💡 1️⃣ The 2025 Shift and Why Homeowners Are Asking

If you’re planning to upgrade your air conditioner or heat pump this year, you’ve probably heard about R-32 systems. They’re the next generation of refrigerant-based HVAC systems replacing the old R-410A units — and they come with some serious benefits in efficiency and environmental performance.

Best Air Conditioners And Gas Furnace Systems

But here’s the million-dollar question:

“Do R-32 systems qualify for federal energy rebates and tax credits in 2025?”

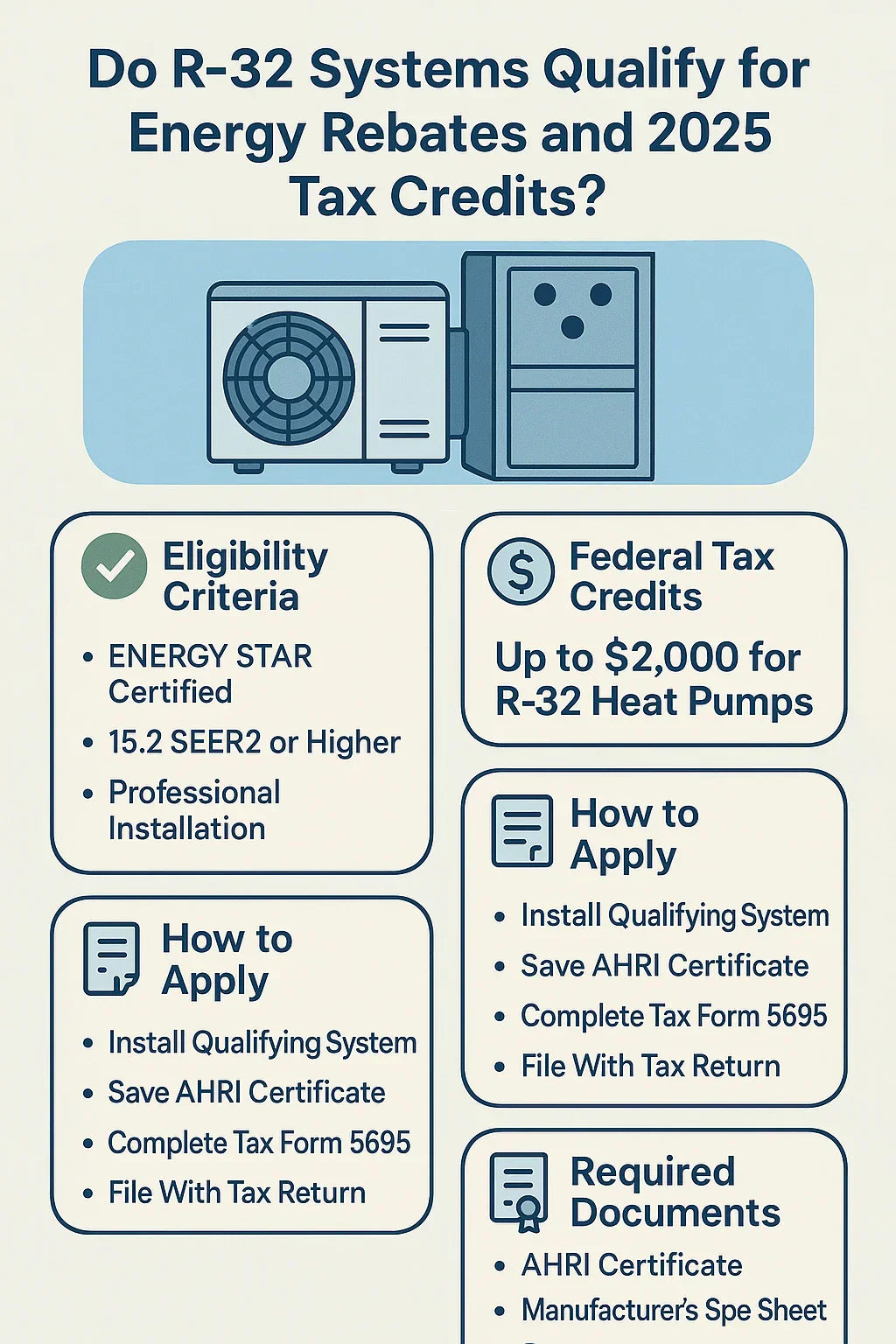

The short answer: Yes — most R-32 systems qualify for both tax credits and rebates if they meet the latest ENERGY STAR efficiency standards and are installed by a licensed professional.

