Thinking of upgrading your HVAC system in 2025? If you're considering an R-32 4-ton air conditioner, you're probably wondering if it qualifies for energy efficiency incentives. Homeowner Savvy had the same question when planning her install. Here's what she uncovered about federal tax credits, local rebates, and what it takes to qualify.

Why R-32 Systems Are Gaining Popularity in 2025

R-32 refrigerant has quickly become the preferred alternative to R-410A due to its lower Global Warming Potential (GWP) and higher efficiency. For eco-conscious homeowners like Savvy, this switch was appealing—but financial incentives helped seal the deal.

R-32 advantages include:

-

Lower GWP (675 vs. 2088 for R-410A)

-

Up to 10% higher heat transfer efficiency

-

Reduced refrigerant charge

-

Easier recyclability and single-component composition

These characteristics make R-32 units a strong contender for meeting energy efficiency benchmarks set by government programs.

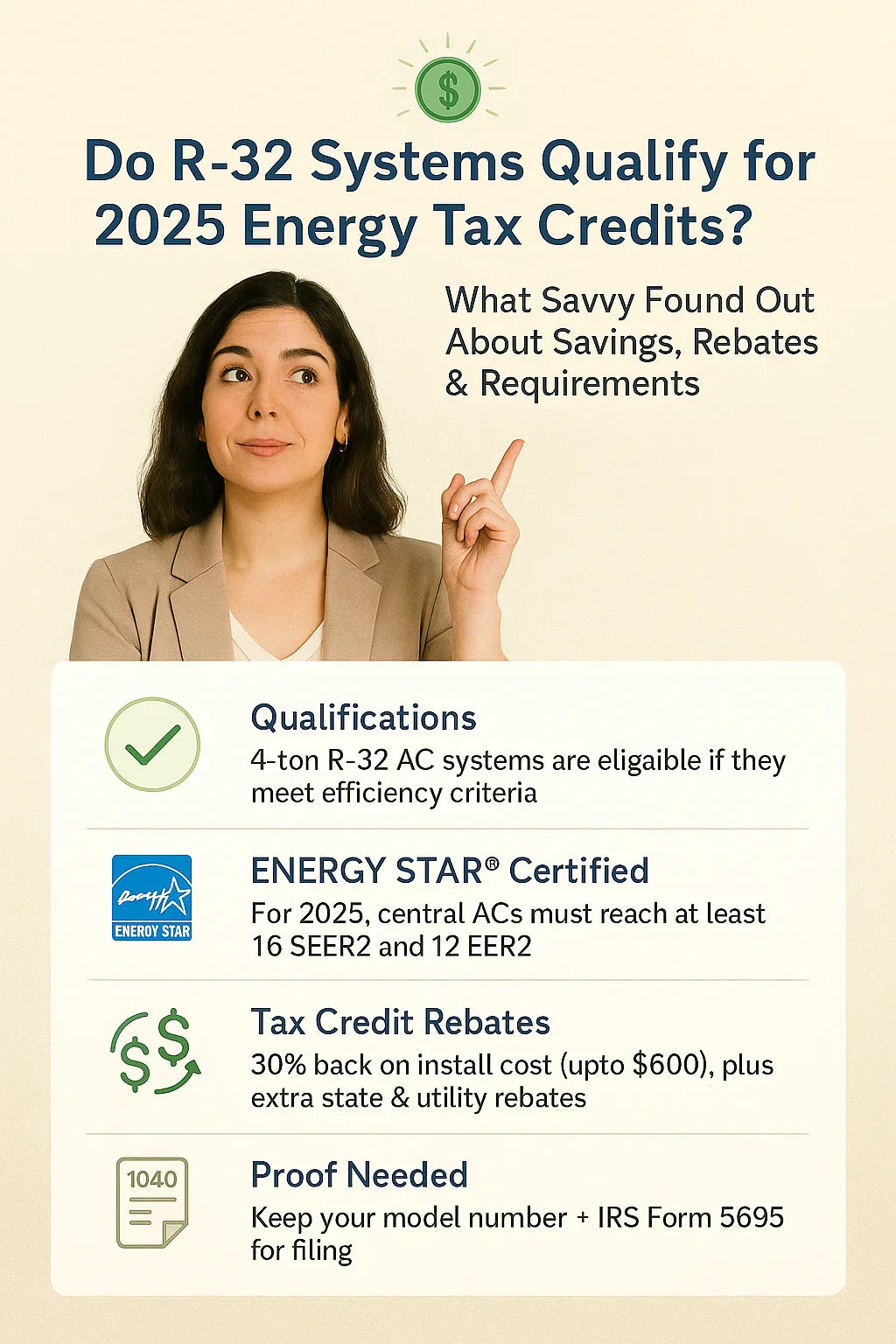

Federal Tax Credit: What R-32 Units Qualify For in 2025

Under the Inflation Reduction Act (IRA), homeowners can receive up to $2,000 in federal tax credits for installing qualified high-efficiency heat pumps or air conditioners. But not all R-32 systems automatically qualify.

Key Federal Requirements:

-

Must meet or exceed ENERGY STAR v6.1 standards

-

Must be installed in a primary residence (not rentals or second homes)

-

Must be installed by a licensed professional

-

Equipment must have a SEER2 of 16 or higher for central ACs

✅ Savvy's pick: A 4-ton R-32 AC with a 17.2 SEER2 and ENERGY STAR label—qualifies!

Additional State & Utility Rebates

Beyond federal incentives, many state energy offices and utility companies offer rebates for switching to climate-friendly technologies.

Examples:

-

California: Up to $1,200 from local utility partners

-

New York: $800–$1,000 through NYSERDA

-

