When your HVAC system fails, the cost of repair or replacement can hit hard. Homeowners often wonder: Will my insurance or home warranty cover it? The answer isn’t always straightforward—it depends on the cause of the breakdown, your coverage type, and the fine print in your policy or warranty agreement.

In this guide, I’ll break down when HVAC failures are covered, when they’re not, and how to make sure you’re not left footing the entire bill.

📘 For the bigger picture, start with our main guide: Should You Replace or Repair Your HVAC System?

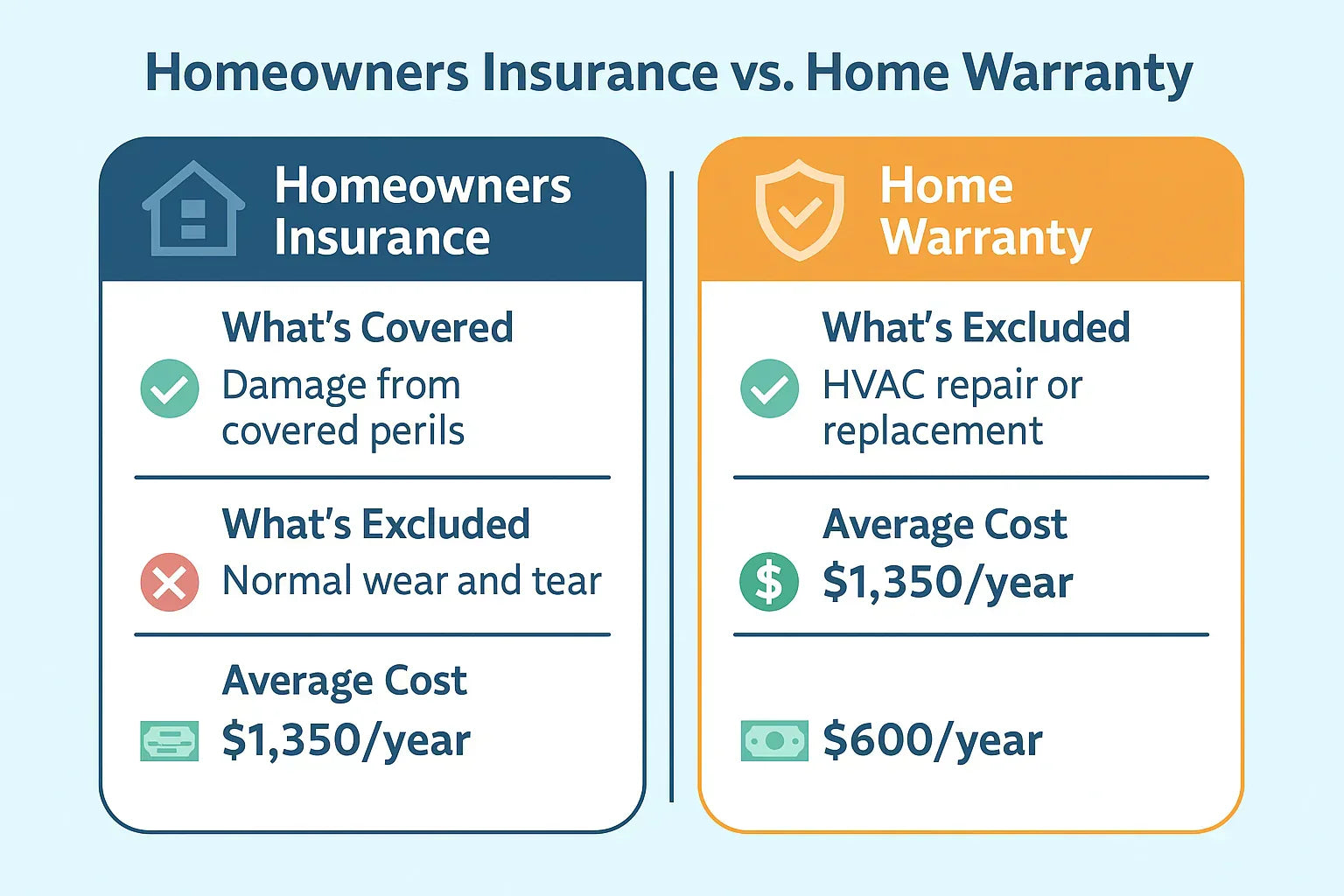

Understanding the Difference Between Insurance and Warranties

Homeowners Insurance generally protects against sudden and accidental damage. That means events like:

-

Fire or smoke damage

-

Storm or lightning strikes

-

Burst pipes flooding your system

However, it does not cover normal wear and tear. If your system simply breaks down from age, don’t expect a payout.

