🔎 Introduction: Save While You Stay Cool

In 2025, homeowners have more opportunities than ever to save money on energy-efficient central air conditioning systems. Thanks to new federal tax credits, state rebates, and utility incentives, upgrading your AC system can deliver immediate financial rewards along with long-term energy savings.

This guide explains exactly which central AC systems qualify for financial incentives, how to claim them, and what to watch for as you shop.

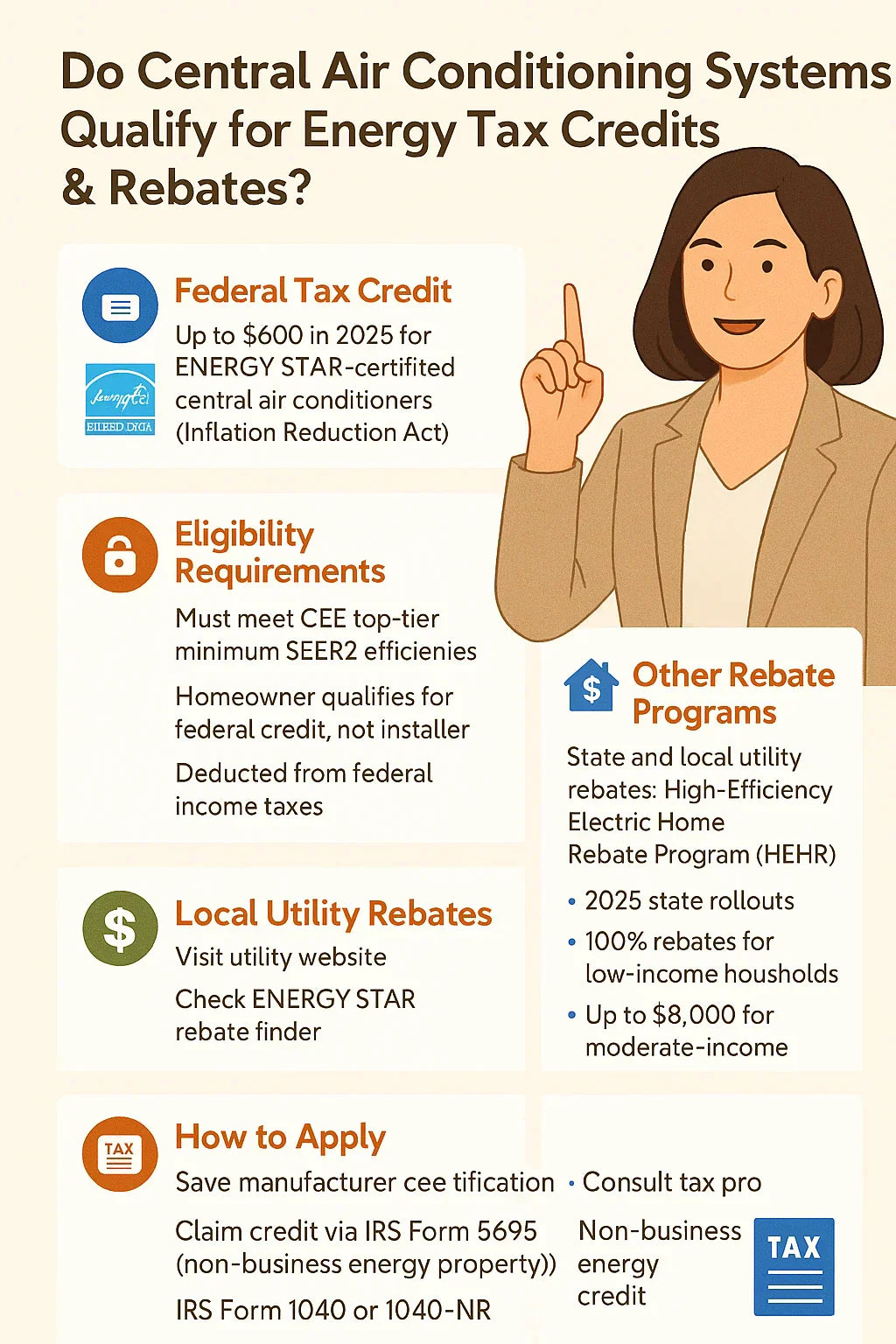

🇺🇸 The 2025 Federal Tax Credits (Inflation Reduction Act)

