As energy efficiency continues to take center stage in home upgrades, more homeowners are exploring ductless mini split systems not only for their comfort but for their potential to save money—both on monthly utility bills and upfront installation costs. One question comes up often: Do mini splits qualify for rebates or energy tax credits in 2025?

The short answer: Yes, many do—but it depends on the model, efficiency rating, and where you live. In this guide, we’ll explain:

-

What rebates and tax credits are available for mini splits in 2025

-

Which systems qualify and why SEER2, EER2, and HSPF2 ratings matter

-

Federal vs. state-level incentives

-

Tips for homeowners looking to maximize savings

-

Common pitfalls that can disqualify a system

Let’s break it down.

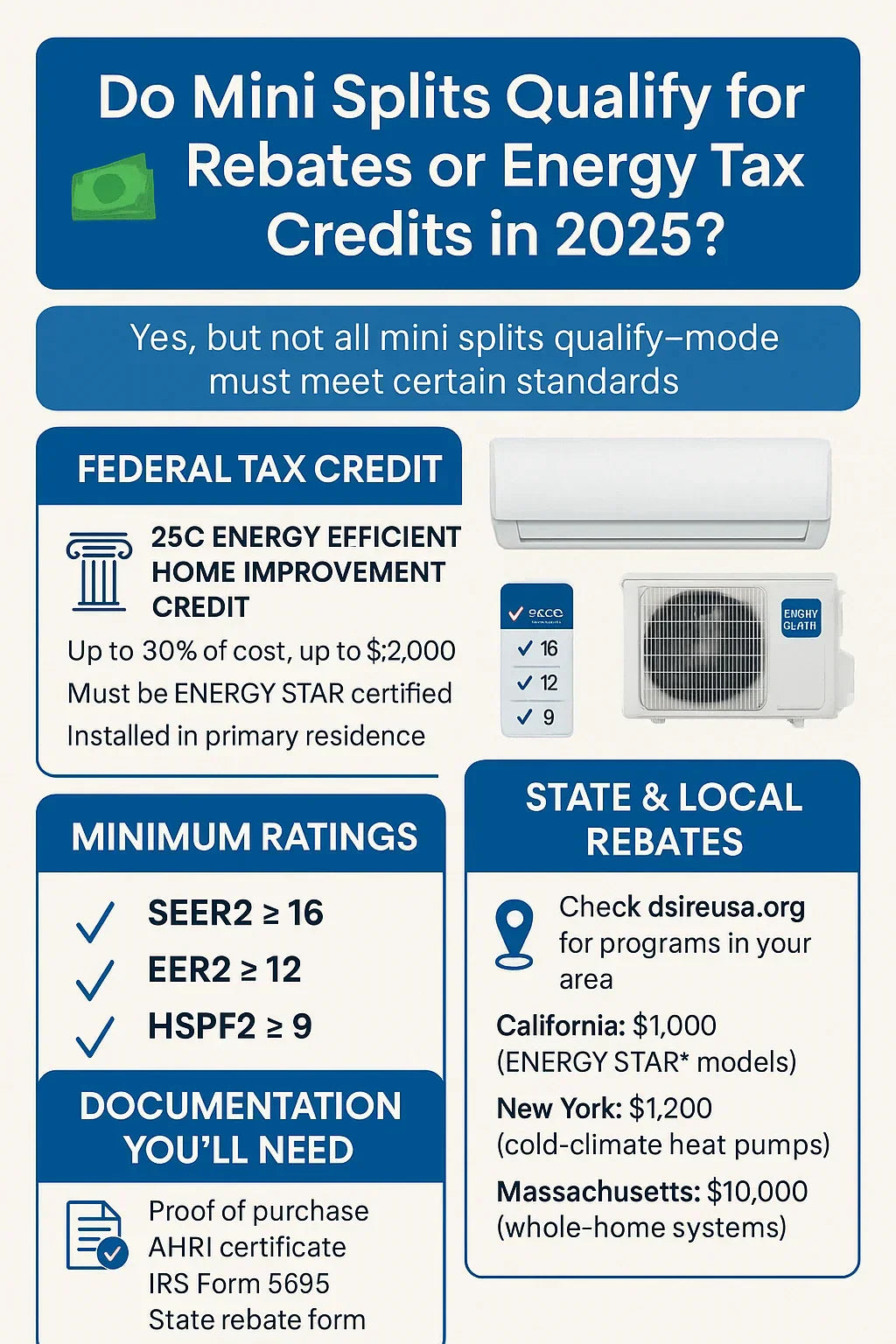

🏛️ The 2025 Federal Energy Efficiency Tax Credits (25C)

Thanks to the Inflation Reduction Act of 2022, tax credits for energy-efficient home improvements were expanded through at least 2032 under the 25C Energy Efficient Home Improvement Credit.

