When I was shopping for my Goodman 2.5 Ton R-32 AC system, I had one big question beyond tonnage, SEER2, and installation:

Will this qualify for rebates or tax credits?

For me, cost mattered just as much as comfort. I wasn’t just looking at the sticker price of the unit. I wanted to know if I could save hundreds of dollars by tapping into government and utility programs.

The good news? In 2025, R-32 AC units absolutely qualify for incentives — in fact, they often qualify for more than older R-410A systems. Here’s everything I learned about how to maximize your savings.

📖 Why Incentives Exist for AC Units

AC incentives aren’t just about helping homeowners save money. They’re about driving a national shift in energy use and refrigerants.

-

Efficiency standards: The DOE raised minimum efficiency requirements in 2023, measured in SEER2. Systems that exceed those standards qualify for incentives.

-

Refrigerant transition: R-410A, the industry standard for two decades, is being phased out due to its high Global Warming Potential (GWP = 2,088).

-

Cleaner choice: R-32 has a much lower GWP (675), so systems using it are prioritized for incentives.

📌 Source: DOE – AC & Heat Pump Efficiency Standards

🌍 What Makes R-32 Different?

Why do R-32 systems get a financial edge in 2025?

-

Lower environmental impact: R-32’s GWP is about one-third of R-410A.

-

Better efficiency: It transfers heat more effectively, often allowing higher SEER2 ratings.

-

Future-proofing: Since R-410A is being phased down, R-32 is the refrigerant utilities and governments want us to adopt.

That means rebates and tax credits increasingly favor R-32 systems.

📌 Source: EPA – Refrigerant Transition

🧾 Federal Tax Credits in 2025

The Inflation Reduction Act (IRA) extended and expanded credits for efficient HVAC systems.

