👋 Introduction: Mike’s Money-Saving Mindset

When Mike decided to buy an Amana 12,000 BTU PTAC with heat pump and 5kW backup, he didn’t just look at the unit’s price tag. He asked a bigger question:

👉 “If I’m investing in a PTAC, can I also get money back through rebates or tax credits?”

Like many homeowners and landlords, Mike wanted to stretch his budget. Energy efficiency programs in 2025 are designed to reward buyers for choosing efficient systems—but not every PTAC qualifies.

This guide breaks down exactly which PTACs qualify for incentives, what federal, state, and local programs are available in 2025, and how Mike used them to save.

💡 Do PTACs Qualify for Energy Star?

Not all PTACs are created equal. The first step in qualifying for rebates or tax credits is understanding Energy Star certification.

🔎 What Energy Star Means

-

Energy Star PTACs meet strict EER (Energy Efficiency Ratio) and CEER (Combined Energy Efficiency Ratio) benchmarks.

-

Certification ensures the unit uses less electricity, lowering both bills and environmental impact.

PTAC Efficiency Ranges

-

Standard PTACs: 8.5–9.5 EER.

-

Energy Star PTACs: 10+ EER or equivalent CEER.

👉 Mike’s Lesson: “I almost bought a cheaper model, but it wasn’t Energy Star certified. Spending a little more upfront qualified me for a rebate and saved me money long-term.”

📎 Reference: Energy Star – PTAC Requirements

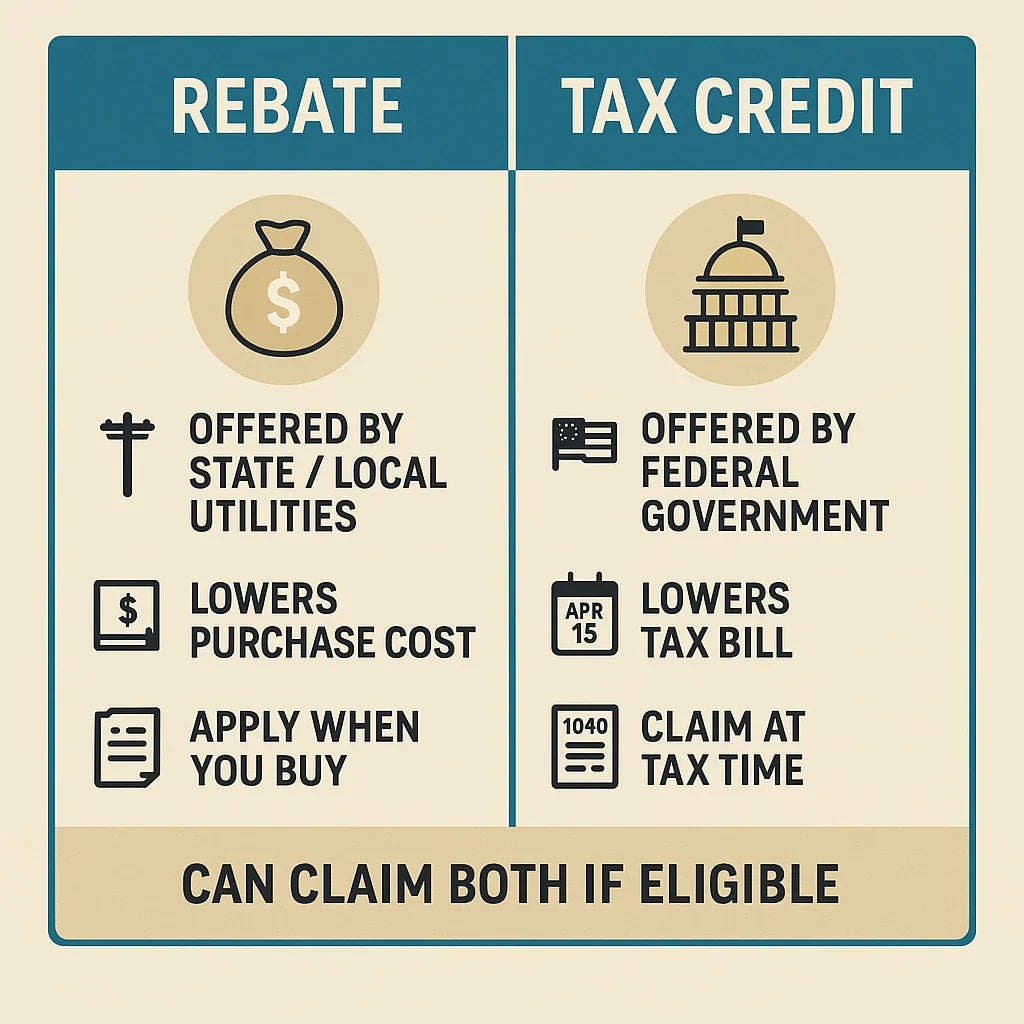

🏛️ Federal Tax Credits in 2025

Thanks to the Inflation Reduction Act (IRA), tax credits are available for energy-efficient upgrades—including certain PTACs.

