🌿 Introduction: Saving Money While Saving Energy

Installing a high-efficiency MRCOOL mini split system not only reduces your home’s energy use and increases comfort but may also qualify you for federal tax credits, state incentives, and utility rebates. Understanding these incentives helps you maximize your return on investment.

This guide will cover:

-

Federal tax credits for MRCOOL mini splits.

-

State and local incentives.

-

Utility rebate opportunities.

-

Eligibility criteria.

-

How to claim these benefits.

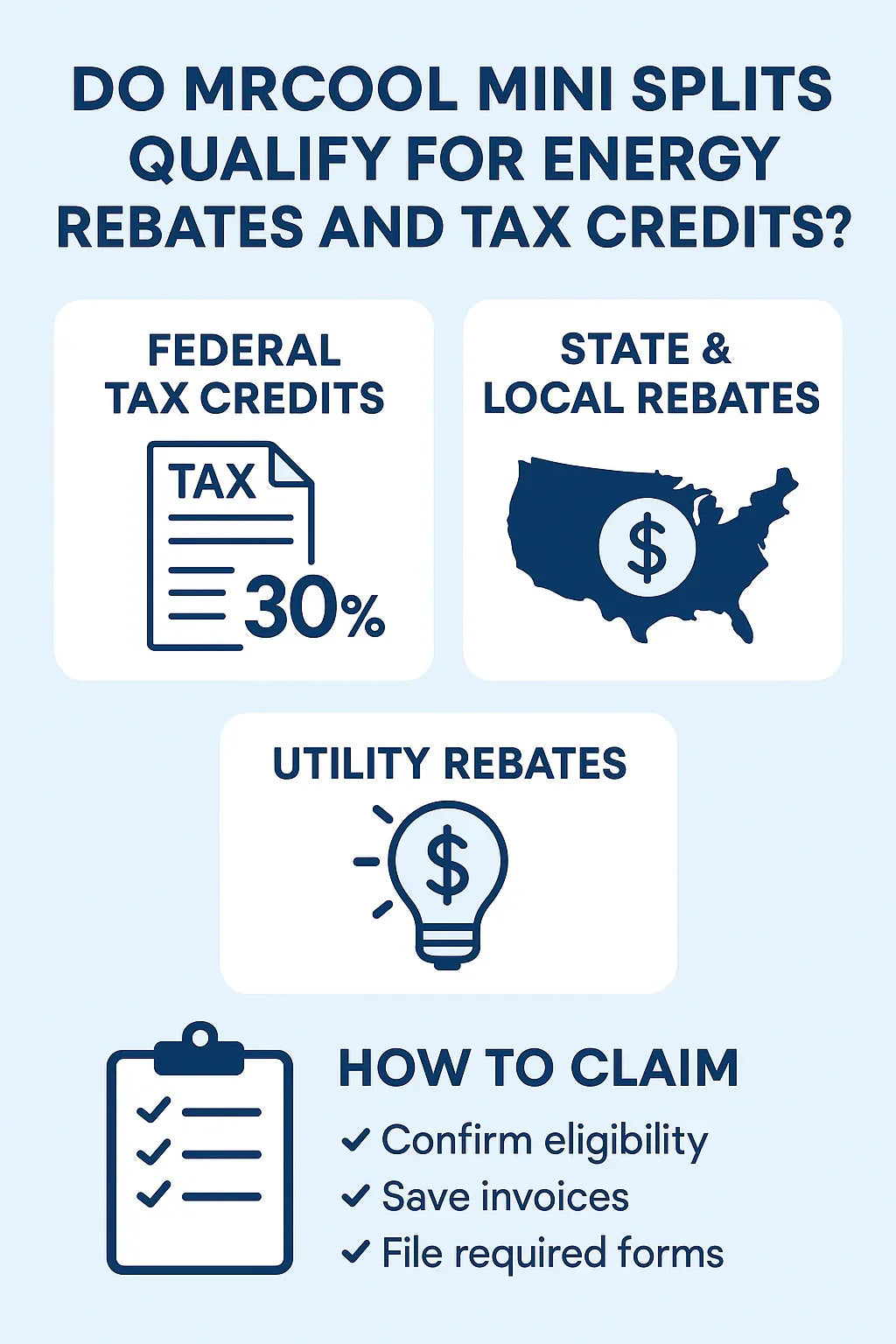

🏷️ 1️⃣ Federal Tax Credits for MRCOOL Mini Splits

Under the Inflation Reduction Act (IRA), homeowners can claim up to 30% of the installed cost (up to $2,000) for qualifying heat pump systems.

Key Points: ✅ MRCOOL mini splits with high SEER2 and HSPF ratings may qualify if they meet ENERGY STAR standards.

✅ Applies to primary residences only.

✅ Systems installed through 2032 are eligible.

✅ Claimed using IRS Form 5695 during tax filing.

📍 2️⃣ State and Local Incentives

Many states offer additional rebates for high-efficiency heat pumps:

-

California, New York, Massachusetts, and Vermont have robust rebate programs.

-

Some states offer cash rebates of $500–$2,500 per system depending on efficiency.

-

Check your state’s energy office or use DSIRE’s incentive database to confirm eligibility.

⚡ 3️⃣ Utility Rebates for MRCOOL Mini Splits

Many local utility providers offer rebates when you install high-efficiency mini split systems: ✅ Rebates range from $300–$1,200 per system.

✅ Often require ENERGY STAR certification and proof of installation.

✅ Some utilities require professional installation; others accept DIY if installed per manufacturer instructions.

🧩 Eligibility Requirements

To qualify for these incentives:

-

Your MRCOOL system must meet ENERGY STAR efficiency standards.

-

Some rebates require installation by a licensed professional (confirm with your utility provider).

-

Keep documentation, including purchase receipts, SEER2 ratings, and AHRI certificates if available.

-

File rebate forms promptly after installation.

📝 How to Claim Tax Credits and Rebates

-

Verify eligibility for your chosen MRCOOL system.

-

Collect documentation: receipts, SEER2/HSPF efficiency ratings, AHRI certificates.

-

For federal tax credits:

-

File IRS Form 5695 with your tax return.

-

Keep documentation for your records.

-

-

For state and utility rebates:

-

Visit your state energy office or utility rebate portal.

-

Complete and submit rebate applications with proof of purchase and installation.

-

💡 Example Savings Scenario

| Item | Cost |

|---|---|

| MRCOOL DIY 18,000 BTU Mini Split | $1,750 |

| Federal Tax Credit (30%) | -$525 |

| State Rebate | -$500 |

| Utility Rebate | -$400 |

| Final Cost After Incentives | $325 |

🔗 Verified External Resources

For up-to-date rebate and credit information:

🏁 Conclusion: Don’t Leave Money on the Table

By installing a high-efficiency MRCOOL mini split system, you not only reduce energy bills but can significantly offset your upfront costs through federal tax credits, state incentives, and utility rebates.

Check your system’s eligibility, save your receipts, and take advantage of these opportunities to maximize your investment while enhancing your home’s comfort.

If you would like a clean infographic summarizing these rebate and credit

In the next topic we will read about: How Many BTUs Do You Need? Choosing the Right MRCOOL Mini Split Size for Your Space