🌟 Why This Question Matters

When I started shopping for my Amana J-Series 17,000 BTU PTAC with 5 kW electric heat, I thought I was just paying for comfort. But then I wondered: “Could this purchase actually save me money in rebates or tax credits?”

The short answer? It depends. While PTAC units aren’t always the stars of federal incentive programs, there are still ways to cut costs if you know where to look. Let’s break down what’s real, what’s marketing fluff, and where an Amana PTAC buyer in 2025 can find actual savings.

🏛️ Federal Tax Credits: What Applies to PTACs

The Inflation Reduction Act of 2022 expanded tax credits for homeowners investing in efficient HVAC systems. But here’s the key:

-

Most federal tax credits target heat pumps, central ACs, and furnaces, not PTACs.

-

To qualify, a unit typically needs to meet strict Energy Star efficiency thresholds.

PTACs and the Energy Efficient Home Improvement Credit

-

Provides 30% of costs up to $600 for qualifying central ACs.

-

Covers heat pumps up to $2,000.

-

But: PTACs rarely qualify, unless explicitly Energy Star–certified at the highest efficiency levels.

👉 That means your Amana J-Series PTAC (with 5 kW electric heat) likely won’t get you a federal credit by itself.

Samantha’s Tip: If you’re upgrading multiple PTACs in an apartment building or hotel, the savings may still be worth exploring at the commercial or utility rebate level (more on that below).

📖 Reference: IRS Energy Efficient Home Improvement Credit

🌎 Energy Star & Efficiency Standards

Here’s where things get interesting. The Energy Star program, backed by the EPA and DOE, sets performance benchmarks for appliances, including PTACs.

-

A PTAC must meet minimum EER (Energy Efficiency Ratio) levels by size category.

-

Some Amana PTAC models do carry Energy Star labels.

-

The J-Series 17,000 BTU unit? Check Amana’s datasheet—most PTACs are designed more for durability and reliability than top-tier Energy Star efficiency.

Why does this matter? Because only Energy Star PTACs unlock rebates from many states and utilities.

📖 Reference: Energy Star PTAC Criteria

🏘️ State & Local Utility Rebates

This is the biggest opportunity for Amana J-Series PTAC owners in 2025. Unlike federal tax credits, local programs are often more flexible.

Examples:

-

New York State Energy Research and Development Authority (NYSERDA): Offers incentives for efficient HVAC upgrades, including PTACs in multifamily housing.

-

California Utilities (PG&E, SoCal Edison): Provide rebates for Energy Star PTAC replacements in hotels and apartments.

-

Midwestern co-ops: Rebates of $100–$250 per PTAC installed in commercial or rental properties.

👉 To find your state or utility program, check DSIRE (Database of State Incentives for Renewables & Efficiency).

📖 Reference: DSIRE Incentives Database

🏨 Hospitality & Commercial Programs

PTACs are most common in hotels, senior housing, and apartment buildings. That’s why many rebate programs specifically target these sectors.

For example:

-

Hotel retrofit programs may pay $150–$300 per unit when swapping out old PTACs for high-efficiency models.

-

Bulk purchase rebates: Installing 20 Amana PTACs at once could net thousands in rebates.

💡 Samantha’s Note: Even if your individual home PTAC doesn’t qualify, landlords, condo boards, and hotel owners often have special pathways for incentives.

📖 Reference: NEEP PTAC Energy Efficiency Programs

📋 How to Claim Rebates or Credits

Step 1: Gather Documentation

-

Save receipts and invoices.

-

Record model and serial numbers.

-

Download the efficiency certificate from Amana’s site.

Step 2: Apply to the Right Program

-

Federal: IRS Form 5695 for eligible HVAC systems.

-

State/Utility: Submit online or paper rebate form to your energy provider.

Step 3: Watch Deadlines

-

Federal tax credits: Claim when filing taxes.

-

Utility rebates: Often have 90–120 day submission windows after purchase.

💡 Samantha’s Tip: Mark your calendar the day you install—rebate windows close faster than you think.

