🏠 1️⃣ Introduction — What to Know About Energy Rebates and Tax Credits for 2025

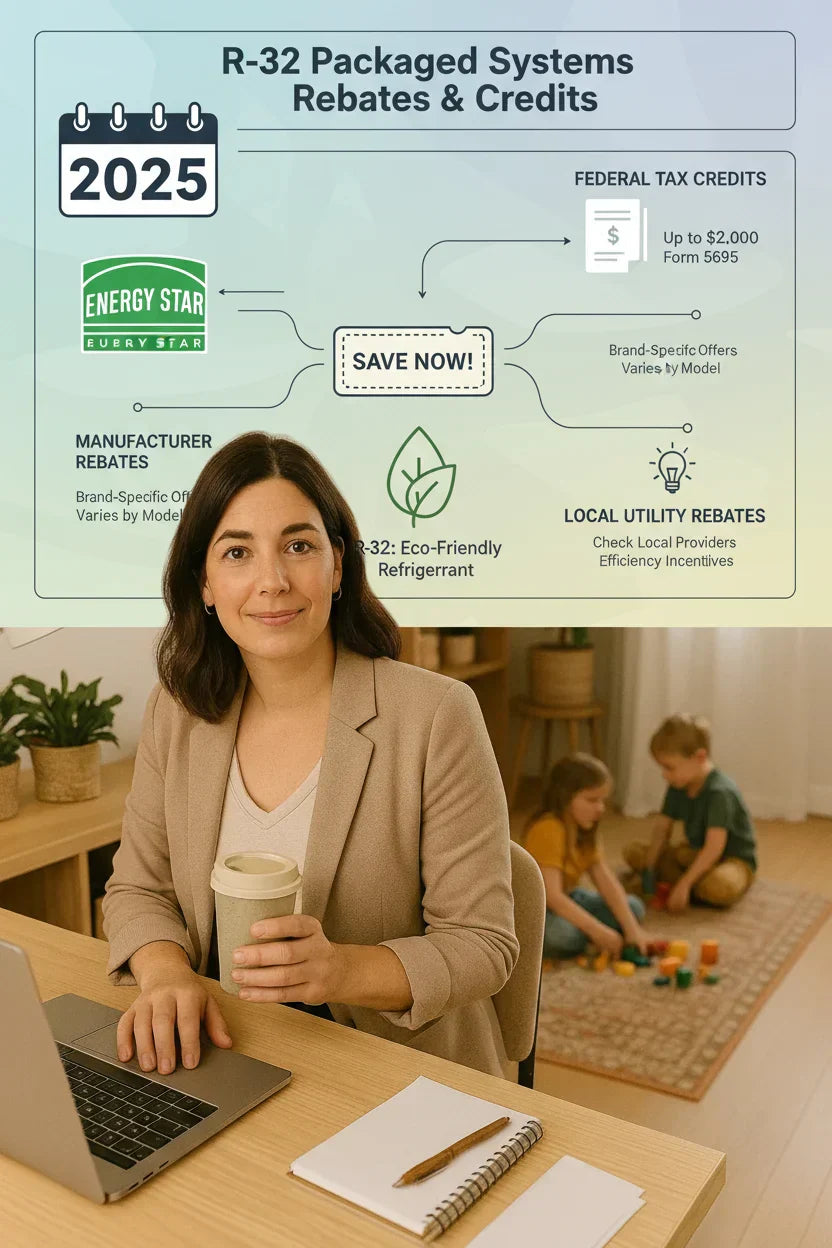

If you’re in the market for a new air conditioner or planning to upgrade your existing system, 2025 is a great year to go with an R-32 packaged AC system. With energy efficiency being more important than ever, federal, state, and local rebates combined with tax credits can significantly lower the upfront cost of your new system.

But here’s the catch — while many homeowners know that tax credits and rebates exist, they often don’t know how to access them or which systems qualify. As we move toward 2025, R-32 packaged systems are now one of the most eligible and eco-friendly systems to qualify for these incentives, thanks to their energy efficiency and environmental benefits.

