Do 3 Ton R-32 Systems Qualify for 2025 Rebates or Tax Credits?

Tony Marino’s Complete Guide to Federal, State, and Utility Incentives That Actually Pay You Back

🧰 Tony’s Intro: “Rebates Are Real — You Just Have to Know Where to Look”

Here’s something I tell every homeowner when they ask about rebates:

“The government won’t show up with a check unless you fill out the forms right — but yes, the money’s there.”

Between federal tax credits, state energy rebates, and local utility incentives, 2025 is one of the best years ever to upgrade to a 3 Ton R-32 air conditioner.

But navigating which ones you qualify for — and what paperwork you need — can feel like doing your taxes blindfolded.

So in this post, I’m breaking it down the Tony way: no legal jargon, just straight, field-tested answers that’ll save you hundreds (or thousands) on your R-32 system install.

⚙️ 1. The 2025 Energy Landscape — Why Rebates Are Bigger Than Ever

The U.S. is moving hard toward low-GWP refrigerants and high-efficiency systems.

That means R-32 air conditioners are at the center of current energy incentives.

The key driver? The Inflation Reduction Act (IRA) was passed in 2022.

It funds billions in HVAC credits through 2032, including:

-

25C Federal Tax Credit for high-efficiency ACs and heat pumps.

-

High-Efficiency Electric Home Rebate Act (HEEHRA) for low-to-moderate-income households.

-

State-level utility programs for R-32 and Energy Star equipment.

(Energy.gov Inflation Reduction Act Overview)

👉 Tony’s Take:

R-32 systems are not just compliant — they’re leading the pack. Goodman designed their R-32 line to hit those new SEER2 minimums and qualify for these credits.

💡 2. Understanding the 25C Federal Tax Credit

Under the Energy Efficient Home Improvement Credit (25C), homeowners can claim 30% of the total project cost, up to $600 for central air conditioners.

| Category | Credit | Limit | Notes |

|---|---|---|---|

| Central Air Conditioner | 30% | Up to $600 | Must be Energy Star certified |

| Heat Pump System | 30% | Up to $2,000 | Must meet high-efficiency criteria |

| Electrical Panel Upgrade | 30% | Up to $600 | If part of an HVAC project |

Eligibility Requirements:

✅ Installed in your primary residence

✅ Must be Energy Star certified

✅ Installed by a licensed HVAC professional

✅ New system (not used/refurbished)

👉 Tony’s Tip:

Keep both your paid invoice and your AHRI Certificate of Product Ratings — you’ll need them for the tax filing.

🧾 3. Does the 3 Ton Goodman R-32 Qualify?