Between the Inflation Reduction Act (IRA), ENERGY STAR rebates, and state-level incentives, homeowners are seeing record savings when upgrading to efficient, low-GWP systems like R-32.

Let’s break down exactly how these programs work, what qualifies, and how to maximize your refund — without getting lost in the government paperwork.

📗 Reference: ENERGY STAR – Federal Tax Credits

⚙️ 2️⃣ The 2025 HVAC Efficiency Standards Explained

In January 2023, the Department of Energy (DOE) rolled out new HVAC testing standards — SEER2, EER2, and HSPF2 — to replace the old SEER and HSPF ratings. By 2025, nearly all new HVAC systems are rated using this improved testing method.

🧾 What’s Changed:

| Efficiency Metric | Old Label | New Label | Purpose |

|---|---|---|---|

| Cooling Efficiency | SEER | SEER2 | Accounts for real-world duct losses |

| Energy Ratio | EER | EER2 | Measures efficiency at peak load |

| Heating Efficiency | HSPF | HSPF2 | More realistic heat pump performance |

These new standards also raised the minimum efficiency requirements for new systems:

-

North Region: Minimum 13.4 SEER2

-

South/Southwest: Minimum 14.3 SEER2

-

ENERGY STAR eligibility: Starts at 15.2 SEER2 and above

R-32 systems naturally excel under these new metrics because they transfer heat more efficiently, using less refrigerant and less energy.

📘 Reference: DOE – New HVAC Efficiency Standards

Jake’s take:

“If your system hits 15.2 SEER2 or higher, congratulations — you’ve already crossed the rebate threshold.”

🌿 3️⃣ Why R-32 Systems Are Perfect for Rebates

The refrigerant inside your AC plays a bigger role in rebate eligibility than you might think. Here’s why R-32 is quickly becoming the “gold standard” for incentive programs:

✅ 1. Higher Efficiency

R-32 transfers heat faster than R-410A, which helps systems achieve 10–15% higher efficiency at similar tonnage.

✅ 2. Lower Environmental Impact

It has a Global Warming Potential (GWP) of about 675 — roughly one-third of R-410A’s 2,088. Many rebate programs now consider GWP in their qualification criteria.

✅ 3. ENERGY STAR-Ready

Manufacturers like Daikin, Goodman, and LG are already certifying their R-32 models under ENERGY STAR Most Efficient 2025 listings.

✅ 4. IRA Alignment

Federal programs are now rewarding systems that align with both efficiency and refrigerant transition goals.

📗 Reference: Daikin – Environmental Benefits of R-32

Jake’s insight:

“It’s not just about how cold your air gets — it’s about how efficiently your system handles it. R-32 checks both boxes.”

🧾 4️⃣ The Inflation Reduction Act (IRA) and R-32 Eligibility

The Inflation Reduction Act of 2022 is the backbone of today’s HVAC tax credits. It provides incentives for energy-efficient home improvements through 2032.

Under Section 25C of the IRS code, homeowners can claim federal tax credits for qualifying heating and cooling upgrades.

Here’s how it breaks down:

💰 2025 Federal HVAC Tax Credits

| Equipment Type | Maximum Credit | Eligibility Requirements |

|---|---|---|

| Central Air Conditioner (R-32 or equivalent) | Up to $600 | Must meet ENERGY STAR (15.2 SEER2 or higher) |

| Heat Pump System (R-32 models included) | Up to $2,000 | Must meet ENERGY STAR Cold Climate specs |

| Gas Furnace + AC Combo | Up to $1,200 total | Both components must meet efficiency standards |

These credits reset annually — meaning you can claim them again for separate projects (like an AC one year and a heat pump the next).

📘 Reference: IRS – Energy Efficient Home Improvement Credit (Form 5695)

Jake’s advice:

“Save every document from your installer — your AHRI certificate is your proof that the system qualifies.”

🧭 5️⃣ ENERGY STAR Rebates: What Qualifies in 2025

ENERGY STAR rebates aren’t just federal — they also come from utilities, state energy offices, and manufacturers.

