🏁 Introduction: Tony’s Money‑Saving Question

Hi, I’m Tony. When my old R‑410A system started struggling last summer, I knew I had to upgrade. A 5‑ton R‑32 heat pump checked all the boxes: powerful enough for my two‑story home, eco‑friendly, and efficient. But I had one big question:

“How much money can I save with rebates and tax credits?”

The good news? In 2025, incentives for heat pumps are stronger than ever. Between federal tax credits, state programs, and local utility rebates, you could save thousands on a new install. But the rules can get tricky, and not every system qualifies.

Let’s break down exactly how to know if your 5‑ton R‑32 heat pump makes the cut, what paperwork you’ll need, and how to maximize your savings this year.

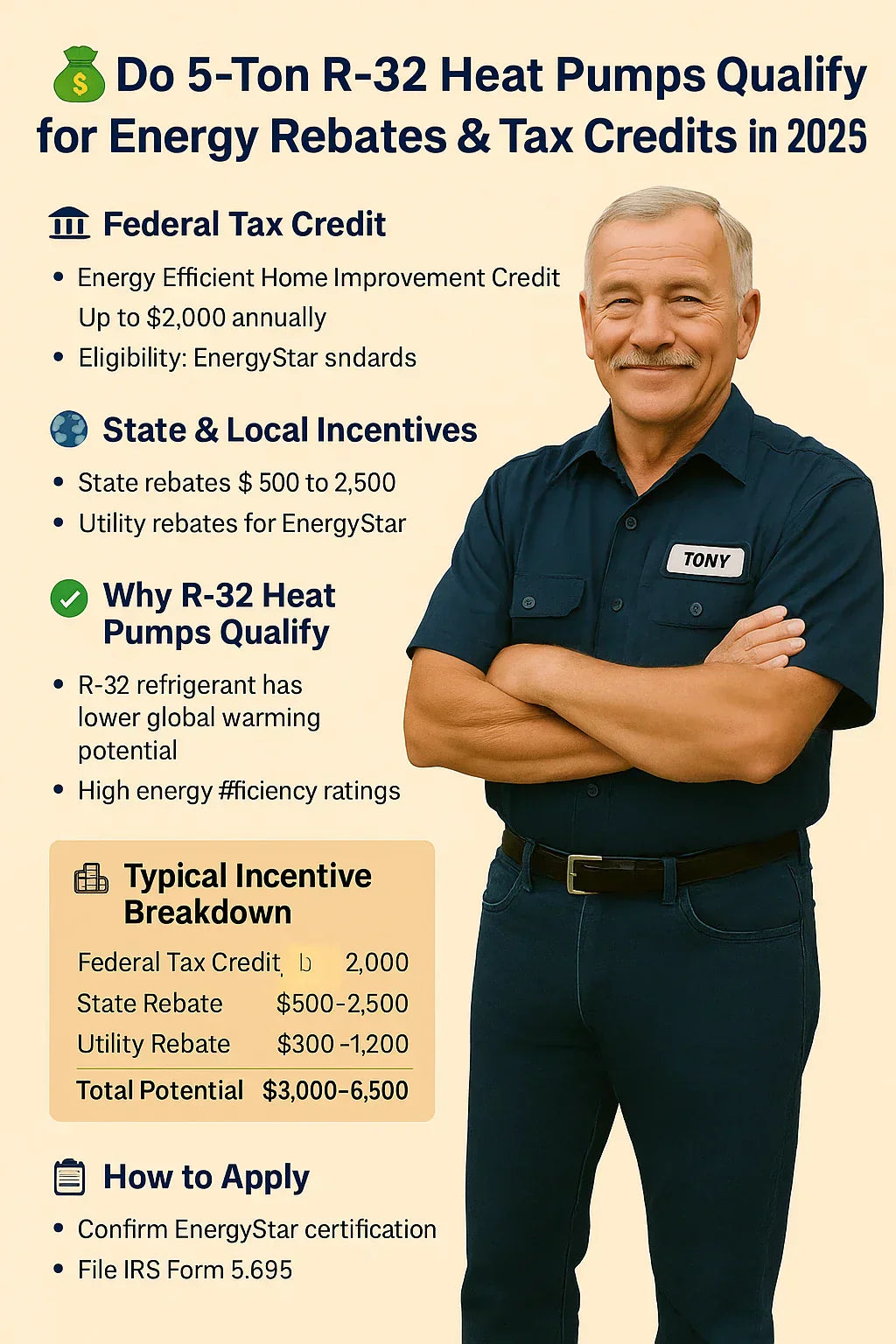

🏛️ Federal Tax Credits in 2025

The Inflation Reduction Act (IRA) has reshaped the landscape for HVAC incentives in the U.S. One of the biggest opportunities for homeowners is the Energy Efficient Home Improvement Credit (25C).

💵 Energy Efficient Home Improvement Credit (25C)

-

Covers 30% of qualifying heat pump installation costs, up to a $2,000 annual limit.

-

Applies to both equipment and installation labor.

-

R‑32 heat pumps that meet EnergyStar efficiency requirements are eligible.

👉 IRS – Energy Efficient Home Improvement Credit

Tony’s Example:

“When I priced my 5‑ton R‑32 system at $15,000 installed, I qualified for the full $2,000 federal credit. That was like getting the tax man to help pay for my new system.”

📜 Eligibility Requirements

To qualify:

-

Your home must be a primary residence in the U.S.

