When I bought my Amana 11,500 BTU Through-the-Wall AC/Heat Pump (PBH113J35CC), I assumed I’d qualify for some kind of rebate or tax credit. After all, it’s energy efficient and doubles as a heat pump—shouldn’t that count?

As it turns out, the rules for rebates and tax credits in 2025 are more complicated than I expected. Some homeowners can claim savings, but not all Amana through-the-wall models qualify automatically.

If you’re wondering the same thing, let’s dive into how rebates and credits work this year, where the Amana fits in, and how you can check if you’re eligible.

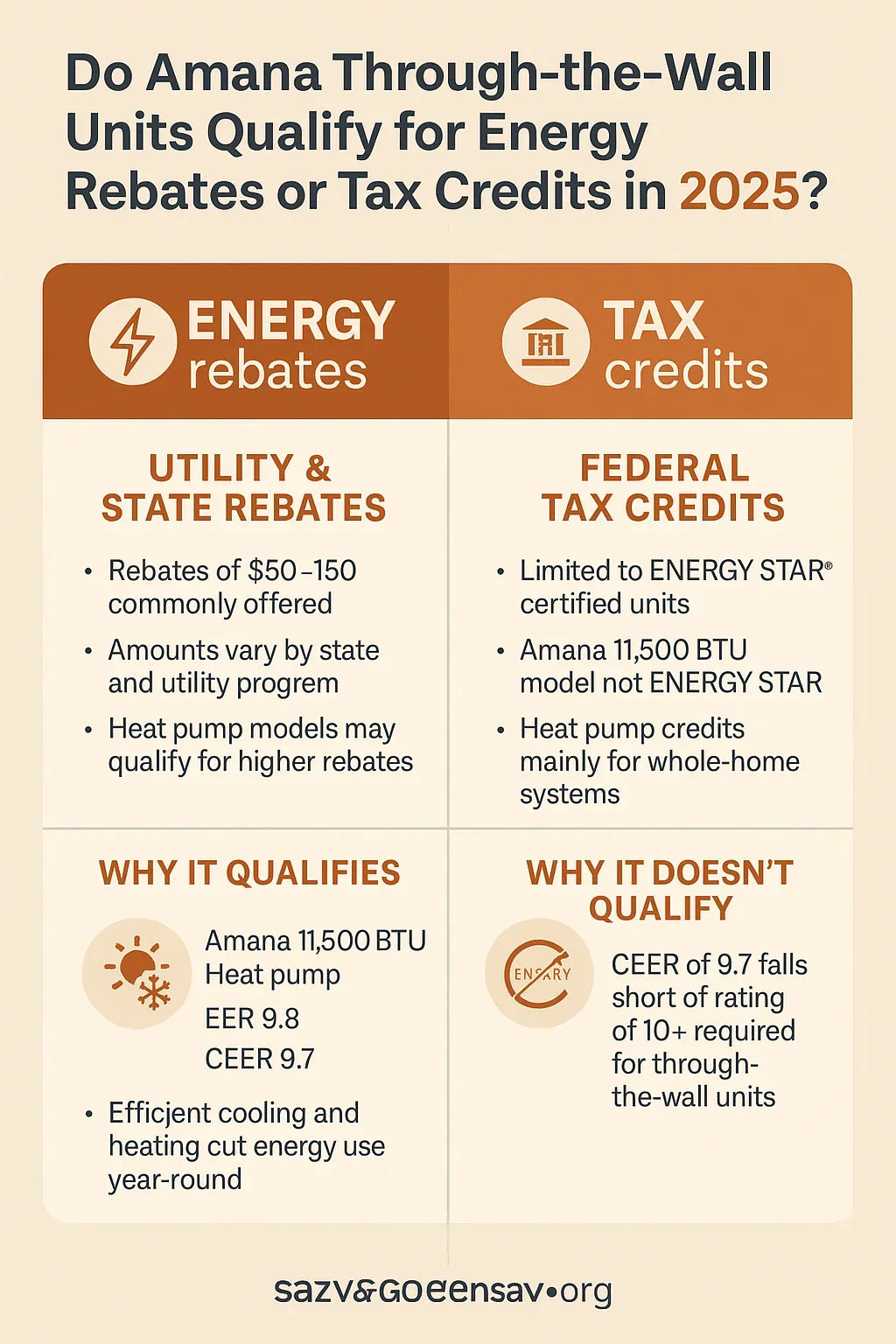

🏷️ Federal Tax Credits in 2025

Thanks to the Inflation Reduction Act (IRA), homeowners can get big incentives for upgrading HVAC equipment. But here’s the catch:

-

Federal tax credits apply mainly to central heat pumps, mini-splits, and whole-home HVAC systems.

-

Room ACs and PTAC units (like the Amana 11,500 BTU) qualify only if they carry the Energy Star label.

