How to keep cash alive without sabotaging your installs

When you’re new, equipment decisions feel permanent. They’re not—but the cash mistakes can be.

Buy too much too early and you starve the business.

Lease the wrong stuff and you bleed monthly.

Do nothing and you can’t work.

This guide breaks down what to buy, what to lease, and how to decide—from the perspective of someone who’s watched startups survive (and fail) over these exact choices.

🧠 The First Rule (Don’t Skip This)

Before we compare options, lock this in:

Your startup’s enemy isn’t cost—it’s cash flow shock.

Any decision that puts you in a hole before revenue stabilizes is a bad one, even if the math “looks good.”

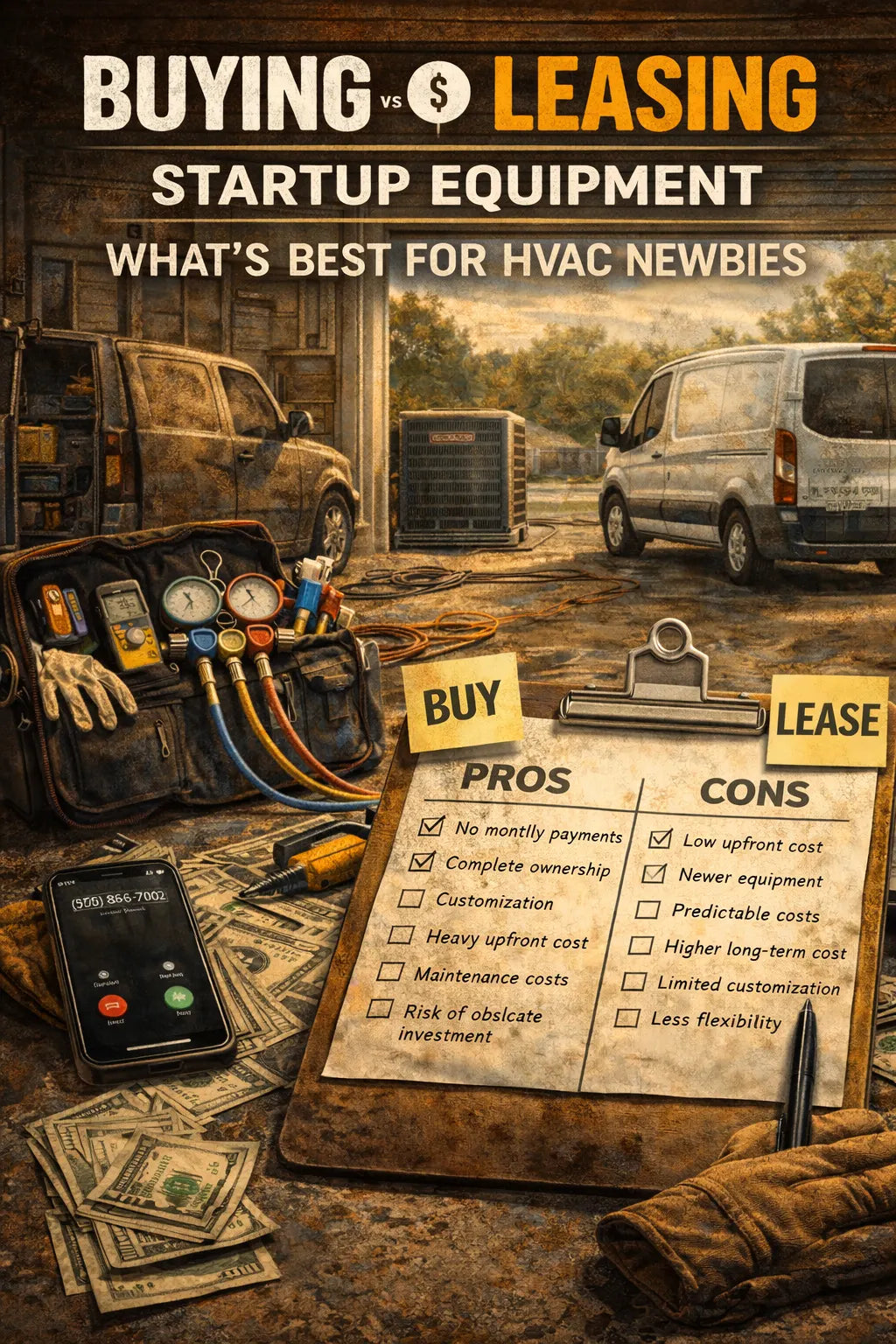

⚖️ Buying vs. Leasing: The Real Difference

🛒 Buying

You pay upfront (or finance), own the asset, and control it.

