👋 Introduction: The True Cost of Going High-Efficiency

If you’re shopping for a new furnace, you’ve probably noticed that high-efficiency models (95%+ AFUE) cost more upfront than standard units. The good news? In 2025, homeowners can offset that cost through a mix of federal tax credits, state incentives, and utility rebates.

That means buying a furnace like the Goodman 96 AFUE, 80,000 BTU variable speed two-stage model (GRVT960803BN) doesn’t just save money on gas bills every winter—it also qualifies for programs that pay you back immediately.

Let’s break down exactly what’s available in 2025 and how you can take advantage of it.

💡 1. What Counts as a High-Efficiency Furnace?

Before we dive into rebates, let’s clarify what qualifies.

-

AFUE (Annual Fuel Utilization Efficiency): Measures how much fuel turns into usable heat.

-

80 AFUE = 80% efficient (20% wasted).

-

96 AFUE = 96% efficient (only 4% wasted).

-

-

ENERGY STAR Certification: Furnaces must meet strict EPA efficiency guidelines.

👉 In 2025, a gas furnace must have an AFUE of 95% or higher to qualify for most credits and rebates.

✅ That means Goodman’s 96 AFUE furnace meets the standard.

🏛️ 2. Federal Tax Credits in 2025 (IRA & 25C)

The Inflation Reduction Act (IRA) extended and expanded residential efficiency tax credits through 2032.

Section 25C – Energy Efficient Home Improvement Credit

-

Credit: 30% of project cost, up to $600 for a qualifying natural gas furnace.

-

Requirements:

-

ENERGY STAR certified.

-

AFUE ≥ 95%.

-

-

How to Claim:

-

File IRS Form 5695 with your tax return.

-

Keep invoices + AHRI certificate from your installer.

-

Example:

-

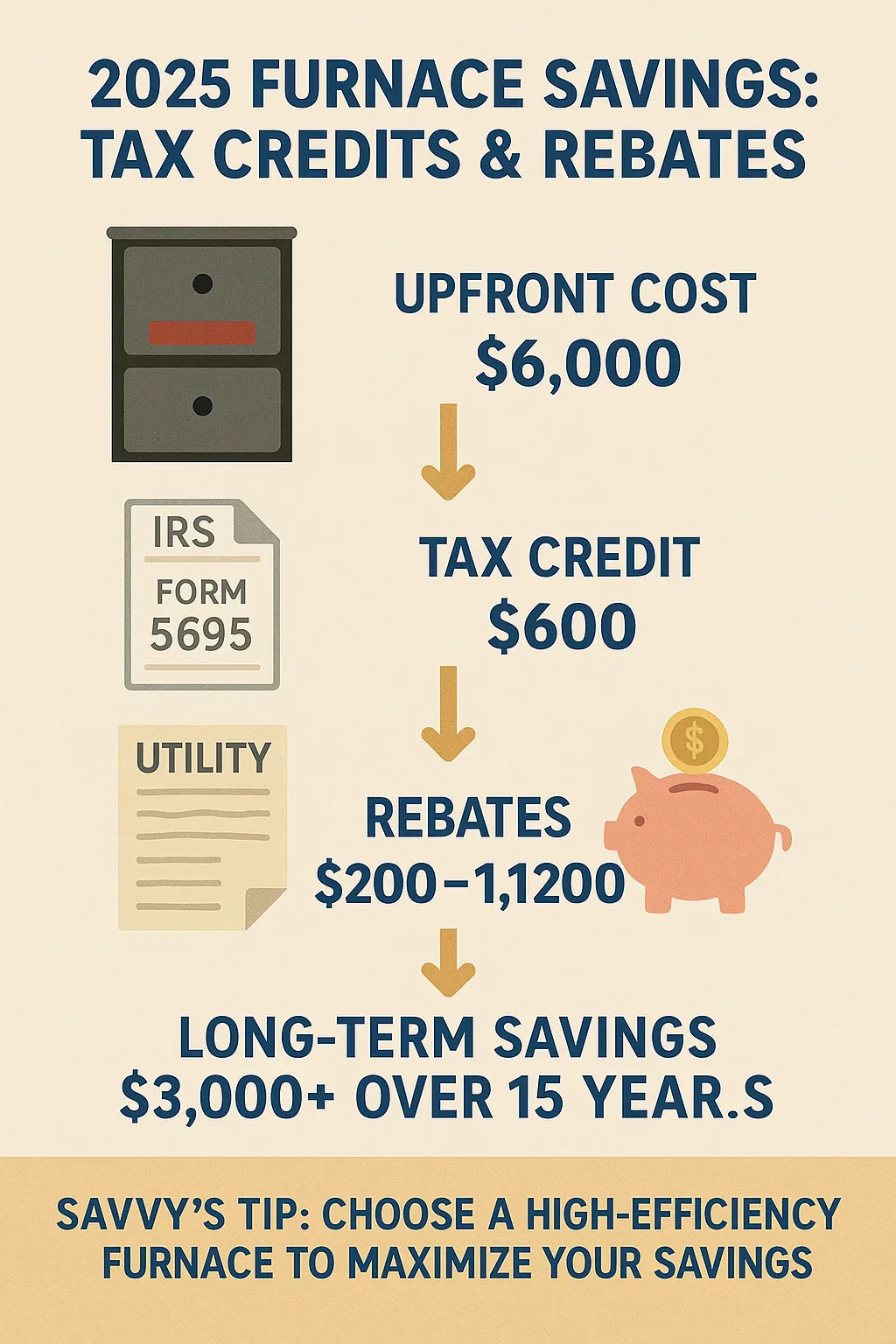

Goodman 96 AFUE furnace installed for $3,000 equipment + $3,000 labor = $6,000 total.

-

Credit = 30% of $2,000 equipment cost (capped at $600).

-

Net savings: $600 from federal taxes.

👉 Savvy’s Tip: Pairing a furnace with an ENERGY STAR heat pump or AC upgrade can unlock additional credits beyond just the $600 furnace cap.

💸 3. State & Local Utility Rebates

On top of the federal credit, utilities and state energy offices offer rebates.

Typical Rebates in 2025

-

Midwest Utilities (e.g., Xcel, Consumers Energy): $400–$600 for 95+ AFUE furnaces.

-

Northeast Utilities (e.g., ConEdison, National Grid): $350–$800 (sometimes higher for low-income households).

-

West Coast (California, Oregon, Washington): Rebates exist, but many states are prioritizing heat pumps. Gas furnace rebates may be smaller ($200–$400).

Where to Check Rebates

-

DSIRE Database – Official database of incentives.

-

Local utility websites (search “furnace rebate” + your city).

👉 Savvy’s Tip: Apply quickly—rebate programs often run out of funds mid-year.

🌍 4. Why Incentives Exist

These programs aren’t just about saving you money—they serve broader goals:

-

Lower Carbon Emissions: High-efficiency furnaces use less fuel.

-

Grid Stability: Efficient equipment reduces peak demand.

-

Affordability: Helps homeowners offset rising energy bills.

High-efficiency furnaces like the Goodman 96 AFUE aren’t just good for your wallet—they align with national and local climate strategies.

📉 5. How Much Can You Really Save? (Cost Scenarios)

Let’s crunch the numbers.

Example: Goodman 96 AFUE 80,000 BTU Furnace

-

Equipment Cost: ~$2,500

-

Installation: ~$3,500

-

Total: ~$6,000

Savings:

-

$600 federal tax credit (25C).

-

$400 state/utility rebate.

-

Net Cost: ~$5,000

Ongoing Efficiency Savings:

-

Compared to an 80 AFUE furnace, you’ll save ~20% on gas bills.

-

For a typical U.S. household ($1,000 heating bill/year), that’s $200/year savings.

-

Over 15 years = $3,000+ savings on fuel.

👉 Between rebates and long-term efficiency, a high-efficiency furnace pays for itself.

🧾 6. Documentation & Claim Process

Federal Tax Credit

-

Keep your invoice and AHRI certificate (proves AFUE rating).

-

Fill out IRS Form 5695 when filing taxes.

-

Attach receipts and documentation.

Utility Rebates

-

Submit within 90 days of installation (varies by utility).

-

Provide: invoice, AHRI cert, installer license info.

-

Most rebates arrive within 6–12 weeks.

👉 Savvy’s Tip: Ask your HVAC contractor to handle rebate paperwork—they often do it for you.

⚠️ 7. Common Mistakes Homeowners Make

-

❌ Buying an 80 or 90 AFUE furnace thinking it qualifies (it doesn’t).

-

❌ Missing application deadlines (utilities are strict).

-

❌ Not using licensed installers (many rebates require licensed HVAC contractors).

-

❌ Forgetting thermostat add-ons (some programs give extra rebates for pairing a smart thermostat).

💡 8. Savvy’s Quick Tips for Maximizing Rebates

-

✅ Always confirm your furnace model on the ENERGY STAR list.

-

✅ Ask for rebate paperwork at installation.

-

✅ Combine incentives (furnace + thermostat = bigger savings).

-

✅ Keep digital copies of everything—paperwork often gets lost.

-

✅ Upgrade to variable speed if rebates make the price difference small—it’s worth it for comfort.

✅ Conclusion: High-Efficiency Pays Off Twice

A Goodman 96 AFUE furnace doesn’t just heat your home efficiently. In 2025, it also:

-

Qualifies for up to $600 in federal tax credits.

-

Unlocks $200–$1,200 in state/utility rebates.

-

Cuts heating bills by 20–30% annually.

That means you save money now and for the next 15–20 years.

👉 Ready to take advantage? Check out the Goodman 96 AFUE 80,000 BTU Variable Speed Furnace here.

In the next topic we will know more about: Troubleshooting Guide: What to Do If Your Goodman Furnace Isn’t Heating Properly