👉 According to Energy.gov, qualifying heat pumps can earn up to $2,000 in federal tax credits, but through-the-wall units are usually excluded unless they meet Energy Star criteria.

📊 Why Amana 11,500 BTU Falls Short of Energy Star

The Amana PBH113J35CC has strong efficiency ratings:

-

EER: 9.8

-

CEER: 9.7

That’s good—but not quite enough for Energy Star certification.

👉 Energy Star’s criteria require CEER ≥10.0 for through-the-wall units.

So while the Amana is efficient in real-world use, it just misses the federal Energy Star threshold. That means it likely won’t qualify for federal tax credits in 2025.

💡 Samantha’s Note: I was disappointed when I realized my unit wasn’t Energy Star certified, but I still saw savings through my local utility (more on that below).

⚡ State & Utility Rebates

Here’s the good news: even if your Amana doesn’t qualify for federal credits, local utilities and states often provide rebates for efficient room units and heat pumps.

-

Many utilities offer $50–$150 rebates for installing efficient through-the-wall ACs.

-

Heat pump models (like the Amana 11,500 BTU) sometimes qualify for extra incentives compared to cooling-only units.

-

Eligibility varies by zip code, provider, and year.

👉 The best resource for finding local programs is the DSIRE database, which lists rebates and incentives by state.

💡 Samantha’s Story: My utility company in Maryland offered me a $75 rebate for choosing a high-efficiency wall unit with heat pump capability—even though it wasn’t Energy Star certified. It only took a 10-minute form and a copy of my receipt to claim it.

🌡️ Heat Pump vs. Cooling-Only Rebates

One advantage of the Amana PBH113J35CC is that it’s not just a cooling system—it’s a heat pump.

Why this matters:

-

Many rebate programs encourage dual-mode heating/cooling systems because they reduce overall energy use.

-

A cooling-only wall AC may qualify for smaller incentives (like $50).

-

A heat pump wall AC often qualifies for larger rebates ($75–$150) since it offsets electric resistance heating.

👉 Energy Star’s heat pump page highlights why utilities are pushing these systems—they’re more efficient in shoulder seasons.

💡 Samantha’s Take: Choosing the heat pump version of the Amana made my rebate bigger than if I’d gone with a cooling-only model.

💰 How Much Can You Actually Save?

Let’s break down the potential savings:

-

Federal Tax Credit (2025):

-

Most Amana through-the-wall units don’t qualify since they lack Energy Star.

-

Savings: $0 unless you buy a certified model.

-

-

State Rebates:

-

Some states offer $50–$100 for efficient room ACs.

-

Example: New York’s “CoolNYC” rebate program has historically offered incentives for high-efficiency room units.

-

-

Utility Rebates:

-

Most common source of savings.

-

Typical: $50–$150 rebate per unit.

-

👉 In total, you might save $50–$150 per unit through state/utility programs—not thousands like with central systems, but still worth claiming.

📝 How to Claim Rebates or Credits

Here’s the step-by-step process I followed:

-

Check DSIRE: Go to dsireusa.org and search by your zip code.

-

Visit Utility Website: My electric company had a rebate portal with eligible product lists.

-

Confirm Eligibility: Make sure your Amana’s model number is listed. If not, call customer service.

-

Save Receipts & Model Info: You’ll need proof of purchase and sometimes the Energy Guide label.

-

Submit Online Form: Most rebate claims take 10–15 minutes to file.

-

Wait for Check or Bill Credit: Mine arrived in about 6 weeks.

💡 Samantha’s Tip: Submit your rebate immediately after purchase—you don’t want to miss the 60- or 90-day deadline many utilities enforce.

⚖️ Rebates vs. Long-Term Savings

Even if you don’t get a rebate, remember:

-

A more efficient wall unit like Amana still saves money monthly.

-

My electric bill dropped about 12% in summer compared to my old unit.

-

That’s roughly $10–$15 per month in savings during cooling season—more than a rebate over time.

👉 Consumer Reports notes that long-term efficiency gains often outweigh one-time rebates.

🏆 Final Verdict

So, do Amana through-the-wall units qualify for rebates or tax credits in 2025?

-

Federal Tax Credits: ❌ No (most models, including the PBH113J35CC, fall just shy of Energy Star criteria).

-

State Rebates: ⚠️ Sometimes (check DSIRE for local programs).

-

Utility Rebates: ✅ Often (expect $50–$150 for efficient units, more for heat pumps).

💡 Samantha’s Take: Don’t count on federal credits for this unit—but definitely check your local utility. Even if the rebate is modest, the real win is lower monthly bills from choosing an efficient Amana wall unit.

In the next topic we will know more about: Is 11,500 BTUs Enough? Choosing the Right Through-the-Wall AC/Heat Pump for Your Space