📌 Introduction: Why Incentives Matter More Than Ever

Buying a PTAC (Packaged Terminal Air Conditioner) has always been about convenience and comfort. Whether you’re a homeowner looking to heat and cool a sunroom, a landlord outfitting an apartment building, or a small business owner upgrading guest rooms, PTACs deliver zoned climate control at an affordable price.

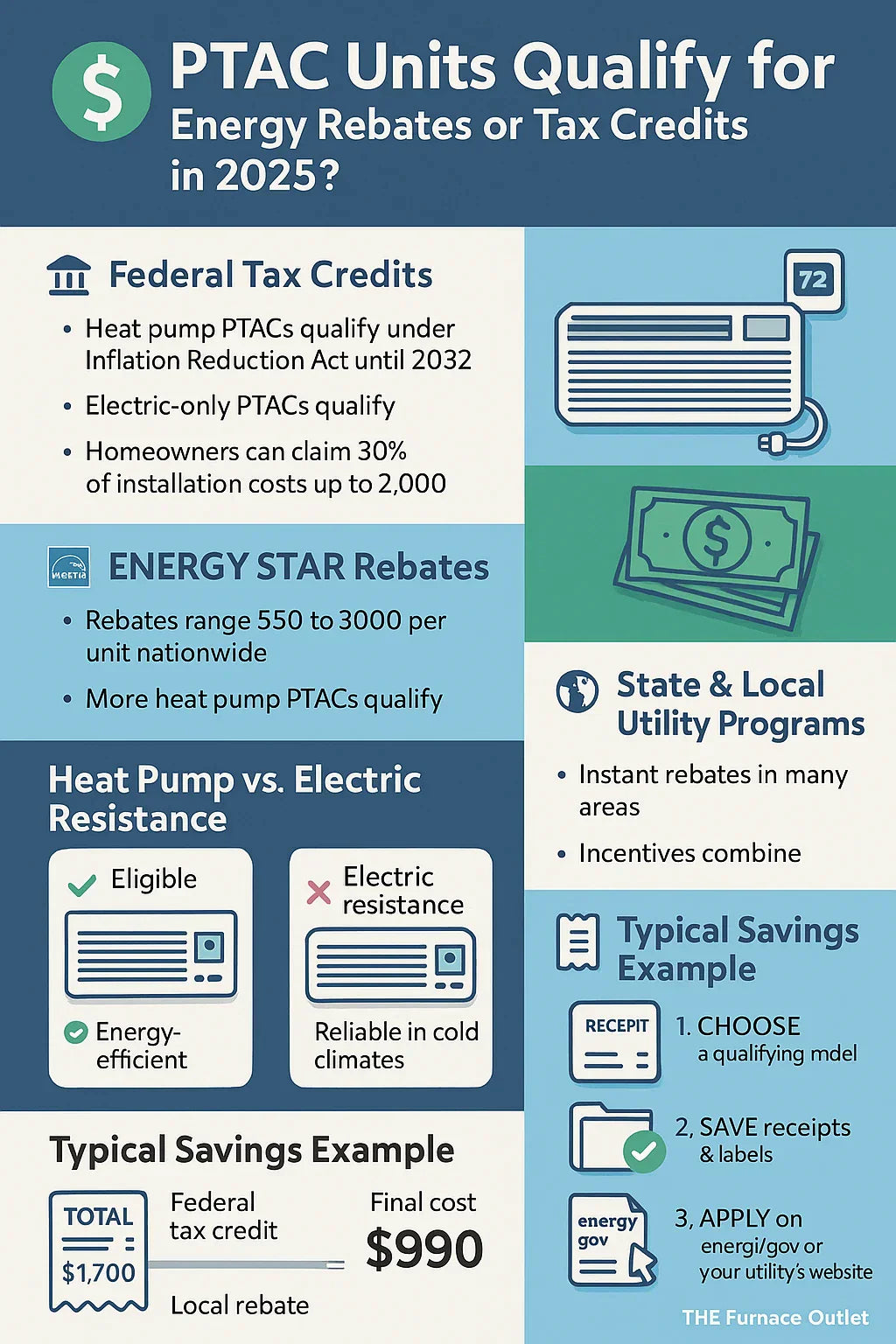

But here’s the kicker in 2025: thanks to the Inflation Reduction Act (IRA) and expanded utility rebate programs, many homeowners and property managers can now cut hundreds of dollars off their PTAC purchase and installation costs — if they pick the right model.

This guide will show you:

-

How PTACs fit into the 2025 federal tax credit programs

-

Which PTACs are eligible for rebates through ENERGY STAR and local utilities

-

The differences between heat pump vs. electric resistance models

-

How much you can realistically save with incentives

-

Step-by-step instructions to claim rebates and credits

By the end, you’ll know whether your PTAC qualifies — and how to make the most of the programs available in 2025.

🏛️ 1. Federal Tax Credits for PTACs in 2025

The Inflation Reduction Act (IRA) extended and expanded tax credits for residential energy efficiency through 2032. That’s huge news for PTAC owners because, for the first time, certain PTAC models are eligible for federal credits.

