If you’ve been researching furnace upgrades in 2025, you’ve probably noticed one number coming up again and again: 96% AFUE.

That figure isn’t just a measure of efficiency — it’s a gateway to real savings through federal tax credits, state rebates, and local incentives designed to reward homeowners for choosing high-efficiency heating systems.

And the good news? The Goodman 96% AFUE furnace, such as the GR9S960803BN model, meets or exceeds every major efficiency requirement to qualify.

In this guide, I’ll explain what rebates and credits are available in 2025, how to claim them, and how much you can realistically save — with clear examples, verified links, and tips from my own experience.

💡 1. Why Energy Rebates Matter More in 2025

Heating and cooling account for nearly 50% of your home’s total energy use. That’s why both the federal government and state utilities are offering new incentives under the Inflation Reduction Act (IRA) to help homeowners switch to more efficient systems.

High-efficiency furnaces — especially those rated 95% AFUE or higher — are at the heart of these programs. The more efficiently your furnace converts fuel into heat, the less energy it wastes and the fewer emissions it produces.

The 2025 rebate programs aren’t just about being eco-friendly — they’re about helping families save hundreds of dollars every year while upgrading comfort.

📖 Reference: Energy.gov — Inflation Reduction Act Savings Guide

⚙️ 2. Understanding AFUE and Furnace Eligibility

AFUE stands for Annual Fuel Utilization Efficiency — it measures how much of your furnace’s fuel turns into usable heat.

-

A 96% AFUE rating means 96 cents of every dollar you spend on natural gas becomes heat for your home.

-

The remaining 4% is lost through exhaust.

In comparison, older furnaces often run at 70–80% AFUE, meaning up to 30 cents per dollar goes right out the flue.

✅ Goodman’s Advantage

Goodman’s 96% AFUE furnaces exceed ENERGY STAR® standards, which is the baseline for nearly all 2025 federal and state rebate programs.

Models like the GR9S960803BN and GM9S96 line use sealed combustion, high-efficiency secondary heat exchangers, and ECM blower motors to minimize energy waste — features that make them instantly rebate-eligible.

📖 Reference: ENERGY STAR — Certified Gas Furnaces

🏦 3. Federal Tax Credits for Goodman 96% Furnaces (2025 Update)

Under the Inflation Reduction Act (IRA), homeowners can receive up to $600 in federal tax credits when installing qualifying furnaces in 2025.

🧾 Program Details

-

Amount: Up to $600 (30% of project cost, capped at $600)

-

Eligibility: Must be a natural gas or propane furnace rated ≥95% AFUE

-

Expiration: Valid through December 31, 2032

-

Requirements:

-

The furnace must be ENERGY STAR certified.

-

It must be installed in a primary residence (not rental).

-

Installation must be done by a licensed contractor.

-

You’ll claim the credit on your federal tax return using IRS Form 5695 (Residential Energy Credits).

🔍 Example:

If your installed furnace cost $4,500, your eligible federal tax credit could be:$4,500 × 30% = $1,350 (capped at $600 credit)

📖 Reference: ENERGY STAR — Federal Tax Credits for HVAC

🏠 4. The High-Efficiency Electric Home Rebate Act (HEEHRA)

The HEEHRA program, also part of the Inflation Reduction Act, focuses on helping low- and middle-income households afford high-efficiency electric systems — including hybrid setups.

While natural gas-only furnaces aren’t directly covered, Goodman dual-fuel systems (pairing a 96% gas furnace with an R-32 heat pump) may qualify for partial rebates under this program.

💰 Income-Based Savings:

| Household Type | Rebate Percentage | Eligibility |

|---|---|---|

| Low-income (<80% AMI) | Up to 100% of project cost | Full coverage up to limits |

| Moderate-income (80–150% AMI) | Up to 50% of project cost | Partial rebate |

| High-income (>150% AMI) | Not eligible | — |

So if you install a dual-fuel Goodman system for $7,500 and meet income qualifications, you could receive up to $3,750 in HEEHRA rebates.

📖 Reference: Rewiring America — HEEHRA Overview

🌎 5. State and Local Utility Rebates (Examples by Region)

Beyond federal incentives, many state and local utility companies offer rebates for high-efficiency furnaces.

Here are examples of common 2025 programs:

| Region | Program | Rebate Amount | Requirement |

|---|---|---|---|

| California | TECH Clean California | Up to $1,000 | 95%+ AFUE gas furnace |

| New York | NYSERDA Clean Heat | Up to $700 | ENERGY STAR certified |

| Texas | Oncor / Atmos Energy | $300–$450 | 95%+ AFUE, professional install |

| Midwest | Xcel Energy / Consumers Energy | $250–$600 | High-efficiency gas models |

| Pacific Northwest | Puget Sound Energy | $400–$500 | 95%+ AFUE models |

| Florida / Southeast | FPL Rebate Program | $150–$250 | Variable by efficiency |

📖 Reference: DSIRE — State Incentives Database

🧾 6. Stacking Credits and Rebates

Here’s where it gets exciting: most homeowners can combine (or “stack”) multiple programs to maximize savings.