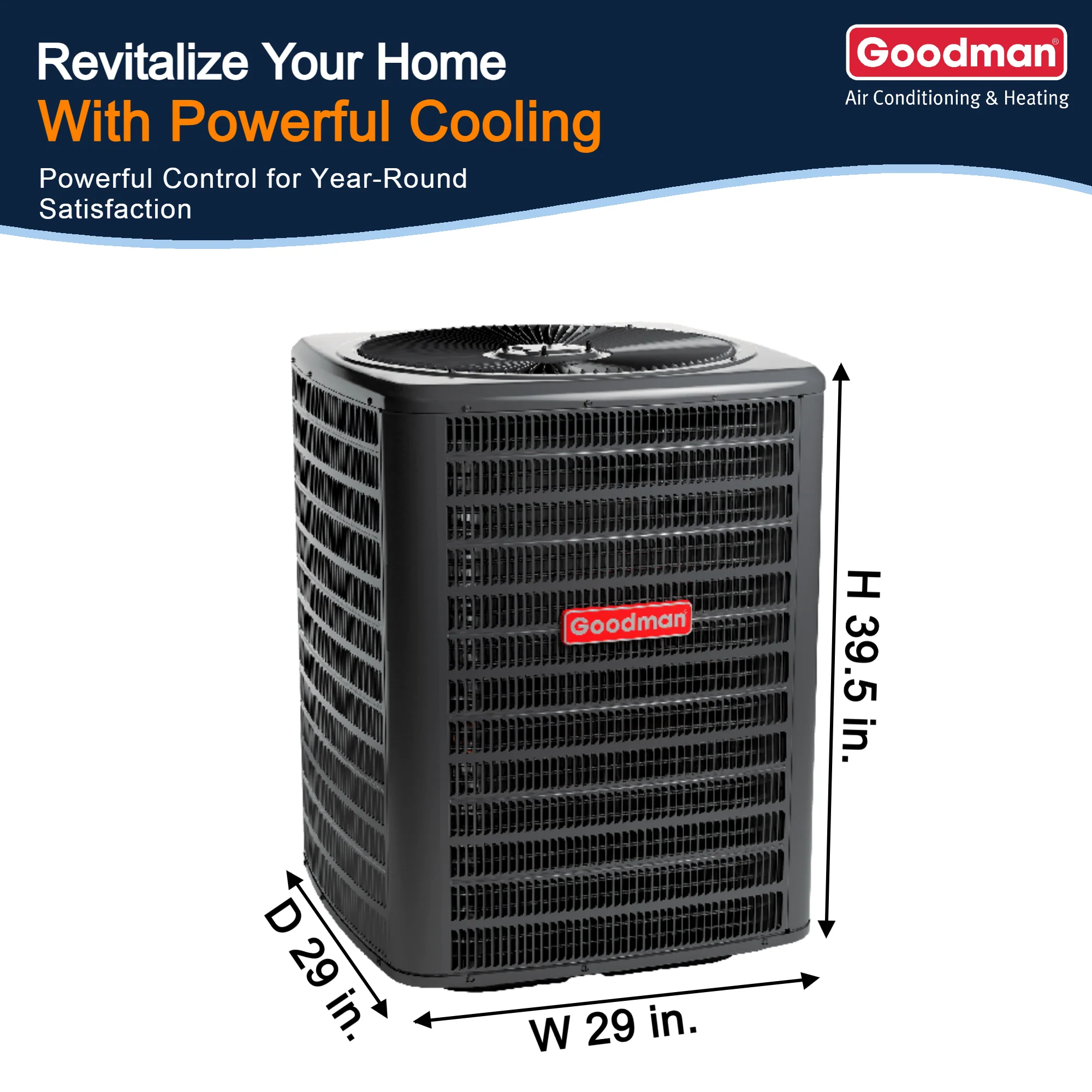

Yes — Goodman’s GLXS4BA3610 condenser paired with the AMST36CU1300 air handler meets or exceeds the new 2025 SEER2 standards and carries Energy Star certification.

| Model | SEER2 | Energy Star Qualified | 25C Eligible |

|---|---|---|---|

| GLXS4BA3610 + AMST36CU1300 | 14.5 SEER2 | ✅ Yes | ✅ Yes (up to $600 credit) |

(Goodman MFG R-32 System Specifications)

👉 Tony’s Note:

The tax credit doesn’t care about refrigerant type — but since R-32 systems hit higher SEER2 scores, they check the box automatically.

💸 4. Example: How the 25C Credit Works

Let’s break it down like a real install:

| Item | Cost | Credit (30%) |

|---|---|---|

| Goodman R-32 System | $3,200 | — |

| Installation Labor | $2,300 | — |

| Total Project | $5,500 | — |

| 30% of Total | — | $600 Max Credit |

You’ll claim it on your 2025 taxes using IRS Form 5695. It’s a nonrefundable credit — meaning it reduces the taxes you owe, not cash back.

👉 Tony’s Tip:

Even if you don’t owe much tax, this credit rolls over for multiple years until fully used.

⚡ 5. State Energy Rebates — Extra Money on Top

Each state runs its own rebate program through utilities or efficiency offices.

(DSIRE – Database of State Incentives)

| State | Typical Rebate | Program Example |

|---|---|---|

| California | $400–$800 | PG&E Clean Energy Homes |

| Texas | $300–$600 | Oncor HVAC Efficiency |

| Florida | $200–$500 | FPL Home Energy Rebates |

| New York | $500–$1,000 | NYSERDA Clean Energy Homes |

| Illinois | $400–$700 | ComEd Smart Efficiency |

👉 Tony’s Tip:

Most utilities require a post-install inspection or proof of SEER2 rating. Keep your paperwork organized — rebate checks can take 4–8 weeks.

🌬️ 6. HEEHRA Rebates (Low-Income Incentives)

The High-Efficiency Electric Home Rebate Act (HEEHRA) offers up to $8,000 for heat pumps and other electrical upgrades — and while your straight-cool R-32 system may not qualify directly, hybrid R-32 systems (AC + heat pump combo) do.

| Household Income | Rebate % | Cap |

|---|---|---|

| <80% AMI | 100% | Up to $8,000 |

| 80–150% AMI | 50% | Up to $4,000 |

👉 Tony’s Advice:

If you plan to add a heat pump or hybrid unit later, this rebate can stack — making the total savings double what you’d get on an AC alone.

🧰 7. Energy Star Rebates

Energy Star-certified R-32 systems often qualify for national rebate programs funded by regional energy efficiency partnerships.

Typical national rebate range: $200–$600 for Energy Star Most Efficient systems.

👉 Tony’s Take:

Goodman’s R-32 systems fall under these incentives because of their verified SEER2 14.5–15.2 range — right in the Energy Star sweet spot.

🔋 8. Utility-Specific Bonus Programs

Some utility companies add local incentives, like:

-

Demand Response Programs: Get paid $50–$100/year to allow brief thermostat adjustments during peak hours.

-

Time-of-Use Rate Discounts: Lower electricity cost for off-peak cooling.

-

Instant Rebate Partnerships: $200–$400 discount applied at purchase.