In this guide, we’ll walk through the key tax incentives, rebates, and programs that will help you save money while making an eco-friendly decision. Whether you’re replacing an old unit, upgrading an existing HVAC system, or building a new home, this article will help you maximize your savings and make the most out of available rebates.

🌱 2️⃣ The Inflation Reduction Act (IRA) & Its Impact on 2025 Energy Rebates

In 2025, energy-efficient systems are more accessible than ever thanks to the Inflation Reduction Act (IRA), which was signed into law in 2022. This law provides substantial federal tax credits for homeowners who choose to install energy-efficient HVAC systems such as R-32 packaged air conditioners.

🏛️ Key Features of the IRA:

-

$2,000 Tax Credit: Homeowners can receive up to $2,000 in federal tax credits for purchasing qualified energy-efficient HVAC systems, which includes R-32 systems meeting EnergyStar® certification standards.

-

Home Efficiency Rebates: Certain state and local programs offer instant rebates at the point of sale for qualifying systems.

-

Upgrading to Energy Efficiency: Homeowners who replace older, less efficient HVAC systems (like R-410A or older models) with newer R-32 units are eligible for the incentives offered through the IRA.

Savvy Tip: “The $2,000 federal tax credit is a huge incentive to make the switch to R-32 systems in 2025 — helping you save on upfront costs while investing in long-term savings and sustainability.”

You can learn more about how to apply for these credits on the EnergyStar website or through the IRS Energy Efficient Property Credit page.

🔋 3️⃣ Energy Efficiency Tax Credits for R-32 Systems in 2025

R-32 systems are part of the EnergyStar® family, which means they meet the highest standards of energy efficiency. These systems are eligible for substantial federal tax credits in 2025, making them an even more attractive option for homeowners.

💰 $2,000 Federal Tax Credit

Under the Energy Efficient Home Improvement Credit within the IRA, homeowners can qualify for up to $2,000 in tax credits when installing a qualified energy-efficient heat pump system, which includes R-32 packaged systems.

Here’s how it works:

-

Eligible System: The system must meet EnergyStar® certification and have a SEER2 rating of at least 15.

-

Claiming the Credit: To claim this tax credit, homeowners must file their 2025 taxes and submit a copy of the purchase invoice with their tax return.

Link to IRS Energy Efficient Property Credit for more detailed instructions on how to claim this tax credit.

Savvy Tip: "The $2,000 tax credit directly reduces your tax liability — meaning it lowers the amount you owe the IRS, or increases your refund."

💡 4️⃣ Local and Utility Rebates for R-32 Packaged Systems

In addition to federal tax credits, many homeowners can take advantage of local, state, and utility-based rebates that help offset the cost of purchasing an R-32 system.

💸 How Local Rebates Work

Some utility companies and local governments offer instant rebates that you can apply for when purchasing your R-32 packaged air conditioner. These rebates vary based on:

-

Energy savings potential (higher efficiency means higher rebates)

-

State-specific programs — for example, California, New York, and Texas are known for offering generous rebates for energy-efficient appliances.

⚡ Common Rebates in 2025:

-

California: Up to $500 for qualifying systems through the California Energy Commission’s Home Energy Efficiency Rebate Program.

-

New York: Offers rebates through the New York State Energy Research and Development Authority (NYSERDA).

-

Texas: Utility rebates up to $1,000 for replacing old HVAC systems with high-efficiency units, including R-32 models.

You can check for your specific state’s rebate programs by visiting the DSIRE USA Database — the most comprehensive resource for energy incentives and rebates available in your area.

Savvy Tip: “Rebates can be applied directly at the point of purchase, which means you won’t need to wait to file your taxes to get the benefit!”

🌍 5️⃣ State-Specific Programs — Saving More in Your Area

Each state has unique energy-saving programs that can help you lower your costs when switching to an R-32 packaged AC system.

🏙️ State-Specific Incentives:

-

California: The California Public Utilities Commission offers large rebates for replacing old HVAC systems with newer, more efficient models like R-32.

-

New York: New York’s Clean Energy Fund offers a variety of incentives for residential energy upgrades, including up to $1,000 for replacing HVAC systems with EnergyStar-rated equipment.