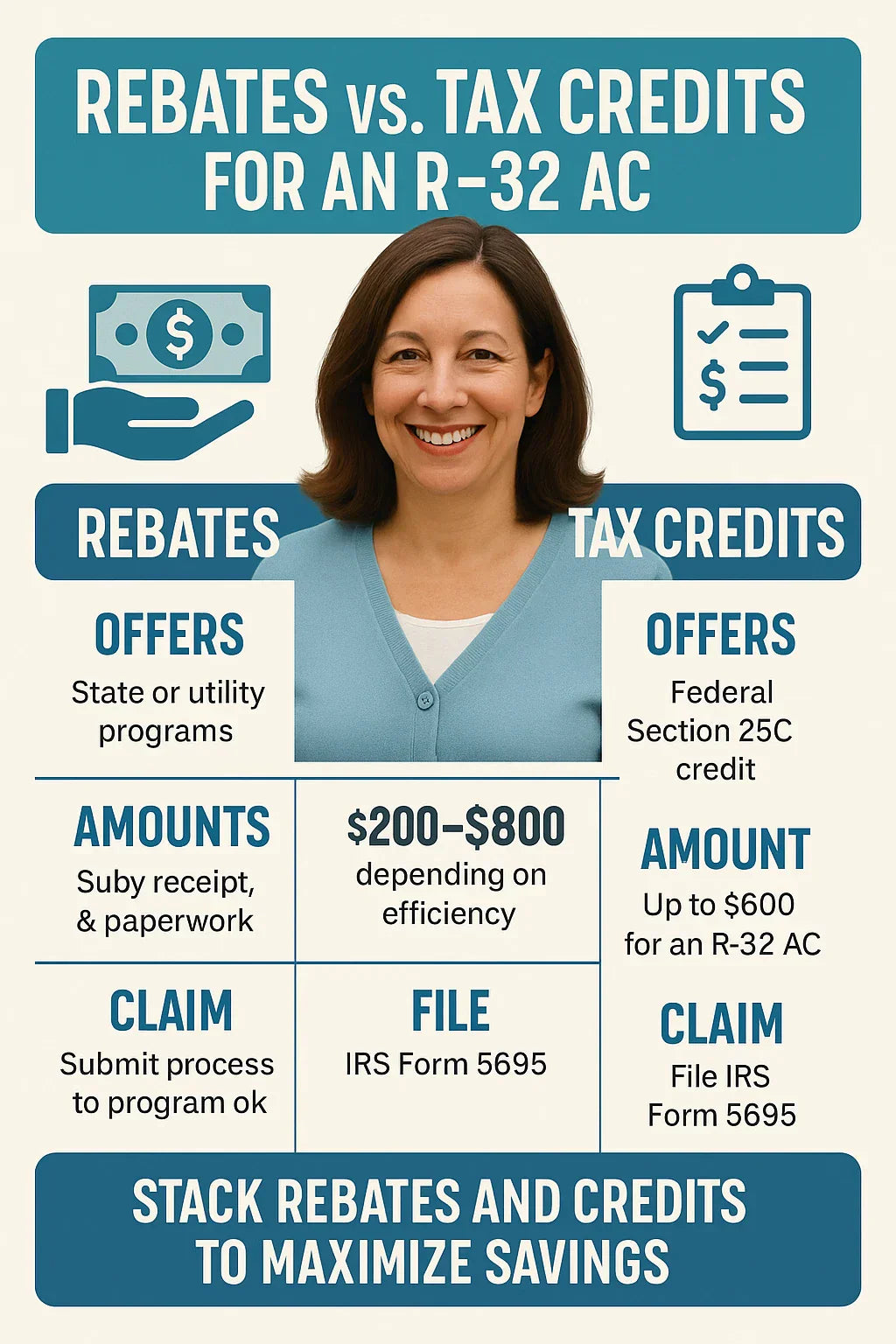

🔑 Key Federal Credit: Section 25C (Energy Efficient Home Improvement Credit)

-

Amount: Up to $600 for central AC systems.

-

Eligibility: Must be ENERGY STAR certified and meet CEE Tier 1 efficiency requirements.

-

Applies once per year (not lifetime, unlike older programs).

👉 Most Goodman R-32 systems with 14.4 SEER2 or higher qualify.

📌 Source: ENERGY STAR – Federal Tax Credits

🏢 State & Local Rebates

Beyond federal credits, many states and utilities offer rebates — and these can stack.

Examples in 2025:

-

California: Rebates of $200–$800 depending on system size and efficiency.

-

New York (Con Edison): $300–$600 rebates for ENERGY STAR central ACs.

-

Texas (Austin Energy): Up to $500 rebates for efficient central AC systems.

👉 Rebates vary widely, so always check your utility’s website.

📌 Source: DSIRE – Database of State Incentives

📊 Example Cost Savings With Rebates

Here’s how my numbers looked when I bought my Goodman 2.5 Ton R-32 system:

-

Installed cost: $5,500

-

Federal tax credit: -$600

-

Utility rebate: -$300

-

Final cost: $4,600

That’s $900 in savings just from paperwork.

👉 Without the rebates, I might have considered a cheaper R-410A system. With them, the R-32 system was the smarter choice long-term.

🛠️ How to Claim Rebates & Credits

The process can feel intimidating, but it’s actually straightforward.

🏛️ Federal Tax Credit (25C)

-

File IRS Form 5695 with your taxes.

-

Include proof of purchase and installation.

-

Keep the AHRI certificate (provided by installer) for your system’s efficiency rating.

📌 Source: IRS – Form 5695 Instructions

🏢 Utility Rebates

-

Submit a copy of your paid invoice.

-

Include the AHRI certificate number.

-

Fill out your utility’s rebate application (often online).

-

Processing takes 6–8 weeks.

👉 Samantha’s tip: Ask your installer for help. Most contractors provide the exact paperwork and AHRI number you’ll need.

⚖️ Do R-410A Units Still Qualify?

Some R-410A units can still qualify if they meet SEER2 thresholds. But the trend is clear:

-

Fewer rebates apply to R-410A systems.

-

R-410A refrigerant is getting more expensive as production phases down.

-

R-32 is more likely to qualify both now and in future years.

👉 If you’re buying in 2025, choosing R-32 increases your chances of earning incentives — and lowers future refrigerant servicing costs.

📝 Samantha’s Takeaways

From my own experience, here’s what matters most:

-

✅ Yes, R-32 AC units qualify for incentives in 2025.

-

✅ Federal tax credit = up to $600.

-

✅ State/utility rebates = $200–$800 more.

-

✅ Always confirm before buying — rebate programs vary by location.

-

✅ Stack credits and rebates for the biggest savings (I saved nearly $1,000).

🏆 Conclusion: Rebates Make the Switch Easier

Rebates and tax credits aren’t just nice perks — they can be the deciding factor in choosing an R-32 system.

For me, knowing I could cut nearly $1,000 off the cost of my Goodman R-32 system sealed the deal. I wasn’t just investing in comfort — I was investing in efficiency, sustainability, and real financial savings.

As I like to tell other homeowners:

“Switching to R-32 wasn’t just an eco-friendly choice. Thanks to rebates and credits, it was the financially smart one too.”

In the next topic we will know more about: Noise, Space, and Design: Will a 2.5 Ton R-32 Condenser Fit Your Home Setup?