🏠 Introduction: Why Energy Incentives Matter

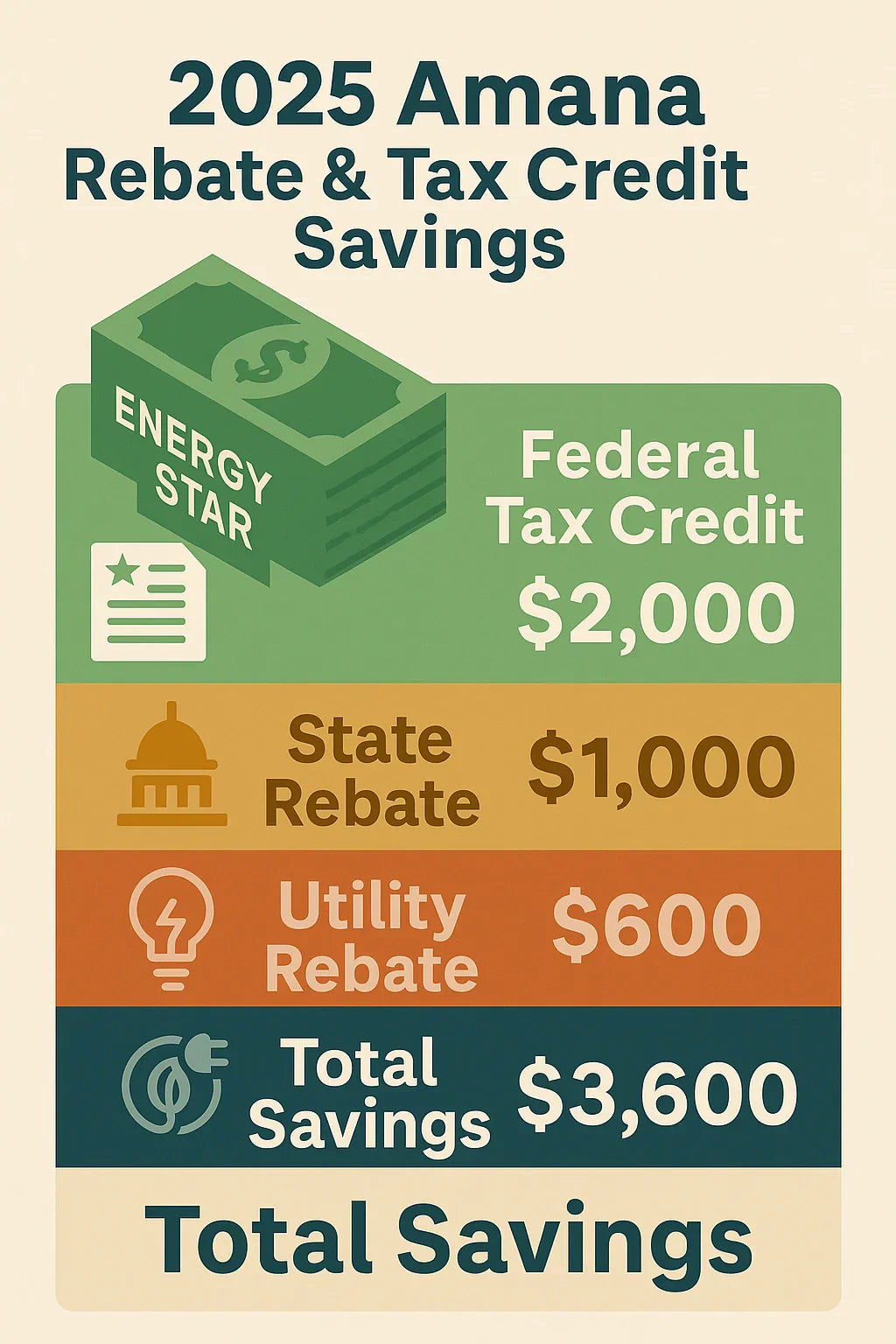

A high-efficiency HVAC system isn’t just a comfort upgrade — it’s also an investment that can pay you back. In 2025, federal tax credits, state rebates, and utility incentives are making it easier than ever to save money when upgrading to an energy-efficient Amana system.

With some Amana models meeting or exceeding ENERGY STAR® 2025 standards, homeowners can take advantage of programs designed to:

-

Lower the upfront purchase cost

-

Reduce annual energy bills

-

Shrink your carbon footprint

But here’s the catch: Not every Amana model qualifies, and eligibility rules have changed under the Inflation Reduction Act (IRA) and new SEER2 efficiency standards.

