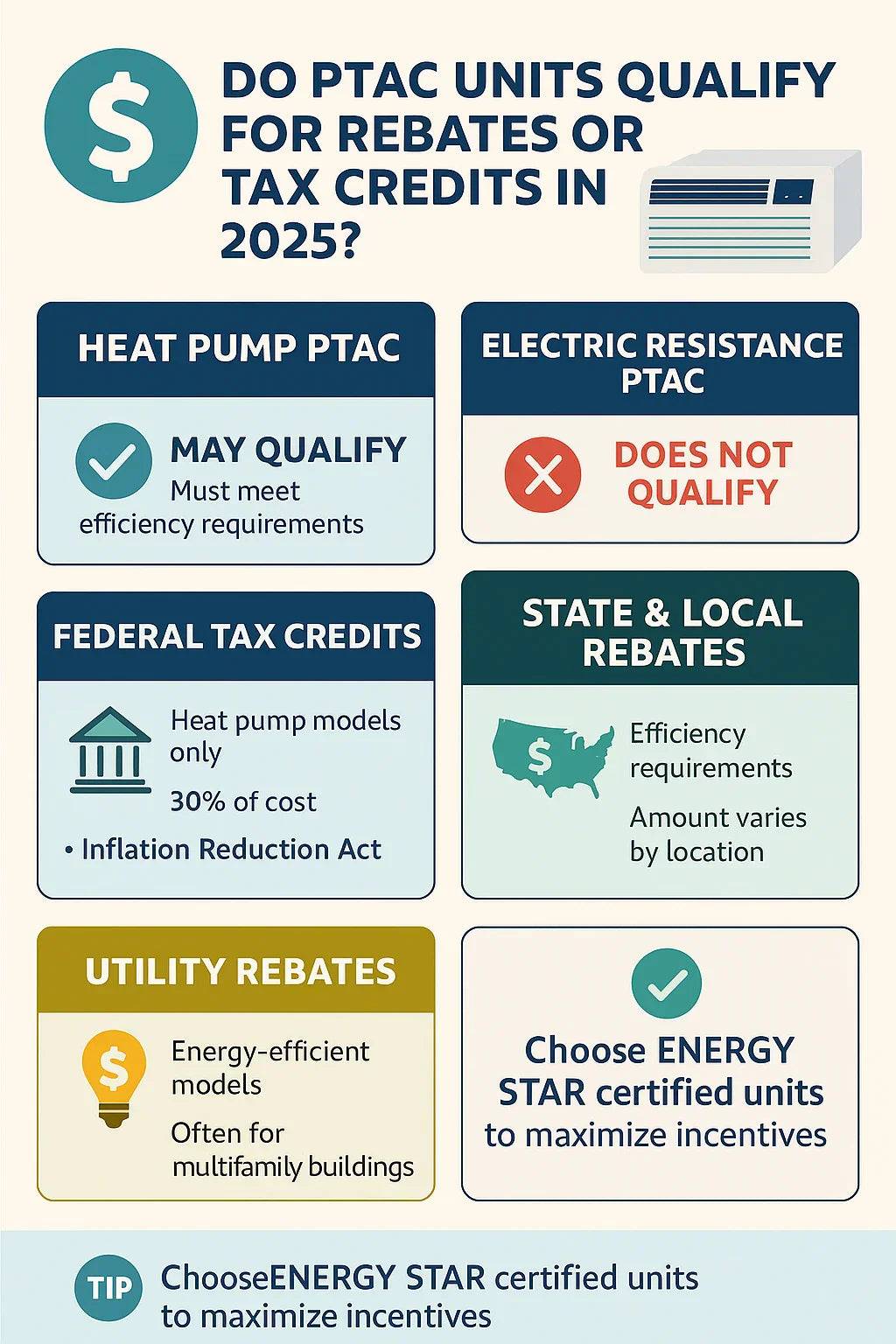

🏠 Introduction: Why Rebates & Credits Matter

Replacing or upgrading HVAC equipment is no small expense. Whether you manage a hotel with 100 rooms, own a multifamily property, or are a landlord with a few units, installing new PTACs (Packaged Terminal Air Conditioners) can cost thousands of dollars upfront.

Amana Distinctions Model 12,000 BTU PTAC Unit with 2.5 kW Electric Heat

That’s why many property owners ask the same question:

👉 “Do PTAC units qualify for energy rebates or tax credits in 2025?”

The short answer: sometimes.

The long answer depends on:

-

The type of PTAC unit you choose (electric resistance vs. heat pump).

-

Whether the PTAC is Energy Star certified.

-

Available federal tax credits, state rebates, and utility incentives where you live.

In this Savvy-style guide, we’ll break down exactly what you need to know about rebates, tax credits, and incentive programs for PTACs in 2025 — and how you can maximize your savings.

🏷️ Section 1: Federal Incentives in 2025

The Inflation Reduction Act (IRA) – Extended Through 2032

In 2022, the U.S. government passed the Inflation Reduction Act, one of the most significant clean energy bills in history. It expanded and extended HVAC tax credits and rebates all the way through 2032.

For PTAC buyers, the two most important programs are:

1. 25C Energy Efficient Home Improvement Credit

-

Covers up to 30% of the cost (equipment + installation).

-

Annual cap: $2,000 per household.

-

Applies to qualifying heat pump systems, including heat pump PTACs that meet Energy Star efficiency standards.

