🎯 Introduction: Why Rebates & Credits Matter

Heating and cooling equipment can be one of the most expensive upgrades in your home. That’s why many homeowners — like Mark — want to know whether their investment in a MRCOOL Easy Pro mini split qualifies for federal tax credits, state rebates, or utility incentives in 2025.

The good news? Thanks to the Inflation Reduction Act (IRA) and ongoing Energy Star® programs, many high-efficiency mini splits do qualify. But there are some important details to understand about eligibility, documentation, and system requirements.

⚡ 1. Federal Tax Credits in 2025

The Energy Efficient Home Improvement Credit (25C) provides homeowners with a federal tax credit for qualifying HVAC upgrades.

-

Credit Value: Up to 30% of installation cost (capped at $2,000 annually for heat pumps/mini splits).

-

Qualifying Equipment: Must meet Energy Star® efficiency standards.

-

Timeline: Available through 2032 under the IRA.

👉 Many MRCOOL systems — including Easy Pro — may qualify if they meet SEER2, EER, and HSPF thresholds set by Energy Star.

📖 Reference: Energy Star – Federal Tax Credits for Heat Pumps

🏠 2. State & Local Rebates

Beyond federal credits, most states and utilities offer additional rebates for ductless mini splits.

-

Example: New York’s NYS Clean Heat Program offers up to $1,000+ per ton for qualifying heat pumps.

-

Example: California’s TECH Clean California program provides rebates up to $3,000 per household.

-

Many utilities (like Duke Energy, Con Edison, PG&E) run local rebate programs.

📖 Check the Database of State Incentives for Renewables & Efficiency (DSIRE) for programs in your area.

🌡️ 3. Do MRCOOL Easy Pro Units Qualify?

✅ Easy Pro Series

-

Single-zone systems with SEER2 ratings around 16–18.

-

May not qualify for all rebates, since many programs require 20+ SEER or cold-climate certifications.

-

Still eligible for some utility rebate programs if installed correctly.

✅ MRCOOL 4th & 5th Gen

-

Higher SEER ratings (20–22+).

-

Better chance of qualifying for both federal and state-level incentives.

-

The 5th Gen cold-climate models almost always meet rebate thresholds.

📑 4. Documentation You’ll Need

To claim rebates or tax credits, you’ll typically need:

-

Manufacturer’s Certificate of Efficiency (download from MRCOOL or The Furnace Outlet).

-

Proof of Purchase (invoice showing equipment model and cost).

-

Installation Details (self-install counts, but check program rules).

-

Tax Filing (IRS Form 5695) for federal credits.

📖 IRS guidance: Form 5695 – Residential Energy Credits

💡 5. Tips for Maximizing Rebates

-

Plan installations strategically: The federal credit maxes out at $2,000 per year. Spread projects over multiple years if upgrading multiple zones.

-

Stack incentives: Combine federal tax credits + state rebates + utility programs.

-

Keep receipts and product labels: Programs often require model-specific verification.

-

Check before you buy: Use Energy Star’s Product Finder to confirm model eligibility.

