Upgrading to a new HVAC system is one of the biggest investments a homeowner can make. A Goodman 5 Ton R-32 air conditioner paired with an 80,000 BTU gas furnace can easily cost $10,000–$12,000 installed. That’s why the first question many of us ask is: “Can I get rebates or tax credits to bring that cost down?”

The short answer is yes—but with conditions. In 2025, homeowners can take advantage of federal tax credits, state programs, and utility rebates for qualifying systems. But eligibility depends on the efficiency ratings of the AC and furnace you choose.

Here’s everything I learned while researching incentives for my own Goodman upgrade—so you can plan your purchase with confidence.

💡 Why Incentives Matter

Rebates and tax credits can make a real dent in HVAC costs:

-

A federal tax credit could give you up to $1,200 back.

-

State and utility rebates often range from $200–$1,000.

-

Combined, you could save $800–$2,200.

That’s not just pocket money—it’s a buffer that helps offset rising energy costs and makes upgrading sooner more attractive.

According to Energy Star, efficient HVAC systems can also reduce your annual energy bills by 15–20% (Energy Star Heating & Cooling Guide ✔️). That means incentives plus ongoing savings.

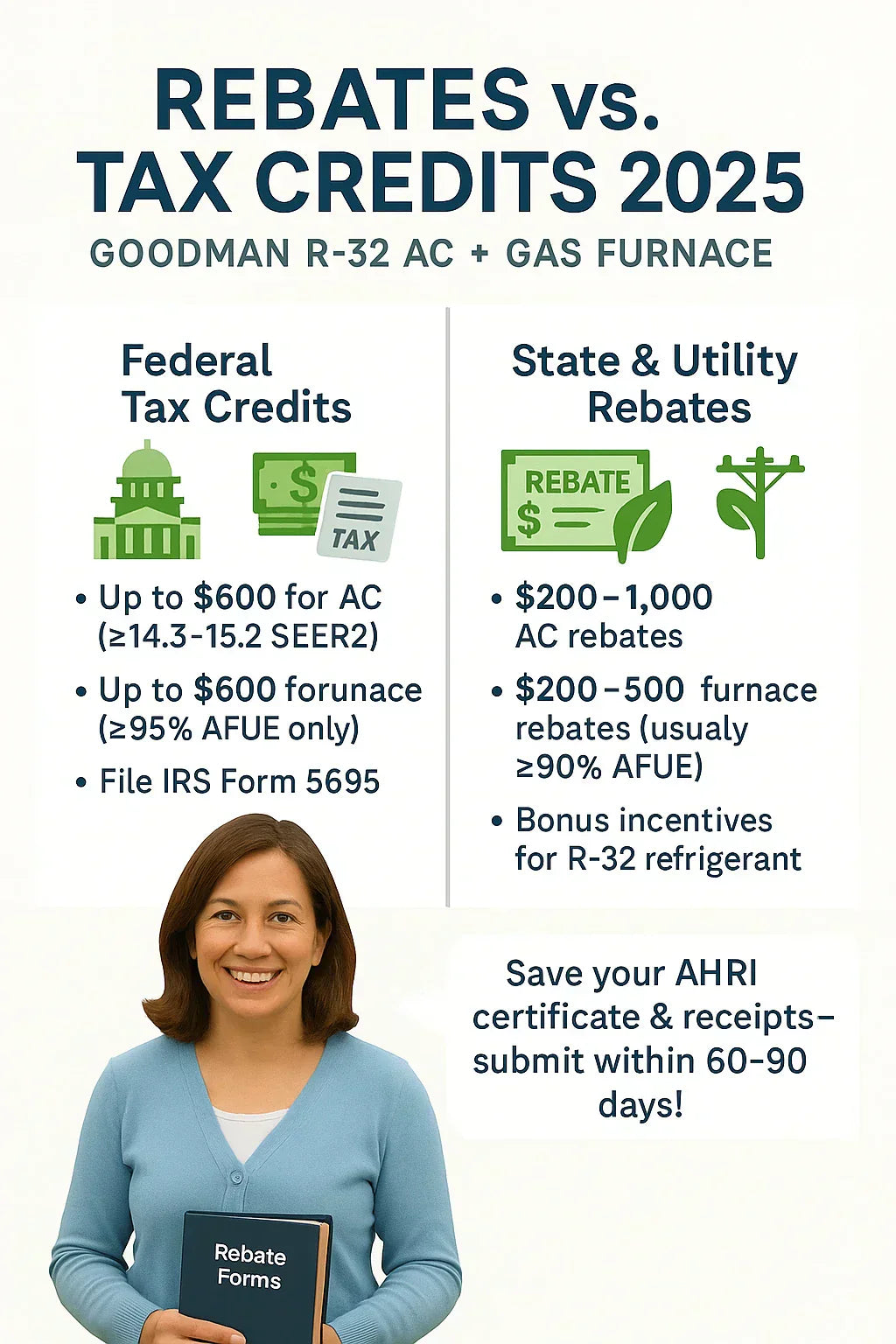

🏛️ Federal Tax Credits in 2025

The Inflation Reduction Act (IRA) extended HVAC credits through 2032. For 2025, here’s how Goodman systems stack up.