To qualify, your R-32 system must:

-

Be ENERGY STAR certified (look for ≥15.2 SEER2)

-

Use an A2L-approved refrigerant (R-32 qualifies)

-

Be professionally installed

-

Be AHRI matched (coil + condenser pairing)

Average 2025 Rebate Ranges:

| Region | Utility/Program | Typical Rebate | Qualifying SEER2 |

|---|---|---|---|

| Midwest | ComEd, Consumers Energy | $300–$600 | 15.2+ |

| South | Duke Energy, Oncor | $400–$800 | 15.2–16.7+ |

| Northeast | Mass Save, NYSERDA | $600–$1,200 | 16.0+ |

| West Coast | SoCalGas, PG&E | $500–$1,500 | 15.2–18.0+ |

📗 Reference: ENERGY STAR – Rebate Finder

Jake’s tip:

“Pop your ZIP code into the Rebate Finder before buying — that’s how I help customers spot hidden programs that can save hundreds.”

🧮 6️⃣ How to Calculate Your Real Savings

Let’s crunch some real-world numbers.

Example:

Old System: 13 SEER R-410A (3-ton, 3,000 kWh per season)

New System: 15.2 SEER2 R-32 (same size, 2,565 kWh per season)

Local Electric Rate: $0.16/kWh

Annual Savings:

3,000 − 2,565 = 435 kWh saved × $0.16 = $70/year

Plus:

-

Federal Tax Credit: $600

-

Local Utility Rebate: $400

-

ENERGY STAR Bonus: $100

Total First-Year Value: $1,170

That’s just year one. Over 10 years, you’ll save $700–$1,000 more on your energy bills.

Jake’s takeaway:

“You’re not just cooling your home — you’re paying yourself back with every degree.”

🧯 7️⃣ What Paperwork You’ll Need

When it comes time to claim your rebates and credits, paperwork matters more than anything. Here’s your checklist:

📋 Required Documents:

-

AHRI Certificate: Proof of system efficiency and model match

-

Installer Invoice: Must list equipment model numbers and installation date

-

Manufacturer Spec Sheet: Showing SEER2, EER2, and HSPF2 ratings

-

Form 5695: For your federal tax return

Jake’s reminder:

“Your installer should give you all this automatically. If they don’t, that’s a red flag.”

🏛️ 8️⃣ State & Utility-Level Incentives for 2025

Beyond federal credits, nearly every state now offers its own HVAC incentive programs — many of which specifically reward low-GWP refrigerants like R-32.

Examples:

| State | Program | R-32 Bonus | Details |

|---|---|---|---|

| California | CEC Clean Air Rebate | +$500 | <750 GWP refrigerant |

| New York | NYSERDA HVAC Upgrade Program | $500–$1,500 | ENERGY STAR R-32 systems |

| Texas | Oncor Energy Rebate | $750 | 16+ SEER2 systems |

| Massachusetts | Mass Save | Up to $1,200 | High-efficiency A2L-certified systems |

📗 Reference: DSIRE – Database of State Incentives

Jake’s advice:

“Some states even stack incentives — I’ve seen customers get $2,500+ in combined credits.”

🧩 9️⃣ Full vs. Partial System Upgrades

This one’s important: if you only replace part of your system, your rebate may disappear.

System Eligibility:

| Upgrade Type | Eligible for Rebates? | Why |

|---|---|---|

| Full System (Condenser + Coil + Furnace or Air Handler) | ✅ | Fully matched AHRI-certified setup |

| R-32 Condenser + New Coil (keep existing furnace) | ✅ | If AHRI match exists |

| Outdoor Unit Only (old coil reused) | ❌ | Efficiency not certified; disqualified |

Jake’s golden rule:

“No AHRI match, no rebate — period.”

🔧 🔟 Step-by-Step: How to Claim a Federal Tax Credit

Here’s Jake’s simple walkthrough for homeowners filing their 2025 taxes:

-

Install a qualifying R-32 system with ≥15.2 SEER2.

-

Get your AHRI Certificate from your contractor.

-

Download Form 5695 from the IRS website.

-

Enter credit amount: up to $600 for central AC, $2,000 for heat pumps.

-

Attach proof (invoice + AHRI certificate).

