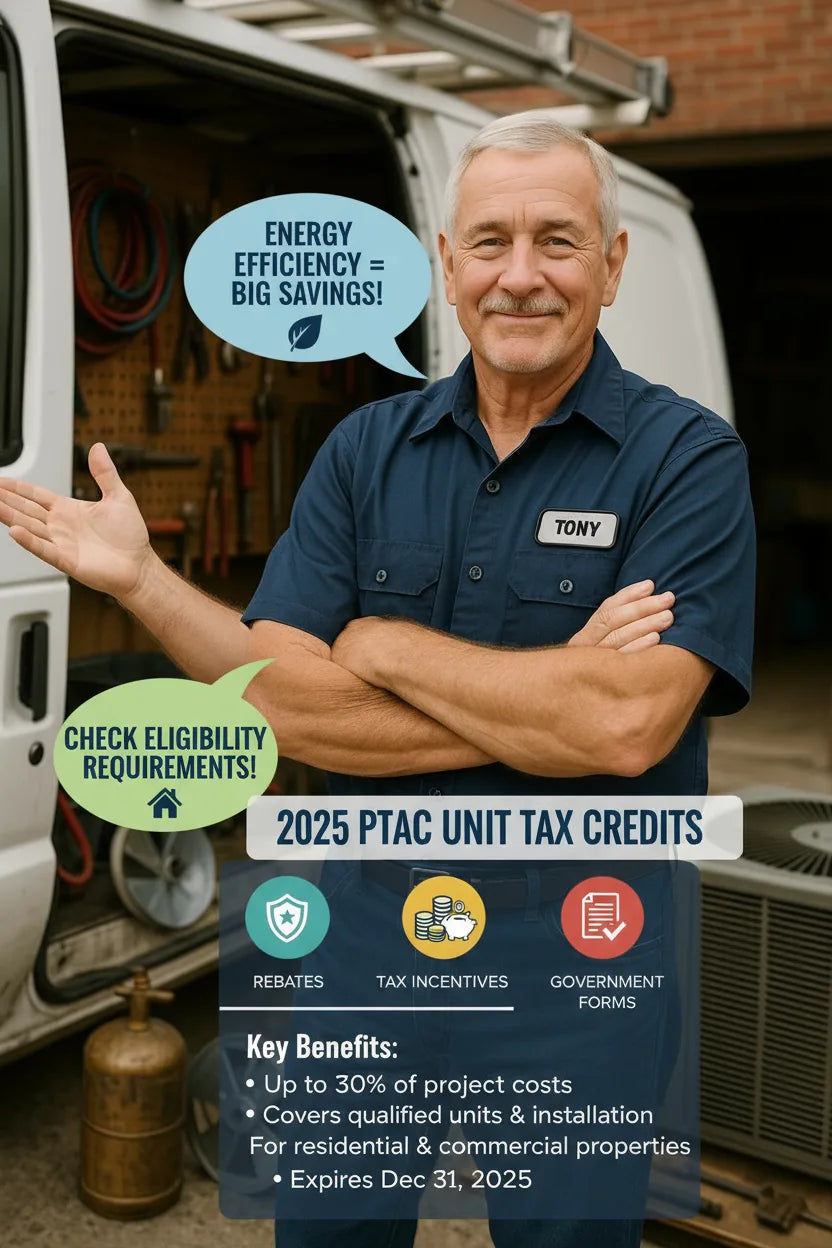

Investing in an Amana 14,700 BTU PTAC Unit with Heat Pump and 3.5 kW Electric Heat Backup offers homeowners like Tony the opportunity to enjoy efficient, reliable heating and cooling. Beyond comfort, one of the most compelling aspects of upgrading to a high-efficiency PTAC unit is the potential for tax credits, rebates, and energy incentives in 2025.

Energy-saving incentives help offset upfront costs, encourage environmentally responsible choices, and reduce long-term energy bills. But navigating the landscape of federal, state, and local incentives can be confusing. This guide breaks down PTAC eligibility, available programs, step-by-step instructions for claiming credits, and tips for maximizing your savings, all in Tony’s practical, hands-on voice.

Section 1: How Energy Tax Credits Work in 2025 🏛️

Energy tax credits are designed to encourage homeowners to invest in energy-efficient technology. These credits reduce your taxable income, effectively lowering the overall cost of energy-efficient appliances, like PTAC units.

Federal Incentives

In 2025, federal incentives include the Residential Energy Efficient Property Credit (sometimes referred to as the Clean Energy Credit). While originally focused on renewable energy, high-efficiency HVAC systems—especially heat pumps integrated into PTAC units—can qualify.

Key points:

-

Credit covers a percentage of the cost, often around 30% for eligible equipment.

-

Applicable to residential installations, including primary and secondary homes.

-

Includes costs for equipment, installation, and labor in most cases.

Tony’s Insight: “I didn’t realize that my new PTAC could get me a federal tax credit. That alone made upgrading a lot more affordable.”

Section 2: PTAC Eligibility Criteria ✅

To qualify for federal, state, or local energy incentives, your PTAC unit must meet specific standards:

-

Energy Efficiency Certification

-

Must be Energy Star-certified or meet DOE efficiency standards for heating and cooling.

-

Verify your unit’s SEER (Seasonal Energy Efficiency Ratio), EER (Energy Efficiency Ratio), and heat pump specifications.

-

-

Residential Installation

-

Units installed in primary or secondary residences are generally eligible.

-

Rental properties may qualify if the property owner claims the credit.

-

-

Proper Documentation

-

Keep purchase receipts, Energy Star certifications, and installation records.

-

These are required when claiming credits or rebates.

