When my cousin asked me to help install an Amana Distinctions 9,000 BTU PTAC Heat Pump with 2.5 kW Backup for her Airbnb studio, her first concern was the upfront cost. Between the unit, wall sleeve, and electrical setup, the price quickly added up. That’s when I suggested looking into rebates and tax credits—and to our relief, she was eligible for both.

If you’re considering a PTAC system in 2025, here’s everything you need to know about whether these units qualify for rebates, incentives, and federal tax credits.

🌬️ Why Rebates & Tax Credits Matter

PTACs (Packaged Terminal Air Conditioners) are often chosen for small spaces, guest rooms, hotels, and studios. They’re cost-effective compared to central HVAC—but the upfront investment still stings.

That’s where incentives come in:

-

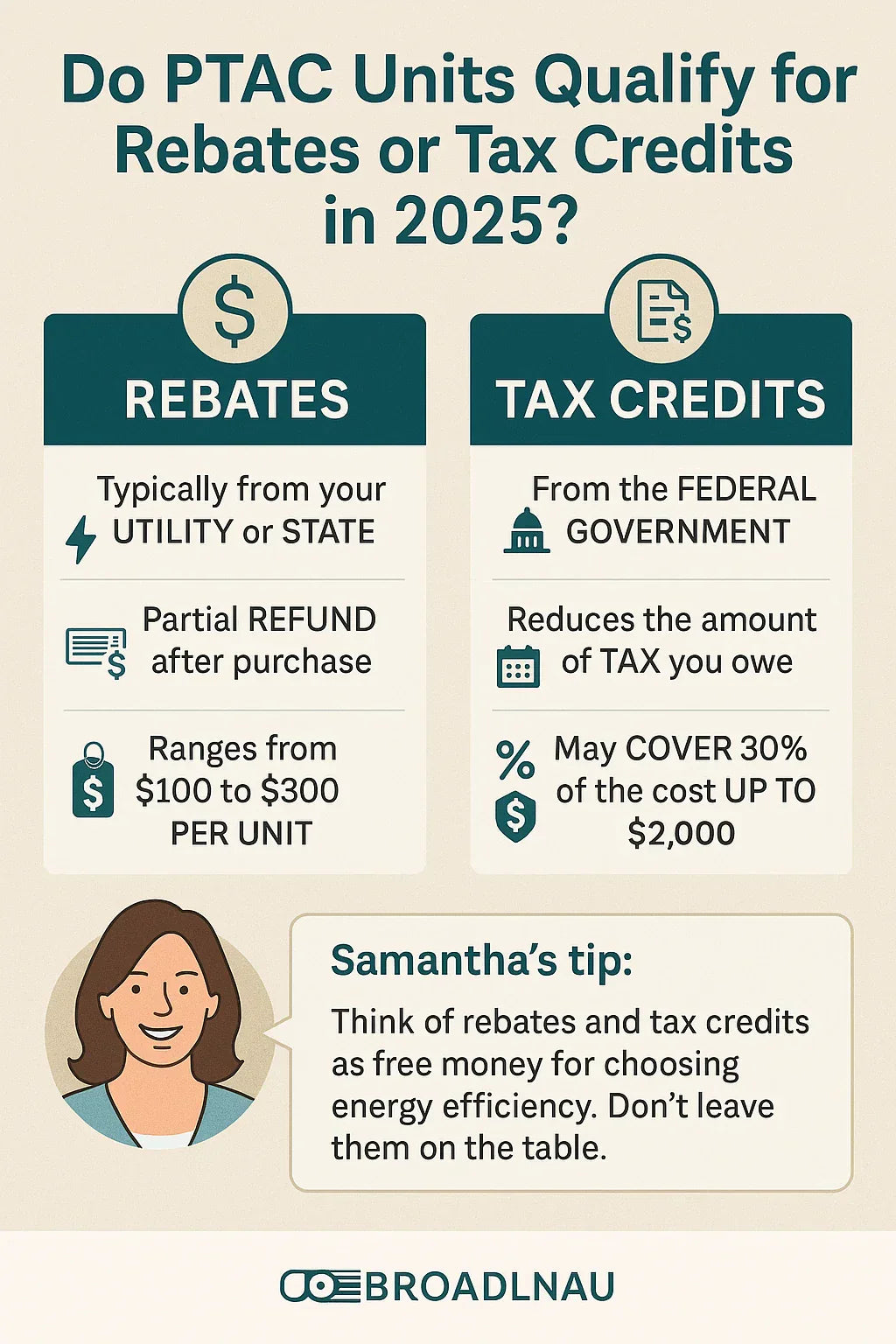

Rebates (usually from your utility or state) = a check or bill credit after purchase.