-

The equipment must be EnergyStar certified for your region.

-

You must use a licensed installer (DIY installs won’t count).

-

Credit resets annually—so if you’re planning other upgrades, space them out.

🌎 State & Local Incentives

Beyond the federal credit, many states and utilities have their own programs.

🗺️ State Energy Rebates

-

Rebates range from $500 to $2,500, depending on your state.

-

States like California, New York, and Massachusetts offer some of the highest rebates under clean energy programs.

-

Programs often require a manual J load calculation and proof of efficiency rating.

👉 DSIRE – Database of State Incentives for Renewables & Efficiency

⚡ Utility Rebates

Your local power company may add rebates such as:

-

$300 – $1,200 for EnergyStar R‑32 heat pumps.

-

Instant discounts applied at the point of sale through approved contractors.

-

Extra incentives for switching from electric resistance heating or oil furnaces.

Tony’s Note:

“My utility gave me a $900 rebate for installing a heat pump. I didn’t even have to wait—it came right off the invoice from the contractor.”

🟢 Why R‑32 Heat Pumps Qualify

You may wonder: Why are R‑32 systems getting so much attention?

♻️ Lower Global Warming Potential

-

R‑32’s GWP ~675 compared to 2,088 for R‑410A.

-

Aligns with the EPA AIM Act refrigerant phase‑down.

-

Many states now prioritize rebates for A2L refrigerant systems.

🔧 High Efficiency Ratings

Most new 5‑ton R‑32 systems:

-

Deliver 15.2–17 SEER2 or higher.

-

Exceed EnergyStar criteria for both cooling and heating.

👉 Daikin Comfort – R‑32 Benefits

📊 Typical Savings Breakdown

Here’s what a homeowner might save in 2025:

| Incentive Source | Typical Value |

|---|---|

| Federal Tax Credit | Up to $2,000 |

| State Rebate | $500 – $2,500 |

| Utility Rebate | $300 – $1,200 |

| Manufacturer Rebate | $200 – $800 |

| Total Potential | $3,000 – $6,500 |

Tony’s Breakdown:

“Between the $2,000 federal credit, $1,000 utility rebate, and a $500 manufacturer promo, I shaved $3,500 off my install bill.”

🏠 Example Scenarios

🏡 Suburban Family in Ohio

-

5‑ton R‑32 system installed for $15,000.

-

Federal credit: $2,000

-

Utility rebate: $800

-

Total savings: $2,800

🏠 Homeowner in California

-

5‑ton install at $16,000.

-

Federal credit: $2,000

-

State rebate: $2,000 (TECH Clean California)

-

Utility rebate: $1,200

-

Total savings: $5,200

🏘️ Multi‑Family Landlord in New York

-

Installs two 5‑ton R‑32 systems in duplex.

-

Federal credits: $4,000 (capped at $2,000 per system).

-

Utility rebates: $2,400 ($1,200 per system).

-

Total savings: $6,400

📋 How to Apply

🧾 Federal Tax Credit Steps

-

Confirm your system meets EnergyStar requirements.

-

Obtain a manufacturer certification statement.

-

File IRS Form 5695 with your 2025 tax return.

-

Keep all receipts and installation paperwork.

📝 State & Utility Rebates

-

Visit your state energy office or utility provider’s website.

-

Submit receipts, contractor info, and AHRI certificate number.

-

Some programs pay within 4–8 weeks; others apply instantly.

Tony’s Tip:

“Don’t wait until April—submit rebate applications right after the install. That way you don’t misplace receipts.”

⚠️ Common Pitfalls to Avoid

-

❌ DIY Install: Disqualifies most rebates and voids warranties.

-

❌ Non‑EnergyStar Equipment: Even if efficient, won’t qualify without the label.

-

❌ Missed Deadlines: Some rebates close in 90 days.

-

❌ Stacking Mistakes: Federal credits are capped at $2,000 per year for heat pumps.

💵 The Real ROI of Incentives

Without incentives, a 5‑ton R‑32 system may cost $14,000 – $18,000 installed. With incentives, you could reduce your effective cost to $10,500 – $13,500.

Plus, you’ll save every year:

-

Energy Savings: Up to $600 annually compared to older R‑410A systems

-

Warranty Protection: Manufacturer rebates often require licensed installation, ensuring warranty coverage for 10+ years.

🔑 Tony’s Takeaways

| Factor | What to Check | Tony’s Tip |

|---|---|---|

| Federal Credit | 25C eligibility | Use IRS Form 5695 |

| State Rebates | DSIRE database | Check before you buy |

| Utility Incentives | Local provider | Ask about instant rebates |

| Warranty & Install | Licensed installer required | Don’t risk DIY |

| Timing | Install in 2025 | Credits reset annually |

🏁 Conclusion: Yes, They Qualify—If You Plan Right

Here’s the bottom line:

“In 2025, a 5‑ton R‑32 heat pump is not just a comfort upgrade—it’s a financial win. Between federal credits, state programs, and utility rebates, you could save thousands. But you’ve got to do your homework and get the paperwork right.”

If you’re planning to install a system this year:

-

Confirm EnergyStar certification.

-

Talk to your contractor about available rebates.

-

Submit applications quickly.

-

Keep all receipts and AHRI certificates.

That way, you’ll enjoy not just comfort, but real financial relief.

In the next topic we will know more about: Troubleshooting a 5-Ton R-32 Heat Pump: What to Do If It Isn’t Heating or Cooling