This guide breaks down which Amana systems are eligible, how much you can save, and exactly how to claim your 2025 rebates and tax credits.

📜 Federal Tax Credits Available in 2025

The Inflation Reduction Act (IRA) continues to provide incentives for energy-efficient home upgrades through 2032.

Key Federal Program: Energy Efficient Home Improvement Credit

-

Credit Amount: Up to $2,000 for qualifying HVAC systems.

-

Annual Limit: No lifetime cap; you can claim credits each year you make qualifying upgrades.

-

IRS Form Required: IRS Form 5695 (Residential Energy Credits).

Qualifying Criteria for Amana Systems in 2025:

-

Central Air Conditioners: SEER2 ≥ 16; ENERGY STAR® certified

-

Heat Pumps: SEER2 ≥ 15.2; HSPF2 ≥ 8.8; ENERGY STAR® certified

-

Gas Furnaces: 97%+ AFUE; ENERGY STAR® certified

📌 Savvy Tip: Verify that your Amana system has an AHRI Certificate of Product Ratings — you’ll need this to prove eligibility.

💡 State & Local Rebates

In addition to federal credits, many states offer rebates for installing high-efficiency HVAC systems.

Finding Programs:

The Database of State Incentives for Renewables & Efficiency (DSIRE) is the most up-to-date source for state-specific programs.

Examples for 2025:

-

California: Up to $3,000 rebate for ENERGY STAR® central AC or heat pump installations.

-

New York (NYSERDA): $1,000+ rebates for air-source heat pumps meeting efficiency thresholds.

-

Texas: Local utility and city rebates up to $1,500 for SEER2 ≥ 16 upgrades.

📌 Savvy Tip: State rebates often require installation by a program-approved contractor.

⚡ Utility Company Incentives

Many utility companies in 2025 offer incentives for reducing energy demand.

Common Utility Rebates:

-

Direct Cash Rebates: $300–$1,500 for qualifying upgrades

-

Bill Credits: Applied over several months for energy-saving improvements

-

Free Energy Audits: Required in some programs before qualifying for HVAC rebates

Why This Matters for Amana Buyers:

-

Utilities may have model-specific lists of eligible units.

-

Combining utility rebates + state rebates + federal tax credits can result in thousands in savings.

📊 Amana Models Likely to Qualify

Central Air Conditioners:

-

ASXC7 (Up to 17.2 SEER2) – ENERGY STAR® certified

-

ASXC6 (Up to 17 SEER2) – ENERGY STAR® certified

Heat Pumps:

-

ASZC7 (Up to 17.2 SEER2 / 8.8 HSPF2)

-

ASZC6 (Up to 17 SEER2 / 8.5 HSPF2)

Gas Furnaces:

-

AMVM97 (98% AFUE) – ENERGY STAR® certified

-

AMVC96 (96% AFUE) – qualifies in some states but not for federal furnace credits unless ≥ 97% AFUE

📌 Savvy Tip: Always check the most current ENERGY STAR® product list (ENERGY STAR Product Finder).

🛠 Installation & Documentation Requirements

Most incentive programs require:

-

AHRI Certificate – Confirms model efficiency rating.

-

Proof of Purchase – Invoice with model and serial number.

-

Proof of Installation Date – Required for rebate application deadlines.

-

Licensed Contractor Verification – Some programs require the installer’s license number.

📌 Savvy Tip: Keep digital and paper copies of all documentation.

📉 Common Mistakes That Cost Homeowners Incentives

-

Choosing a non-qualifying model — Efficiency rating just under the requirement.

-

Missing rebate deadlines — Some programs require applications within 90 days.

-

DIY installation — Many programs require a licensed pro for eligibility.

-

Not registering your Amana warranty — Required for some manufacturer bonus rebates.

📌 Savvy Takeaway

In 2025, many Amana systems do qualify for valuable federal, state, and utility incentives — but only if you choose the right model, work with a qualified installer, and submit complete, timely applications.

Quick Steps to Maximize Your Savings:

-

Confirm eligibility before purchase using AHRI and ENERGY STAR resources.

-

Hire a licensed, program-approved contractor.

-

Collect all documentation (invoice, AHRI certificate, installation proof).

-

Submit applications early to meet rebate deadlines.

-

File IRS Form 5695 with your tax return for federal credits.

Bottom line: With the right planning, you could save $3,000–$6,000 on a high-efficiency Amana system in 2025 — and enjoy lower energy bills for years to come.