Texas: Oncor and CPS Energy offering $500+ for ENERGY STAR heat pumps

Savvy used her ZIP code in the DSIRE database to find her local offers. She stacked a $2,000 federal credit with a $900 utility rebate, bringing her total savings to $2,900.

Installation Must-Haves for Eligibility

If you want your R-32 system to qualify, you must:

-

Document SEER2 and ENERGY STAR certification

-

Have a licensed contractor perform the installation

-

Keep all receipts, model numbers, and installation records

-

File IRS Form 5695 when claiming the tax credit

Savvy used a qualified HVAC installer who provided all paperwork and helped her claim the credit.

Does Every 4-Ton R-32 AC Qualify?

Not necessarily. Here's a quick checklist:

| Feature | Minimum Requirement | Savvy's 4-Ton R-32 System |

|---|---|---|

| SEER2 Rating | 16+ | 17.2 |

| ENERGY STAR Certified | Yes | ✅ Yes |

| Installed by a Licensed Pro | Yes | ✅ Yes |

| Primary Residence | Yes | ✅ Yes |

If your system doesn’t meet these, you may not be eligible.

Bonus: High-Efficiency Add-Ons That Also Qualify

Savvy went a step further and added:

-

Smart thermostat (qualified for a $50 rebate)

-

Advanced filtration upgrade

Bundling these with her R-32 system enhanced comfort and savings.

Final Takeaways from Savvy

If you're going the R-32 route in 2025:

-

✅ Make sure the SEER2 is 16 or higher

-

✅ Confirm ENERGY STAR status

-

✅ Use a licensed installer

-

✅ Check your local rebate programs

The switch to R-32 not only helps the planet—it can also save you serious cash if you know how to navigate the tax credit and rebate landscape.

Ready to claim your savings? Check your R-32 system specs, confirm ENERGY STAR status, and talk to a licensed installer about qualifying for 2025 tax credits and rebates.

In the next topic we will know more about: Can a 4-Ton R-32 System Handle Open Concept Homes? Layout Tips, Real-Life Performance & What Savvy Learned