In 2025, homeowners can claim up to 30% of the installed cost of a qualifying mini split system, with a maximum annual cap of $2,000 for heat pumps (which includes mini split systems with heating).

✅ Key Requirements:

To qualify, your mini split must:

-

Be a ductless mini split heat pump (cooling-only systems do not qualify for the tax credit)

-

Meet or exceed the following 2023 ENERGY STAR requirements:

-

SEER2 ≥ 16

-

EER2 ≥ 12

-

HSPF2 ≥ 9

-

⚠️ Note: Not all mini splits—even from reputable brands—qualify. Always check the AHRI Certificate for proof.

How to Claim:

-

File IRS Form 5695 with your federal tax return

-

Keep receipts and documentation, including the AHRI certificate number

-

Only primary residences are eligible—not rentals or new construction

💸 State, Local, and Utility Rebates for Mini Splits

In addition to federal tax credits, state governments and utility companies across the U.S. offer mini split rebates ranging from $200 to over $2,000.

Here are a few examples for 2025:

| State/Program | Rebate Amount | Requirements |

|---|---|---|

| California TECH Initiative | Up to $2,000 per system | High-efficiency mini splits; must use approved installer |

| Mass Save (Massachusetts) | Up to $10,000 whole-home systems | HSPF2 ≥ 9.5, must be cold-climate certified |

| NYSERDA (New York) | Up to $2,000 per household | Must replace existing heating system; heat pump must qualify |

| Xcel Energy (Minnesota) | $300–$800 per system | Based on SEER2/HSPF2 ratings and system size |

💡 Pro Tip: Use dsireusa.org to search all available incentives by ZIP code.

🌡️ Cold-Climate Certified Mini Splits = Bigger Rebates

If you live in a northern climate, certain programs (like Mass Save or NYSERDA) require Cold-Climate Air Source Heat Pump (ccASHP) certification, which ensures the system performs well in winter.

Look for models labeled:

These units often have:

-

Variable-speed compressors

-

Better low-ambient heating performance (down to -5°F or lower)

-

Enhanced insulation and smart defrost cycles

🧾 Documentation You’ll Need

To successfully claim a rebate or tax credit, have the following on hand:

-

Proof of purchase/installation (invoice with model numbers)

-

AHRI Certificate verifying efficiency ratings

-

IRS Form 5695 (for tax credit)

-

State or utility-specific rebate form

-

Photos or inspection reports (if required)

💬 Common Mistakes That Disqualify You

Avoid these pitfalls that can cost you hundreds—or thousands—of dollars:

❌ Buying a unit that isn’t ENERGY STAR certified

❌ Using a non-certified installer (for certain rebate programs)

❌ Failing to register the system with your utility or rebate portal

❌ Missing deadlines (some rebates require application within 60–90 days of install)

❌ Not keeping documentation

📊 Real-World Example: Samantha’s Savings

Samantha, a homeowner in Oregon, installed a 27,000 BTU 2-Zone MRCOOL DIY Mini Split in early 2025. Here's how she saved:

-

$2,000 Federal Tax Credit (25C)

-

$800 utility rebate through Energy Trust of Oregon

-

$300 additional savings through manufacturer seasonal promotion

Total savings: $3,100 off a $6,500 project. And with an average utility bill savings of $75/month, she’ll recoup her full cost in under 4 years.

🧠 Final Thoughts: Are Rebates Worth It?

Absolutely—if you plan ahead. Rebates and tax credits can dramatically reduce the cost of installing a mini split system, especially when you choose an ENERGY STAR certified heat pump with high SEER2 and HSPF2 ratings.

✅ Key Takeaways:

-

Most ductless mini split heat pumps qualify for the 2025 25C tax credit

-

Many state and local rebates stack on top of that

-

Always check AHRI ratings and program requirements before you buy

-

Cold-climate systems often unlock the highest savings

In the next topic we will know more about: How to Maintain a 1-Zone Mini Split: Filters, Drain Lines & Seasonal Checks