Home Warranties, on the other hand, cover mechanical failures due to normal use. These are service contracts that step in where insurance won’t. With a warranty, you’ll often pay a service fee, but the cost of parts and labor is covered for certain repairs.

👉 Tip: The Insurance Information Institute provides a clear breakdown of what typical homeowners insurance covers—and what it doesn’t.

When Homeowners Insurance Covers HVAC Failures

Insurance steps in when the damage is linked to a covered peril. For example:

-

Storm Damage – If a lightning strike fries your air conditioner’s compressor, it’s likely covered.

-

Fire – Smoke or flames damaging ductwork or indoor units usually qualify.

-

Theft or Vandalism – If your outdoor condenser is stolen or vandalized, insurance may pay for replacement.

But here’s the catch: your claim is only approved if the event is listed as a covered peril in your policy. And your deductible applies—meaning small claims may not be worth filing.

Allstate notes that coverage depends on the specific terms of your policy and the cause of the damage. Everyday wear and tear, old age, or poor maintenance usually aren’t covered.

When Insurance Won’t Help

Here are common scenarios where your homeowners insurance won’t cover HVAC costs:

-

Normal wear and tear from aging

-

Lack of routine maintenance (dirty filters, clogged coils)

-

Improper installation or neglect

-

Gradual deterioration of ductwork

Put simply, if your system is simply “old and tired,” insurance won’t cover it. That’s where warranties or replacement planning come into play.

👉 The National Association of Insurance Commissioners notes that insurers expect homeowners to maintain their equipment—failure to do so often voids coverage.

What Home Warranties Usually Cover

A home warranty is often your safety net for HVAC failures due to normal wear and tear. Typical coverage includes:

-

Furnace repairs

-

Air conditioner breakdowns

-

Ductwork repairs (in some policies)

However, warranties aren’t a blank check. Coverage limits, exclusions, and service fees apply. Some policies cap HVAC repair coverage at $1,500–$3,000, which may not cover a full replacement.

NerdWallet explains that warranty coverage varies widely by provider, so it’s important to review what’s included, what’s excluded, and the service call fees before signing up.

Gray Areas: Where Coverage Gets Tricky

Some HVAC issues fall into a “gray zone” that depends on policy fine print:

-

Power surges: Some insurers cover surge damage, others don’t.

-

Flooding: Standard homeowners insurance excludes floods, but FEMA’s National Flood Insurance Program can help if you carry flood coverage.

-

Improper installation: Neither insurance nor warranties usually cover it.

This is where reading your policy and asking the right questions upfront pays off.

Situations Where Neither Covers You

Unfortunately, there are gray areas where neither insurance nor warranties apply:

-

Poor Maintenance – Skipping filter changes or annual service voids both policies.

-

Code Violations – Outdated or unsafe installations may be excluded.

-

Pre-Existing Conditions – Warranties often exclude issues noted before coverage began.

That’s why documenting regular maintenance is crucial. A simple HVAC inspection record could make the difference between approval and denial of your claim.

Steps to Take Before Filing a Claim

-

Check Your System’s Age – If it’s 15–20 years old, insurance likely won’t help, and warranties may have limited value.

-

Review Your Policy or Warranty Agreement – Look for HVAC-specific exclusions.

-

Schedule a Professional Inspection – A licensed technician can identify if the cause is wear-and-tear versus a sudden event.

-

Calculate the Repair vs. Replacement Value – Sometimes filing a claim isn’t worth it if replacement is a smarter long-term move.

Protecting Yourself from Future Costs

Even if your current system isn’t covered, you can reduce future risks:

-

Invest in annual maintenance to catch issues early.

-

Keep receipts and service logs as proof of upkeep.

-

Upgrade to an ENERGY STAR-certified system when replacement is needed—eligible for rebates and cheaper to run.

👉 ENERGY STAR highlights HVAC systems that qualify for rebates and incentives, lowering long-term ownership costs.

Final Thoughts

HVAC coverage through homeowners insurance or a home warranty isn’t guaranteed. Insurance helps when disasters strike, while warranties cover wear and tear—but only within their limits. That’s why knowing the difference, reading the fine print, and planning ahead is critical.

If your system is old, unreliable, or facing costly repairs, you may find that replacement with a modern, efficient unit offers the best peace of mind—and financial return.

📘 Read next: How Long Can You Delay Replacing an Aging HVAC System?

Your Home Comfort Advocate