👉 Tony’s Tip:

Ask your installer if they’re a participating contractor in your utility’s rebate network. Only approved installs qualify.

🧱 9. Electrical Panel Upgrade Credits

If your new R-32 system requires a breaker panel upgrade for safety, that cost qualifies for its own 30% credit (up to $600) under the IRA.

👉 Tony’s Take:

Don’t forget this — if your electrician replaces an outdated 100-amp panel during your AC install, claim that, too.

🌍 10. Local Municipal Programs

Cities and counties often run additional rebate programs separate from the state.

| City | Program | Incentive |

|---|---|---|

| Austin, TX | City of Austin PowerSaver | Up to $600 |

| Los Angeles, CA | LADWP Cool LA | Up to $500 |

| Denver, CO | Energize Denver | Up to $800 |

👉 Tony’s Note:

These stack with state and federal programs — triple-dipping is allowed if each credit covers a different part (equipment, labor, utility).

💬 11. How to File Your Federal Credit

Step-by-step filing for the 25C tax credit:

-

Save your paid invoice (showing model, labor, and date).

-

Get the AHRI certificate from your installer.

-

Download IRS Form 5695.

-

Enter your credit amount under “Energy-Efficient Building Property.”

-

Submit with your 2025 tax return.

👉 Tony’s Pro Tip:

If you hire a CPA, make sure they know HVAC-specific credits. Many tax pros miss energy line items entirely.

⚙️ 12. Timing Your Purchase Right

Rebates and credits apply to systems installed after January 1, 2023, and before December 31, 2032 — but funds for state programs are limited.

👉 Tony’s Advice:

If you’re upgrading in 2025, schedule early in the year — states often run out of rebate funding by late summer.

🧾 13. Can You Combine Rebates and Tax Credits?

Yes — 100%.

Federal tax credits stack with state and utility rebates.

Example:

| Program | Benefit |

|---|---|

| Federal 25C | $600 |

| State rebate | $400 |

| Utility instant rebate | $200 |

| Total Savings | $1,200 |

👉 Tony’s Tip:

Always apply for rebates first — then claim your credit at tax time using the post-rebate total cost.

🧱 14. What Doesn’t Qualify

❌ Used or secondhand equipment

❌ DIY installations (no licensed contractor)

❌ Systems below SEER2 minimum

❌ Vacation or rental homes (for some state programs)

👉 Tony’s Take:

If it’s not Energy Star certified and professionally installed, don’t waste time filing — it’ll get denied.

💡 15. The R-32 Advantage in 2025

R-32 systems meet all future refrigerant phase-down rules under the EPA AIM Act — meaning you won’t get stuck with an outdated refrigerant (like R-410A).

That alone makes them eligible for future “green” rebates as more programs prioritize low-GWP refrigerants.

👉 Tony’s Insight:

If you install R-410A now, you’re buying into a refrigerant that’ll be phased out — and likely won’t qualify for rebates after 2026.

🧰 16. How to Prove Your System’s Eligibility

Your AHRI Certificate of Product Ratings is your proof.

Ask your contractor to provide it — it lists model numbers, SEER2, EER2, and certification data.

👉 Tony’s Tip:

Don’t file without this — it’s what rebate reviewers use to confirm your system qualifies.

⚡ 17. What About Multi-Zone or Heat Pump Combos?

If your R-32 system is part of a dual-fuel or multi-zone setup, it can qualify for higher-tier credits under the heat pump category ($2,000 limit) — even if part of your system is cooling-only.

👉 Tony’s Pro Advice:

Combine an R-32 condenser with an electric air handler and variable-speed blower — that’s a hybrid setup utilities love to reward.

💬 18. Tony’s Customer Story

Last summer, a homeowner in Georgia replaced her 3 Ton R-410A with a 3 Ton Goodman R-32 system.

-

Total install cost: $5,200

-

Federal 25C credit: $600

-

Georgia Power rebate: $350

-

City program: $250

Total savings: $1,200

That’s roughly one full year of electricity paid for — just by doing paperwork.

🧾 19. Key Documents to Keep

| Document | Why It Matters |

|---|---|

| Paid invoice | Proof of install date |

| AHRI certificate | Confirms system rating |

| Installer license copy | Some rebates require it |

| Photos of install | Optional, but helps for audits |

👉 Tony’s Tip:

Create a digital folder labeled “HVAC Rebate Docs 2025” — saves headaches later.

🏁 20. Tony’s Final Word

If you’re upgrading to a 3 Ton R-32 system in 2025, you’re not just investing in comfort — you’re getting real money back.

Between federal credits, local rebates, and long-term efficiency savings, your system can practically pay for itself in a few years.

👉 Tony’s Bottom Line:

“Don’t leave rebate money on the table. The government already took it — this is just you getting some back.”

So fill out your forms, register your warranty, and enjoy the double win of efficiency and savings.

Tony will provide a troubleshooting guide in the next blog.