Upgrading to a high‑efficiency furnace isn’t just a win for your comfort and energy bills—it can also score you serious rebates and tax credits in 2025. But the incentives landscape is full of fine print: varying federal rules, distinct state programs, and time‑sensitive manufacturer deals. In this guide, I’ll walk you through everything Tony-style—clear, actionable, and grounded in real data.

What Counts as a "High-Efficiency Furnace" in 2025? 🔍

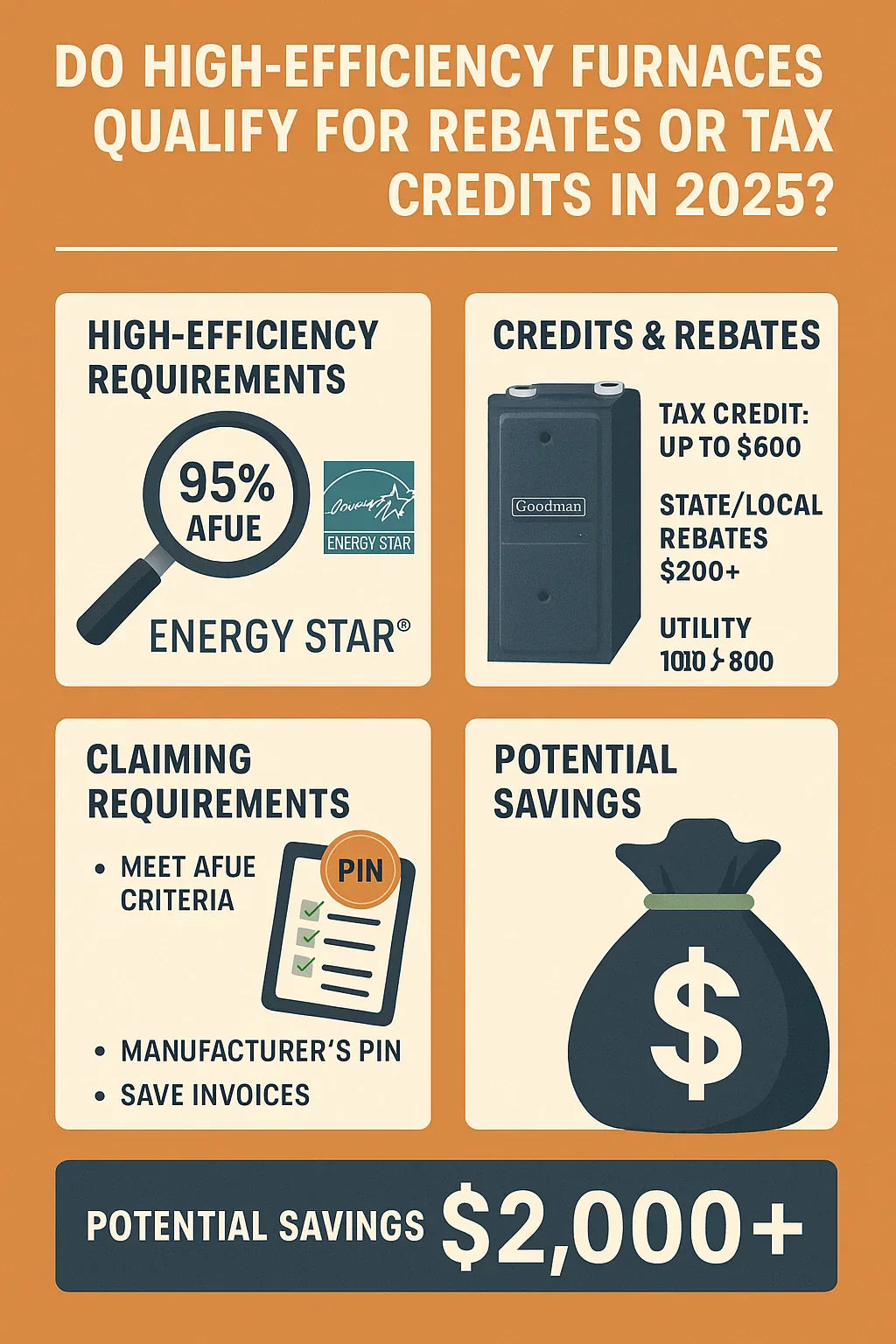

“High efficiency” usually means 95% AFUE or higher—a big improvement over typical 80% units.

-

AFUE (Annual Fuel Utilization Efficiency) measures how much fuel becomes usable heat.

-

ENERGY STAR-certified models meet or exceed these thresholds and are required for most incentives.

