💬 Introduction: Samantha’s $1,800 Surprise Check

When I upgraded to my 3-ton R-32 heat pump last year, I was focused on comfort, efficiency, and reducing my carbon footprint. But a few months after installation, I got a check in the mail for $1,800.

I had completely forgotten that my system qualified for multiple rebates and tax credits—and honestly, I almost didn’t apply because the paperwork looked intimidating.

If you’re shopping for a 3-ton R-32 heat pump in 2025, this guide will help you figure out which incentives you can get, how to qualify, and how to avoid missing out.

🏛️ 2025 Federal Tax Credits & Rebates

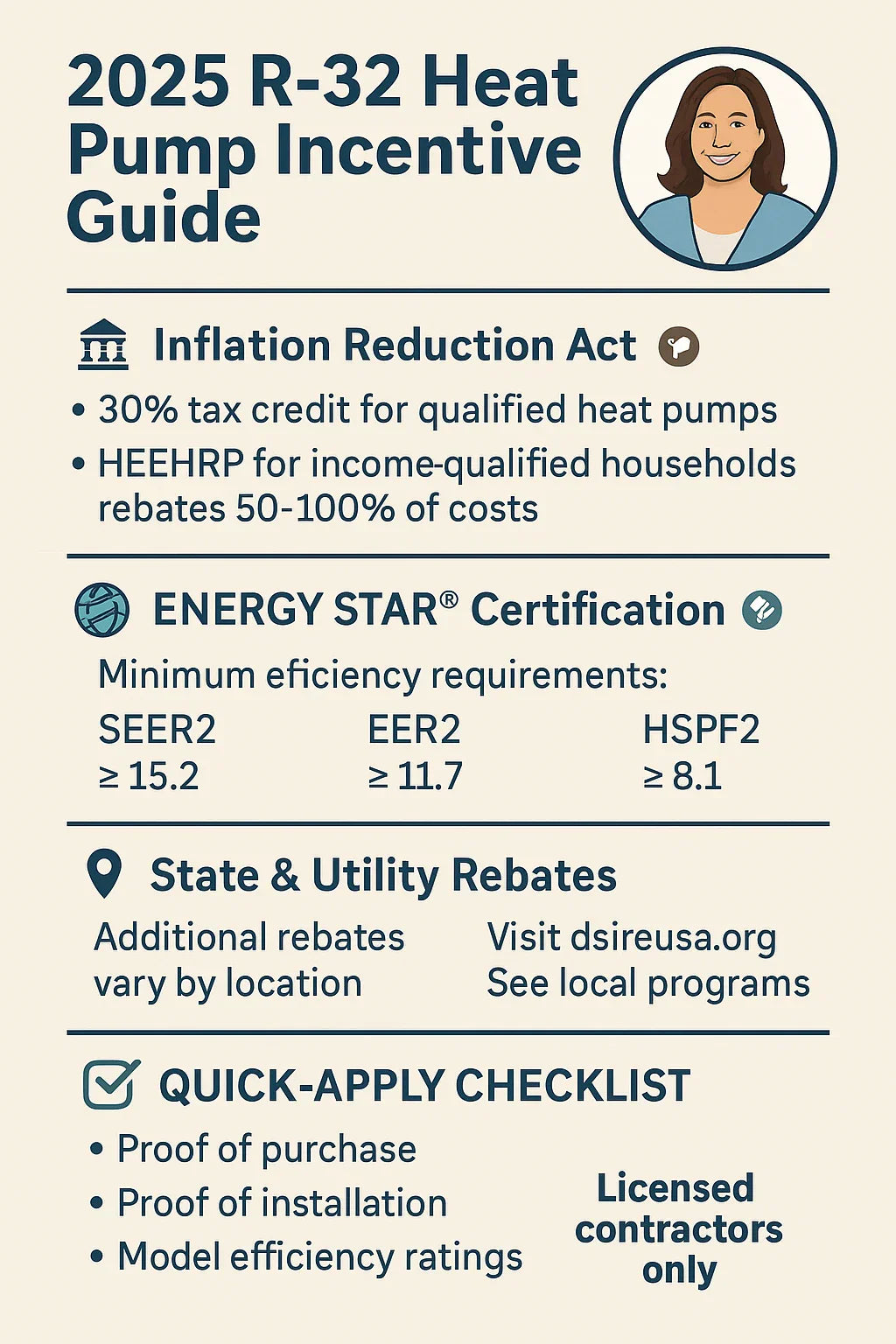

The Inflation Reduction Act (IRA) continues to make heat pump upgrades financially attractive in 2025.