Pros

-

No monthly lease payments

-

Full control and customization

-

Asset value (even if small)

Cons

-

Cash-heavy upfront

-

Maintenance is on you

-

Mistakes are permanent

🔁 Leasing

You pay monthly for use—not ownership.

Pros

-

Lower upfront cost

-

Predictable monthly expense

-

Easier upgrades

Cons

-

Long-term cost is higher

-

Contracts can trap you

-

Less flexibility

🧰 Tools: Buy These First (No Debate)

Tools aren’t optional. They’re how you work—and how you avoid mistakes.

🔧 Tools You Should Buy

-

Hand tools (nut drivers, cutters, wrenches)

-

Electrical meters (multimeter, clamp meter)

-

Refrigeration tools (vacuum pump, micron gauge)

-

Safety gear (PPE)

Why buy? Because:

-

You’ll use them daily

-

Leases don’t make sense for wear items

-

Ownership prevents downtime

Tony’s take: If you use it every week, buy it.

❄️ Big Equipment Inventory: Buy Per Job (Early On)

Newbies lose money by stocking equipment too early.

🧊 Don’t Stockpile Yet

Avoid buying and storing:

-

Condensers

-

Furnaces

-

Air handlers

-

Coils

Why?

-

Cash tied up

-

Risk of damage

-

Model changes

-

No guaranteed demand

Instead, order per job until volume proves itself.

Predictability beats variety early.

🚐 Vehicles: Where Leasing Can Make Sense

Your truck or van is both a tool and a billboard.

🚗 Buy vs Lease: Vehicles

Buying (Used)

-

Lower long-term cost

-

No mileage penalties

-

Easier customization

Leasing

-

Lower upfront

-

Newer vehicle

-

Predictable payments

Tony’s take:

If you can buy a reliable used vehicle without killing cash—buy it.

If not, a short, flexible lease beats a broken truck.

🏗️ Specialty Equipment: Lease or Delay

Some tools don’t earn their keep early.

🧪 Consider Leasing or Delaying

-

Brand-specific diagnostics

Lease only if:

-

You need it to complete paid jobs

-

The lease is short and flexible

-

It replaces subcontracting costs

📊 The Tax Angle (Keep It Simple)

Taxes shouldn’t drive decisions—but they matter.

🧾 Buying

-

Depreciation

-

Section 179 (in some cases)

🧾 Leasing

-

Payments may be deductible as expenses

👉 IRS small business equipment basics:

🔗 https://www.irs.gov/businesses/small-businesses-self-employed

Tony’s rule: Don’t buy something just for a tax break.

🧮 Cash Flow Scenarios (Realistic Examples)

Scenario A: Buy Heavy, Early

-

Tools: $8,000

-

Vehicle: $20,000

-

Inventory: $15,000

Result: No cash cushion, panic if work slows.

Scenario B: Buy Tools, Order Equipment Per Job

-

Tools: $8,000

-

Vehicle: $10,000 (used)

-

Inventory: $0

Result: Lean, flexible, survivable.

🚨 Leasing Traps to Watch For

Leases aren’t evil—but contracts are.

Avoid leases with:

-

Long lock-in periods

-

Mileage penalties you can’t control

-

Mandatory service add-ons

-

Early termination fees

If you can’t explain the lease in plain English—don’t sign it.

🧱 Tony’s Decision Framework (Use This)

Ask three questions before buying or leasing:

-

Do I need this to complete paid work this month?

-

Will this reduce callbacks or risk?

-

Does this hurt my cash reserve?

If it fails #3—pause.

🔚 Final Word: Flexibility Beats Ownership Early

Owning everything feels good.

Surviving feels better.

Early on:

-

Buy what you use daily

-

Lease cautiously

-

Order equipment per job

-

Protect cash like it’s oxygen

Because for HVAC startups—it is.