-

Submit with your 2025 federal return.

📗 Reference: ENERGY STAR – How to Claim Tax Credits

Jake’s reminder:

“You can’t double-dip the same upgrade — but you can stack state, federal, and utility incentives.”

🧠 11️⃣ Common Homeowner Mistakes to Avoid

After years in the field, I’ve seen a few preventable mistakes that cost homeowners their rebates. Avoid these:

-

❌ Not registering product warranties (disqualifies rebate claims).

-

❌ Buying from unlicensed or online-only sellers.

-

❌ Installing without a licensed HVAC contractor.

-

❌ Failing to get AHRI certificate.

-

❌ Misreporting old SEER values (use SEER2 ratings for 2025).

Jake’s advice:

“If you don’t have a paper trail, the IRS and utility company will assume you didn’t qualify.”

🧰 12️⃣ How to Verify R-32 System Eligibility

Before you buy, verify that your system qualifies for rebates. Here’s how:

-

Visit the AHRI Directory.

-

Enter your outdoor condenser and coil model numbers.

-

Confirm SEER2, EER2, and certification number.

-

Save or print the AHRI certificate — it’s required for rebates.

Jake’s insight:

“Your AHRI certificate is basically your system’s birth certificate — it proves your setup meets federal and ENERGY STAR standards.”

💵 13️⃣ How R-32 Systems Stack Up Financially

Here’s what R-32 ownership looks like over 10 years compared to older systems:

| Category | R-410A System | R-32 System | Savings |

|---|---|---|---|

| Efficiency | 13 SEER | 15.2 SEER2 | 15% less energy use |

| GWP | 2,088 | 675 | 67% reduction |

| Average Install Cost | $6,000 | $7,000 | – |

| Rebates & Credits | $0–$300 | $600–$2,000 | +$1,400 average |

| 10-Year Energy Savings | – | $700–$1,000 | +$1,000 total benefit |

Jake’s summary:

“R-32 systems may cost a little more upfront, but the rebates and savings easily make up the difference.”

🧭 14️⃣ Combining Federal, State, and Utility Incentives

Yes — you can stack multiple rebates, as long as they come from different sources.

Example:

-

Federal Tax Credit: $600

-

State Incentive: $500

-

Utility Rebate: $400

-

Manufacturer Promotion: $200

Total Savings: $1,700

Jake’s pro tip:

“Ask your contractor to fill out rebate forms for you — most reputable installers will handle the submission.”

🧰 15️⃣ What Contractors Need to Do

If you’re an installer (or hiring one), here’s what the contractor must ensure:

-

System matches AHRI-certified combination.

-

Coil and condenser are A2L-rated.

-

Proper refrigerant charge verification (R-32 requires precise mass).

-

Labeling meets UL 60335-2-40 safety standards.

-

Documentation for rebates and warranties is complete.

Jake’s field note:

“Rebates reward craftsmanship. Cutting corners on documentation is like leaving money on the table.”

🌎 16️⃣ R-32’s Role in the Green HVAC Transition

Beyond the money, R-32 systems help homeowners meet upcoming climate goals:

-

Comply with EPA HFC phase-down under the AIM Act.

-

Reduce refrigerant emissions by up to 70% per home.

-

Encourage adoption of mildly flammable A2L refrigerants safely and efficiently.

📘 Reference: EPA – HFC Phase-Down Plan

Jake’s final thought:

“Rebates aside, R-32 is the future. You’re not just upgrading your comfort — you’re upgrading your footprint.”

✅ 17️⃣ Final Verdict: Yes, and Here’s Why It’s Worth It

So, do R-32 systems qualify for 2025 rebates and tax credits?

Absolutely.

They meet — and often exceed — all the major requirements:

-

ENERGY STAR certified

-

High-efficiency SEER2 and EER2 ratings

-

Low-GWP refrigerant (A2L safe)

-

AHRI-certified system match

If you’re planning an HVAC upgrade in 2025, choosing an R-32 system isn’t just the right move for the environment — it’s the smart financial decision.

“Between rebates, tax credits, and lower bills, you’re saving green while going green.”

— Jake Lawson

In the next topic we will know more about: R-32 vs. Heat Pump Systems: Which Offers Better Year-Round Efficiency?