Energy Efficient Home Improvement Credit (Section 25C)

-

Credit amount: Up to $2,000 per year (non-refundable)

-

Eligible equipment: High-efficiency central air conditioners and heat pumps

-

Effective through: December 31, 2032

-

Annual limit: $1,200 for general energy-efficient improvements, PLUS $2,000 for qualifying HVAC equipment

Full program details available at Energy Star’s tax credit resource.

🏷 What AC Systems Qualify for Federal Tax Credits?

Split System Central AC (2025 Requirements):

-

SEER2: 16 or higher

-

EER2: 12 or higher (in southern regions)

-

Certification: ENERGY STAR certified systems

Packaged Systems:

-

SEER2: 15.2 or higher

-

EER2: 11.5 or higher

For official qualifying equipment lists, visit AHRI’s Directory of Certified Products.

🌎 State & Local Incentives

Many states and utilities offer additional rebates:

| State | Typical Incentives |

|---|---|

| California | $300–$1,000+ per unit (varies by utility) |

| New York (NYSERDA) | $500–$1,500 rebates for high SEER2 systems |

| Massachusetts | $750+ through Mass Save program |

| Texas | $300–$800 via Oncor & local utilities |

| Florida | $250–$1,000 depending on SEER2 rating |

Check your ZIP code for personalized rebates at DSIRE (Database of State Incentives for Renewables & Efficiency).

⚡ Utility Company Rebates

Many utility providers offer instant rebates for efficient central AC installations. Examples:

-

Duke Energy

-

PG&E

-

APS

-

Xcel Energy

-

Con Edison

Contact your utility directly or browse rebate databases at Energy Star's rebate finder.

📋 Required Documentation to Claim Credits

-

AHRI certificate showing system model and efficiency rating

-

Paid invoice showing system purchase and installation date

-

Completed IRS Form 5695 (filed with your tax return)

-

Utility rebate application forms (if applicable)

For IRS tax forms, visit IRS Form 5695 instructions.

🧾 Who Is Eligible for Tax Credits?

-

Primary homeowners (owner-occupied residences)

-

Existing home renovations or replacements

-

New construction generally excluded

-

No income limits for 25C credit

Consult a tax professional for personal eligibility advice.

🏦 Stacking Incentives — Maximize Savings

In many cases, you can combine:

-

Federal tax credits

-

State rebates

-

Utility rebates

-

Manufacturer promotions

-

Local financing programs

Example savings stack:

| Incentive | Amount |

| Federal Tax Credit | $2,000 |

| State Rebate | $800 |

| Utility Rebate | $500 |

| Manufacturer Discount | $300 |

| Total Savings: | $3,600 |

🔬 Key Takeaways on Qualifying AC Systems

| Factor | Requirement |

| SEER2 Rating | 16+ (split), 15.2+ (packaged) |

| Certification | ENERGY STAR certified |

| Equipment Type | Central AC or heat pump |

| Installation Year | 2025 or later |

| Professional Installation | Highly recommended for compliance |

🚩 Common Mistakes to Avoid

-

Choosing non-certified models

-

Failing to collect AHRI certification paperwork

-

Missing filing deadlines for tax forms or rebates

-

Skipping utility pre-approval steps

-

DIY installation disqualifying tax credit eligibility

🏁 Conclusion: Don’t Leave Free Money on the Table

Thanks to 2025’s expanded energy efficiency incentives, upgrading your central AC system can deliver huge savings upfront and over time. But claiming these credits requires careful planning, paperwork, and compliance.

Start by browsing pre-qualified, ENERGY STAR-certified models at trusted suppliers like The Furnace Outlet, where you can find compliant systems ready for maximum rebate eligibility.

In the next topic we will read about: How Central Air Conditioning Systems Work — A Beginner-Friendly Guide