🌟 Introduction

When shopping for a PTAC (Packaged Terminal Air Conditioner) like the Amana Distinctions 9,200 BTU with 5 kW electric heat, one question pops up right after “How efficient is it?”

👉 “Do PTAC units qualify for rebates or tax credits in 2025?”

The answer isn’t as simple as yes or no. In 2025, thanks to new programs under the Inflation Reduction Act (IRA) and ongoing Energy Star rebate programs, homeowners and property managers may find savings—but PTACs don’t always fit neatly into the categories that qualify for federal tax credits.

This guide breaks down everything you need to know about rebates, incentives, and tax credits for PTACs in 2025.

🏛️ Section 1: What Are Energy Rebates & Tax Credits?

Rebates

-

Offered by utility companies, states, or municipalities.

-

Work like an instant or after-purchase discount.

-

Example: A $100 rebate from your local utility for installing an Energy Star PTAC.

Tax Credits

-

Federal government incentives claimed on your annual taxes.

-

Example: 30% tax credit (up to $2,000) for installing a qualifying heat pump (EnergyStar.gov).

👉 Key Difference: Rebates = instant/local savings. Tax credits = federal/tax-based savings.

⚖️ Section 2: Do PTAC Units Qualify for Federal Tax Credits in 2025?

Here’s the big question: Can you claim a PTAC on your taxes under the IRA incentives?

Short Answer: Usually No

Most PTAC units do not qualify for federal residential tax credits. Why?

-

Federal credits primarily cover heat pumps, mini splits, central HVAC, and high-efficiency furnaces (DOE).

-

Standard electric resistance PTACs (like Amana’s 5 kW heater models) don’t meet efficiency criteria for credits.

Exceptions

-

Some PTAC heat pump models may qualify if they meet Energy Star’s efficiency thresholds.

-

These are rare in residential applications, but some hotel/multifamily retrofits could use them.

👉 Savvy’s Note: If your PTAC is electric heat only, don’t expect a federal tax credit. If it’s a heat pump PTAC, check Energy Star’s certified list.

🌍 Section 3: State & Utility Rebates for PTACs

While federal tax credits are limited, state and local utility rebates are where PTAC owners can save.

How They Work

-

Many utilities encourage Energy Star PTACs because they reduce grid demand.

-

Rebates typically range from $50–$150 per unit.

Real-World Examples

-

Con Edison (NY): Rebates up to $100 per Energy Star PTAC.

-

Mass Save (MA): Incentives for efficient cooling equipment, sometimes including PTACs.

-

Midwest Utilities: Rebates often tied to commercial PTAC installations in hotels or multifamily housing.

👉 If you’re installing multiple PTACs in an apartment building or hotel, rebates can add up to thousands of dollars.

⭐ Section 4: Energy Star & PTAC Units

To qualify for most rebates, your PTAC must be Energy Star–certified.

Why Energy Star Matters

-

Certified PTACs use 15–20% less energy than standard models

-

They often include better insulation, quieter fans, and updated refrigerants.

Energy Star PTAC Example

-

A certified PTAC may have a CEER (Combined Energy Efficiency Ratio) above 9.4.

-

Amana, GE, and Friedrich all produce Energy Star PTACs in specific models.

👉 Savvy’s Note: Always look for the blue Energy Star logo before buying—it’s your ticket to rebates.

💵 Section 5: How Much Can You Save?

Federal Tax Credits

-

Most PTACs: ❌ Do not qualify.

-

Heat pump PTACs (rare): ✅ Possibly qualify for up to 30% of project cost (max $2,000).

Utility Rebates

-

Typical savings: $50–$150 per PTAC unit.

-

Bulk installations (e.g., 20 hotel rooms): $1,000–$3,000 in rebates.

ROI Example

-

Cost of Amana PTAC: ~$750

-

Utility rebate: $100

-

Effective cost: $650

-

Add in 15% lower energy bills from Energy Star model: ~$50/year savings.

-

Over 10 years: $600+ in savings.

🔎 Section 6: Steps to Check Eligibility

Here’s how to find out if your PTAC qualifies:

-

Look for the Energy Star Label

-

No label = no rebate.

-

-

Check Energy Star Rebate Finder

-

Use the Energy Star Rebate Finder and enter your zip code.

-

-

Call Your Utility Provider

-

Ask: “Do you offer rebates for Energy Star PTACs?”

-

-

Review State Programs

-

Some states incentivize R-32 refrigerant PTACs to encourage eco-friendly adoption.

-

-

Save Documentation

-

Rebate programs often require purchase receipts and Energy Star proof.

-

🧭 Section 7: Savvy’s Final Word

-

Federal Tax Credits (2025): Most PTACs don’t qualify. Don’t count on this unless you buy a heat pump PTAC.

-

Utility Rebates: Very real. $50–$150 per unit adds up—especially for multifamily installs.

