When Tony replaced the old wall unit in his guest apartment with an Amana Distinctions 12,000 BTU PTAC Heat Pump with 3.5 kW Electric Backup, he thought:

👉 “Maybe I can snag one of those energy rebates or tax credits I’ve heard about.”

Like many homeowners, Tony knew the government and utilities offer incentives to encourage energy-efficient heating and cooling. But he quickly realized that PTACs (Packaged Terminal Air Conditioners) don’t always fall into the same rebate categories as central HVAC systems or ductless mini splits.

This guide will walk you through what tax credits and rebates exist in 2025, whether PTACs qualify, and how to check for savings in your area.

🔍 Federal Energy Tax Credits in 2025

The big legislation shaping incentives today is the Inflation Reduction Act (IRA), passed in 2022. It expanded tax credits and rebates for homeowners upgrading to high-efficiency systems.

🏛️ Key Federal Programs in 2025

-

25C Energy Efficient Home Improvement Credit – Offers 30% back (up to $600–$2,000) for qualifying HVAC systems.

-

High-Efficiency Electric Home Rebate Program (HEEHRA) – Provides income-based rebates for electric heat pumps, mini splits, and HVAC upgrades.

👉 But here’s the catch:

-

These credits apply mostly to ENERGY STAR certified heat pumps, mini splits, and central systems.

-

PTAC units are rarely included unless they specifically carry the ENERGY STAR label.

Does the Amana PTAC Qualify?

The Amana Distinctions 12,000 BTU PTAC has an EER of ~10.0, which is efficient for its class, but most models don’t carry ENERGY STAR certification, meaning they don’t qualify for the federal 25C tax credit.

Reference: ENERGY STAR Federal Tax Credit Guide.

Tony’s take:

“If you’re counting on Uncle Sam to help cover your PTAC, don’t hold your breath. The tax credits are really geared toward bigger upgrades like mini splits.”

💡 Do PTACs Qualify for Utility Rebates?

Here’s where homeowners have better luck. Many state energy offices and local utilities offer rebates for energy-efficient equipment, and some include PTACs.

Utility Rebates for PTACs

-

Rebates range from $50–$150 per unit, depending on efficiency rating.

-

More likely in regions where PTACs are common (multi-family housing, hotels, apartments).

-

Usually requires proof of purchase and efficiency rating.

👉 Example:

Tony lives in Ohio and found his local utility offered a $75 rebate for replacing an older unit with a more efficient PTAC.

How to Check Rebates Near You

-

Use the DSIRE database (Database of State Incentives for Renewables & Efficiency).

-

Visit your utility provider’s website rebate section.

-

Look for “room air conditioner,” “heat pump,” or “PTAC” rebate programs.

Tony’s Tip:

“I didn’t get a federal tax credit, but my local power company gave me $75 back. Not bad for 10 minutes of paperwork.”

⚡ Amana Distinctions PTAC Efficiency

The Amana Distinctions PTAC isn’t the most efficient system on the market, but it strikes a balance between cost and performance.

-

EER (Energy Efficiency Ratio): ~10.0

-

Cooling capacity: 12,000 BTU (good for ~450–550 sq. ft.)

-

Heating: Heat pump with 3.5 kW electric backup

While EER ~10 meets minimum standards, it’s below ENERGY STAR requirements for rebates and tax credits.

Reference: Energy.gov – Room AC Efficiency.