-

Tony’s Tip: “I keep all my invoices, Energy Star certificate, and installation proof in a folder. It makes filing for credits much easier.”

Section 3: Federal Incentives for PTAC Units 💵

1. Energy Efficient Home Improvement Credit

-

Provides a credit for qualified heating and cooling equipment, including heat pumps integrated into PTAC units.

-

Covers up to 30% of the purchase and installation costs.

-

Requirements: Equipment must meet federal efficiency standards, and the installation must occur in a residential property.

2. Residential Clean Energy Credit

-

Includes certain high-efficiency heat pumps, which PTAC units like the Amana model may qualify for.

-

Focuses on energy savings and reduced carbon footprint.

-

Eligibility: Must reduce energy consumption compared to standard electric resistance heating.

Tony’s Take: “My Amana PTAC unit’s heat pump is high-efficiency, so I qualify under the Residential Clean Energy Credit. It’s like getting a discount for being energy-conscious!”

Section 4: State and Local Rebates 🏙️

In addition to federal incentives, many state and local programs offer rebates for energy-efficient appliances:

-

Utility Rebates: Some electricity providers provide cash rebates for installing PTAC units or heat pumps.

-

State Tax Credits: States may allow residents to claim credits for energy-efficient upgrades.

-

Local Incentives: City or county programs sometimes offer financing options or discounts for energy-efficient systems.

Tony’s Advice: “Before I bought my unit, I checked my local utility company’s website and found a rebate program that covered part of the cost. It’s like an extra bonus on top of the federal credit.”

Section 5: How to Claim PTAC Tax Credits and Rebates 📝

Step 1: Confirm Eligibility

-

Ensure your PTAC unit meets energy efficiency standards.

-

Verify that the installation qualifies (primary residence, correct installation type).

Step 2: Gather Documentation

-

Keep purchase receipts, installation invoices, and Energy Star certifications.

-

Document installation dates and locations.

Step 3: Federal Credit Filing

-

Use IRS Form 5695 for Residential Energy Credits.

-

Include total costs, energy-efficient certifications, and installation proof.

Step 4: State or Local Rebates

-

Submit rebate applications to your utility provider or state program.

-

Include proof of purchase and installation, energy certifications, and required forms.

Step 5: Check Deadlines

-

Federal, state, and utility programs may have specific filing periods.

-

File on time to avoid losing eligibility.

Tony’s Tip: “Double-check all forms and deadlines. Missing paperwork is the easiest way to lose a rebate or tax credit.”

Section 6: Real-World Example – Tony’s Savings 💡

Tony installs his Amana PTAC unit in his studio apartment:

-

Unit Cost: $900

-

Installation Cost: $300

-

Federal Tax Credit (30%): $360

-

State Utility Rebate: $100

Total Savings: $460

Tony’s Insight: “The combination of federal and state incentives almost cut the total cost in half. It made the upgrade much more affordable.”

Section 7: Maximizing Energy Incentives

-

Combine Incentives: Federal, state, and utility rebates often stack.

-

Energy Star Certification: Ensure the PTAC unit is certified to qualify for all applicable programs.

-

Timing: Install before the end of the year or within program timelines to maximize benefits.

-

Keep Documentation Organized: Helps with rebate submissions and tax filings.

-

Maintenance Records: Some programs require proof of proper installation and upkeep.

Section 8: Common Pitfalls to Avoid ❌

-

Skipping documentation – without receipts or Energy Star certifications, you cannot claim credits.

-

Ignoring eligibility criteria – ensure your PTAC meets efficiency standards.

-

Missing deadlines – rebate applications and tax filings have strict timelines.

-

Improper DIY installations – some incentives require professional or certified installation.

-

Overlooking maintenance – keeps the unit efficient and eligible for ongoing incentives.

Section 9: Benefits of Claiming PTAC Incentives 🌟

-

Reduced upfront cost – Tax credits and rebates lower initial investment.

-

Energy savings – High-efficiency PTAC units consume less electricity.

-

Environmental impact – Lower energy use reduces carbon emissions.

-

Improved comfort – Efficient PTAC units maintain consistent temperature while saving money.

Tony’s Perspective: “The incentives made the PTAC unit upgrade a no-brainer. I get comfort, energy savings, and financial benefits—all in one package.”

Section 10: Quick Checklist for PTAC Tax Credits and Rebates ✅

| Step | Action | Notes |

|---|---|---|

| Check eligibility | Energy Star / DOE standards | Required for federal & state programs |

| Gather documentation | Receipts, certifications, installation proof | Keep organized for filing |

| Apply for federal credit | IRS Form 5695 | Residential Energy Credits |

| Check state/local programs | Utility rebates, tax credits | Can be combined with federal credits |

| File on time | Observe program deadlines | Avoid losing eligibility |

| Maintain PTAC | Regular cleaning & inspection | Ensures continued efficiency & eligibility |

Conclusion: Claiming PTAC Tax Credits and Incentives in 2025 🌟

In 2025, installing an Amana 14,700 BTU PTAC unit could qualify for federal tax credits, state rebates, and utility incentives, making it an affordable, energy-efficient upgrade for Tony and other homeowners.

Key takeaways:

-

Confirm unit eligibility and Energy Star certification.

-

Keep detailed documentation for tax and rebate claims.

-

Apply for all applicable federal, state, and local incentives.

-

Maintain the unit for continued efficiency and long-term savings.

Tony’s Final Tip: “By keeping my receipts, certificates, and installation documentation organized, I claimed both federal and state incentives. It significantly reduced my costs and made upgrading to a high-efficiency PTAC unit an easy decision.”

In the next topic we will know more about: Is It Worth the Investment? Durability and Longevity of the Amana PTAC Unit