-

Cannot be claimed for standard electric-resistance PTACs (the type with just heating coils).

2. High-Efficiency Electric Home Rebate Program (HEEHRP)

-

Offers point-of-sale rebates for low- to moderate-income households.

-

Covers part of the cost of efficient electric appliances, including heat pump systems.

-

Available depending on your income level and state rollout of funding.

👉 In short: heat pump PTACs may qualify for both programs, electric-resistance PTACs do not.

🔗 IRS – Energy Efficient Home Improvements Credit

⚡ Section 2: Energy Star & Efficiency Standards

Rebate eligibility isn’t just about whether your PTAC is a heat pump. It also depends on efficiency ratings.

Key Ratings to Know

-

EER (Energy Efficiency Ratio): Measures cooling efficiency. Higher = better.

-

CEER (Combined Energy Efficiency Ratio): Includes standby and operational energy use.

Energy Star Certification

-

Only PTACs that meet Energy Star’s efficiency thresholds qualify for rebates or credits.

-

In 2025, that means:

-

Heat pump PTACs are often eligible.

-

Electric-resistance PTACs (like Amana’s 12,000 BTU electric heat model) usually are not.

-

Amana PTACs Example

-

Amana Heat Pump PTACs: More likely to be Energy Star certified → rebate/tax credit eligible.

-

Amana Electric-Heat PTACs: Reliable, but not Energy Star → no federal incentive eligibility.

🔗 Energy Star – PTAC Efficiency Criteria

🌎 Section 3: State & Utility Rebates

Beyond federal incentives, many state governments and local utilities offer rebates for energy-efficient PTACs.

State Programs (Examples)

-

California: Rebates for Energy Star HVAC upgrades, including PTAC heat pumps ($150–$300/unit).

-

New York (NYSERDA): Incentives for multifamily housing efficiency retrofits.

-

Massachusetts: Rebates for Energy Star-certified PTAC systems, especially in hospitality and commercial properties.

Utility Rebates

-

Local utilities frequently offer rebates for multifamily property owners and hotels.

-

Rebates range from $100–$250 per PTAC.

-

Some utilities provide higher incentives for bulk purchases (e.g., hotels upgrading 50+ rooms at once).

How to Check Your Eligibility

-

Use the Energy Star Rebate Finder.

-

Contact your local utility company’s energy efficiency program.

🏨 Section 4: Residential vs. Commercial Incentives

Residential (Homeowners, Small Rentals)

-

Eligible for 25C federal tax credit if installing an Energy Star-certified heat pump PTAC.

-

May also qualify for HEEHRP rebates, depending on income.

Commercial (Hotels, Apartments, Condos)

-

Can claim state & utility rebates for bulk PTAC installations.

-

May qualify for 179D tax deduction for energy-efficient commercial buildings.

-

Many rebates require an energy audit before and after installation.

🔗 DOE – Energy Efficiency Incentives

📊 Section 5: Real-World Cost & Savings Examples

Example 1: Single PTAC Heat Pump in an Apartment

-

Unit Cost: $1,200

-

Installation: $300

-

Total: $1,500

Federal 25C Credit (30%): –$450

State Rebate (NY example): –$150

👉 Final Net Cost: $900

Example 2: Hotel Installing 50 Heat Pump PTACs

-

Unit Cost: $1,200 × 50 = $60,000

-

Installation: $300 × 50 = $15,000

-

Total: $75,000

Federal Credit (capped at $2,000 per property): –$2,000

Utility Rebate ($150 per unit): –$7,500

👉 Final Net Cost: $65,500

💡 Even though the federal credit caps out, the utility rebate savings add up big at scale.

💡 Section 6: How to Check Your PTAC’s Eligibility

Before you buy, take these steps:

-

✅ Confirm your PTAC type: Heat pump vs. electric resistance.

-

✅ Check Energy Star certification: Look up your model on the Energy Star site.

-

✅ Review federal credits: IRS guidelines for 25C and HEEHRP.

-

✅ Search rebates: Use the Energy Star Rebate Finder.

-

✅ Contact your utility provider: Ask about commercial/multifamily rebate programs.

🏨 Section 7: Who Benefits the Most?

-

Hotels & Hospitality Chains

-

Incentives save thousands when installing dozens of PTACs at once.

-

Energy-efficient heat pump PTACs lower long-term operating costs.

-

-

Apartment & Condo Owners

-

Rebates + lower tenant bills = higher property value.

-

Great selling point for marketing rentals as “energy-efficient.”

-

-

Vacation Rentals (Airbnb, VRBO)

-

Federal credits help offset single-unit installs.

-

Guests appreciate eco-friendly comfort.

-

✅ Conclusion: Do PTAC Units Qualify for Rebates or Credits in 2025?

Here’s the bottom line:

-

Heat Pump PTACs → Yes, they can qualify for:

-

Federal tax credits (25C).

-

State & utility rebates.

-

Energy Star incentives.

-

-

Electric Resistance PTACs → No, they generally do not qualify for rebates or tax credits.

👉 If you want to maximize savings on your PTAC purchase in 2025:

-

Choose an Energy Star-certified heat pump PTAC.

-

Check federal, state, and local incentives.

-

Stack rebates + tax credits for 30–40% savings.

For property owners installing multiple units, the rebates can add up to tens of thousands of dollars — making high-efficiency PTACs a smart financial move.

In the next topic we will Know more about: Noise Levels & Comfort: How Quiet Is the Amana Distinctions PTAC?