1. Energy Efficient Home Improvement Credit

-

Credit covers 30% of the total installed cost, up to $2,000 per year for qualified heat pumps (Energy.gov IRA Overview).

-

Applies to both equipment and labor.

-

Must meet ENERGY STAR® certification requirements.

2. High-Efficiency Electric Home Rebate Program (HEEHR)

-

For low- and moderate-income households.

-

Covers 100% of project costs up to $8,000 for eligible households (Rewiring America HEEHR Guide).

-

Income caps vary by state and household size.

🌎 ENERGY STAR® Requirements

Your 3-ton R-32 heat pump must meet 2025 ENERGY STAR® efficiency criteria to qualify for federal credits:

| Region | SEER2 (Cooling) | EER2 (Cooling) | HSPF2 (Heating) |

|---|---|---|---|

| All Regions | ≥ 15.2 | ≥ 11.7 | ≥ 8.1 |

-

R-32 refrigerant itself does not affect ENERGY STAR® eligibility.

-

Efficiency ratings depend on the model’s design and components, not just refrigerant type (ENERGY STAR Heat Pump Criteria).

📍 State & Local Incentives

In addition to federal credits, many states and utilities offer rebates for heat pump installations.

Examples for 2025:

-

California (Tech Clean California Program) – Up to $3,000 rebate for qualifying heat pump installations.

-

New York (NY Clean Heat Program) – $1,000–$5,000 depending on system size and efficiency.

-

Massachusetts (Mass Save Program) – Up to $10,000 for whole-home heat pump conversions.

You can find programs in your area using the DSIRE Incentives Database.

📑 What You’ll Need to Apply

From my experience, you’ll save a lot of headaches if you gather these before starting your application:

-

Proof of Purchase – Itemized receipt with model number.

-

Proof of Installation – Invoice from a licensed HVAC contractor (DIY installs are typically ineligible).

-

Efficiency Ratings Sheet – Manufacturer’s documentation showing SEER2, EER2, HSPF2.

-

Permit Documentation – Some programs require proof of approved building permits.

⚠️ Common Pitfalls That Disqualify Applications

I’ve seen neighbors miss out because of small mistakes:

-

DIY Installations – Almost all rebate and tax credit programs require licensed professional installation.

-

Buying Non-Qualifying Models – Even efficient systems won’t qualify if they’re missing ENERGY STAR® certification.

-

Missing Deadlines – Many programs require you to apply within 90–180 days of installation.

-

Incomplete Paperwork – Missing one document can delay or void your application.

🧮 Samantha’s Maximizing Strategy

When I installed my R-32 system, I stacked incentives like this:

-

$1,800 Federal Tax Credit (IRA Energy Efficient Home Improvement Credit).

-

$500 State Rebate from my local energy office.

-

$1,200 Utility Rebate from my electric provider.

Total Incentives: $3,500 — which cut my net project cost by almost 40%.

Tip: Time your project to coincide with utility rebate funding cycles—some programs run out of money mid-year.

💬 Closing Thoughts

If you’re installing a 3-ton R-32 heat pump in 2025, there’s a good chance you qualify for thousands of dollars in incentives—but only if you choose a qualifying model, hire a licensed installer, and apply on time.

My advice: don’t leave free money on the table. A few hours of paperwork could mean years of savings.

In the next topic we will read about: Troubleshooting Guide: What to Do If Your R-32 Heat Pump Isn’t Heating or Cooling