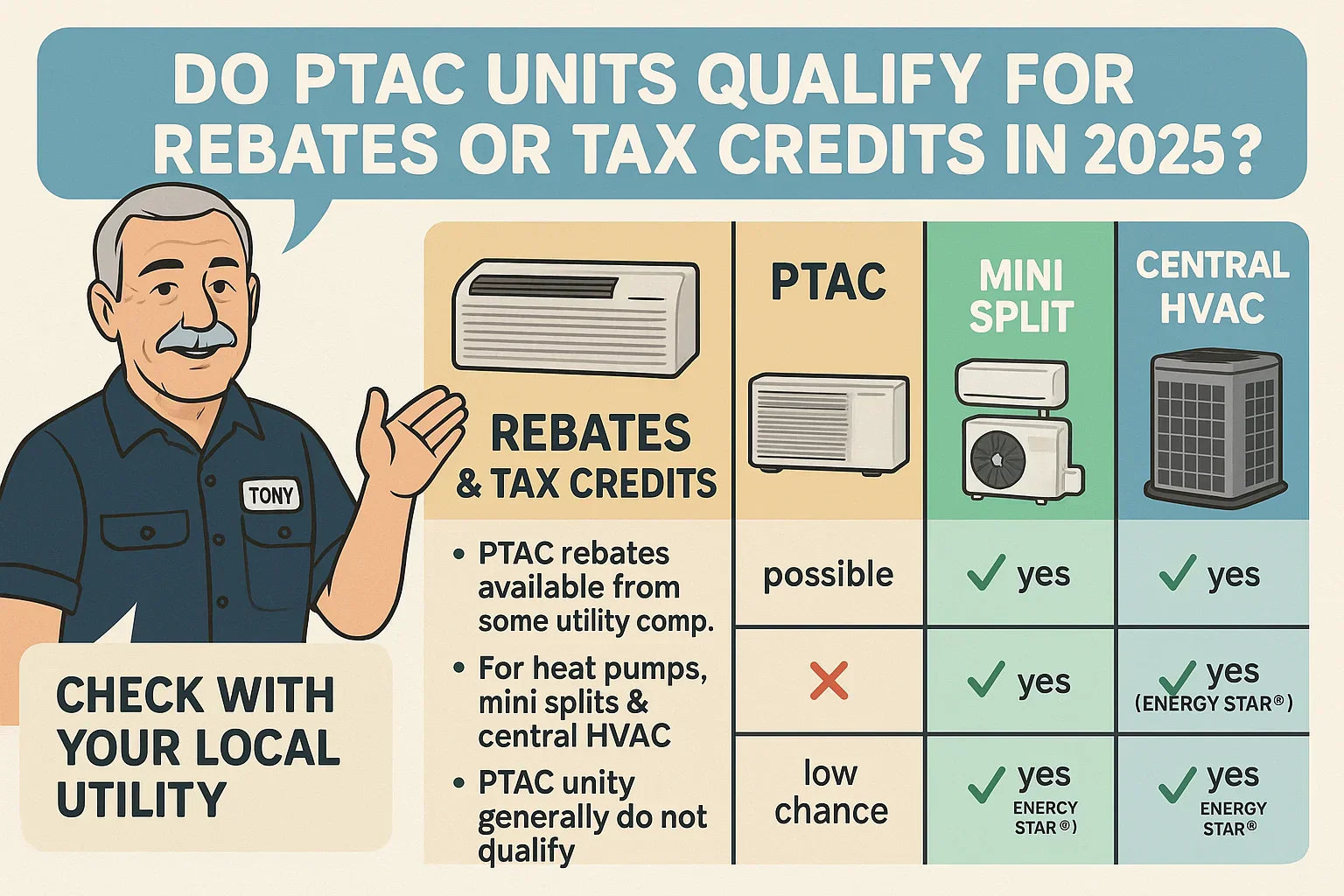

📊 Comparison: PTAC vs. Mini Split vs. Central HVAC Rebates

| System | Efficiency | Typical Rebates | Federal Tax Credits | Best Case Savings |

|---|---|---|---|---|

| PTAC (Amana Distinctions) | ~10 EER | $50–$150 utility rebate | Rarely qualifies | $50–$150 |

| Mini Split | 18–25 SEER2 | $500–$1,500 utility rebate | Yes (30% up to $2,000) | $2,000+ |

| Central HVAC (Heat Pump/Furnace) | 14–20 SEER2 | $300–$1,200 utility rebate | Yes (30% up to $600–$2,000) | $2,000+ |

👉 Reference: ENERGY STAR HVAC Rebate Programs.

🏠 Real-World Example: Tony’s Experience

Tony compared the incentives he got for different upgrades:

-

Amana PTAC (Guest Apartment):

-

Cost: ~$1,000

-

Rebate: $75 from utility

-

Federal tax credit: ❌ Not eligible

-

-

Mini Split (Main Living Area):

-

Cost: ~$4,000

-

Rebate: $500 utility + $2,000 federal credit

-

Net savings: $2,500

-

Tony’s takeaway:

“The PTAC gave me comfort where I needed it, but the mini split gave me real rebate money. I see the PTAC as an affordable, practical fix—not a tax-credit winner.”

🛠️ How to Check If Your PTAC Qualifies

Tony recommends a simple four-step process before you buy:

-

Look for ENERGY STAR certification on the PTAC model.

-

Check DSIREUSA.org for state and utility rebates.

-

Ask your utility company directly if PTAC rebates are available.

-

Consult a tax preparer for federal eligibility (though PTACs rarely qualify).

🎯 Final Verdict: Do PTAC Units Qualify in 2025?

-

Federal Tax Credits (IRA/25C): ❌ PTACs usually don’t qualify unless ENERGY STAR.

-

Utility Rebates: ✅ Possible—$50–$150 is common for efficient models.

-

Best Alternatives: ✅ Mini splits and central HVAC systems qualify for the largest credits.

Tony’s advice:

“Don’t bank on big rebates for your PTAC. If you want serious incentives, look at mini splits. But check your local utility—you might still shave a little off your bill.”

In the next topic we will know more about: Is 12,000 BTUs Enough? Sizing a PTAC Heat Pump for Your Room or Apartment