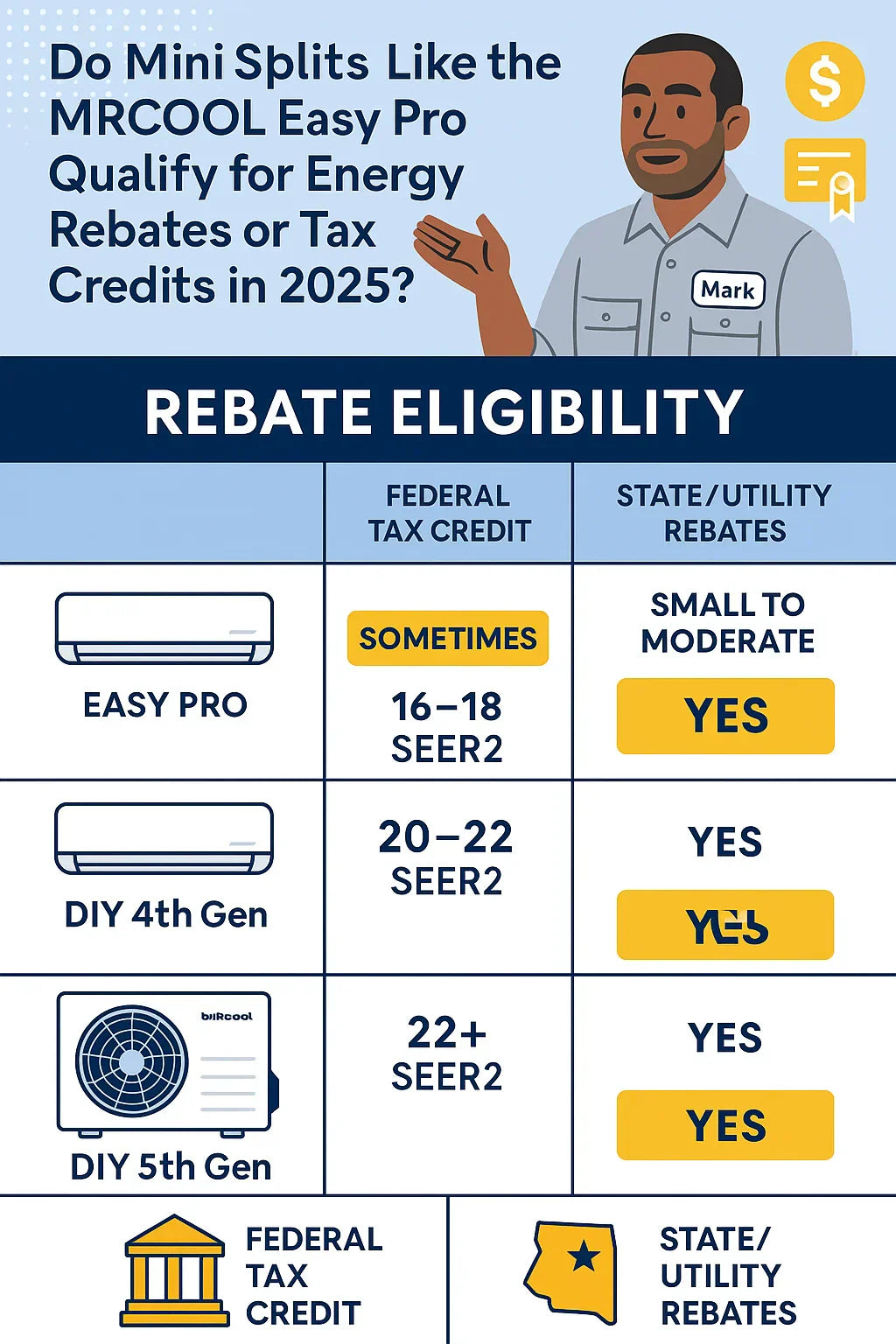

📊 Comparison: Easy Pro vs. 4th & 5th Gen (Rebate Potential)

| System | Typical SEER2 | Federal Tax Credit Eligible? | Likely State/Utility Rebates? |

|---|---|---|---|

| Easy Pro | 16–18 | Sometimes (depends on program) | Small to moderate rebates |

| DIY 4th Gen | 20–22 | Yes | Higher rebate eligibility |

| DIY 5th Gen | 22+ | Yes | Strong eligibility, esp. cold-climate rebates |

✅ Conclusion: Should You Count on Rebates for Easy Pro?

-

If you’re buying the MRCOOL Easy Pro for its affordability and DIY simplicity, you may qualify for some rebates, but not always the maximum federal/state incentives.

-

If maximizing rebates and long-term efficiency is a priority, the 4th or 5th Gen DIY systems are stronger candidates.

Either way, be sure to check Energy Star listings and your state’s rebate database before you purchase.

👉 Mark’s advice: Don’t buy just for the rebate — buy the system that fits your space. Rebates are a bonus.

In the next topic we will know more about: Wall Mounting 101: Best Locations for Your MRCOOL Easy Pro Indoor Unit