-

Tax credits (from the federal government) = reduce the amount you owe on your taxes.

👉 Samantha’s tip: “Think of rebates and credits as free money for choosing energy efficiency. Don’t leave them on the table.”

🔗 Reference: Energy.gov – Energy Saver Rebates & Credits.

🏛️ Federal Tax Credits in 2025

The Inflation Reduction Act (IRA) extended and expanded tax credits for energy-efficient HVAC systems, including certain PTAC units.

🔹 Eligible Equipment

-

Heat pump PTACs qualify if they meet efficiency standards.

-

Cooling-only PTACs generally do not qualify.

🔹 Credit Amount

-

Up to 30% of the project cost, capped at $2,000 per year for heat pump systems.

-

Covers equipment + installation.

🔹 How It Works

-

Buy and install a qualifying PTAC heat pump.

-

Keep all receipts and model info.

-

File IRS Form 5695 with your tax return.

👉 Samantha’s story: “We claimed $560 back on my cousin’s PTAC through the tax credit. It was like getting half the installation free.”

🔗 Reference: Energy.gov – Inflation Reduction Act HVAC Credits.

⚡ Utility & State Rebates

Many utility companies offer rebates for high-efficiency heat pumps—and PTAC heat pump models often qualify.

🔹 Typical Rebate Range

-

$100–$300 per unit.

-

Larger rebates for multi-unit installs (hotels, senior living facilities).

🔹 Availability

-

Programs vary widely by state and provider.

-

Example: Duke Energy (NC) offers $200 rebates on qualifying PTACs.

👉 Samantha’s tip: “Search your utility’s website before you buy. Rebates sometimes require pre-approval.”

🔗 Database: DSIRE USA – Rebates & Incentives Search.

🌍 Energy Star Certification Matters

To qualify for most incentives, your PTAC must be Energy Star–rated.

🔹 Energy Star PTAC Requirements

-

Must meet minimum CEER efficiency ratings.

-

Verified performance by the EPA.

-

Marked with the blue Energy Star logo on packaging and the yellow EnergyGuide label.

👉 Samantha’s note: “Always double-check the Energy Star list. Just because it’s efficient doesn’t mean it qualifies.”

🔗 Reference: Energy Star – PTAC Efficiency Standards.

🧾 How to Claim Rebates & Tax Credits

1. For Rebates (Utility/State):

-

Keep invoices and proof of Energy Star certification.

-

Submit rebate application online or by mail.

-

Receive check or bill credit within 6–12 weeks.

2. For Federal Tax Credits:

-

Complete IRS Form 5695 with your tax return.

-

Attach receipts and certification statement.

-

Credit applies directly against your tax bill.

👉 Samantha’s hack: “I scanned everything into a folder labeled ‘PTAC Rebates’ so tax time was painless.”

🔗 Reference: IRS Form 5695 – Residential Energy Credits.

💰 Real-World Example (North Carolina Studio)

Here’s how rebates and credits impacted the true cost of my cousin’s Amana 9,000 BTU PTAC:

-

PTAC Unit: $975

-

Accessories (sleeve, grille, cord): $350

-

Installation (contractor + electrician): $550

-

Subtotal: $1,875

Savings:

-

Federal tax credit (30%): -$560

-

Local utility rebate: -$200

Net Cost: $1,115

👉 Nearly 40% savings after incentives.

🛠️ Common Mistakes to Avoid

-

Buying cooling-only PTACs → No rebates/tax credits.

-

Forgetting to apply → Most rebate programs expire 90 days after purchase.

-

Not using an Energy Star model → No eligibility.

-

Missing paperwork → Keep receipts, spec sheets, and certification documents.

🌡️ Who Benefits Most?

-

Homeowners in mild to moderate climates → Heat pump mode handles most heating efficiently.

-

Rental property owners → Rebates scale when installing multiple units.

-

Budget-conscious buyers → Incentives offset upfront costs, making PTACs more affordable than central HVAC.

🔗 Reference: HVAC.com – Heat Pump Rebate Guide.

✅ Key Takeaways

-

Yes, PTAC heat pumps qualify for rebates and tax credits in 2025.

-

Cooling-only PTACs do not.

-

Federal tax credit: 30% up to $2,000.

-

Utility/state rebates: $100–$300.

-

Energy Star certification is essential.

-

Rebates + credits can cut upfront cost by 20–40%.

👉 Samantha’s advice: “If you’re buying a PTAC in 2025, don’t stop at the sticker price. Check for rebates and tax credits—you’ll thank yourself later.”

In the next topic we will know more about: Is 9,000 BTUs Enough? Sizing Your PTAC for Guest Rooms, Studios & Small Spaces