✅ What Qualifies

-

PTAC units that function as heat pumps may qualify.

-

Electric-resistance-only PTACs generally do not.

-

The unit must meet minimum efficiency ratings set by the IRS.

💵 How Much You Can Claim

-

Tax credit: 30% of the unit cost, up to $2,000 (for heat pumps).

-

Applies to new installations in primary residences.

📝 How to Claim

-

Keep receipts and manufacturer’s certification statement.

-

File IRS Form 5695 with your 2025 taxes.

👉 Mike’s 12,000 BTU Amana PTAC with heat pump qualified for a federal credit, lowering his effective cost by nearly $300.

📎 Reference: IRS Form 5695 – Residential Energy Credits

🏠 State & Local Rebates

Federal credits are just the start. Many state and local utilities offer additional rebates.

Examples (2025 Programs)

-

California: $100–$200 rebates for PTAC heat pumps.

-

New York: Up to $300 rebate per Energy Star PTAC for multi-family housing.

-

Texas & Midwest utilities: Incentives for hotels and apartments installing efficient PTACs.

👉 Mike’s Story: Living in Ohio, his local utility offered a $150 rebate for installing a PTAC with heat pump. That reduced his upfront cost even further.

📎 Reference: DSIRE – Database of State Incentives

⚡ Utility Incentive Programs

Utilities often run efficiency incentive programs to reduce peak energy demand.

How They Work

-

Rebate amount depends on efficiency rating and system type.

-

Applications typically require:

-

Purchase receipt.

-

Model number.

-

Proof of installation.

-

Typical Utility Rebates (2025)

-

PTAC heat pump: $50–$300/unit.

-

Multi-unit buildings (hotels/apartments): bulk rebates available.

👉 Mike’s Lesson: “I checked my power company’s website before buying. That’s how I found the rebate I used.”

📎 Reference: Energy Star Rebate Finder

📋 How to Apply for Rebates & Credits

Mike found the process straightforward once he had the right paperwork.

✅ Steps:

-

Check Eligibility – Confirm model is Energy Star or heat pump.

-

Save Documentation – Receipt + product model.

-

Submit Application – Online form with utility or rebate portal.

-

File Taxes – If eligible, use IRS Form 5695 for federal credit.

👉 Mike’s Tip: “I created a folder with all receipts and certification papers. When tax season came, it was easy.”

📊 Mike’s Real Example

Here’s how Mike’s PTAC purchase broke down with rebates and credits:

| Item | Cost |

|---|---|

| PTAC Unit | $1,050 |

| Sleeve + Grill | $180 |

| Trim Kit + Thermostat | $100 |

| Electrician | $450 |

| Subtotal | $1,780 |

| Local Utility Rebate | -$150 |

| Federal Tax Credit | -$300 |

| Final Cost | $1,330 |

👉 Mike saved $450 upfront—a 25% reduction in his effective cost.

✅ Pros & Cons of Rebates for PTACs

✅ Pros

-

Reduces upfront cost.

-

Rewards efficient choices.

-

Federal + local programs can be stacked.

❌ Cons

-

Not all PTACs qualify.

-

Electric-only PTACs often excluded.

-

Rebates vary by state, some areas offer none.

👨 Mike’s Advice

“If you’re buying a PTAC, always check rebates first. Go with a heat pump model if possible—it’s more efficient, and it usually qualifies for incentives. Between the rebate and tax credit, I cut my upfront costs by a quarter.”

📌 Conclusion: Are Rebates Worth It?

Yes—if you choose the right PTAC.

-

✅ Heat pump PTACs with Energy Star certification qualify for many 2025 programs.

-

❌ Cooling-only or electric-only PTACs rarely qualify.

-

Rebates + credits can save $400–$600 upfront, and efficiency keeps bills lower.

👉 For Mike, rebates turned a good deal into a great investment. If you’re shopping in 2025, make rebates and tax credits part of your buying strategy.

In the next topic we will know more about: Heat Pump + Electric Heat Backup: Why the Combo Matters for Cold-Climate Comfort