Example Savings Breakdown

| Incentive Type | Typical Value | Goodman 96% Furnace Eligible? |

|---|---|---|

| Federal Tax Credit | $600 | ✅ Yes |

| Local/Utility Rebate | $200–$700 | ✅ Yes |

| State Program (e.g., NYSERDA, TECH) | $300–$1,000 | ✅ Yes |

| Total Savings Range | $800–$2,000 | ✅ |

🧠 Samantha’s Story:

“When I replaced my old 80% furnace with a Goodman 96% model last winter, I got a $600 federal credit and $500 from my local gas company. That’s $1,100 back — almost enough to cover my new smart thermostat and first-year service plan.”

📖 Reference: IRS — Residential Clean Energy Credits

🧰 7. How to Claim Your Furnace Rebates and Tax Credits

It’s easier than it sounds — here’s the step-by-step process:

🔧 Step 1: Choose and Install Your Furnace

Select an ENERGY STAR–certified Goodman furnace rated 95%+ AFUE and have it professionally installed.

📄 Step 2: Gather Documentation

Keep these documents handy:

-

Purchase receipt

-

Installation invoice (with installer license number)

-

Manufacturer’s Certificate from Goodman confirming ENERGY STAR compliance

-

Model and serial number of your furnace

💰 Step 3: Claim on Your Taxes

-

Complete IRS Form 5695.

-

Enter your furnace cost and efficiency data.

-

File with your annual tax return (Form 1040).

⚙️ Step 4: Apply for Local Rebates

-

Visit your utility provider’s website (e.g., Atmos Energy, NYSERDA).

-

Fill out the rebate claim form online.

-

Upload your proof of purchase and certificate.

Keep all documents for five years in case of audits or warranty claims.

💸 8. Example Cost & Savings Comparison

| System Type | Upfront Cost | Rebate + Credit | Final Cost | Annual Energy Savings |

|---|---|---|---|---|

| Standard 80% Furnace | $3,800 | $0 | $3,800 | — |

| Goodman 96% Furnace | $4,800 | $1,000 | $3,800 | $250–$350 |

| Dual-Fuel (Furnace + R-32 Heat Pump) | $7,800 | $1,800 | $6,000 | $400–$600 |

In short: you get a better furnace, lower bills, and roughly the same upfront cost as a standard model after incentives.

📖 Reference: Furnace Installation Costs

🔍 9. Common Homeowner Questions

Q: Can I claim rebates if I install the furnace myself?

❌ No. Rebates and tax credits require professional installation by a licensed contractor.

Q: Are these rebates only for new homes?

✅ No. They apply to existing primary residences (not rentals or vacation homes).

Q: Can I combine rebates with financing or loans?

✅ Yes, but credits apply only to out-of-pocket expenses.

Q: What about thermostats or duct upgrades?

✅ Some utility programs offer additional rebates for ENERGY STAR smart thermostats or air sealing when installed together.

Q: When will I receive my rebate?

Most rebates are processed within 6–8 weeks after submission.

🌍 10. Environmental Benefits of Upgrading

Beyond the financial perks, switching to a Goodman 96% AFUE furnace has a measurable environmental impact.

🌱 Annual Emissions Savings

Replacing an 80% furnace with a 96% model can:

-

Cut CO₂ emissions by 20–25%

-

Reduce natural gas use by 15–20%

-

Lower household carbon output by roughly 1 ton of CO₂ per year

Multiply that by the 60 million U.S. homes using gas heat, and the collective impact is huge.

📖 Reference: DOE — Energy Efficiency and Emissions

🏁 11. Samantha’s Take: Claim the Savings You’ve Earned

“I used to think energy rebates were complicated or only for contractors. But after I filed for my own rebate and credit, I realized it was just a few forms — and over $1,000 in savings.

If you’re upgrading to a Goodman 96% furnace, don’t leave that money on the table. You’ve already paid for it with your taxes — now it’s your turn to get something back.”

High-efficiency furnaces like Goodman’s 96% AFUE series don’t just deliver comfort. They pay you back in lower bills, better performance, and real financial rewards.

And with rebates and credits lasting through 2032, there’s no better time to make the switch.

🧭 Key Takeaways

✅ Yes, Goodman 96% furnaces qualify for both federal and most state/local incentives.

✅ Claim up to $600 federal tax credit plus $200–$1,000 in local rebates.

✅ Use IRS Form 5695 and Goodman’s certification to apply.

✅ Save $800–$2,000 instantly — and $250+ per year in energy bills.

✅ Combine with R-32 cooling systems for dual-fuel efficiency and potential HEEHRA rebates.