Key modern features that boost efficiency include:

-

Variable-speed ECM blowers

-

Condensing heat exchangers

-

Sealed combustion systems

1. Federal Tax Credits (Section 25C – IRA) 🏛️

The Inflation Reduction Act (IRA) revamped tax incentives, including extension of the Energy Efficient Home Improvement Credit (IRC Section 25C):

-

30% of total cost (equipment + installation)

-

Up to $600 for furnaces

-

Effective through December 31, 2025

Eligible units must be:

-

ENERGY STAR-certified with the right AFUE levels (often ≥ 97%)

-

Installed in a primary residence in the U.S. during 2025

How to claim:

-

Submit IRS Form 5695 with your tax return

-

Keep invoices and manufacturer’s certifications

Also note: Improved 2025 rules now require a Product Identification Number (PIN) on qualifying equipment, to prevent fraud

Pairing with heat pumps?

If paired with a qualifying heat pump setup, total credits can reach up to $2,600—but rules vary by system type

2. State & Local Rebates 🗺️

State-level programs vary widely. Many offer substantial incentives—$200 to over $1,000—especially for high-efficiency furnaces installed in 2025.

Some programs are built on IRA funding, but not all are live yet:

-

Only 11 states (plus DC) are actively accepting applications as of March 2025

-

The rest are awaiting rollout.

To check current availability and eligibility:

3. Manufacturer & Dealer Promotions 🏭

Big-name HVAC brands like Goodman, Trane, Lennox, Carrier, and others offer rebates on high-efficiency models:

-

Typically range from $150–$500

-

Available for ENERGY STAR units

-

Sometimes bundled with utility or federal incentives

To find them:

-

Check manufacturer websites

-

Visit local dealer showrooms

-

Ask for incentives at quote time

4. Utility Company & Program Rebates 🔌

Many utilities—especially gas providers—offer:

-

Instant rebates at purchase

-

Incentives for smart thermostat pairings

-

Seasonal deals

Typical savings: $100–$800 depending on your location and equipment type

Check energy provider websites or use rebate tools to compare eligibility in your area.

5. Low-Income & Future IRA Home Rebates 🏘️

Two major IRA rebate programs offer broader, income-based support:

-

Home Energy Rebate Programs (HEAR / HOMES): funded but not fully live in many states

-

Home Electrification Rebate (HEEHRA): up to $14,000 in upgrades for eligible households

These programs overlap with efficiencies, especially if you’re installing heat pumps or hybrid systems.

6. How to Claim All Eligible Credits & Rebates 📋

Here’s a step‑by‑step breakdown (Tony-style):

-

Confirm qualification:

-

ENERGY STAR status

-

Manufacturer PIN for tax credit

-

-

Keep documentation:

-

Invoices with breakdown of labor & equipment

-

Efficiency certifications

-

-

Apply strategically:

-

Federal: IRS Form 5695 (cost deduction limited annually)

-

State: Utility or state rebate portal

-

Manufacturer: Online submission

-

-

Stack smart:

-

Federal + State + Utility + Manufacturer often stack—but always check overlap restrictions

-

-

File on time:

-

Use Form 5695 with 2025 return

-

Save receipts for 3–5 years

-

7. Long-Term Savings from High-Efficiency Furnaces 💡

Beyond upfront incentives, you also save on fuel bills:

-

Upgrading from 80% to ≥ 95% AFUE may save 10–15% annually—$500+ per year in colder climates

-

Over 10 years, that’s $5,000+ saved—well beyond rebate value.

Stacking rebates, tax credits, and efficiency gains can cut total costs up to 50% in some scenarios

8. Common Pitfalls & What to Avoid ⚠️

-

Installing a non-ENERGY STAR or low-AFUE model

-

Forgetting to get and submit the correct PIN

-

Missing rebate deadlines

-

Assuming all rebates stack automatically—some don’t

-

Overlooking the labor-included rule for tax credits

9. Future Trends: Furnaces vs. Heat Pumps? 🔄

The U.S. is shifting more toward electrification:

-

Heat pumps earn higher credits ($2,000+)

-

Some states are prioritizing heat pump rebates over furnace incentives

But for now, high-efficiency furnaces remain one of the most accessible, reliable options—especially where electric upgrades aren’t practical.

Final Takeaways ✅

-

Yes, high-efficiency furnaces qualify for 2025 rebates and tax credits—but you must meet the criteria, including ENERGY STAR certification and manufacturer PIN.

-

You can stack savings: Federal (up to $600) + State (up to $1,000+) + Utility (up to $800) + Manufacturer (up to $500).

Total potential savings: $2,000+ -

Combined with energy bill reductions, upgrading to a high-AFUE furnace pays off fast—often within 5–7 years.

Your next step, Tony-style? Call a local HVAC contractor, ask about ENERGY STAR ≥ 95% AFUE models, and apply for everything you qualify for. Don’t sleep on those incentives!

In the next topic we will know more about: Troubleshooting Guide: What to Do If Your Furnace Won’t Start or Heat Properly