When you’re preparing to spend $20,000–$30,000 on a 10-ton packaged rooftop air conditioner (RTU), every dollar matters. The right unit doesn’t just keep your building cool—it can also unlock rebates, tax deductions, and incentives that significantly reduce your net cost.

But here’s the challenge: navigating federal, state, and utility programs can feel like a maze. Requirements change annually, efficiency thresholds rise, and paperwork can be overwhelming.

This guide cuts through the noise. By the end, you’ll know:

-

✅ Whether 10-ton packaged ACs qualify for incentives in 2025

-

✅ The federal programs (like Section 179D) that reduce tax liability

-

✅ How ENERGY STAR and IEER2 ratings impact eligibility

-

✅ The state & utility rebates you can stack for even more savings

-

✅ A clear ROI picture for high-efficiency RTUs like Daikin’s 15 IEER2 model

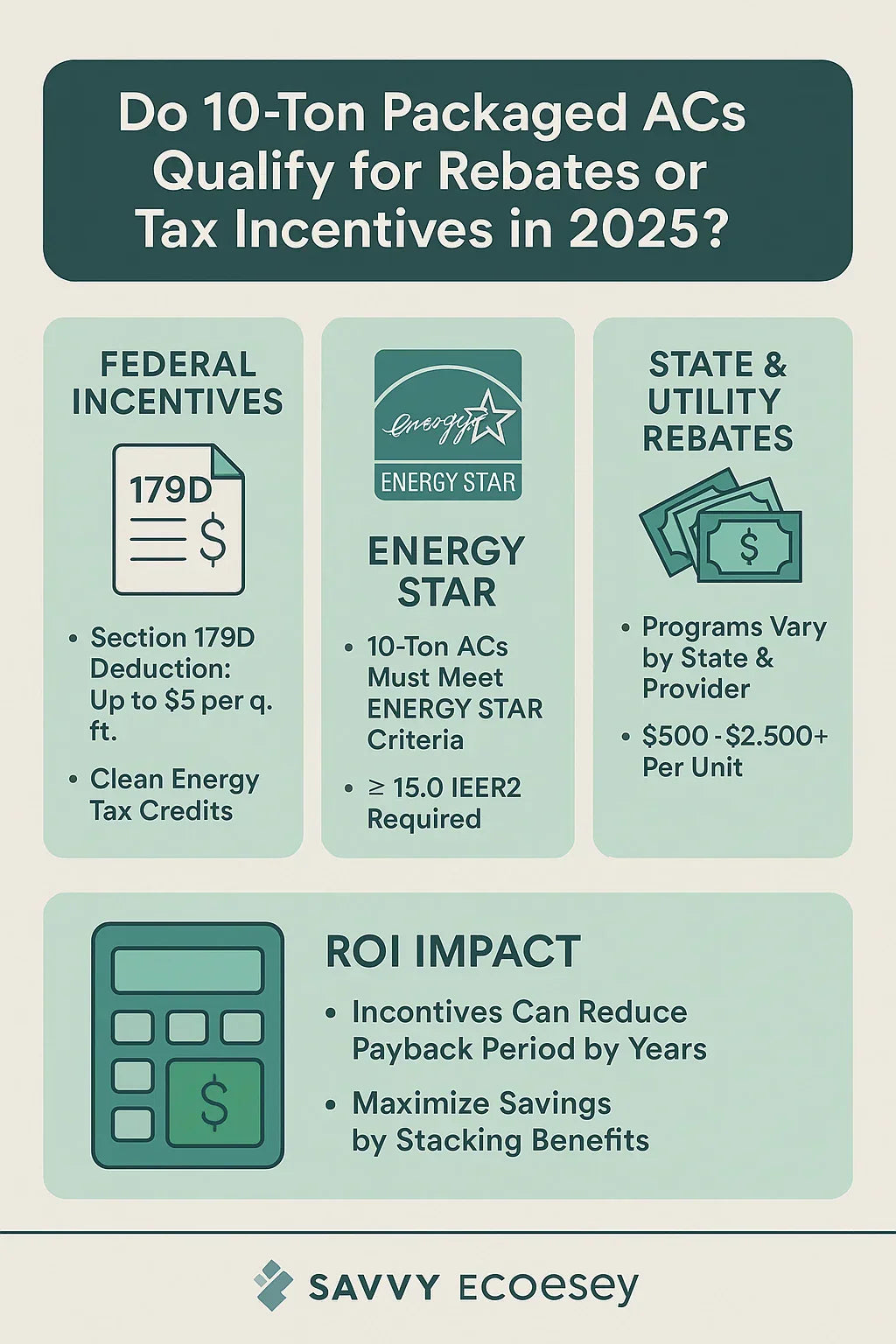

📦 1. Federal Incentives in 2025

Federal incentives are the largest buckets of savings for commercial HVAC. In 2025, two primary opportunities stand out: Section 179D and Inflation Reduction Act (IRA) tax credits.

