wi-Fi control. Set schedules and raise temperatures when you’re away.

☀️ 4. Shade the Exterior Wall

Install your AC on a north or east-facing wall to minimize solar heat gain. A shaded location can reduce energy use by 5–10%.

🧰 5. Annual Tune-Up

If your unit includes heating, get a technician to inspect coils, refrigerant, and drainage annually for peak performance.

(Reference: Energy.gov – Air Conditioning Maintenance)

📊 9. Cost vs. Savings Breakdown

Here’s a quick look at the numbers for a typical homeowner replacing an older wall unit with an ENERGY STAR-certified model:

| Item | Non-Efficient Unit | ENERGY STAR Unit | Difference |

|---|---|---|---|

| Upfront Cost | $650 | $950 | +$300 |

| Energy Use (Annual) | 1,000 kWh | 850 kWh | -150 kWh |

| Annual Energy Cost (@ $0.15/kWh) | $150 | $127.50 | -$22.50/year |

| Tax Credit / Rebates | $0 | $250–$600 | +$250–$600 |

| 5-Year Savings (Energy + Rebates) | — | $350–$700 | — |

That means your higher upfront cost could pay for itself within the first year thanks to rebates and lower bills.

🧠 10. Common Myths About Energy Credits

Let’s clear up some of the confusion around 25C and ENERGY STAR rebates:

| Myth | Reality |

|---|---|

| “Only central systems qualify.” | ❌ ENERGY STAR through-the-wall units qualify under room AC standards. |

| “DIY installs don’t count.” | ✅ You can still claim the credit if you have proper documentation. |

| “Tax credits apply to rentals.” | ❌ Credits only apply to owner-occupied primary residences. |

| “Portable ACs qualify.” | ❌ They do not. They’re considered temporary appliances. |

| “All ENERGY STAR units qualify.” | ⚠️ Only those with CEER ratings above IRS minimums count for 25C. |

🌎 11. The Bigger Picture — Efficiency Beyond the Tax Break

While the credits and rebates are great, there’s another upside to upgrading your wall unit: long-term sustainability.

According to ENERGY STAR, if every U.S. homeowner replaced their old AC with an ENERGY STAR-certified model, the country would save over 2 billion kilowatt-hours annually — equivalent to powering 180,000 homes.

That’s less strain on the grid, fewer carbon emissions, and cleaner indoor air for you.

It’s a small change that adds up fast — especially as more homeowners swap out aging systems for efficient, tax-credit-eligible models.

🏡 12. Brand Examples of Qualifying Wall Units

Here are some of the top through-the-wall models that currently meet ENERGY STAR and 25C credit standards:

| Brand | Model | BTU | CEER | ENERGY STAR | Notes |

|---|---|---|---|---|---|

| LG | LT1036CER | 10,000 | 10.7 | ✅ | Smart Wi-Fi, quiet inverter compressor |

| GE Appliances | AJEQ10DCF | 10,200 | 10.7 | ✅ | Fits standard 26" sleeve |

| Friedrich | Uni-Fit UCT10A10A | 10,000 | 10.6 | ✅ | Ultra-quiet, heavy-duty steel build |

| Amana | PTC093G35AXXX | 9,000 | 10.5 | ✅ | Heat pump model, qualifies for $600 credit |

| Frigidaire | FFTA103WA1 | 10,000 | 10.9 | ✅ | Lightweight polymer chassis |

All of these meet or exceed the ENERGY STAR CEER thresholds, and most qualify for rebates or 25C credits depending on your location.

(Reference: LG Wall ACs, Friedrich Uni-Fit Series, GE Appliances – Wall ACs)

🧾 13. Quick Step-by-Step: How to Claim Your Credit

-

Confirm Eligibility:

Check ENERGY STAR database for your model’s listing. -

Keep Records:

Save product manual, receipts, and ENERGY STAR certificate. -

Complete Form 5695:

Download from IRS.gov. Enter cost under “Qualified Energy Efficiency Improvements.” -

File with Taxes:

Submit the form with your annual return. You’ll receive the credit as part of your refund or offset against taxes owed. -

Track State Rebates:

Visit the ENERGY STAR Rebate Finder for regional programs.

Jake’s Reminder:

“Unlike a deduction, a credit reduces your tax bill dollar-for-dollar. A $400 credit literally means $400 less owed to the IRS.”

🧾 14. When Wall Units Don’t Qualify — and What to Do Instead

If your current model doesn’t meet ENERGY STAR or IRS thresholds, you still have options:

-

Add smart plug timers to reduce standby energy.

-

Upgrade to an ENERGY STAR-certified sleeve replacement when ready.

-

Consider a through-the-wall heat pump — many qualify for the full $2,000 rebate under 25C.

If you’re replacing multiple units in a multifamily building, consider bulk purchase rebates through your utility or state program.

🏁 15. Jake’s Final Take

If there’s one thing I tell every homeowner, it’s this:

“Efficiency pays — and thanks to tax credits, it pays faster than ever.”

A well-chosen ENERGY STAR through-the-wall AC doesn’t just save you on utilities — it can also put cash back in your pocket through IRS 25C credits and local rebates.

So before you hit “add to cart,” check for the ENERGY STAR label, verify CEER ratings, and keep those receipts handy. You might just find that the coolest part of your new AC is the refund you’ll get next spring.

In the next topic we will know more about: How to Keep Your Through-the-Wall Air Conditioner Functioning Like New