✅ What Qualifies

-

Heat Pump PTACs: These are the clear winners. If the unit meets ENERGY STAR certification or CEE Tier 2/3 efficiency levels, it can qualify for up to 30% of the cost, capped at $2,000 per year.

-

Electric Resistance PTACs: These typically do not qualify on their own, since they aren’t considered energy-efficient technology. However, some may qualify if installed as part of a larger home efficiency upgrade package (like with insulation or window improvements).

💵 How Much You Can Claim

-

Heat Pump PTAC Units: Up to 30% of the purchase + installation cost, capped at $2,000 annually.

-

Other Efficiency Upgrades (like sleeves with insulation): Up to $600 per year (if part of an overall upgrade).

👉 Learn more from the U.S. DOE – Energy Efficiency Tax Credits.

⚡ 2. ENERGY STAR Rebates

The ENERGY STAR Rebate Finder is your best friend in 2025. Many utility companies and state agencies offer rebates for PTAC units that meet ENERGY STAR standards.

What You Can Expect

-

$50 to $300 per PTAC unit rebate from local utilities

-

Additional incentives for multi-unit installations (common in apartments and hotels)

-

Rebates often applied as instant discounts at checkout when you buy from authorized dealers

👉 Check the ENERGY STAR Rebate Finder to see what’s available in your zip code.

🌎 3. State & Local Utility Programs

Beyond federal credits, many states and utility companies are offering generous incentives in 2025 to encourage homeowners and landlords to install efficient PTACs.

Examples of State Programs

-

California: Rebates of up to $300 per ENERGY STAR PTAC, with higher amounts for income-qualified households.

-

New York (NYSERDA): Bonus rebates for hotels and multi-family properties installing multiple units.

-

Massachusetts: Heat pump PTACs qualify for the Mass Save program, offering up to $500 per unit.

-

Texas: Utilities like Oncor and Austin Energy provide rebates for high-efficiency PTACs.

👉 Use DSIRE USA – Rebates & Incentives to check your state.

🔥 4. Heat Pump vs. Electric PTAC Incentives

The type of PTAC you choose matters a lot in 2025.

Heat Pump PTACs

-

✅ Eligible for most federal and state rebates

-

✅ Save 20–40% on energy bills compared to electric-only models

-

✅ Best for mild-to-moderate winter climates

-

❌ Slightly higher upfront cost

Electric Resistance PTACs

-

❌ Rarely eligible for rebates or credits

-

✅ More reliable in very cold climates

-

✅ Lower upfront cost than heat pump models

-

❌ Higher operating cost

👉 More on PTAC heat pump performance: Consumer Reports – Heating & Cooling.

📊 5. Real-World Cost Example

Let’s break down what this looks like for a homeowner in 2025.

Scenario: Installing a Heat Pump PTAC

-

Unit Cost: $1,200

-

Wall Sleeve + Accessories: $200

-

Installation: $300

-

Total Before Rebates: $1,700

Savings

-

Federal Tax Credit (30%): -$510

-

Local Utility Rebate: -$200

-

Final Cost After Incentives: $990

🧰 6. How to Claim Rebates & Credits

Here’s a simple step-by-step plan I use with clients:

-

Choose an ENERGY STAR-certified PTAC → heat pump models are best.

-

Save all receipts and model documentation.

-

Apply for rebates through your utility’s website or the ENERGY STAR Rebate Finder.

-

File IRS Form 5695 (Residential Energy Credits) when doing your taxes.

-

Combine programs → federal + state + utility = maximum savings.

🏠 7. Case Studies

🏢 Apartment Manager in New York

-

Replaced 20 old PTACs with ENERGY STAR Amana heat pump PTACs

-

Federal Tax Credit: ~$10,000

-

NYSERDA Rebates: $4,000

-

Final cost reduced by ~40%

🌴 Homeowner in Florida

-

Installed one GE Zoneline heat pump PTAC for a sunroom

-

Federal Tax Credit: $480

-

Local rebate: $150

-

Net cost under $1,000

❄️ Cabin Owner in Minnesota

-

Chose Hotpoint electric PTAC for reliable heating

-

No rebates, but reliable electric heat in subzero temps justified the choice.

💡 Jake’s Pro Tips

-

Always Go ENERGY STAR: Non-certified PTACs won’t qualify.

-

Heat Pumps Are the Future: They may cost more upfront but are eligible for rebates and save money over time.

-

Stack Incentives: Use local utility rebates on top of federal credits.

-

Act Early: Some rebate funds are limited and run out mid-year.

-

Keep a Maintenance Log: Some utilities require proof of upkeep for ongoing efficiency rebates.

📌 Conclusion: Yes, PTACs Can Qualify — If You Choose Right

In 2025, heat pump PTACs are the clear winners when it comes to rebates and tax credits. While electric resistance models remain dependable in harsh winter climates, they rarely qualify for financial incentives.

💡 Jake’s Takeaway: If you want to cut upfront costs and enjoy lower monthly bills, go with an ENERGY STAR-certified heat pump PTAC. Between federal credits and local rebates, you can save 30–40% of your investment.

In the next topic we will read more about: What Is a PTAC Unit? A Complete Guide for Homeowners and Small Businesses