🏛 Section 179D: Energy Efficient Commercial Buildings Deduction

-

Updated by the Inflation Reduction Act (IRA) of 2022.

-

Provides a tax deduction up to $5.00 per square foot for energy-efficient improvements.

-

Applies to HVAC systems, lighting, and building envelope upgrades.

Eligibility for HVAC systems:

-

Must exceed ASHRAE 90.1 standards.

-

10-ton packaged ACs that achieve 15 IEER2 or higher typically qualify.

Example:

-

20,000 sq. ft. retail store installs a Daikin 10-ton 15 IEER2 RTU.

-

Deduction: $3/sq. ft. (conservative estimate).

-

Tax savings = $60,000.

📖 Reference: IRS – Energy Efficient Commercial Buildings Deduction

🌍 Inflation Reduction Act (IRA) Incentives

The IRA also extends clean energy tax credits into 2025.

-

Commercial HVAC systems exceeding baseline efficiency may qualify for:

-

Direct tax credits

-

Bonus credits for projects in energy communities or low-income areas

-

This is especially important for businesses in states prioritizing decarbonization.

📖 Reference: DOE – Inflation Reduction Act Incentives

⚡ 2. ENERGY STAR & IEER2 Requirements

Almost every rebate program ties to ENERGY STAR certification.

ENERGY STAR Packaged AC Criteria (2025):

-

For 10-ton units, ENERGY STAR requires IEER2 ≥ 15.0.

-

Daikin’s commercial packaged ACs exceed this threshold.

👉 If your RTU doesn’t meet this, you’ll likely lose access to rebates and deductions.

📖 Reference: ENERGY STAR – HVAC Requirements

🏙️ 3. State & Local Utility Rebates

Beyond federal programs, your local utility company and state programs can provide cash-back rebates.

Typical Utility Incentives (per unit):

-

$500–$2,500 rebate for installing high-efficiency RTUs.

-

Some utilities offer per-ton incentives ($50–$100 per ton).

-

For a 10-ton AC: $500–$1,000.

-

State Example:

-

California: Strong rebates through PG&E, SoCal Edison.

-

New York: NYSERDA offers rebates for commercial RTUs.

-

Texas & Florida: Utilities provide direct incentives for ENERGY STAR-certified equipment.

📖 Reference: DSIRE – Database of State Incentives for Renewables & Efficiency

🧾 4. How to Claim Rebates & Deductions

Many businesses leave money on the table simply because they don’t file correctly.

Steps to Secure Incentives:

-

Confirm equipment eligibility

-

Ensure your RTU meets ENERGY STAR and IEER2 thresholds.

-

Get manufacturer documentation (Daikin provides AHRI certificates).

-

-

Apply for utility rebates

-

Submit forms through your local utility provider within 90 days of purchase.

-

Attach invoices, proof of ENERGY STAR rating, and installation details.

-

-

File Section 179D deduction

-

Work with a licensed tax professional.

-

Must include certified energy modeling demonstrating efficiency above ASHRAE baseline.

-

-

Stack incentives

-

Federal + state + utility rebates can all be combined.

-

Example: $15,000 federal deduction + $2,000 utility rebate.

-

📈 5. ROI Impact: Why Incentives Matter

Without incentives, a new 10-ton packaged AC can feel like a heavy financial lift. With them, the ROI picture changes dramatically.

Case Study: Daikin 10-Ton 15 IEER2 RTU

-

Installed cost: $25,000

-

Utility rebate: $2,000

-

Section 179D deduction: $15,000 (based on sq. ft.)

-

Net cost = $8,000 less

Annual operating savings: $3,000 (vs. old low-IEER unit)

👉 Payback time: ~5 years (instead of 8 years)

👉 System lifespan: 15–20 years → 10+ years of net savings

🏆 Key Takeaways

-

✅ Yes, 10-ton packaged ACs qualify for rebates & incentives in 2025.

-

✅ Programs include Section 179D, IRA credits, and local utility rebates.

-

✅ To qualify, your unit must meet ENERGY STAR/IEER2 ≥ 15.0.

-

✅ A high-efficiency RTU like Daikin’s 15 IEER2 can save $3,000/year + thousands in rebates.

-

✅ Always stack incentives for maximum ROI.

In the next topic we will know more about: Packaged AC vs. Split System: Which Makes More Sense for Your Business?