Central AC (Goodman R-32)

To qualify for federal credits, your air conditioner must meet minimum SEER2 efficiency standards based on your region:

-

North: ≥15.2 SEER2

-

South/Southwest: ≥14.3 SEER2 + EER2 requirement

👉 What this means for Goodman R-32:

-

The baseline 14 SEER2 models may qualify in northern states.

-

15–16 SEER2 models qualify nationwide.

💵 Federal credit amount: 30% of cost up to $600 for central AC.

Gas Furnaces

To qualify, a furnace must have an AFUE (Annual Fuel Utilization Efficiency) of at least 95%.

-

Goodman’s 80 AFUE furnaces do not qualify.

-

If you upgrade to Goodman’s 96%+ AFUE models, you could claim a furnace credit.

💵 Federal credit amount: 30% of cost up to $600 for furnaces.

👉 Max combined credit for AC + furnace: $1,200.

See details from Energy Star – Federal Tax Credits ✔️.

🌍 State & Utility Rebates

Even if your Goodman 80 AFUE furnace doesn’t qualify federally, don’t give up. Many utilities still offer rebates for efficiency upgrades.

-

Air Conditioner Rebates: $200–$1,000 for high-SEER2 central ACs.

-

Furnace Rebates: Usually for ≥90% AFUE, but some utilities reward any new high-efficiency model.

-

Eco Incentives: R-32 refrigerant’s lower Global Warming Potential (675 vs. R-410A’s 2,088) makes some programs prioritize R-32 adoption.

👉 Examples:

-

Texas utilities: $300–$700 for high-SEER2 ACs.

-

Minnesota energy programs: $400–$500 for ≥95% AFUE furnaces.

-

California incentives: Extra rebates for low-GWP refrigerants like R-32.

Find your exact rebates with the Energy Star Rebate Finder ✔️.

⚖️ Why R-32 Matters for Incentives

Goodman’s switch to R-32 refrigerant does more than meet federal regulations—it positions these systems for eco-focused incentives.

-

Lower Global Warming Potential (GWP): 675 vs. R-410A’s 2,088.

-

Improved efficiency: Better heat transfer reduces energy use.

-

Regulation-ready: Meets EPA refrigerant standards for 2025 and beyond

Some states are already rewarding early R-32 adoption with bonus rebates.

🧾 How to Claim Rebates & Credits

Here’s the step-by-step process I followed:

For Federal Tax Credits

-

Verify efficiency ratings on your AHRI certificate.

-

Save your contractor invoice.

-

File IRS Form 5695 when you do your taxes.

For State & Utility Rebates

-

Download the rebate form from your utility’s website.

-

Attach invoice + AHRI certificate.

-

Submit online or by mail within 60–90 days of installation.

-

Expect rebate checks within 6–12 weeks.

👉 Samantha’s tip: Keep a “Rebate Folder” (digital or paper) with all receipts and forms—it makes claiming easy at tax time.

💵 How Much You Can Save

Here’s a realistic savings range for Goodman homeowners in 2025:

-

Federal AC credit: $600

-

Federal furnace credit: $600 (if ≥95% AFUE)

-

Utility rebate (AC): $200–$1,000

-

Utility rebate (furnace): $200–$500

👉 Total savings: $800–$2,200 possible.

Even if your 80 AFUE furnace doesn’t qualify federally, you can still pocket $600–$1,000 in AC rebates + credits.

✅ Samantha’s Take

Here’s my advice after digging into the fine print:

-

Goodman R-32 ACs qualify for rebates and tax credits as long as you select the right SEER2 model for your region.

-

Goodman 80 AFUE furnaces don’t qualify for federal credits—but local utility rebates may apply.

-

If you want the maximum savings, consider upgrading to a 95%+ AFUE Goodman furnace to capture both AC and furnace credits.

-

Always ask your installer for the AHRI certificate—it’s the document you’ll need to prove eligibility.

-

Don’t wait—rebates often have limited funding each year.

🔑 Final Thoughts

So, do Goodman R-32 AC + Gas Furnace systems qualify for rebates or tax credits in 2025?

-

Yes, the AC qualifies—with SEER2 requirements met.

-

No, the 80 AFUE furnace doesn’t qualify federally (but may get utility rebates).

-

Yes, you can save $800–$2,200 depending on your setup and location.

When planning a major HVAC investment, incentives shouldn’t be an afterthought—they’re a built-in way to cut costs and future-proof your comfort.

If you’re shopping in 2025, take the extra 30 minutes to check rebates, file your forms, and make your Goodman upgrade a little easier on the wallet.

In the next topic we will know more about: Noise, Space & Design: Will a 5 Ton Goodman System Fit in Your Home?