📖 Reference: IRS Form 5695 Instructions

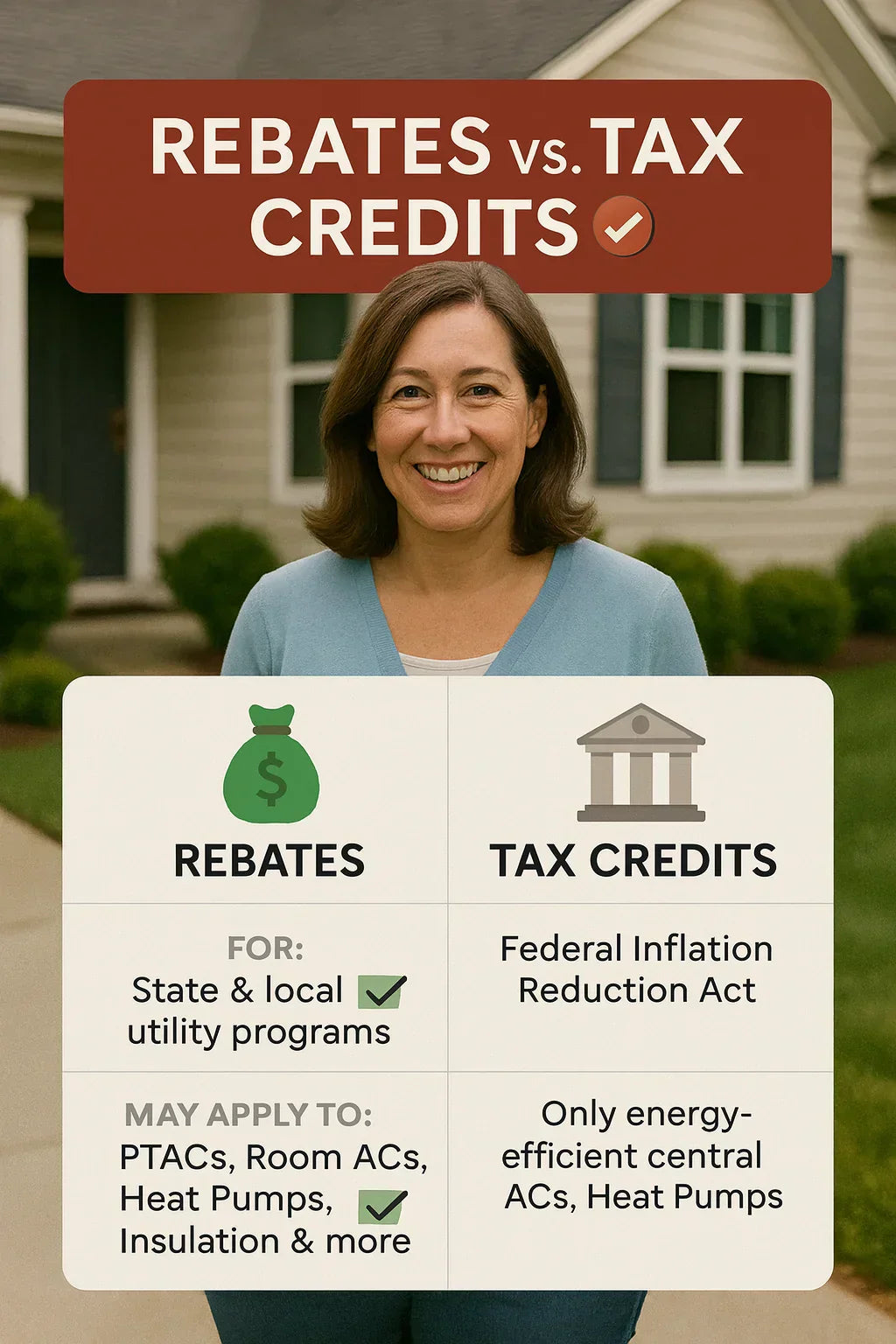

📊 Rebates vs. Tax Credits: The 2025 Reality

Here’s the bottom line for Amana J-Series PTAC buyers:

| Incentive Type | Applies to PTACs? | Typical Value | Notes |

|---|---|---|---|

| Federal Tax Credits | ❌ Rarely | $0 | Usually excludes PTACs |

| Energy Star Rebates | ✅ Sometimes | $100–$300 | Requires Energy Star model |

| State Programs | ✅ Yes | $50–$250 | Varies by state/utility |

| Commercial/Hotel Rebates | ✅ Strong | $150–$300 per unit | Bulk install advantage |

👉 Translation: Don’t expect Uncle Sam to foot the bill for your Amana J-Series PTAC. But your state, city, or utility provider just might.

✅ Samantha’s Bottom Line

So, do Amana J-Series PTAC units qualify for rebates or tax credits in 2025?

-

Federal credits: Not likely (unless future IRS guidance expands).

-

Energy Star rebates: Only if your PTAC meets Energy Star efficiency levels.

-

Utility & state programs: Your best bet—often pay $100–$300 per unit.

-

Commercial/hospitality incentives: Strong opportunities for hotels, condos, and multi-family housing.

If you’re a homeowner buying one PTAC, your savings may be limited. But if you’re outfitting multiple units, the rebates can add up fast.

📝 Final Thoughts

If you’re considering the Amana J-Series PTAC, know this: You’re investing in reliable, room-by-room comfort. While you probably won’t score a big federal tax credit, don’t overlook state, local, and utility programs.

My advice?

-

Check your utility provider’s rebate portal.

-

Use DSIRE to confirm state-level incentives.

-

Save every receipt and spec sheet.

Because when it comes to PTAC savings in 2025, rebates beat tax credits every time.

In the next topic we will know more about: Ultimate Accessories for Your Amana PTAC: Wall Sleeves, Smart Controls and Thermostat