-

Texas: Programs such as the Texas Energy Efficiency Incentives Program offer rebates based on system size and energy savings potential.

Be sure to check with your local energy provider to see if they offer any instant rebates or financing options for your new system.

Savvy Tip: “Some states provide rebates based on income level, so low-income homeowners could receive a larger rebate amount or additional assistance.”

⚡ 6️⃣ How to Apply for Energy Rebates and Tax Credits

Once you’ve purchased your R-32 packaged system, you’ll need to apply for rebates and tax credits. Here’s a step-by-step guide to getting those savings.

🧾 Steps to Apply for Tax Credits:

-

Make sure your system is EnergyStar-certified (R-32 systems are eligible).

-

Keep a copy of your receipt or invoice that includes the make, model, and cost of your system.

-

File your 2025 taxes and claim the $2,000 tax credit for energy-efficient home improvements.

-

Attach your system purchase documentation to your tax return.

💸 Steps to Apply for Local and Utility Rebates:

-

Check eligibility: Review your utility provider’s rebate program to confirm your R-32 system qualifies.

-

Fill out rebate forms: Utility companies often require homeowners to fill out forms online or in-person.

-

Submit proof of purchase: You’ll likely need to provide your purchase receipt, along with details of the installation and system model.

-

Get your rebate: Some utilities provide instant rebates at the time of purchase, while others send a check after processing.

Savvy Tip: “Make sure to submit all necessary documentation for both rebates and tax credits to avoid delays. Keep digital records of all receipts.”

🧮 7️⃣ How Much Will You Really Save? Breaking Down Your Potential Savings

Now that we know how to access rebates and tax credits, let’s break down how much you can save.

💰 Tax Credit + Local Rebate = Big Savings

-

Example Savings:

-

$2,000 federal tax credit

-

$500 local rebate (from California’s energy programs)

-

$100–$200 annual savings on energy bills

-

Total savings over 10 years could add up to $5,000–$6,000.

-

The savings don’t stop there. By installing a more efficient R-32 system, you’ll lower your energy bills and reduce your environmental impact, making your home more eco-friendly and cost-effective for years to come.

Savvy Tip: “You’re investing in long-term savings — the tax credit and rebates cut down your upfront costs, but the true payoff is in the lower utility bills year after year.”

🌎 8️⃣ Additional Benefits of Installing an R-32 System in 2025

Besides rebates and tax credits, here are the additional reasons why R-32 systems are worth the investment:

🌱 Environmental Benefits

-

Lower Global Warming Potential (GWP): R-32 systems have a 68% lower GWP than older refrigerants like R-410A, making them a better choice for eco-conscious homeowners.

-

Energy Savings: R-32 systems use less refrigerant, resulting in fewer emissions and lower energy consumption.

🏡 Increased Home Value

Upgrading to an energy-efficient HVAC system like R-32 can also increase your home’s market value, as more buyers look for homes that are energy-efficient and eco-friendly.

🧮 9️⃣ Comparing R-32 to Other Refrigerants — What’s the Best Choice for Your Wallet and the Planet?

It’s important to consider R-32’s advantages when comparing it to other refrigerants.

| Refrigerant | Global Warming Potential (GWP) | Efficiency | EPA Compliance |

|---|---|---|---|

| R-32 | 675 | High | Fully compliant |

| R-410A | 2,088 | Moderate | Phasing out by 2025 |

| R-22 | 1,810 | Low | Discontinued |

🌿 Why R-32 is the Better Choice:

-

Lower GWP means it has a smaller environmental impact.

-

It is more efficient, offering better cooling performance with less energy.

-

As R-410A is phased out, R-32 is the future-proof choice.

🧠 10️⃣ The Savvy Takeaway — Maximize Your Savings with R-32 in 2025

With rebates, tax credits, and energy savings, 2025 is a perfect year to install a high-efficiency R-32 system. Here’s what you should remember:

-

$2,000 federal tax credit for qualified energy-efficient systems.

-

State and utility rebates can add additional savings, often applied immediately at point of sale.

-

Long-term energy savings will lower your utility bills and reduce environmental impact.

In the next topic we will know more about: R-32 Performance in Extreme Weather — Cooling and Heating Tested