-

Energy Star Certification: The key to unlocking savings and long-term energy efficiency.

👉 Savvy’s Advice: Don’t assume all HVAC incentives apply to PTACs. Always double-check Energy Star’s database and your local utility. For homeowners, rebates are a nice bonus. For property managers installing 10–50 PTACs, rebates can mean major project savings.

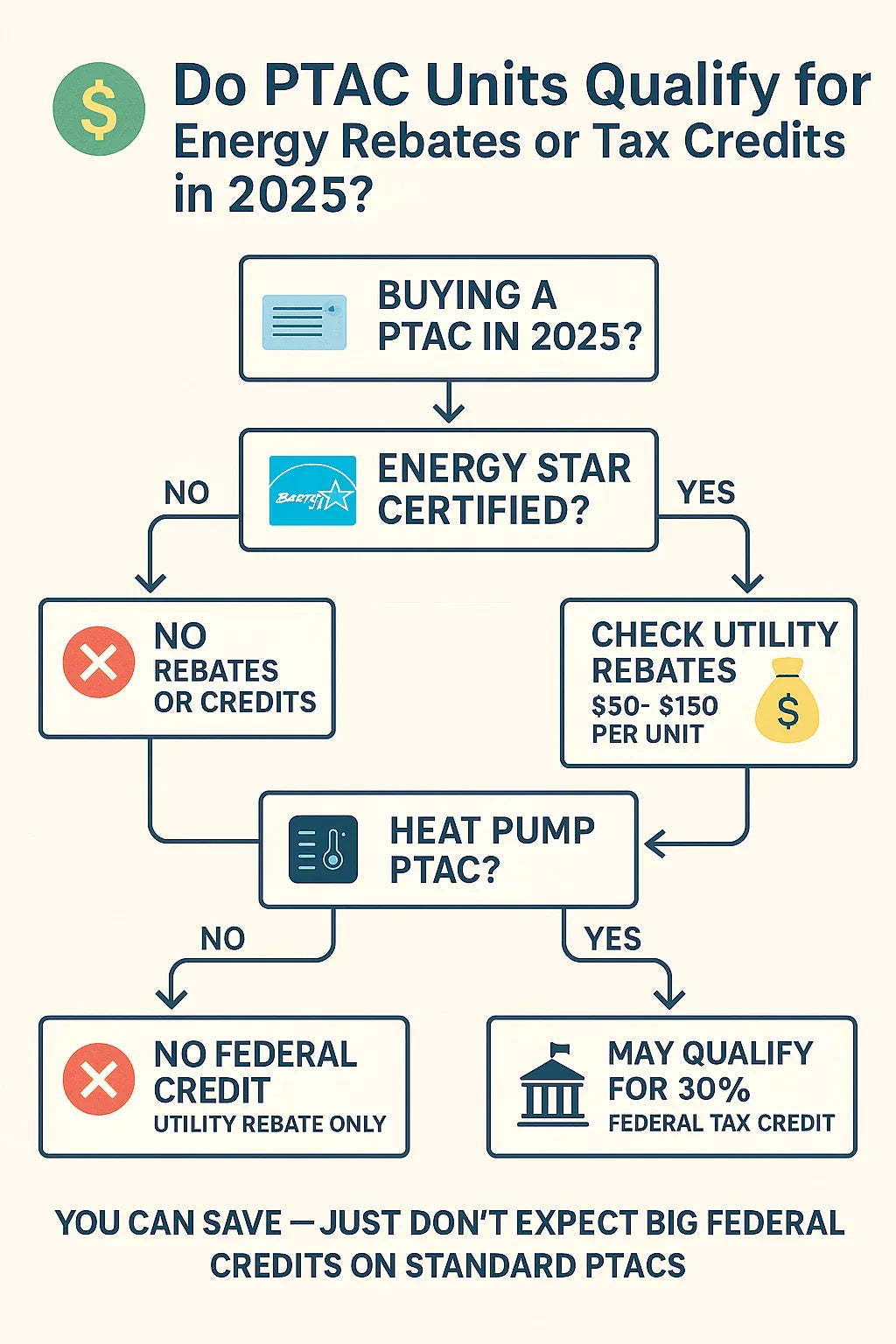

🎨 Infographic Concept

Flowchart: Do PTACs Qualify for Rebates/Tax Credits in 2025?

-

Box 1: Buying a PTAC in 2025?

-

Box 2: Energy Star Certified?

-

❌ No → No rebates or credits

-

✅ Yes → Check utility rebates ($50–$150 per unit)

-

-

Box 3: Heat Pump PTAC?

-

❌ No → No federal credit, utility rebate only

-

✅ Yes → May qualify for 30% federal tax credit

-

-

Final Box: You can save—just don’t expect big federal credits on standard PTACs.

In the next topic we will know more about: Comfort & Noise Levels: How Quiet Is the Amana Distinctions PTAC?