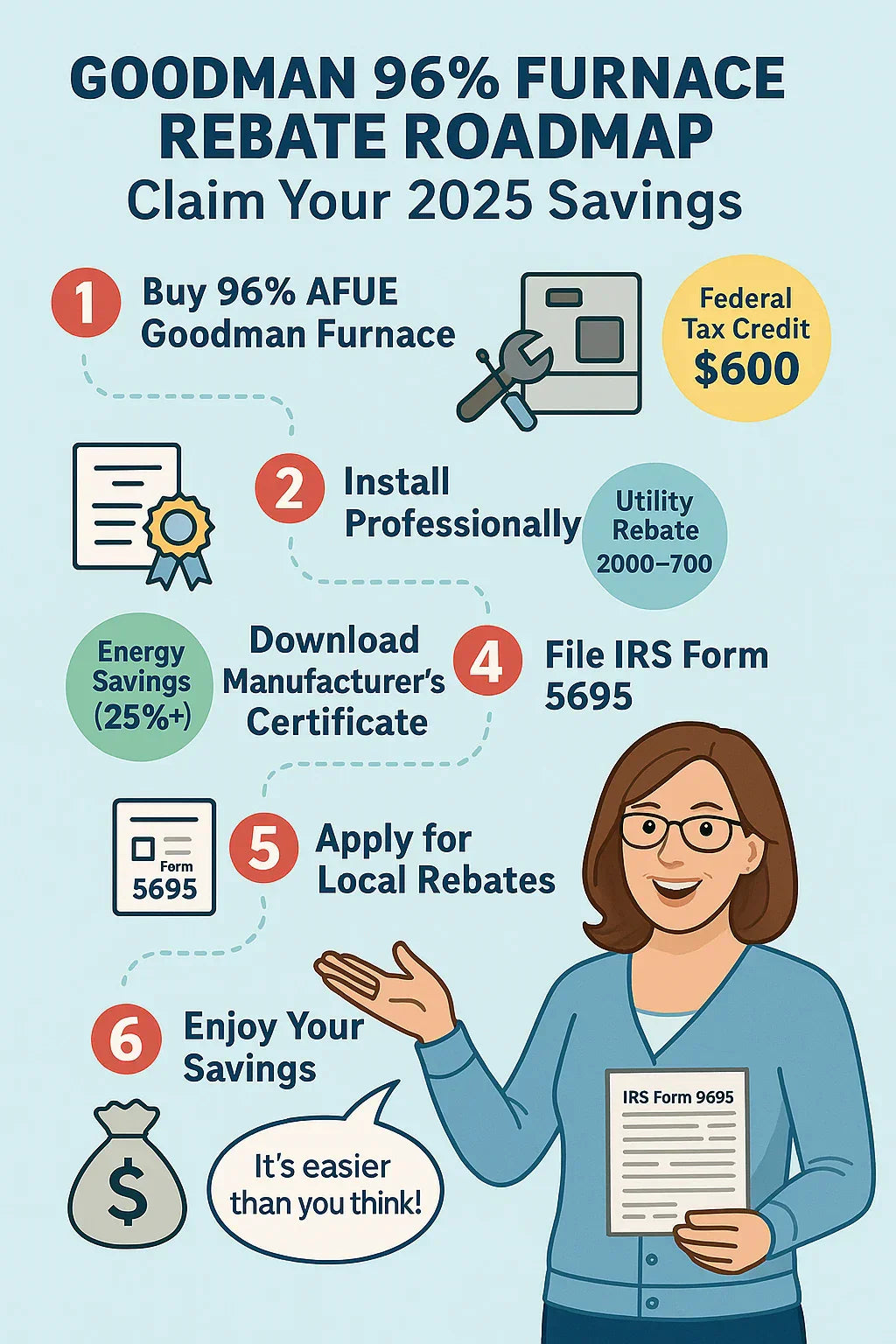

🎨 Visual Companion Infographic

Title: “Goodman 96% Furnace Rebate Roadmap: Claim Your 2025 Savings”

Design Elements:

-

Step-by-step flowchart:

1️⃣ Buy a 96% AFUE Goodman Furnace

2️⃣ Install Professionally

3️⃣ Download Manufacturer’s Certificate

4️⃣ File IRS Form 5695

5️⃣ Apply for Local Rebates

6️⃣ Enjoy Your Savings 💰 -

Icons:

-

💸 Federal Tax Credit ($600)

-

⚡ Utility Rebate ($200–$700)

-

🌎 Energy Savings (25%+)

-

-

Samantha at the bottom holding tax paperwork, saying:

“It’s easier than you think!” -

Design: red and blue Goodman palette, clean and homeowner-friendly layout.

In the next topic we will know more about: How Goodman Furnaces Perform in Northern Winters: Real-World Tests